The jury is still out on how much EVs will depress lubricant sales. Additive companies will need to plan carefully to stay ahead of a downward curve.

Industry analysts agree that the number of electric vehicles is growing, especially in China, but the extent to which they will disrupt demand for lubricants and additives is still unclear. Full battery EVs do not need crankcase lubricants and associated additives, but hybrid and full internal combustion engine vehicles will continue to need them and in substantial quantities.

There is a global additives market worth about U.S. $16 billion per year, and its key markets – passenger cars, other light-duty vehicles and motorcycles – will be the most impacted by EV growth. These represent an estimated 20% of sales, and so the pace of vehicle electrification impacts the industry’s bottom line. How do companies see their future in this changing world?

The growth of EVs is a threat across the oil majors’ entire value chain, from demand for crude to refined products such as lubricants, as well as it being a disruptor for lubricant additive suppliers. Shell and ExxonMobil (joint venture partners in Infineum) and Chevron (owners of Chevron Oronite) also have direct interest in future additive sales.

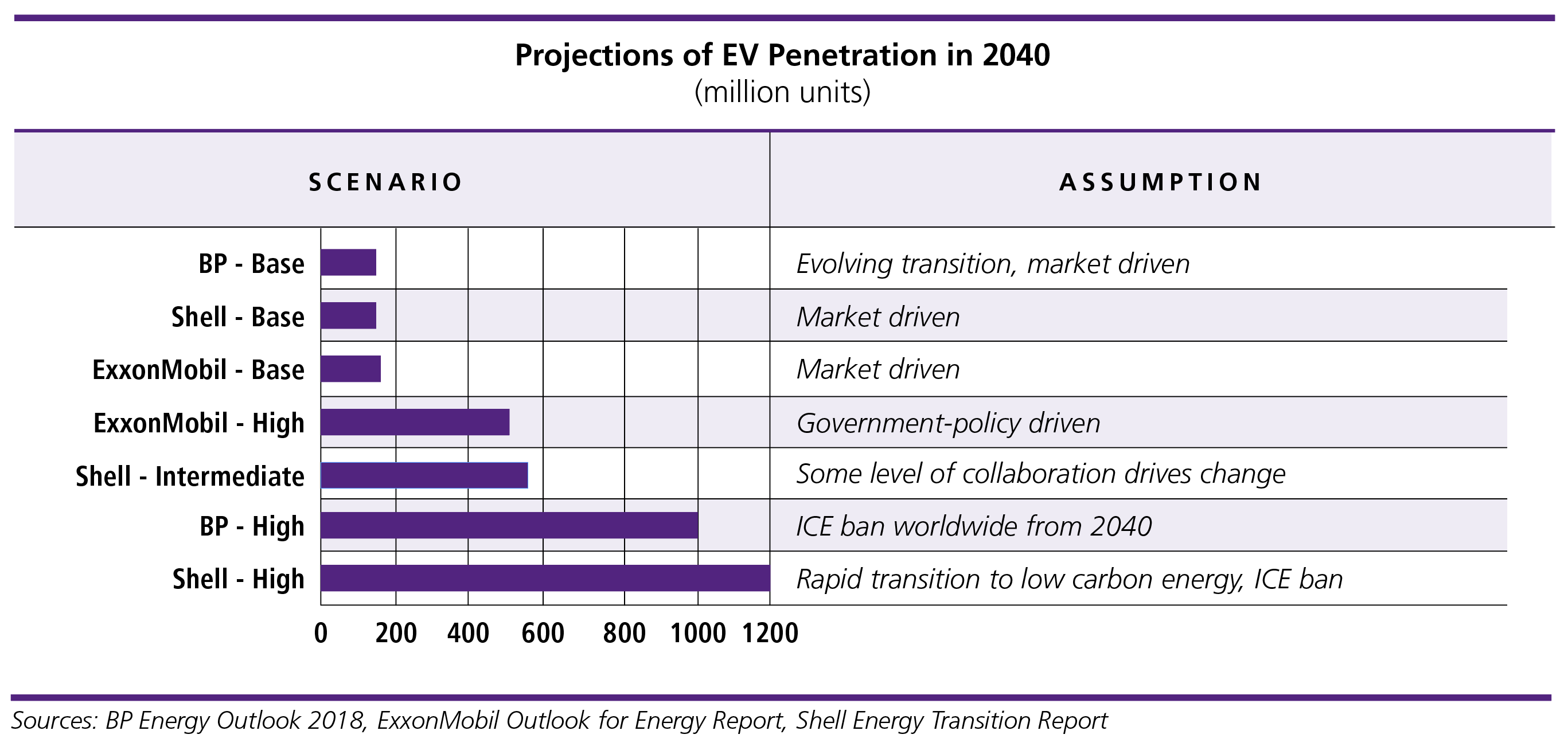

There are many predictions of the future market penetration of EVs. Major oil companies BP, ExxonMobil and Shell have all published forecasts of EV numbers. However, they vary widely depending on the assumptions made in the different scenarios. In all of the projected scenarios, ICEs continue to grow, albeit at a varying rates, while BEVs sales also increase.

These models of future demand use variables such as GDP, energy use per capita and rates of technological change. Different scenarios emerge as assumptions are made about the level of collaboration between economic actors and government policies to manage climate change. The variation in output reflects the differences in models and assumptions used, which remain undisclosed.

The projections also show a large degree of uncertainty and illustrate that analysts believe a number of variables could have huge impacts on future EV numbers.

“All forecasters expect increasingly electrified powertrains over the next 30 years. Experts differ in two main assumptions: the future powertrain mix and the future number of vehicles in operation,” Anouska Norman, commercial manager and electrification team lead at additive company Lubrizol, told Lubes’n’Greases. “One thing to keep in mind is that the average vehicle age globally is about 10 years, which puts a natural buffering onto the impact of new vehicle powertrains on the overall lubricant additive market.”

