This year will see the awakening of a sleeping giant when the world’s largest car maker, Volkswagen Group, begins mass-producing battery electric vehicles. One lubricants industry insider predicts significant effects on finished lubricant sales across Europe and the United States.

Production of Volkswagen Group’s first mass-produced BEV will get underway in Zwickau, Germany, from November, with first deliveries tentatively scheduled for April 2020.

The Zwickau production line, which the company says is “the first complete transformation of a major car factory from internal combustion engines to e-mobility in the world,” has capacity of up to 330,000 units per year. To put that into perspective, that is more than double the number of Tesla Model 3s produced in 2018 and greater than the total number of Tesla’s sold in the U.S. to date.

The German auto group delivered some 10.8 million passenger cars, trucks and busses in 2018. Its namesake brand, Volkswagen, alone put 6.24 million vehicles on the road.

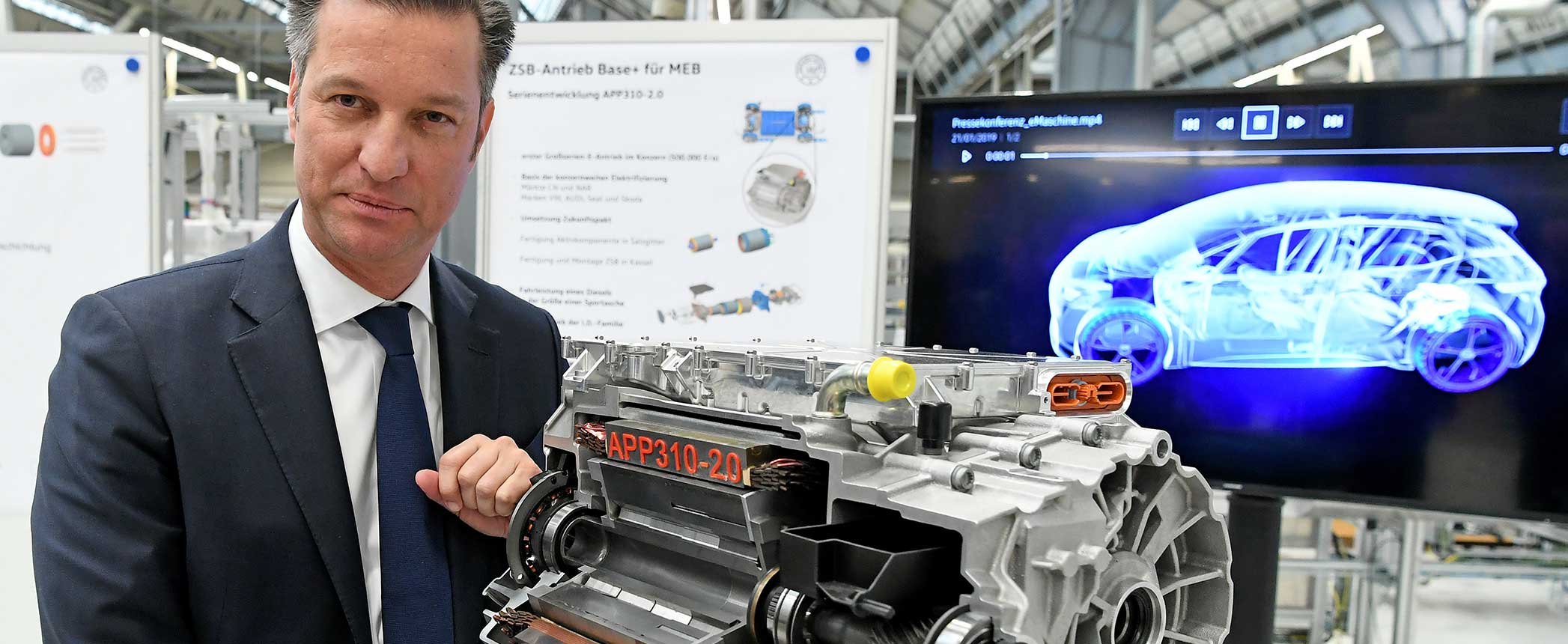

The yet-to-be-named Volkswagen compact BEV – part of its new all-electric ID family of cars – will undoubtedly be the most important launch but it will not be the group’s first. Group brand Audi will kick things off with the e-tron, which is already coming off the assembly line in Brussels. The group’s sports marque, Porsche, will soon follow suit with its high-performance EV Taycan, which will be built in Zuffenhausen, Germany. This opening series of EV launches will culminate in the introduction of the all-important first vehicle of Volkswagen’s ID range toward the end of 2019.

Volkswagen executives are not mincing their words when it comes to underscoring the importance of the ID compact car.

