Asia is an area so culturally and geographically diverse that it would paint a false picture trying to characterize it vast swathes of rural landscape interspersed with mega-cities jammed with honking horns and belching exhaust pipes. But what is evident is that over the next decade, a population the size of China to surpass the income threshold to be able afford a car.

There are other hurdles to overcome. More than 800 million people without access to basic electricity services and nearly 1.9 billion still using such as wood, charcoal and dung for cooking and heating, people are unlikely to prioritize buying an EV over a fridge.

Still, the region that includes powerhouse economies of China, India, Vietnam, Thailand and Indonesia are set to outpace the rest of the world in vehicle sales in the near future. Some governments in the region are looking to EVs as part of a solution to the problem chronic pollution and energy independence.

“Thailand and Vietnam would be the two major forefronts,” Eric Yip, marketing director of Quantel, an Asian company focused on clean energy and electricity, told regional media. The market in Vietnam is growing, especially for electric motorcycles, known as e-motorbikes. And in Thailand, the EV market is expected to reach 1.2 million units within the next few years. “This makes Southeast Asia quite a big market,” Yip said.

Countries are encouraging car companies and trade groups to help make EVs more accessible to the people. In Vietnam, Vinfast, the country’s first carmaker, released a line of electric scooters. The Philippines Department of Energy partnered with the Asian Development Bank to introduce e-tricycles that run on lithium-ion batteries. Singapore announced a series of incentives to grow the country’s EV population and phase out ICE vehicles by 2040. In late 2018, its Land Transportation Authority awarded a tender to three companies for the first 60 electric buses.

Many Asian automakers are transforming and adopting EV technology, and some have started building components instead of an entire EV. Yip added that most of the key components for EVs, such as batteries, will soon be manufactured in Asia, possibly making the region a major global source for parts.

However, there are still hindrances before EVs overtake ICEs in the region, including higher tax rates on EVs, a shortage of charging stations and limited range. Analysts have suggested more government intervention is needed to drive growth of the sector, and Yip told the EE Times Asia in June 2019 that similar incentives such as London’s ultra-low emission zones, which charge certain vehicles an entry fee to drive in the city, could be a viable incentive.

“I believe that the Vietnam government is looking at moving in this direction,” he said. “To only allow electric vehicles on the roads of the cities. They are planning this soon.”

Since petroleum is relatively cheap and there is a lack of battery charging stations in certain Asian countries, some analysts said, it will be difficult for government legislation and regulations to work. Even if governments fast-track charging stations, at least five years are needed before the infrastructure is in place to handle demand.

China

Chian is the biggest producer and user of EVs. The government to date has ploughed huge incentives into low- and zero-emission vehicle ownership and manufacturing, as well as clean energy – much to the chagrin of the European Union, which in June slapped Chinese OEMs with tariffs.

EVs in China are not subject to registration restrictions or driving bans on certain days in certain cities. Purchase incentives have supported high demand for EVs in the country so far.

All this looked set to cool down when in 2019, the government announcement it was scaling back on subsidies for EVs. It said the move was meant to encourage local manufacturers to rely on innovation instead of handouts. Beijing said it intended to eliminate subsidies after 2020.

The subsidy for BEVs with a driving range of 400 km and above was slashed by 50% to €3,700 from €7,300 per EV, according to the government, adding that to qualify for any subsidy an EV must have a driving range of at least 250 km. Purchase incentives are expected to be cut entirely after 2020.

Immediately after the roll-back announcement, stocks of China’s largest EV manufacturer fell nearly 4.2%, while another EV maker’s stocks fell 3.5%. BAIC Blue Park New Energy Technology Co. said it may increase EV pricing going forward amid “certain and even relatively huge” pressure on the sector.

Then came the announcement in December 2020 by the Ministry of Finance that would reduce tax breaks for EV buyers by 20% from last year’s level, equating to an average of $550. A mandate was also passed requiring EVs to make up 40% of automakers’ sales by 2030.

“While financial support for purchases has fueled the rapid growth of China’s electric car industry, there are concerns that automakers have become overly reliant on them at the expense of developing new technologies and better vehicles,” Bloomberg reported.

Over the past 10 years, some analysts estimate that China has pumped $60 billion into its domestic EV industry and now controls between half and three-quarters of the global supply of raw materials for EVs, according to a study by the Yano Research Institute.

In 2018, China had more than 1 million EV sales (more than all other countries combined), is home to 99% of the world’s 250 million electric scooters and has 99% of the globe’s electric buses, according to a number of sources.

