Hyundai Motor Group has been building battery electric vehicles for four years, and although beleaguered by supply chain woes, its electrified lineup has sold well. The Korean carmaker has yet to realize its full market potential, but hopes its latest five-year plan will push the group’s marques up the EV production leaderboard. In their wake, compatriot lubricant companies see opportunities of their own.

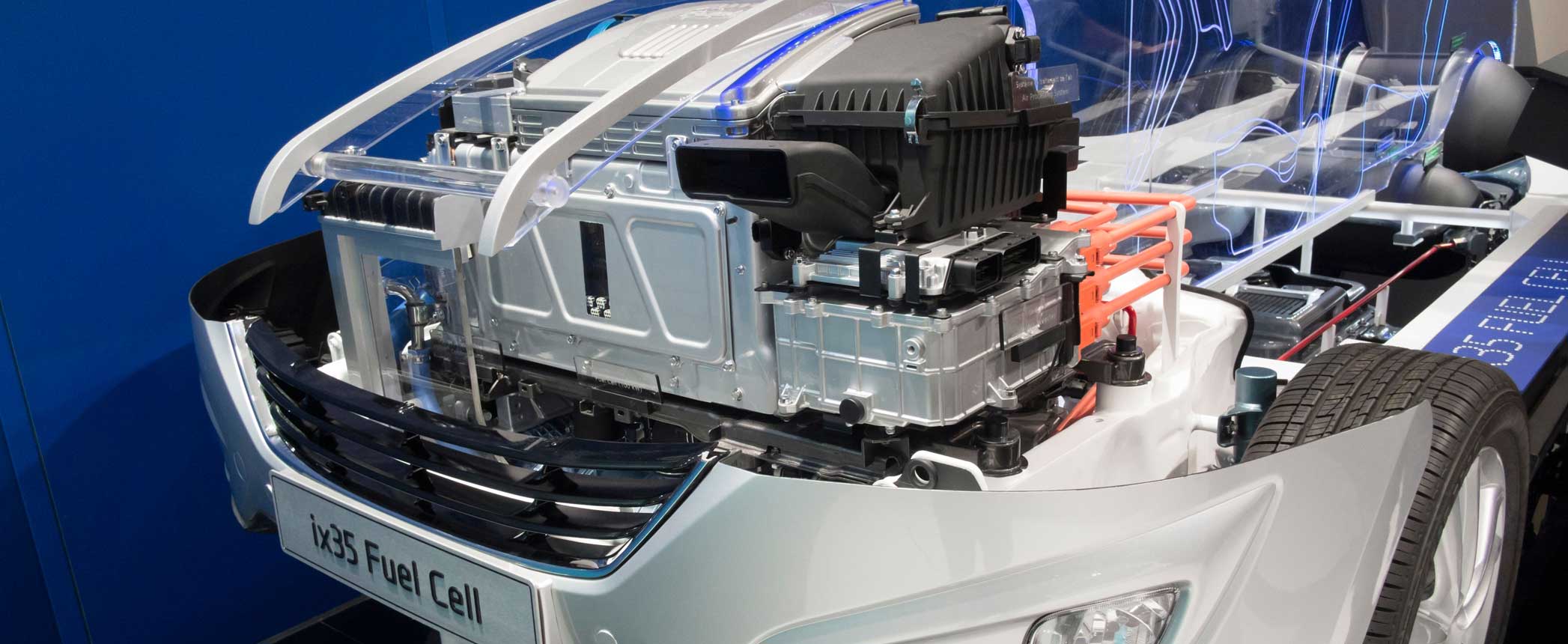

Hyundai has certainly earned its new energy vehicle bragging rights. The South Korean carmaker was the first in the world to make a commercially available fuel-cell electric vehicle when it launched the ix35 in 2013. Toyota quickly followed suit with its Mirai in 2014, but whereas the Japanese company has yet to kick off a complementary BEV campaign in earnest, Hyundai has been offering such vehicles since 2016.

Back then, the company launched the Ioniq Electric and two years later the Kona Electric. When it put out the Nexo FCEV in 2018, Hyundai became the first and still only car company in the world to offer a full suite of electric cars, ranging from regular hybrids and plug-in hybrids to BEVs and FCEVs.

Hyundai is part of the Hyundai Motor Group, which also comprises Genesis and Kia Motors. HMG presented ambitious electrifications plans at the start of the year, with the group aiming for annual BEV sales of more than 1 million units by 2026. Its BEV lineup will be expanded to 23 models by 2025. The first of the group’s dedicated EV models will be launched in 2021, and from 2024 all of HMG’s BEVs will use a new EV architecture.

Kia will launch 11 new EVs over the next five years, with the first model scheduled for 2021. (It is unclear whether or not they will be pure battery vehicles.) By 2025, it aims to achieve annual EV sales of 500,000 units (excluding China) as part of its so-called Plan S to move to a full e-mobility lineup from the current handful of models. The company reported a net profit of U.S. $1.57 billion in 2019, up from $995 million the year before.

HMG’s luxury marque Genesis will also launch its first BEV in 2021, with full-scale electrification expected to start in 2024.

While Hyundai has not announced how many BEVs it intends to bring to market in the coming years, it will likely be the remaining 11 models out of the total of 23, after Kia’s 11 and the single Gensis vehicle.

Hyundai’s own production roadmap, called Strategy 2025, sets out the company’s aim to become one of the three biggest EV manufacturers in the world by 2025, with annual sales of 670,000 units, of which 560,000 will be BEVs and the rest FCEVs.

