Among the many zero- or low-carbon fuels being considered by engine manufacturers to address the International Maritime Organization’s 2050 deadline to reduce marine shipping carbon dioxide emissions by 50%, ammonia may be the most radical.

It is also on a much earlier timeline than that deadline would suggest. Some original equipment manufacturers plan to introduce engines that run on ammonia by the middle of this decade. As a result, lubricant formulators who scurried to accommodate last year’s ratcheting of fuel sulfur limits are already under the gun to find solutions for a new problem. At least one chemical additive company warns that the learning curve will be steep.

For several years, the lubricants and marine industries have focused on the IMO 2020 requirements to cut acidic sulfur-containing emissions from ships worldwide. IMO is a specialized agency of the United Nations that sets shipping industry policies for 174 member nations. The impact of IMO 2020, both potential and now real, has been top of mind for lubricant blenders for some time.

At the highest level, IMO 2020 affects lubricants in two ways. First, some refineries are unable to economically produce the low-sulfur fuels required for the majority of ships that do not have exhaust scrubbers without affecting their ability to produce Group I base oils. Second, the absence of sulfur in the fuel means that lubricants do not have to neutralize as much acidic combustion products. However, simply moving to low base number lubricants does not appear to be the solution.

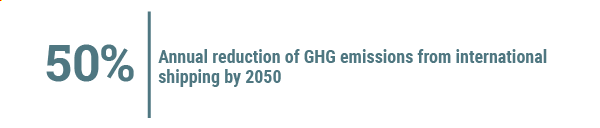

While the industry grapples with the real-time issues of lubricating ships powered by low-sulfur fuels, the targets to reduce greenhouse gas emissions are exercising many whose brief is to look longer term. The IMO’s website outlines those ambitious targets, including this one: “Total annual GHG emissions from international shipping should be reduced by at least 50% by 2050 compared to 2008.”

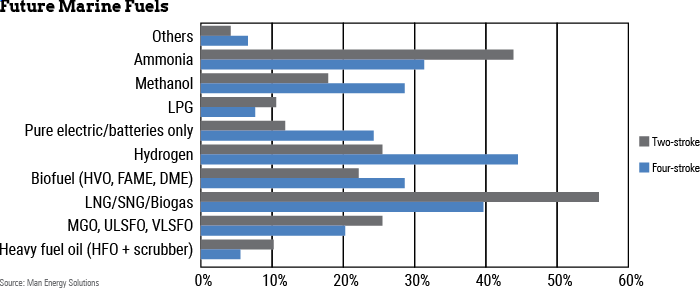

The industry is looking at innovative ways to address this. While batteries and fuel cells are possible ways forward for short-trip vessels, like ferries or river and canal transport, some form of combustion engine seems likely for larger vessels that have either two-stroke (low-speed) engines or four-stroke (trunk piston) marine diesel engines.

Future Fuels

Four new fuels are being considered, sometimes called “future fuels”: methanol, liquefied petroleum gas, hydrogen and ammonia. Most of us have seen the first three burn in a kitchen, on a barbecue or in a chemistry laboratory. But ammonia has been much less common.

Because methanol is a liquid, it can be handled relatively easily. Like LPG, it is already in use. Both are considered to be “bridges” to zero carbon fuels, because some of both fuels can be produced from renewable sources, reducing the manufacturing carbon footprint. However, there are drawbacks. For instance, methanol is toxic, and demand for both fuels is so high that some methanol or LPG in circulation will be carbon-intensive for many years.

The two potential zero-carbon fuels are “green” hydrogen and ammonia, which get the designation if they are produced using only renewable energy. Hydrogen has low energy density, must be compressed and/or refrigerated and is highly flammable. Ammonia’s advantage is that it can be stored at higher temperatures than LPG or hydrogen and is more energy dense than the latter. However, some consider its toxicity to be a major disadvantage.

Each of the future fuels is chemically simpler than current heavy marine fuels. They are composed of smaller molecules and simpler mixtures than conventional marine fuels. Because of this, they should burn more consistently, leading to less uncombusted fuel. This could result in lubricants requiring less detergency and dispersancy than current formulations.

However, there are significant unknowns about the new fuels, such as the temperatures they generate at the walls of cylinders or the relative fuel-to-air ratios, which will strongly influence the combustion products that interact with the lubricant, either directly on the walls of the cylinder or after blowing by the pistons to the lower engine areas. These effects, once understood, could lead to lubricants that require different chemistries than those used today.

Focus on Ammonia

The list is long of major players announcing ammonia projects in the last year. Ian Bown, technical manager – marine diesel engine oils, based at Lubrizol Ltd.’s European Research and Development Centre in the United Kingdom told Lubes’n’Greases: “Many players believe ammonia is going to be one of the fuels of the future for two-stroke marine engines. This may be as a hydrogen carrier or as a fuel.” Among those making recent announcements regarding ammonia-powered marine engines are engine manufacturers Wärtsilä and Man Energy Solutions.

