Change is ahead for the global lubricants industry. For industry professionals across the value chain, preparing for these key trends will lead to the industry’s collective and continued success.

Are you ready for change? Because it’s coming to the global lubricants industry.

This may not sound surprising or new. Change has been a theme in our space for the past several years as we’ve grappled with the rippling effects of a pandemic, the ongoing need for higher levels of performance from our products and other factors.

But more is coming.

Population growth around the world, increasing urbanization and other broad demographic shifts will begin to fundamentally alter how we think of mobility. Connected, autonomous, shared and electric technologies—often referred to collectively as CASE technologies—and other breakthroughs may upend the concept of the personal automobile in the coming years. And perhaps most importantly, ongoing decarbonization and sustainability efforts grow apace and will have widespread new implications for lubricants in every application.

With all of this in mind, below are the three most impactful trends we are watching this year and what they will mean for lubricant marketers and professionals everywhere.

Trend #1: Sustainability Efforts Will Level Up

While additives and lubricant businesses have certainly contributed to sustainability in many ways, industry stakeholders should expect new challenges and opportunities in the years ahead.

For example, European legislation requires that the fleet-average CO2 emissions of new vehicles (both light-duty and heavy-duty) registered in 2025 be 15% lower than the levels in 2021. To meet these requirements, vehicle manufacturers are increasingly adopting lower-viscosity engine oils, with SAE 0W-20 engine oils now used as the factory fill option for many engines.

Furthermore, plans to introduce “in-service verification” rules are under development, aiming to ensure CO2 performance is maintained throughout vehicle lifetimes. Some original equipment manufacturers (OEMs) are therefore adopting stricter servicing, requiring the same engine oil specification and viscosity grade to be used for the entire life span of a vehicle.

Meanwhile, the United States Environmental Protection Agency (EPA) recently announced strict new emissions rules for 2027-2032 model year vehicles. This is one of the reasons why ILSAC GF-7—the successor to ILSAC GF-6, which just received first licensing in 2020—has been requested by the first quarter of 2025. The ILSAC GF-7 specification request encompasses crucial improvements across a wide range of performance characteristics, and the industry will focus intensely throughout 2024 on proving the technology related to this specification’s requested improvements, including the following:

- Enhanced piston cleanliness

- Improved fuel efficiency

- Protection against low-speed pre-ignition (LSPI) in aged oil

- Adaptations to accommodate the increased adoption of gasoline particulate filters (GPF)

- Reduction in timing chain wear

- Oil pumpability

- Gelation performance

- Material compatibility with new seal elastomer materials.

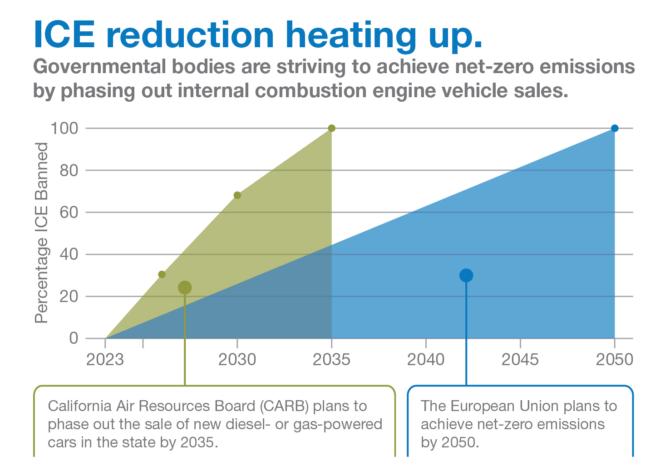

Elsewhere, governmental bodies are proposing the outright banning of the internal combustion engine (ICE). For example, a ban on ICE-powered cars is intended to be a major component of the European Union’s plan to achieve net-zero emissions by 2050, with the proposal of a total ban on the sale of new diesel and gasoline cars by 2035. In the United States, the California Air Resources Board (CARB) in 2023 finalized a rule to phase out the sale of new diesel- or gas-powered cars in the state by 2035. The rule will require 35% of new cars, SUVs and small trucks sold to be zero-emissions vehicles starting in 2026, increasing to 68% in 2030 and 100% in 2035. In 2022, zero-emissions vehicles made up about 16% of new cars sold in California. The rule also sets durability, warranty and other provisions on zero-emissions vehicles.

Finally, numerous industries are also seeking lubricants that are friendlier to the environment. Significant volumes of industrial fluids leak into the environment through machine seepage, spillage and careless disposal every year. As the world continuously seeks to become more environmentally conscious, minimizing the impact of such losses has become increasingly critical—and it is why demand for environmentally acceptable lubricants (EALs) will continue to grow in 2024 and beyond. EALs are fluid formulations that have been shown to meet such regulatory standards for biodegradability, non-bioaccumulative potential and minimal toxicity to aquatic life compared to conventional lubricants.

Taken collectively, these measures point to a new normal when it comes to sustainability efforts—one that continually requires performance enhancements for finished lubricant products. Next-generation engine oils must enable new engine technology to meet new emissions standards around the globe and will require some fundamental shifts in formulation and additive chemistry to meet the challenge. In the case of EALs, complete reformulations will be required for marketers seeking to seize the opportunity that market represents; many of the most commonly used additives in traditional fluids simply do not meet the environmental standards required of EALs.

