The lubricants industry is working to get a firmer understanding of the market implications posed by low- and zero emissions vehicles. Could hybrids cushion the inevitable blow to automotive lubricant blenders?

The transition to electric mobility is irreversible, and depending on the region, the speed of change varies from tentative to breakneck. Even during the pandemic, which shuttered the economy for the best part of a year, battery electric vehicle sales in places like China and Northern Europe grew apace. This is bad news for passenger car motor oil manufacturers.

The impact of motor-oil-free BEVs on automotive lubricant sales may not be as severe as some may think, neither now nor in the future. According to Adam Banks, e-mobility manager for additive company Afton Chemical, there may be plenty of revenue to capture.

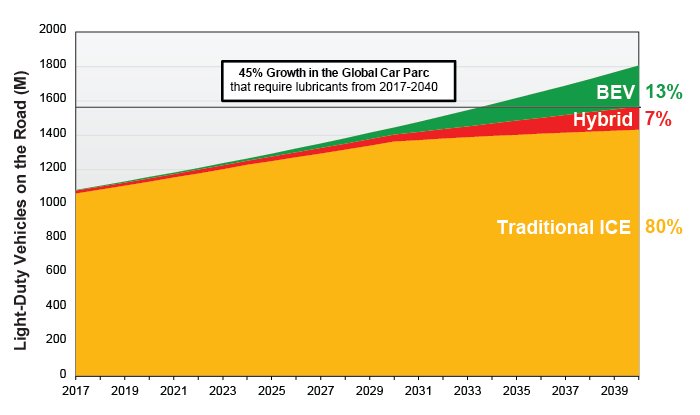

Afton’s long-term projection is that the engine parc will continue to grow, Banks told Lubes’n’Greases. This outlook is based on the current number of vehicles in the world and the potential for motorization in the Southern hemisphere.

“This is not something we can significantly control one way or the other, but we can be active and maximize the opportunities,” Banks said. “However, the style of fluids in markets seeing electrification will shift.”

There are about 1.5 billion cars on the world’s roads today. That number could grow to 2 billion by 2040, with anywhere between 30% and 40% being electrified to some degree, including hybrids.

Afton believes that most vehicles will still have a combustion engine 20 years from now. The company is still banking on hybrids as a revenue stream, since they require the same engine and transmission oils as ICE vehicles.

“Europe is racing toward battery electric, but other parts of the world, to reduce carbon emissions, we need hybridization in the short term,” Banks said during a presentation at the 2023 ICIS World Base Oils & Lubricants conference.

Afton expects peak demand for automotive lubricants will be in 2040, despite growth in electrified vehicles and given the time it takes to change over a car parc.

Drivers and Obstacles

Climate change, fluctuating fossil fuels prices and geopolitics have sealed the fate of the ICE. From the United States to the European Union, and from India to China, governments have been steadily lowering limits on transport greenhouse gas emissions. For example, in the EU there is an impending de facto ban on the sale of new ICE vehicles by 2025. One way for carmakers to stay below these limits and avoid crippling fines is switching to alternative drivetrains.

“When we look at it from the OEM perspective, you can see they’re driven by these emissions legislations and technical legislations that they have to hit,” Banks said. “All of the OEMs now have a clear path and a strategy toward electrification.”

Charging infrastructure, raw materials supply chains and enough consumer spending power to be able to buy the vehicles—even in the more affluent global North—are slowing growth to a certain extent. This is good news for lubricant blenders.

“The biggest barrier is supply and distribution of sufficient clean energy. Smart grids, buffering to serve less consistent supply from renewables, high-capacity connections, etc.—this is what requires the investment and political will,” Banks told Lubes’n’Greases. “Charge infrastructure is then the cherry on the cake that consumers will see.”

In the U.S., Bloomberg estimated that by 2030, 50% of new cars sold in the country will be BEVs. This would place a large strain on the aging and fractured electricity transmission grid, the majority of which is fossil fuel or nuclear. Demand for power will increase by up to 20% by 2030 and 40% in 2035, whereas demand grew by 5% in the previous 10 years. The White House wants to achieve 100% renewable power generation by 2035, a goal many in the power industry think is unrealistic.

In places like Indonesia, sub-Saharan Africa and South America, electricity infrastructure is lacking even more. People’s priority is to buy a fridge before they can afford a BEV. In these regions, hybrids are a solution, at least in the interim, Banks believes.

Until recently, many EV carmakers were losing money, and some still are. It was in 2020—17 years after the company launched—that Tesla began making a profit on every vehicle sold. CEO Elon Musk then reduced the prices of vehicles to shift inventory, thwart the competition and weather economic uncertainty. Meanwhile, hybrid engines are based on the legacy of ICE technology.

“The OEMs’ big overriding consideration is to avoid the risk that they don’t want to go wrong at the start,” Banks told Lubes’n’Greases. “As we move toward a mass market, it’s about optimizing—making sure that the mass market and consumers can come into this.”

For this reason, Banks said, efficiency of the machinery is critical to allow smaller batteries to do the same job. This greatly reduces vehicle cost and charge times.

