Electrification of the four-wheeler passenger vehicle fleet may affect the quantities of transmission fluids, greases and other types of lubricants used in automobiles, but the impact of electric vehicles on overall consumption can largely be distilled down to engine oils.

Engine oils account for around 20% of global automotive lubricant demand, but battery EVs need no engine oil. The size of that impact, therefore, will depend mostly on the future of the entire automobile population, the extent to which EVs replace vehicles powered solely by internal combustion engines, the pace at which that shift occurs and the mix between BEVs and plug-in hybrid EVs, since the latter still use engine oil.

Global annual sales of EVs passed 10 million units in 2022, accounting for 14% of all car sales that year, according to the International Energy Agency. This even as total passengers in spite of wilting car sales in the face of the COVID-19 pandemic. By the end of 2023, they are projected to go beyond 12 million, even though the market has cooled slightly.

The world’s passenger car parc grew steadily over the past decade, from 748 million in 2009 to up to 1.4 billion in 2020, depending on the source. Most analysts agree that the overall car population will continue to increase, so in assessing the impact on engine oil volumes, the questions are: How much will that number increase and to what extent will it shift from ICE vehicles to EVs? Crucially, does this give PCMO blenders and other automotive lubricant stakeholder cause to panic or is there life left in the market?

|

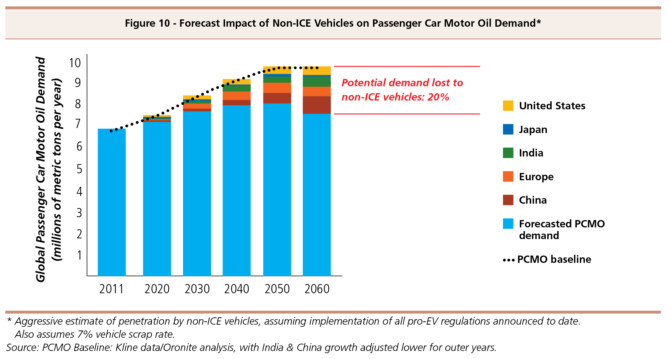

PCMO demand would peak at roughly 8.2 million tons in 2050, Oronite said, then fall to 7.5 million tons by 2060 – at that point 20% less than it would be without EVs.

|

Analysts deem such impacts significant but not devastating for lubricant marketers. Oronite officials said they would not expect EVs to have a severe impact on the industry unless the shift away from ICE-only vehicles happens much faster than currently forecast in China, which is by far the world’s largest EV market and one of the two largest lube markets.

Additive company Chevron Oronite calculated that demand for passenger car motor oil will continue to rise, although not as much as if ICE vehicles retain their dominance in the car parc.

By 2040, the company estimates, global PCMO demand will be 8.1 million metric tons, up from 7.2 million tons in 2020, but still 13% less than it would be by that date were it not for the impact of EVs.

Of course, the potential losses will keep increasing as the trend continues toward EVs. Oronite’s analysis calculated that numbers of both EVs and ICE-only cars will continue rising until 2050, at which point the numbers of conventional vehicles will start to decrease. PCMO demand will peak at roughly 8.2 million tons in 2050, Oronite thinks, then fall to 7.5 million tons by 2060 – at that point 20% less than it would be without EVs.

Fellow additive company Afton Chemical largely concurs with Oronite. It also believes there is a decade or so of consistent growth in PCMO demand. Adam Banks, Afton’s senior e-mobility marketing manager, says there are two factors are setting the pace of change from ICEs to EVs, and therefore the rate of PCMO demand decline. The first is the rate of fleet change. Even in a country like Norway, where EV registrations are more than 90% of ew cars, there is still an ICE fleet with many years of functional life.

The second factor is the growth of the total vehicle parc. This will accelerate in Southeast Asia, where a projected 1.5 billion people will reach the key income bracket for vehicle ownership. These vehicles are unlikely to be EVs.

“‘You put those two things together … and it means that the sky is not about to falling on our heads in the projections for 2040 that we’ve got, I think I referenced it in the talk was it’s effectively steady demand at 2040 for passenger car, let alone the other sectors that we see. So, I think there’s cause for optimism there

Other analysts predict different degrees of impact. IHS Markit said in 2018 that it expected global PCMO demand to be 7% lower in 2040 than it would be were it not for EVs, adding that it believes the transition to e-mobility will be slower than some forecasters predict because the lengthening average lifespan of cars slows the rate of turnover.

U.S.-based consultancy Kline & Co. estimates that by 2040, EVs will cause combined PCMO demand in the 15 countries to be about 20% lower than it would be had it not been for EVs. The demand volume will decrease at a cumulative annual rate of 0.1% over that period, whereas it would have increased at a rate of 0.9% without EVs.

Some analysts deem such impacts significant but not devastating for lubricant marketers. Oronite officials say they do not expect EVs to have a severe impact on the lubricant industry unless the shift away from ICE-only vehicles happens much faster than currently forecast in China, which is by far the world’s single-largest EV-buying country and one of the two largest lube markets.

“After studying the data, one of the key takeaways from the Oronite assessment is that unless China adopts EVs at a much more aggressive rate, EVs would be a moderating rather than disrupting force on PCMO demand,” the company told Lubes’n’Greases.

Others are even more sanguine. “Penetration of electric vehicles will reduce lubricant volumes, but the impact on global demand will be limited,” Blake Eskew, former vice president of global consulting at IHS Markit, said.

Kline frequently notes that it expects the trend toward longer drain intervals to cut into PCMO demand more than EVs.

“The expansion of EVs will clearly dampen PCMO demand, but the most intense negative impact will be felt in the long term – 2030 and beyond,” George Morvey, industry manager for Kline’s energy practice, said during a presentation at the ICIS World Base Oils & Lubricants Conference in London in February 2019. “In the short and medium term, through 2027, oil drain intervals will remain the main factor driving PCMO demand.”

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at cs@lubesngreases.com.

Click here link to homepage