It is irrefutable that vehicle electrification is completely recalibrating the automotive industry in every aspect. But this is far from a death knell for the lubrication industry. Three tribologists share their perspectives.

Electrified vehicles, including those powered solely by batteries, need greases, functionalized coolants and various other fluids that can meet the unique needs and specifications of their powertrains. There are projections that by the 2040s and 2050s, the propulsion systems used in vehicles ranging from fully electric to hybrid will be radically altered. New power sources such as hydrogen fuel cells and synthetic carbon dioxide-neutral fuels are further upcoming solutions.

Four primary factors are propelling these changes. First and foremost, batteries are getting cheaper per unit of power output – a trend expected to extend to alternatives to the current lithium-ion standard that are still being developed, such as solid-state or batteries with cobalt-free cathode materials like lithium niobium titanate. Prices for the latter are expected to plummet another 67% by 2030.

Secondly, a growing number of jurisdictions have implemented public health policies to ban internal combustion engines from metropolitan areas in the near future, most notably in China and Europe, or to impose pricy CO2 fleet taxes. These taxes are leading automakers to cease development of ICEs, at least until or unless sustainable transportation fuels come to market.

Lastly, EVs now offer the optional extras, comforts and modular architectures enjoyed by their ICE counterparts, while gradually assuaging buyers’ fears surrounding range.

With all that in mind, tomorrow’s transportation scenario still must contend with several as-yet-unknown variables. For instance, no one knows whether established carmakers will be better equipped than groundbreaking newcomers like Tesla or even ride-hailing apps or car sharing. Furthermore, it is still up for debate whether China, which has not yet taken a leadership position in ICEs, will attain the global vanguard position that it seeks for EVs, albeit two years later than planned due to the covid-19 pandemic.

As it stands, China’s confidence in EVs indicates it believes the EV shift will reverberate across every facet of the automotive ecosystem, including fuel, lubricants and equipment, as well as generate market opportunities.

Lubricating oils and greases play a critical role by making vehicles safer, more reliable and more efficient, something many car owners are not aware of or take for granted. Lubricating an ICE indeed diverges greatly from a comparable role for an e-motor and its gears. The former requires oil to decrease engine friction and a transmission fluid, but these two substances differ widely. Engine oils, most saliently, degrade throughout their lifespan as combustion gases infiltrate them, meaning they must regularly be replaced.

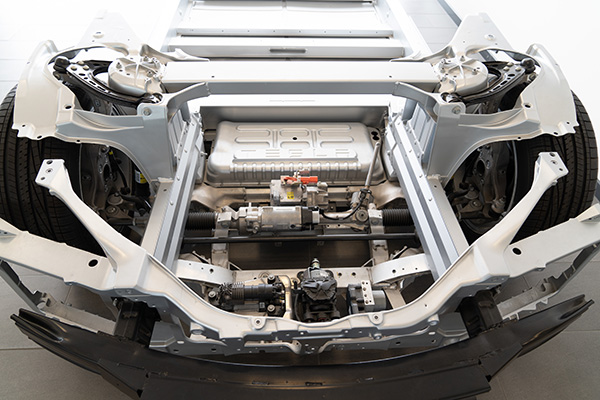

Meanwhile, in an EV there is a significant variation in power flows, and high electric motor speeds of up to 15,000 revolutions a minute are possible. This can require several fluids, including for the gear reducer (the EV’s transmission), the e-motor and coolant for batteries and charging cables.

In the not-too-distant future, thermal management fluids for the battery and power electronics will be made available to bolster fast charging, improve range and safety, and cope with rapid acceleration and deceleration.

Fast charging with powers above 300 kilowatts requires cooled cables. Such fast charging systems operate at 400 or 800 Volts. These cooled high-power charging points so far use water-glycol mixtures similar to engine coolants. A battery thermal management system is required to reduce the parasitic losses for higher-power outputs and longer battery life. The Tesla, BMW i3 and i8, Chevy Volt, Ford Focus, Jaguar I-Pace and LG Chem’s lithium-ion batteries all use some form of liquid cooling system and an indirect cooling system for the high-power charging cables. If the battery is directly exposed to the coolant, as in the case of fuel-cell vehicles, the coolant needs to have low to no conductivity.

The name most synonymous with EVs is undoubtedly Tesla Inc., with maverick industrial designer and technology entrepreneur Elon Musk at the helm. Every major carmaker around the globe is analyzing the unparalleled success of the enfant terrible of the EV world. South African born Musk has proved as unconventional, visionary and controversial as the company’s eponymous muse – the inventor, engineer and futurist Nikola Tesla, most famous for his invention of the alternating current electricity supply system.

While Tesla is still a relatively small car company, it has, after some initial downturns and media firestorms, become a force to be reckoned with as a significant player in the EV arena. The company is projected to expand production to reach 1.8 million units by 2025 – more than three times its 2020 forecast. This factors in the impacts from the covid-19 pandemic. Car making titans such as China’s own BYD, U.S.-based GM and Ford, Renault-Nissan and VW Group offer EVs, but they all pale in comparison with Tesla.

