Market surveys can give companies a look at successes and problem areas within their industry, allowing a glimpse into the future and enabling better decision-making. A survey conducted by industrial packaging specialist Greif helps elucidate potential growth areas and trends shaping packaging for the lubricants sector.

During the six months prior to the COVID-19 outbreak, Greif undertook a full market appraisal by surveying customers, conducting online market research, analyzing sales and consulting with influencers operating in the lubricants market. The research aimed to explore future trends for the lubricants industry and assess their impacts on the packaging sector, with a specific focus on industrial packaging. One-on-one interviews were conducted with a sample of 25 customers across the globe, including some of the world’s leading lubricant manufacturers and suppliers.

At the time, data from Grand Market Research showed that lubricant demand was anticipated to grow across each of four main sub-segments: automotive, industrial, marine and aerospace. The total lubricant market was expected to see a 2.9% compound annual growth rate through to 2027. In terms of the lubricants packaging market, the automotive sector was expected to grow at a 3.1% rate over that time frame. For industrial, this figure is 3.5%, marine 3.8% and aerospace 4.6%.

However, less than six months on, industrial packaging and lubricant companies are now implementing resilience strategies and redirecting resources in response to the new and highly dynamic operating conditions they are facing. Greif’s research provides an insight into the long-term trends that are likely to hold. For example, new technologies, services or production activities, augmented by stronger environmental credentials, are likely to be required to help create differentiation to weather the wider market recovery.

Sustainability Tops the List

Perhaps unsurprisingly, Greif’s research points to an ever-growing focus on sustainability within the lubricants industry. The importance of sustainability was mentioned by 90 percent of Greif’s interviewees and confirmed by the top industry players’ key strategies. This perhaps mirrors the increasing commitment to decarbonization and circular economy business models industry wide.

While acknowledging that environmental policy varies by country and region, there is a growing coalescence around circular economy principles as evidenced by a brief published by the World Business Council for Sustainable Development in October 2018. This provides information on the increasing number of circular economy policies that are already in place within the European Union and China. Furthermore, the European Green Deal, announced in December 2019, covers all sectors of the economy and sets out proposals to help make Europe the first climate-neutral continent by 2050.

Study findings also highlight the increasing purchasing power held by consumers and the fact that sustainability credentials are now a core part of today’s purchasing decisions. They show a push toward using more biodegradable and cleaner lubricants and increased awareness about the hazardous impact of industrial waste on the environment. This is creating a growing demand for more eco-friendly packaging and sustainable practices.

In April of this year, Shell became the latest global energy company to commit to a net-zero emissions goal by 2050. Other leading lubricant manufacturers, including Total, ExxonMobil, Chevron and BP, have all made similar commitments.

Aysu Katun, director of sustainability at Greif, explained the significance for packaging: “Before many companies will even consider adding you to their supply chain network, you need to have a robust sustainability program in place, including being able to demonstrate how you are proactively taking steps toward developing zero-waste-to-landfill operations and increasing circular systems.

“That said, there certainly isn’t uniformity globally on this point. For example, waste programs in Europe are typically backed by the strong regulatory frameworks there. However, customers in other regions, such as North America, tend to operate with less environmental regulations compared to those in Europe,” Katun observed.

This is where sustainability ties into other priorities. “While sustainability has been a key concern for businesses and consumers throughout the world, smaller manufacturers are re-emphasizing the need for cost-effective and durable packaging options for various end-use markets,” said David Richards, Chief Operating Officer for Philadelphia, Pennsylvania-based RichardsApex Inc.

“Recycling and reconditioning programs vary from state to state, not to mention throughout the many international markets. We lean on packaging suppliers to help us meet the growing demands of our customer base in various markets, which includes better outlets for recycling, reuse and disposal,” he said.

