Chinese domestically produced BEVs are still selling well amidst falling conventional engine sales and cheaper alternative fuel models on the market. Some projections place domestic EV sales at 50% by 2025.

Despite stalling sales, China easily remains the world’s biggest market for passenger cars and light commercial vehicles. Last year, registrations totaled around 28 million units, more than North America, Japan and South Korea combined. China also holds a commanding lead in the global sales rankings for battery electric vehicles and plug-in hybrid EVs, with close to 770,000 deliveries in 2018, or more than three times the volume recorded in the United States.

Almost 61% of all BEVs sold in the world last year were registered in China. With HEVs added, China’s electrified vehicle sales in 2018 amounted to 1.12 million units, an increase of 88%.

Chinese manufacturers BAIC, BYD and Zotye were among the top five BEV producers last year, along with U.S. company Tesla and Japan’s Nissan. In 2019, BYD was the world’s top-selling BEV maker through May, and no less than six of the 10 best-selling BEVs came from Chinese original equipment manufacturers, also including Geely and SAIC.

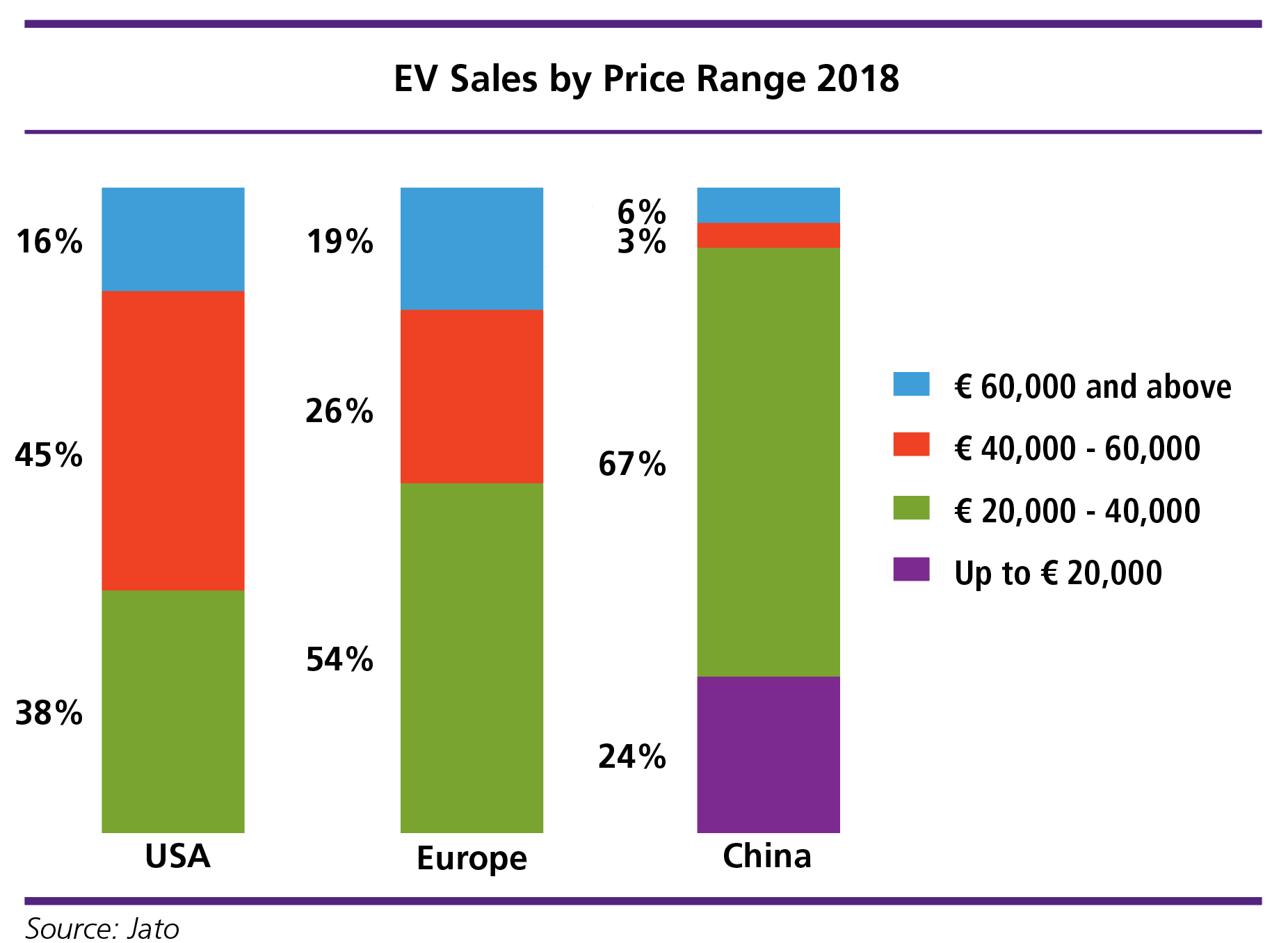

Part of the relative success of BEVs in China is their lower average sticker price, despite an ongoing phase-out of financial incentives for buyers. According to automotive consultancy Jato, alternative fuel vehicles, such as those running on fuel cells or compressed natural gas, are 37% cheaper on average than comparable BEVs, PHEVs and HEVs in Europe, where 45% of all EVs cost more than U.S. $45,000.