“The start of production of the ID … will herald a new era for Volkswagen – comparable with the first Beetle or the first Golf,” Thomas Ulbrich, a board member at the Volkswagen brand responsible for e-mobility, said in a November press release.

Volkswagen is targeting sales of 100,000 units worldwide of its next generation of BEVs in the first year alone. The marque aims for an annual sales volume of 1 million BEVs by 2025 at the latest. Combined with BEV sales of the other Volkswagen brands, such as Audi, Seat, Skoda and Porsche, that number is set to increase to 3 million vehicles by 2025.

Volkswagen has already announced the end of internal combustion engine development. Chief strategist Michael Jost told German business newspaper Handelsblatt in December that the company’s final line of products using an ICE platform will launch from 2026. Indeed, Volkswagen executives have said that the brand can offer an all-electric lineup in certain markets by 2030, should governments require.

Analysts expect Volkswagen to deliver on its promises.

“For VW to retain its market leadership in Europe it is essential to adapt to changing market demand. VW has recognized the importance of BEVs and the need to be able to supply increasing volumes of BEVs,” Max Erich, sector economist for automotive and retail at ING, told Lubes’n’Greases.

“I expect VW is certainly capable of developing and manufacturing successful high volume BEVs. They will, however, also need to secure a supply chain that can handle these volumes. Looking at the enormous amount of money VW is allocating to BEVs and the fact that they have already announced the end of gasoline engine development, I expect VW is doing everything to achieve 1 million BEVs by 2025,” Erich added.

Volkswagen has already secured various battery purchase deals worth U.S. $25 billion with the likes of Samsung SDI, LG Chem and Contemporary Amperex Technology.

Such far-reaching plans by an automaker of this size are bound to reverberate throughout the lubricants business. Apu Gosalia, vice-president for sustainability and global intelligence at independent German lubricants manufacturer Fuchs, estimates that demand for automotive lubricants across the European Union and the U.S. could fall by 15% to 20% by 2030 due to the impact of upcoming EV launches, as well as from efficiency gains and lengthening drain intervals. Fuchs also thinks total finished lubricant demand will grow 10% in China, reined in by the first slump in car sales in 26 years and flat demand for metalworking fluids and industrial oils, and the impact on total global demand for lubes impacted by EVs is expected to be a drop of 2% to 3%.

What is more, Gosalia does not see disruptions to the lubricants industry such as e-mobility as threats. “I call it the seven Ds theory. Drive electric doesn’t destroy demand – drive electric diverts demand. There are opportunities to at least sustain demand. EVs have different lubrication needs, and new formulations for battery cooling fluids, for example, have yet to be researched and developed.”

Gosalia’s sentiment was echoed by Fuchs Lubricants Norway Managing Director Morten Herregården, who said the company would continue to develop lubricants in line with market requirements.

“We are working on innovations for lubrication and cooling, both will become more important in e-mobility. We also see opportunities in special lubrication for the manufacturing process of battery electric cars,” Herregården said.

Volkswagen Group’s plant assignment plans will also see its factories in Emden and Hanover converted to EV plants. The ID Buzz, a reinterpretation of the iconic T1 minivan, known colloquially as the camper, will roll off the assembly line in Hanover beginning in 2022. Meanwhile the Emden plant will be a production center for small electric cars and sedans from several brands. While not confirmed, this could refer to future Seat EVs.

In January, Volkswagen announced that it would invest $800 million in its U.S.-based plant in Chattanooga, Tennessee, for the production of the ID Crozz, an all-electric sports utility vehicle. The first units are expected to roll off the assembly line in 2022.

By then, the Volkswagen brand wants to have eight plants up and running for the production of vehicles based on its Modular Electrification Toolkit (known as MEB) platform. In addition to the Chattanooga, Emden, Hanover and Zwickau plants, BEV production in Dresden, where the e-Golf is being built, will continue. Skoda’s Mladá Boleslav site in Czechia is also included in Volkswagen’s plant assignment plans. Meanwhile, the Chinese market will be supplied by plants in Anting and Foshan.

Volkswagen Group is working to retool a total of 16 plants across the world for the production of EVs. While part of the Volkswagen Group, Audi and Porsche are not making use of the MEB platform. Instead, their forthcoming upmarket BEVs will ride on Audi’s MLB platform.

At the end of January, German daily Tagesspiegel reported that the company was in talks about making the MEB architecture available to competitors. The move could make the platform “a standard not only for the VW group,” Jost was quoted as saying. Ford will likely be one of those companies, following the announcement of a joint venture earlier that month.

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at cs@lubesngreases.com.

Click here link to homepage