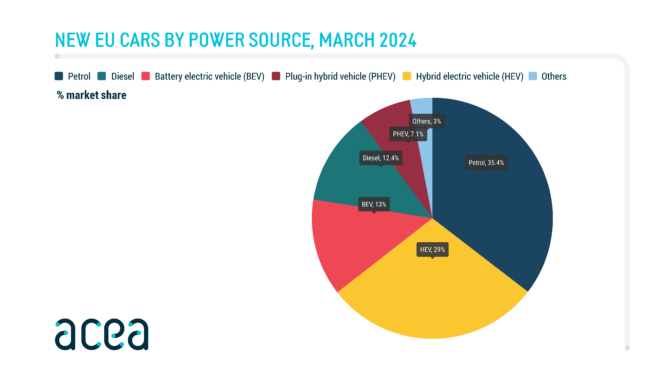

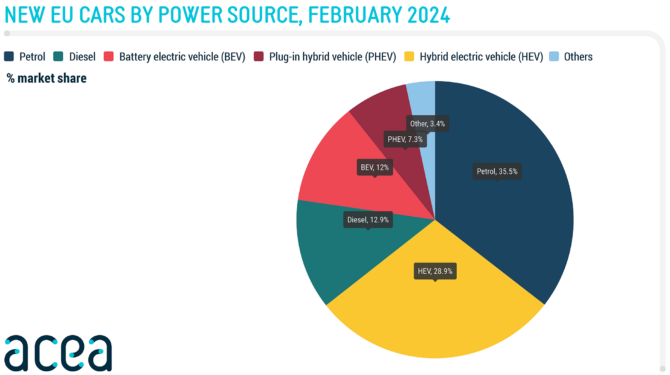

Now, Europe has passed China in EV sales, though China still leads in electrified two- and three-wheelers and buses.

“It’s very important for the governments to take the necessary steps to promote indigenous manufacturing of lithium-ion cells for EV batteries,” said Sri Harsha Bavirisetty, chief operating officer at Gayam Motor Works, adding that Beijing controls the vast majority of lithium and cobalt – two vital minerals for EV batteries – through joint ventures or outright purchasing of mines in Congo, Chile, Bolivia and Australia, leaving other carmakers, such as Tesla, far behind.

South Korea

EVs are also turning heads on the streets of South Korea, since a large number of motorists still cannot fathom the transition from an ICE vehicle to an EV because of economics, though the tides may be starting to turn.

The latest figures report there are 140,000 electric cars being driven in South Korea, up from 10,000 in 2016. The market share of BEVs and PHEVs in the country is at more than 2%, while there are almost 10,000 public chargers in the country with plans to install 3,000 more throughout 2021.

Currently, South Korea provides a little over $17,000 in purchase subsidies for EVs that cost up to $52,000, and half that amount for EVs that cost between that and $80,600. They also enjoy a 50% reduction of tollgate fees and free or reduced parking at public parking lots. However, proponents of EVs said more is needed to encourage purchases and usage.

Japan

Across the Tsushima Strait, Japan has the third-largest fleet of plug-in vehicles in the world, after China and the U.S. The government aims to reduce vehicle greenhouse gas emissions by 80% by 2050 through a combination of hybrids, PHEVs, BEVs and fuel-cell vehicles.

The country’s investment in EVs is not new. Its postwar gasoline shortage gave birth to a small EV industry that in 1947 produced the Nissan Tama, an adorable cream-colored two-door mini-car. Now, Japan’s auto industry is famous for the world-dominating Toyota Prius, the bestselling hybrid ever, and the Nissan Leaf, which is cruising toward sales of half a million.

The government has offered generous incentives since the 1990s, when there was a 50% purchase subsidy. These days, the incentives are less enticing, but zero-emissions vehicle buyers still qualify for a grant $7,300 dollars after the government doubled its offered subsidies at the end of 2020, depending on the vehicle’s range. The most generous subsidy offered today is up to $11,400 for FCEVs.

In January 2020, it also signaled continued support for EVs with a mandate to end the manufacture of new ICE vehicles beginning in 2030. This will be aided by a $20 billion for investment in reducing the cost of battery manufacture $96 per kilowatt hour, as well as money for improving electricity generation infrastructure, something that many jurisdictions seem to ignore.

The country also has a network of more than 18,000 charging stations, and there are plans to have a charge point every 15 km.

Lastly, the country is also considering cradle-to-grave implications of EVs. 4R Energy Corporation, a joint venture between Nissan and Sumitomo Corp, has opened a battery recycling plant to refurbish Leaf batteries in the town of Namie, devasted by an earthquake in 2011. Toyota intends to reuse retired batteries to power freezers and ovens in Japan’s 7-Eleven convenience stores.

Two countries where EV numbers are expected to skyrocket in the next few years are India and Indonesia, both in terms of manufacturing and consumption. Both countries have a burgeoning middle class and a desire to either increase or start a domestic EV manufacturing industry. But an obstacle stands in the way – relations with China.