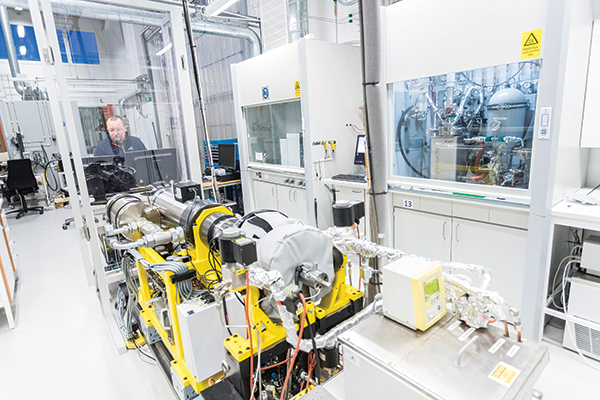

In mid-2020, Wärtsilä announced the world’s first long-term, full-scale testing of ammonia as a fuel in a commercial marine four-stroke combustion engine as part of the Norwegian Government’s DEMO 2000 program. One of the other partners is the Norwegian subsidiary of Spanish oil company Repsol. “We are really excited to further develop and understand the combustion properties of ammonia as a carbon-free fuel in one of our multifuel engines,” said Egil Hystad, general manager, market innovation at Wärtsilä Marine Business. In mid-July, Wärtsilä announced that the first test had been successful on a fuel mix containing 70% ammonia and 30% marine diesel oil.

Man Energy Solutions aims to have a commercially available two-stroke ammonia engine by 2024, followed by a retrofit package for the gradual rebuild of existing maritime vessels by 2025. Swiss and Singaporean commodities trader Trafigura—one of the world’s largest traders of crude oil, refinery products, metals and minerals—is a co-sponsor. Speaking at the launch of the sponsorship, Bjarne Foldager, senior vice president and head of two-stroke business at Man Energy Solutions, said, “We believe that hydrogen-based fuels will ultimately be the shipping fuels of the future.” Where hydrogen is generated from renewable resources, shipping operations can become carbon neutral.

In June, TotalEnergies announced a joint study on ammonia as an alternative marine fuel with 22 other companies, including engine manufacturers, shipbuilders and repair yards, traders, ship owners and operators, and terminal operators.

With frequent announcements about ammonia as a green fuel for onshore power generation, momentum is building, so what does this mean for lubricants?

Back to Basics

With a little more than two years until the first engine is on the market, the discussion might have been expected to consider flame behavior in the cylinder, the interactions of the lubricants with the combustion products on the cylinder walls and the effects of blow-by gases on deposit formation between and behind the rings. However, the situation is quite different.

To start, ammonia is a toxic substance that has never been used as a fuel in the laboratories of most lubricants or additives companies. So the first steps these companies are taking is to risk assess the transport, receipt, storage, use and disposal of ammonia and ammonia-contaminated products. “We’ve really had to go through a considerable amount of risk assessment,” Bown said. Many test methods have been reviewed to assess whether they are relevant to this new fuel. Some will be rewritten, and some new test methods will be developed.

“We’ve been gathering information,” Bown said. “We know ammonia has a tendency to corrosivity, but which components will be affected?” Lubrizol has therefore begun by exposing metal engine parts to ammonia, particularly coated parts, like piston rings. Other issues include compatibility of the fuel with elastomer seals. While there are not many in a two-stroke marine engine, it is still an issue that must be considered.

A Simple Burn?

Ammonia contains nitrogen. When it burns in air, nitrogen oxides can be produced as byproducts. Water is an intended product of the direct reaction of ammonia and oxygen, which means that there is plenty of scope for a further reaction of NOx and water to produce acids of similar strength to those formed with high-sulfur fuels. Because of this, acid neutralization could become a major issue once again.

Beyond the chemistry of the combustion process, where does the flame propagate in the cylinder? “We know from liquefied natural gas studies that the flame can burn down the sides of the piston crown,” Bown said. This has clear implications for deposit formation between and behind the piston rings.

Of course, the issues are not simply for the cylinder lubricant in a two-stroke marine engine. “When we first studied methanol and lubricant interactions, we observed emulsification of the system oil with methanol.” This was a potential problem, as the system oil, which also acts as the hydraulic oil for some systems in a marine engine, provides some of the sealing within the fuel valves. “Is this likely to be an issue with ammonia? We don’t know yet,” Bown said.

Fuel Mix and Quality

Whether other fuels may be mixed with ammonia is unknown. In their DEMO 2000 project, Wärtislä and partners used 30% marine diesel oil in ammonia for its first successful tests in a four-stroke engine, but it is unclear whether this will be relevant to two-strokes.

Focusing solely on ammonia in the short term, many industry players are hopeful that a specification will arise before testing is well advanced, but there is no indication that this is imminent. Another concern of lubricant blenders, additives companies and—to a certain extent—vessel operators and owners is that there will not be a representative fuel available for testing. Bown outlined the situation that those players experienced in the run-up to IMO 2020 implementation. “Even in 2019, we couldn’t get real samples for testing,” he said. Lubrizol is anticipating that “it will be difficult to obtain a fuel-quality ammonia sample that we can do work with at the moment.”

Could history repeat? “To keep in time with engine and fuel development, fuel-quality ammonia samples must be made available to the additive and lubricant companies for their development programs,” Bown said. “Delays in obtaining fuel samples will inevitably lead to delays in offering the right lubricants to protect engines.”

OEMs have indicated where they want to be in three years. But without representative fuels, can the lubricants and additives industries get there in time?

Trevor Gauntlett has more than 25 years’ experience in blue chip chemicals and oil companies, including 18 years as the technical expert on Shell’s Lubricants Additives procurement team. He can be contacted at trevor@gauntlettconsulting.co.uk