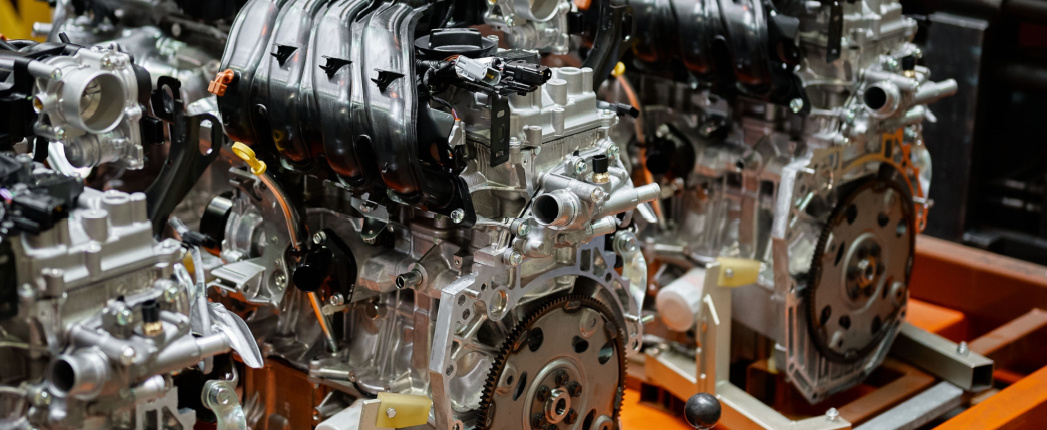

Although the writing is on the wall for internal combustion engines, lubricant formulators still have work to do meeting original equipment manufacturers’ emissions and efficiency targets, says lubricant industry consultancy Kline & Co.

Estimates vary, but according to the U.S. Energy Information Administration, the global light-duty vehicle parc will grow to 2.2 billion units by 2050, up from the current 1.3 billion. Most of those vehicles will be new or existing internal combustion engines.

During that period, OEMs will likely produce ICE vehicles for domestic and export markets where zero-emissions transport is yet to take hold. These vehicles will also be subject to ever-tightening emissions standards, which will require lubricant formulators to keep responding to engine developments.

“Before ICEs are officially dead, there are still more fuel economy targets to hit. So, I believe the changes to lubricants will need to continue for a while,” David Tsui, Kline & Co’s energy sector project manager, told Lube Report.

In August, the California Air Resources Board announced a ban the sale of new ICE vehicles by 2035. And where California goes, other states usually follow. But until the ICE ban goes into effect, there will still be a need for greater efficiency from ICE engines and longer-lasting protection, Tsui thinks.

“Certainly, I think ICE development will slow and at some point, cease, but I’m not sure when. The EV conversion is taking time and certainly a global recession is not going to help people afford a $50,000 EV,” he said.

Around the world, automotive and lubricant standards organizations are updating specifications. In August, the American Petroleum Institute’s Lubricants Standards Group and the Auto/Oil Advisory Panel began the process of developing their new GF-7 specification at the request of the International Lubricants Standardization and Approval Committee, which represents American and Japanese automakers.

GM also recently updated its GM dexos1 specification to Gen 3, which became official as of Sep. 1, 2022. Tsui explained in an article published by Kline that the specification includes stricter limits on oxidation, turbo coking, sludge, corrosion and ash.

In 2021, the European Automobile Manufacturers’ Association released its long-awaited oil sequences for light-duty engines and in May this year the sequences for heavy duty.

“Even with just currently developed technology rolling out, often OEMs find issues as the new tech is deployed – like when they found low speed pre-ignition issues with turbo gasoline direct injected engines and got the American Petroleum Institute to address it,” he said.

Tsui thinks the trajectory will lead to greater use of polyalphaolefins and API Group III base stocks.

For more coverage of electric vehicles and their impact on lubricants, subscribe to Lubes’n’Greases’ Electric Vehicles InSite.