Today the world consumes about 39 million metric tons of lubricants per year, worth U.S. $146 billion, but if the industry does not want to go the way of the dinosaur, then relying solely on combustion engines running on fossil fuels is a grave mistake and a huge missed opportunity.

From Nissan to Volkswagen, carmakers are changing to production of battery-powered models, fueled consumer demand and incentives making them cost-effective alternatives to petroleum-powered alternatives. These battery-powered options use fewer lubricating products than ICE vehicles, and with demand for lubricants projected to decline from 2025, lubricant makers are doing all they can to ensure they remain in business.

|

All in all, an ICE vehicle can require 40 different types of lubricating product.

|

The pressing prognostic question is: Will EVs be in 2040 the primary propulsion technology for individual mobility or stagnate at a market share of about 15% and thus be complementary to the combustion technology needed to burn any type of fuel?

In 2019, 2.21 million new EVs were sold, which represents a market share of new vehicle sales of 2.5% and an increase of 10% year-on-year.

Lubricant makers for the past two decades have focused on squeezing more fuel efficiency from ICEs and lengthening the interval between oil changes, and the end of development has not been reached – the widespread use of ultra-low-viscosity engine oils and lubricants with very high viscosity indices is around the corner. All in all, an ICE vehicle can require 40 different types of lubricating product.

However, while EVs require fewer types of fluid, they up the ante considerably with other challenges to lubrication. For instance, they need a grease that can cool and lubricate the e-motor while concurrently safeguarding the power electronics onboard the vehicle and simultaneously maintaining compatibility with non-metal materials such as plastics.

Every grease is a unique formulation, and during the past 30 years, demands on automotive grease have changed dramatically. E-motors deliver a whole new set of challenges to formulations. EVs will have more use of the lubricating grease compared with conventional ICE-powered vehicles because the greases will lubricate more components. The range of temperatures is much broader, especially on the high end, which puts pressure on bearing lubricants to avert damage and minimize noise and torque. The need for service greases has decreased in favor of bearings and chassis components that come filled-for-life, requiring no re-greasing during maintenance. The primary role of grease in the automotive space is the lubrication of bearings. Bearings are small but essential pieces of hardware in a motor and help redistribute force to minimize machine wear. The rising popularity of EVs changes more than the favored energy source for the vehicle – even the bearings are altered by the new design.

|

EVs will have more use of the lubricating grease compared with conventional ICE-powered vehicles because the greases will lubricate more components.

|

The demands from EVs heavily influence these new applications. Gear oils, coolants and greases all have to be reformulated to work in close contact with electric modules, new polymers, sensors and circuits. Lubricants will have to be compatible with a broad range of electrical hardware, including everything from copper wires to special plastics and insulation materials. Low-viscosity lubricants will rise in popularity for these applications, thanks to their fuel-economy advantage. However, low-viscosity fluids reduce film thickness in the application, which may accelerate wear. This reduced film thickness increases operating temperatures and reduces the calculated fatigue life of the bearings. Although, the thinner lubrication films that result from low-viscosity lubrication also can be supplemented by a performance-enhancing slip-rolling resistant surface coatings.

But the most significant challenge to EV grease formulators is predicting the needs of e-motors, whose specifications are continually evolving. It is difficult to quantify what issues lubricating grease will face in an EV, partly because it is not 100% clear how future vehicles will be powered. That variability means there is a grease for every bearing at every occasion, if engineers know what to look for.

|

Demand for e-motors will continue to grow steadily, driven primarily by factors such as fuel savings and carbon taxes, government incentives for “green” vehicles and other products, as well as increasing consumer awareness of the impact of fossil fuel use on climate change.

|

Most base stocks are affordable petroleum-based mineral oils, for example, but synthetic oils can add a level of heat resistance that is essential for some industrial applications. Similarly, thickening agents also vary widely in terms of temperature suitability. The range of temperatures, especially at the high end, is much wider with electric vehicles.

Demand for e-motors will continue to grow steadily, driven primarily by factors such as fuel savings and carbon taxes, government incentives for “green” vehicles and other products, as well as increasing consumer awareness of the impact of fossil fuel use on climate change. Given this radical shift in priorities from consumers and regulators, vehicle engineers are confronting an array of new problems exclusive to the bearings of the new electric standard.

The push for electrification has changed the prevailing wisdom around many essential substances involved in automotive engineering, from engine hardware to chassis. Even basics like grease must adapt to the changing needs of an electric future.

Until EVs reach price parity with their ICE equivalents, it would be risky to draft a business model on public subsidies because they can suddenly be reduced or disappear altogether. Despite this, no major carmaker can neglect a global market share of around 15% for EVs.

Much of the oil industry is still engaged in fighting the tide of public demand and legislative decrees. The volume of ICE vehicles will grow globally grow, and the market share of EVs will grow the number of specialty lubricants.

The opinions expressed in this article are solely those of the authors.