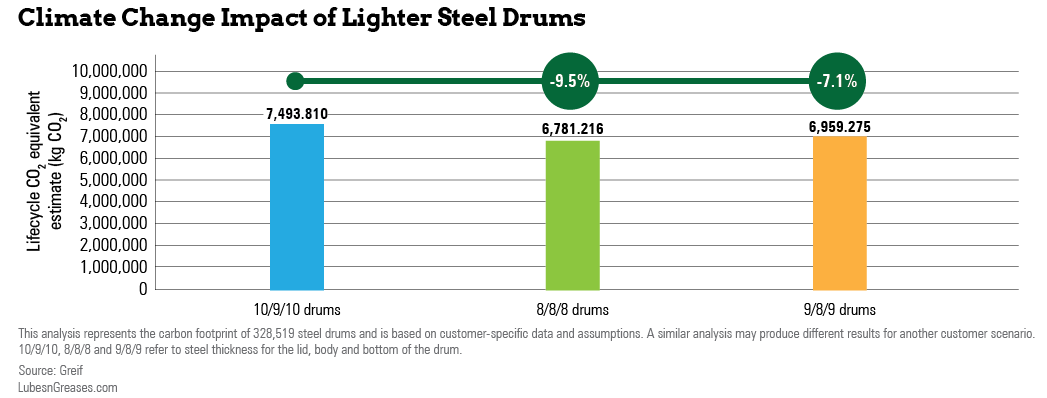

Greif’s research also demonstrates how customers within the lube industry are actively seeking reductions in the amount of raw material used in their packaging, such as using lower-gauge steel drums. Equally, there is a desire to see more packaging that encompasses recycled plastics and a drive to increase recycling and reconditioning.

“We are wholly committed to minimizing the environmental impact of packaging. However, there are trade-offs between different sustainability objectives,” continued Katun. “For example, reconditioning provides the most emissions savings, which, depending on the product, can be up to 75% or more. Downgauging, on the other hand, (depending on the extent) can limit steel drums from being reconditioned. With plastic packaging, residual lubricant can be hard to remove, making recycling and reconditioning difficult. Therefore we grind, wash and extrude the plastic.

“The challenge for the lubricant industry and us as industrial packaging suppliers is always to find the right balance. When implementing sustainable practices, we must ensure we are not compromising on either the quality or safety of our packaging. Strong, collaborative work between customers and suppliers on this issue is the only way to develop real sustainable value,” she said.

Meeting Modern Challenges

While sustainability rates highly on the agenda for many companies in the industry, it is certainly not the only factor influencing the buying decision.

Growing competition within the highly fragmented lubricants industry means that manufacturers are increasingly seeking ways to differentiate and promote brand quality. Product differentiation to help underpin premium pricing models or to nurture brand loyalty is a key marketing tactic.

“In such a highly competitive space as the lube industry, especially when it comes to sectors such as automotive, being able to set yourself apart from the competition is vital,” said Alain Sirejacob, product manager for steel at Greif. “Where brand image is important to customers, high-quality print and product decoration is critical. It allows customers to differentiate products and generate impactful packaging design to support the price point of high-value products.”

Leon ten Hove, marketing manager from Kroon-Oil in the Netherlands, said, “High quality, digitally printed steel drums have been critical to our brand success. We have used digital printing to support our promotional initiatives. Importantly, it has helped boost our brand status through providing us with better brand recognition and protection.”

Greif’s research also highlights brand protection, anti-counterfeiting and product integrity as key issues for the global lubricants industry. There are various solutions to these challenges, including more branded packaging and anti-tamper technology and devices. Cost is an important factor, though, so finding cost-effective ways of surmounting these issues is critical for industrial packaging suppliers and customers. Examples include embossed logos on caps and the use of UV or infrared invisible marks.

Interestingly, the research points toward growing demand for specialist packaging in response to growth in specialty and premium-quality lubricants, such as white oil for food applications and special lubricants for wind turbines and aerospace.

For Greif, this has resulted in the introduction of food-approved lacquers and linings with no added bisphenol A—which some believe is harmful to human health—and cleaner steel drums. Used for highly sensitive filling goods, cleaner drums are specially cleaned using compressed air. This replaces the traditional manual cleaning process using solvents, which results in the loss of 1 liter of solvent per drum or 1.7 kilograms of carbon dioxide emissions per 55-gallon drum.

Comparatively, the use of compressed air creates little or no CO2 impact. Therefore, it is safer for the environment, safer for workers and uses fewer resources.

Better packaging logistics and smart packaging solutions, for example real-time tracking technology, is another area where demand is set to increase. Greif’s GCube Connect is an example of packaging that provides tracking information through an Internet of Things-based device. According to Sirejacob, tracking can save money by reducing operating working capital, optimizing production planning and automating procurement and sales processes.

“While smart technologies and appearances help differentiate the high-end products, the reality is the cost often outweighs the benefit for many smaller players,” noted Richards. “However, opting for cheaper alternative packaging options risks compromising product integrity and handling safety. Finding a balance between economical packaging costs, durability and reusability seems to be the important feature during these challenging times.”

The current COVID-19 crisis has undoubtedly created significant risks and uncertainties for both lubricant companies and industrial packaging suppliers. Many key questions about the market recovery and the medium-term market performance remain unanswered. Despite those macro-level uncertainties, Greif’s pre-pandemic research signifies that any form of recovery is likely to witness greater focus on smart packaging solutions, better brand and product protection and more specialist packaging, all underpinned by sustainability throughout the lubricants value chain.

Jennifer Dally is responsible for global strategic marketing at Greif and has 30 years of marketing experience. She can be reached at jen.dally@greif.com.