Legacy Technology

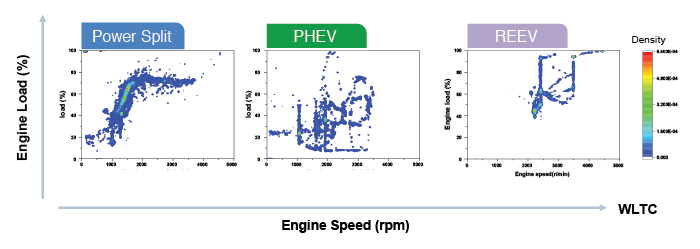

There are lingering challenges with hybrid engines, not least with lubricant performance. The combustion portion of a hybrid’s engine is largely unchanged, Banks explained. What differs is how it is used.

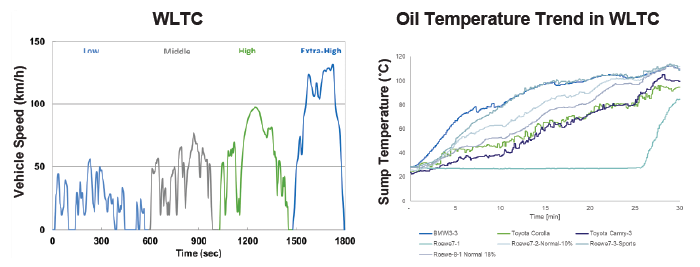

The presence of the electric motor in a hybrid places unique demands on the engine oil. High-power cold starts cause wear. Water and fuel mix with the lubricant and cause corrosion when the vehicle runs mainly from the battery and the ICE is unable to get hot enough. Driving a hybrid in hot climates raises oxidative load. In short, hybrids can increase engine operational severity.

Figure 1. ICE Continues to Grow to 2040 – Volume will remain for a long time. What and how you sell will slowly change.

Source: Afton Chemical

Comparing a Toyota hybrid with a conventional ICE car of the same engine displacement, Banks pointed out that the engine oil specification and drain interval are the same—as it stands today. To address the problems above, tailor-made specifications are needed.

According to BP’s lubricant brand Castrol, there is no specific industry specification for hybrid engine oils. In response, the company released its own specification called Hymax.

“We could see the evolution of specifications, and we can start to see some of the needs of hybrids brought into those specifications,” Banks said.

Transmission of Opportunities

There are other opportunities for sustained automotive lubricant business into the future. Whatever the drivetrain, most vehicles have some kind of transmission. It is in this sphere that significant volume sales can be found as electrification continues to ramp up.

In his presentation, Banks looked at a handful of vehicles to illustrate the volumes of fluid each one requires. The Dacia Sandero was Europe’s third-biggest seller in 2021. It holds 2.4 liters of manual transmission fluid and is fill for life. The Ford F150—the U.S.’s best-selling truck for 46 years straight—has 10 liters of automatic transmission fluid, drained roughly every 100,000 kilometers. The world’s favorite hybrid, Toyota’s Prius, has a dedicated hybrid transmission that likes 4 liters of transmission fluid to be changed out every 160,000 kilometers. Lastly, two big-selling BEVs—the Nissan Leaf and the Tesla S—have e-axles that take 1.5 liters of gear oil in a dry system and 6 liters in a wet dual motor, respectively.

Figure 2. Hybrid Operation Changes Speed/Load Map – Hybrids can increase engine operational severity.

In summary, a dry e-motor EV like the Leaf requires similar amounts of transmission fluid as the manual Sandero and the DHT Prius. On the other end of the scale, the wet dual motor Tesla consumes similar amounts to the automatic F150.

“Thinking about what that means for the volume of transmission fluid in the industry … any manual that goes over to an e-axle is either neutral or good for our volumes,” Banks said. “And any time it moves to a wet system, it’s a net positive; it increases the size of the industry.”

ICEs are shifting to automatics, and first-generation dry e-motors are shifting to wet e-motors in subsequent generations. This means that volume demand per vehicle is staying roughly the same, rather than declining. Concurrently, needs are changing as electric motors are introduced.

Outlook

Despite the inevitable increase in EV adoption, Afton predicts the continued viability of automotive lubricants.

“Predicting beyond 2040 and decades into the future is harder of course, but demand is not forecast to dramatically drop away. The mix of applications and product needs will evolve as the car parc electrifies,” Banks said. “Anything that moves will require lubrication.”

Oil marketers must face the fact that the total lifetime fluid volume for an EV versus an ICE vehicle is lower. But they still need a transmission oil, among other lubrication products.

Figure 3. Different Engine Operations Can Affect the Temperature – Experiencing different conditions at different temperatures is why hybrids can affect severity.

As BEVs take an ever-larger share of new vehicle sales in the West, like many other companies Afton is eyeing other markets for future business in the automotive space.

In the past two decades, there has been a significant shift in demand patterns from mature markets in the West to the developing East, as motorization expands and well-established technology is redeployed in those emerging markets. But regions like South America and sub-Saharan Africa also offer opportunities.

“The next two decades will see a shift from North to South and a growing need for bespoke technologies in growing markets,” Banks said.

Like many of their direct competitors in the additive sector—as well as a host of traditional lubricant companies and chemicals producers—Afton is pursuing other avenues to sustain volume output, namely thermal management of applications such as EV batteries and e-motors, power electronics, charging stations and data centers.

“We have positions today in these systems and are assessing how we can add greater value,” Banks said.

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.