Trend #2: Emerging Technologies Will Push Boundaries Further

Along with new sustainability requirements, we are also witnessing the introduction of new forms of mobility that will introduce additional challenges for lubricants.

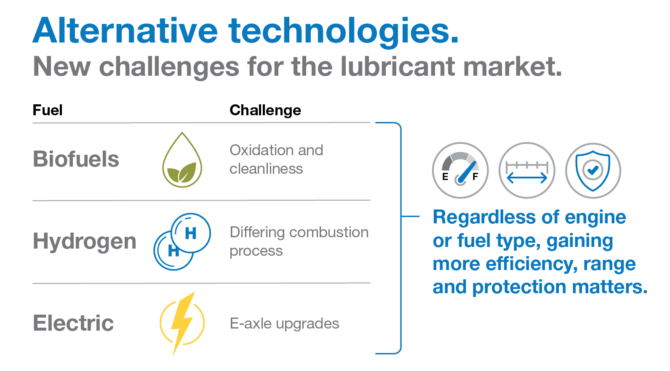

Within the ICE space, OEMs are exploring a wide range of alternative fuels that maintain better environmental and sustainability profiles than traditional fossil fuels. These include hydrogen, natural gas, biofuels and e-fuels (also known as synthetic gasoline)—each of which may have completely different requirements of the lubricant than gasoline or diesel fuel.

Biofuels, for example, present challenges involving oxidation and cleanliness. Because biofuels are well-enough established, these challenges are well understood. But we can anticipate that biofuel use will only continue to grow in 2024 and beyond, particularly in Latin America where domestic production of biofuels is plentiful. Lubricant marketers wishing to compete in these markets must be prepared.

Other alternative fuels will pose entirely new challenges. Hydrogen, for example, differs from gasoline in the combustion process itself, its air-to-fuel ratio, ignition energy, flame velocity, auto-ignition temperature, diffusivity, quenching distance and density. These factors can significantly influence the required performance characteristics required for a lubricant in such an application.

Then, of course, there is the ongoing electrification of the automotive industry, which will continue to have a major impact on the lubricant market. For instance, many first-generation e-axles (e.g., the transmission used in battery electric vehicles, or BEVs) were designed with the electric motor sealed off from the transmission fluid, and the transmission design typically consisted of a single gear ratio.

That is changing and evolving as OEMs seek to gain efficiency, improve range and reduce the cost and weight of the e-axle, and we will see the impacts in 2024 and beyond. Many second-generation e-axle designs include the electric motor within the transmission itself, leaving the electric motor now exposed to the transmission fluid. The fluid needs to perform all the same functions as before, all while protecting against copper corrosion and keeping the motor at optimal temperatures. Additionally, multi-speed e-axles will also balance friction performance for clutches. These demands will require specially formulated transmission fluids that significantly differ from those available today.

Trend #3: Industry 4.0 Will Drive Comprehensive New Efficiencies

Industry 4.0—also referred to as smart manufacturing or the fourth Industrial Revolution—is fundamentally changing the way companies manufacture, improve and distribute their products in all global markets. Its impacts are significant and wide-ranging.

For the lubricants market, Industry 4.0’s principal impact has to do with how lubricants are selected, consumed and evaluated. These processes are becoming increasingly digitized, meaning that operators are coming into contact less and less with the lubricant itself and instead are relying on data systems to gauge performance and make decisions. This new reality has two major implications:

- For end users, it is oftentimes more important to know about the data systems than the lubricant itself, and that could mean that on-the-ground knowledge of lubricants and their proper applications could erode.

- Lubricant product development and usage guidelines will be more influenced by those data systems as well as the people managing them.

But data does not tell a meaningful story without analysis, interpretation and insight. It will be important for operators to understand why the data shows what it shows and what improvements should be made, be it a different product, new chemistry or a change in maintenance behavior. For professionals in the lubricants market, our evolving role must be that of a consultant, becoming the connection point between what the data shows and what it means in terms of real-world performance and lubrication strategies.

These shifts will also lead to opportunities. The data-driven systems of Industry 4.0 give greater transparency to end users regarding the performance benefits of higher-quality lubricants. Increasingly, they will be able to see the efficiencies high-performance products bring to the table and how they translate into real value. As such, bringing true meaning and insight to data by correlating it with lubricant performance and degradation will be a core role for the lubricants industry.

The Bottom Line

Change is coming. Are you ready?

High-performance additives and lubricants will be fundamentally necessary to navigate the trends outlined within this article. Customized lubricant solutions tailored for specific industries and applications will become more prevalent. Lubricant marketers may need to rethink their product portfolios entirely, and they must lean on the right vendors, suppliers and partners to drive success. Close collaboration between all stakeholders will be an absolute necessity.

Lubricant marketers across industries should leverage their partners and suppliers to keep them on the cutting edge. Advanced additive technology, chemistry expertise and close consultation with the right partners will be critical as the industry moves forward—together.

Flavio Kliger is senior vice president and president of Lubrizol Additives, where he has served in several roles for the past seven years. He has 30 years of experience within the chemical industry.