Indonesia

Indonesia is pushing for the development of EVs and battery production facilities to create a downstream sector to exploit the nation’s rich deposits of nickel, which is used in lithium batteries. The country also hopes to start producing EVs in 2022, after a number of auto manufacturers, including Japan’s Toyota and South Korea’s Hyundai, announced plans to invest in the country’s nascent EV manufacturing industry. In July 2019, Toyota announced that over the next five years it plans to invest $2 billion, including EVs.

By 2025, the government estimates, EVs will have a 20% share in the nation’s auto market, which is dominated by two wheelers. Meanwhile, the government cut tariffs to 0% for PHEVs earlier this year. The country also offers tax holidays to companies manufacturing EV batteries.

India

In July 2019, India witnessed its worst month in passenger car sales in 20 years, as purchases plummeted 35% from the year before. But in the same month, the country’s bestselling carmakers – Maruti, Suzuki, Tata Motors and Mahindra – announced their EV plans. In a country where four-wheeler EVs account for 0.1% of India’s car parc, some met the announcement with arched eyebrows, including major shareholders in some of those companies.

The government’s FAME program – in full, Faster Adoption and Manufacturing of Hybrid and Electric Vehicles – was launched in the same year. The scheme, which mostly targets two- and three-wheelers, was set to run until 2022 but was extended until 2024. FAME’s purpose was to encourage localization of EV manufacturing.

Indian carmakers’ shift from ICE vehicles to EVs is in line with a very ambitious government target announced in 2017 of 100% new EVs sold by 2030. This was walked back to 30%, but it is still a lot of vehicles. This includes three-wheelers manufactured in India by 2023 and two-wheelers with an engine output equivalent to less than 150 CC by 2025, according to Indian news outlets. The government said the reason for the shift was to curb rising air pollution and mitigate dependence on imported oil. The country is the world’s fourth-largest car market and has some of the most polluted cities on Earth.

Trying to advance EVs is nothing new in India. A decade ago, the Ministry of New and Renewable Energy gave incentives to carmakers to produce EVs. Then in 2015, the administration of Prime Minister Narendra Modi earmarked $140 million for infrastructure development, incentives, research and development and pilot projects.

Then in 2019, Modi’s budget reduced the federal sales tax on EVs from 12% to 5% and on chargers from 18% to 5%. Additionally, EV buyers were given exemptions on certain taxes, and import duties on lithium-ion cells were removed.

Modi’s action has caused jitters among the car industry, which constitutes about 15% of India’s economy. The industry voiced concerns over time frames for transition from ICEs, while complaining about the lack of charging infrastructure.

“The response forced the government to soften its stance and clarify that its policies would allow internal combustion engines vehicles and EVs to coexist and grow,” according to an article in This Week in Asia.

Given the opposition from the powerful and well-funded Indian auto lobby, sector analysts predict the adoption of EVs in the market is still a fair way off and are wary of the government’s timeline for EVs cruising the streets of New Delhi and Mumbai.

The analysts said the pace of reform is too fast for EV manufacturers, infrastructure and resources. For example, in March 2019, the Modi administration mandated EV manufacturers should produce 50% of their components locally to benefit from subsidies, which proved to be a hard punch for the market. In response, EV sales slumped from 12,000 a month in March to just 300 in April, according to the Society of Manufacturers of Electric Vehicles.

“An industry which is not even 1% of market share cannot possibly replace the sector 100% within three years,” said Alok Ray, assistant director of the Society of Manufacturers of Electric Vehicles. “What we need are more subsidies, robust models for consumers, a cleaner road map like setting up charging centers and unambiguous regulations to streamline the commercial usage of vehicles.”

Indian media reported Modi’s government plans to target India’s 10 most-polluted cities, including Delhi, Bangalore and Gurugram, which host about one-third of the nation’s vehicles.

“I will not say it is sustainable in terms of short-term goals – it is more of a vision from the government’s side. Even the major auto players are not wholeheartedly supporting [the government’s initiatives], and consumers are not fully ready to embrace EVs,” Puneet Gupta, advisor at market research firm IHS Markit, told local media. “Most of the auto giants are still keeping EVs as a backup option as the industry is still nascent, and they do not know how it will shape up regarding [government] policies and investments.”

Not a great deal is happening down under in the EV scene. No cash is on the table for buyers, only tax breaks worth in the hundreds of dollars. The New Zealand government’s Electric Vehicles Program aims to get 64,000 EVs on the road by the end of 2021, but it only offers EVs exemption from road user charges until they make up 2% of the fleet and reduced national accident compensation fees. Australia’s EV incentives are virtually non-existent beyond breaks on luxury car tax and stamp duty. An outgoing Labour government had pledged to develop an EV policy but failed to win the 2019 election, and the policy evaporated.