In the U.S., the higher-priced EVs commanded a share of 62% last year. By contrast, only 9% of EVs produced and sold in China fell into that category. The vast majority of vehicles, some 67%, were in the $22,000 to $45,000 price range. Another 24% were priced under $22,000, a price category that is non-existent in Europe and the U.S.

Most Chinese EVs are only used in cities, and research has found that the average daily driving distances in major urban areas is 48 kilometers at most. In short, a cheap and compact EV will suffice for most people.

That is not to say that BEVs can be found parked on every street in China. As in many countries, there is direct correlation between a region’s GDP per capita and vehicle penetration. This is becomes even more apparent when looking at the sales penetration of cars that use alternative fuels. When including EVs, alternative fuel vehicle sales last year were highest in the municipality of Tianjin, with a share of 17%. These slightly more expensive vehicles accounted for 13% and 8.3% of sales in Beijing and Shanghai, respectively. In centrally located Gansu Province, GDP per capita stands at some $4,500, or less than a third of that in Tianjin. As a result, alternative fuel vehicle sales penetration in Gansu stood at 2.1% in 2018.

China not only builds a great number of BEVs, it is also far ahead of the pack when it comes to lithium battery production capacity. Global production capacity is forecast at 316 gigawatt hours for this year, and China’s share of cell manufacturing is 73%. BYD and Contemporary Amperex Technology are among the world’s top five battery producers, with the latter also supplying European OEMs such as Volkswagen and BMW. In June, Toyota, world’s third-biggest automaker in terms of sales, announced that it too would be sourcing batteries from Contemporary Amperex Technology.

|

According to Kline & Co., demand for passenger car motor oil will grow by about 1.1 percent through 2030, by which time EV penetration will gain “critical mass” in the world’s major car markets.

|

Bloomberg New Energy Finance projects that passenger EVs will gain the biggest share in global lithium demand from 2021 onwards. This also explains why Chinese lithium products companies have been acquiring shares in mining ventures in Argentina, Chile and Australia, which together hold more than 90% of the world’s lithium reserves and produce over 80% of the resource.

China is also a major lithium producer and according to local media may have found a way to significantly reduce production cost. Citing a government report, the South China Morning Post in May wrote that extraction costs had fallen to $2,180 per metric ton. While it is unclear how close production costs are to selling prices, the difference between the average global selling price of $12,500 last year is significant.

An increase in BEV sales will invariably soften demand for automotive lubricants. However, while the market for passenger cars and light commercial vehicles contracted by 2.8% last year, the total number of vehicles in China is expected to more than double to 340 million over the next two decades.

Speaking at the ICIS World Base Oils & Lubricants Conference in February 2019, George Morvey of consultancy Kline & Co., expects that demand for passenger car motor oil will grow by about 1.1% over the next 11 years, by which time EV penetration will gain “critical mass” in the world’s major car markets. That said, Kline still expects 64% of new cars sold in China in 2040 will be an HEV or a traditional ICE vehicle, or cars without charging capability.

In its e-mobility ramp-up scenario for China, German independent lubricant producer Fuchs Petrolub expects annual passenger car production in China to reach 38 to 40 million within 15 years – up from 22 million in 2016 – and for 16 million of those to be EVs. Citing the University of California’s China Center on Energy and Transportation, the domestic passenger car fleet is projected to balloon to 400 million cars in 2030. By that time, some 160 million will be EVs.

The mentioned industry forecasts might be on the conservative side, as Research and Markets’ Global and China Electric Vehicle (BEV, PHEV) Industry Report, 2019-2025, expects plug-in vehicles to command a share of 68% of new car sales in China by 2040 and registrations of ICE vehicles to “nosedive from 2024” onwards. The figures are most likely sourced from Bloomberg NEF, as its 2040 estimate for the share of EVs in sales in China stands at close to 70%. By its own admission, Bloomberg NEF “continues to hold the most aggressive view on EV adoption” compared with other industry forecasts.

|

While PHEVs still have an internal combustion engine and therefore require lubrication, the rapidly growing number of BEVs in China bodes ill for lubricant manufacturers.

|

While PHEVs retain a combustion engine and therefore require lubrication, China is very much a BEV market, which does not bode well for lubricant manufacturers. Already, 78% of all vehicles with a charging cable are full electric, the International Energy Agency reported in its Global EV Outlook 2019.

The IEA’s outlook is more in line with that of Kline. In its New Policies Scenario, the agency projects that the share of EVs in new vehicles sales (including light commercial vehicles, buses and trucks) will expand to 28% in 2030.

The Clean Energy Ministerial – a forum for the world’s energy ministers and other high-level stakeholders – works with its own projection called the EV30@30 scenario. This campaign is geared towards achieving a benchmark 30% share of EVs in vehicle sales by 2030. In this scenario, the IEA expects EVs to reach a 42% share in China in 2030, 6 percentage points higher than the estimates by Kline.

Yet all of these numbers pale in comparison with projections by the online EV community. Writing for the Clean Technica website, Maximillian Holland pointed to a “clear path” to EVs claiming a 50% market share in China as early as 2025, blasting “mainstream analysts and industry consultants” in the process for using “all kinds of faulty assumptions” and “over conservatism” in their forecasts.

Regardless of the numbers, it is safe to say China is all in on EVs. “Time and tide wait for no man,” the proverb goes, and the tide may well turn in favor of Chinese manufacturers. Will the rest of the world join the charge?

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at cs@lubesngreases.com.

Click here link to homepage