Like Kia, its sister brand, 2019 was a good year for Hyundai. Net profit soared from $1.41 billion in 2018 to $2.79 billion last year. Meanwhile, Kia earmarked $25 billion for investment by 2025 while Hyundai will direct some $51 billion toward research and development until 2025.

Last year, Hyundai and Kia shipped a combined 63,414 BEVs, up from 27,798 units in 2018. By far the most popular model was the Hyundai Kona Electric, with global sales of around 47,000. While that seems like an impressive number, it pales in comparison to Tesla’s sales figures. The U.S. company sold roughly the same number of Model 3s in the Netherlands and Norway alone.

HMG could probably have sold more Kona Electrics and sister model, the Kia e-Niro, had it not been for severe supply constraints. In countries around the world, waiting times were at least a year, driving potential customers into the arms of Nissan and Tesla.

For this reason, Hyundai announced in January that it would be adding a second production location for the Kona electric in the Czech Republic to serve the major EV buying markets in Europe. The automaker will make available 80,000 zero-emission vehicles to European customers in the coming year, Hyundai said.

Hyundai and Kia have been betting heavily on partnerships, be they with tech companies specializing in autonomous driving technologies through to EV startups. For example, HMG is looking to manufacture purpose-built vehicles (for specific transport applications) in the coming years. To that end, in January Hyundai and Kia announced a $110 million investment in United Kingdom-based purpose-built EV startup Arrival with the goal of utilizing the latter’s scalable BEV platform technology.

“The partnership with Arrival will help Hyundai and Kia meet rapidly growing demand in Europe for eco-friendly commercial vehicles,” the two automakers said in a press release.

In February, Hyundai shook hands with another startup called Canoo, which will develop small passenger cars, a Hyundai spokesperson said at the time.

The deals come on the heels of investments in Rimac Automobili of Croatia, Silicon Valley’s Aurora, Indian startup Ola and Singapore-based entity Grab. Last September, HMG and Irish tech company Aptiv announced they would be setting up a $4 billion, 50-50 joint venture for the development of autonomous driving.

“The new joint venture marks the start of a journey with Aptiv toward our common goal of commercializing autonomous driving,” Euisun Chung, HMG executive vice chairman said in a press release.

HMG’s plans are timely. Strategy 2025 and Plan S largely synchronize with the Korean government’s aim for domestic carmakers to capture a 10% share of the global BEV market by 2030. At home, the government also intends to have every third car be electric and expand the number of EV charging stations by 15,000 over the next five years.

In an effort to achieve this and boost sales in September last year the government announced it would provide some $610 million in subsidies for the purchase of BEVs (around $6,600 per vehicle), as well as for expanding charging infrastructure. The plans should result in an additional 71,000 BEVs on the road by year-end. Around that time, the entire electric fleet (including PHEVs and FCEVs) should exceed 200,000 vehicles.

|

“Most of the vehicles on the road today still have an internal combustion engine. Barring a dramatic increase in BEV uptake, we actually forecast demand for automotive lubricants to increase until 2030.”

— Wan Seop Kwon, SK Lubricants

|

Despite the growing fleet of EVs in South Korea, Wan Seop Kwon, the technology manager at Korea’s SK Lubricants, said that a significant impact on the local lubricants market is still a few years away.

“Most of the vehicles on the road today still have an internal combustion engine. Barring a dramatic increase in BEV uptake, we actually forecast demand for automotive lubricants to increase until 2030,” he told Lubes’n’Greases.

That is not to say the market is booming at the moment. There has been a slump in demand, but Wan points to the economic headwind South Korea has faced in recent years instead of BEV penetration as the reason behind a shrinking lubricants market. SK Lubricants will therefore seek to expand its business elsewhere in Asia, he said.

The growth in EV sales does offer opportunities to develop EV fluids, including battery coolants and gearbox lubricants. A commonly held belief is that BEVs do not have a transmission. While many of them do not, some, such as the Porsche Taycan, are fitted with a two-speed gearbox to help reach autobahn-worthy top speeds at greater efficiency.

SK already supplies batteries to a number of automakers, as well as semiconductors, motion sensing systems for autonomous vehicles and 5G technology, among others.

“Companies in the SK Group already have a strong position in the realm of e-mobility. EV fluids are part of that overarching strategy towards electric driving,” said Wan.

In some respects, EV fluids are a different technological ballgame, and many of the requirements still need to be clarified and defined. This, however, can be considered as a good thing, Wan argued.

“OEMs are much more open to partnering with companies such as SK Lubricants for the development of new driveline fluids than they were in the development of requirements for conventional engine oils. This enables us to reach out to OEMs around the world and expand into the EV fluids business,” he said. SK Lubricants has partnered with several OEMs to develop fluids.

It is expected that most demand for EV fluids will be first fill, as opposed to service fill, which makes up the larger volume with conventional engine autos, which means the importance of becoming an OEM supplier carries additional weight.

“SK Lubricants has a strong interest in a so-called ‘integrated’ EV fluid for both electric motors and gearboxes, which makes for a more cost-effective proposition,” Wan added.

HMG has grand plans for the future and seems confident it will achieve the goals it has set out. The could explain why the group’s latest concept BEV, to be unveiled at the Geneva International Motor Show in March, is christened the Prophecy.

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at cs@lubesngreases.com.

Click here link to homepage