Green Shoots

In January and February, base oil participants were still facing Omicron-induced supply chain disruptions and staff shortages that resulted in reduced production rates and temporary shutdowns. But the pandemic has also had a positive effect on the industry: It appeared to have lent increased impetus to the development and implementation of more environmentally friendly production methods and the use of renewable feedstocks.

Heightened awareness about climate change and its consequences also pushed governments to incentivize using greener energy sources and reducing pollution. These trends are shaping many of the strategies that base oil and lubricant companies are implementing and will color their actions in the future.

One of the challenges these companies will have to address is altering the public perception of the lubricants industry. It is often lumped with less environmentally friendly enterprises in the oil and gas business, even though a number of base stock and lubricant companies have long been investing in sustainability practices.

“We have been working with customers for years to understand their needs and create solutions for more sustainable products,” said Lance Puckett, president of Ergon Refining Inc. and Ergon – West Virginia Inc. “The timing of those transitions depends on varying demands in different parts of the world, whether brought on by regulations or by customers who are searching for green solutions. We have customers in Europe asking that all suppliers be carbon neutral by 2025. The dilemma is around timing and the market’s ability to consume the higher costs that are inherent to many of those solutions.”

Among the many roadblocks that companies have encountered is difficulty attracting new talent, as new graduates and younger generations tend to gravitate toward businesses at the forefront of environmental, social and governance practices, and technological advances—not financials alone.

“One of the key lessons from the pandemic is to focus on the overall improvement of the environment and not just emissions,” said Harji Gill, CEO of Penthol LLC. “The industry needs to start a new media campaign explaining its role and contributions to global growth. The new generation loves solving the challenging problems of tomorrow, but at this time, recruiting good young talent is almost impossible for oil companies.”

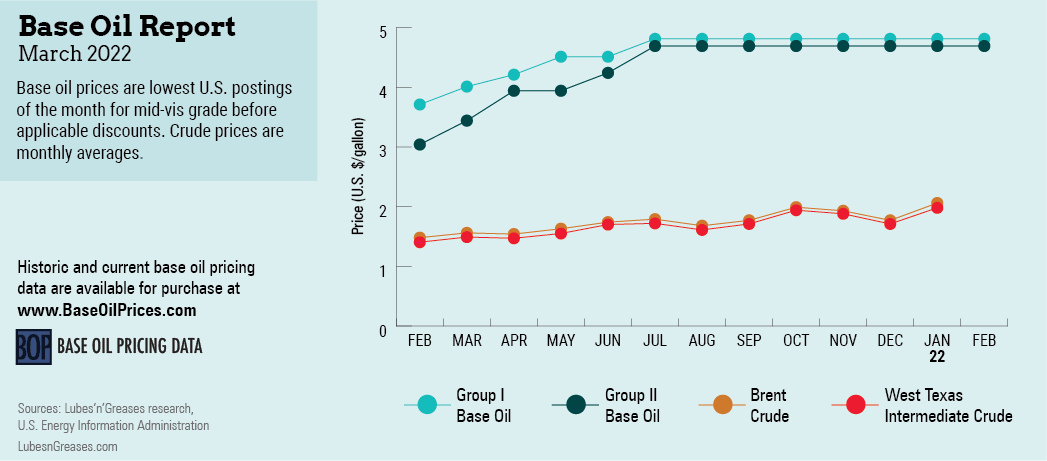

Of more immediate concern to base oil and lubricant market participants was the steady rise of crude oil and feedstock prices that has squeezed margins and placed pressure on base oil values since the beginning of the year. At the time of writing, West Texas Intermediate futures hovered near $92 per barrel, from $80 per barrel only a month earlier.

In early February several naphthenic base oil price initiatives emerged, with Cross Oil, Ergon, Calumet and San Joaquin Refining nominating increases of 25 cents per gallon to be implemented in the first half of the month.

The initiatives received further support from healthy demand and tightening supply. Valero was reported to have shut down its naphthenic base oil plant for a short turnaround in January, while San Joaquin and Cross Oil were preparing for turnarounds in early February and March, respectively.

The Omicron variant has exacerbated lingering supply chain disruptions due to staff absences, including the lack of truck drivers. Shortages of additives and other raw materials have led to reduced manufacturing rates at even more blending plants, triggering a slowdown in base oil requirements.

Labor shortages were expected to last at least through the end of the year, and ocean freight transportation may see extended disruptions, experts predict. Despite these issues, most base oil suppliers were fielding plenty of orders. Some of the lighter grades have tightened, particularly as producers have adjusted production rates or redirected light oils into the distillates stream.

Finished lubricant producers were expected to continue implementation of price increases up to 16%, which were announced between November 2021 and February 2022. The markups would be rolled out between December and March, fueled by the steeper costs of raw materials, additives, packaging, labor and freight.

Two major additive producers intended to increase prices by 15% on Jan. 31 and Feb. 21, respectively. Securing enough additive supply for blending operations was difficult for many manufacturers; gear oil additives and other automotive and industrial products were particularly elusive. Difficulties were expected to persist into the second quarter.

There is no doubt that the industry is facing unprecedented challenges and undergoing tremendous change, but there is light at the end of the tunnel. Some may say that the light is green and will likely guide the industry toward achieving financial targets and sustainable development.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com