Rick Finn Jr., Infineum’s strategy manager said that, “three interdependent factors are most significant for BEV penetration: technology development towards BEV-ICE cost parity, government policies and charging infrastructure.”

Adam Banks, driveline marketing manager at additive company Afton said, “Passenger car additive demand projections made by Afton show flatter growth for crankcase additives but no decline until 2040. The key barriers to BEV growth are meeting the energy demand, infrastructure development and consumer acceptance.” Factors affecting consumer acceptance include range anxiety, battery life and total cost.

But there is a balance to be struck market forces and the societal demands of moving to a lower carbon intensity economy.

The main threats to the additive companies from BEVs relate to a reduction in sales of crankcase additives into the light-duty vehicle and motorcycle markets. Additive marketers add value through formulating packages and conducting testing programs to meet industry and original equipment manufacturer specifications. Lower future sales volumes would either reduce the return on investment or require longer cost-recovery periods.

New specifications may emerge, for example for hybrid engine lubricants, which would require extra investment to meet emerging requirements. Hence this would require investment decisions to prioritize new market opportunities over existing market needs.

Specifically for EVs, additive companies will face the challenge of developing modified or even new additive components or packages to be compatible with electrical systems.

As BEVs are a potential threat to the traditional crankcase lube and additive business, does greater electrification also create new opportunities for the industry? For passenger cars and light-duty trucks, transmission fluids and greases will continue to be required for BEVs, so new opportunities will emerge, say some in the industry.

“The future of mobility will bring both disruption and opportunities, requiring a disciplined, coherent and integrated strategy aligned towards a steadily ‘carbon de-intensifying’ economy. A continuing move towards higher quality lubricants is expected globally, and the introduction of more sophisticated transmissions for hybrids and BEVs will generate demand for new gear and transmission oils,” Finn told Lubes’n’Greases.

Banks also believes that, “electrification will provide new opportunities for ICE-hybrid lubes with different drive cycles and in transmission fluids where electrical conductivity becomes more important.”

“Most ICEs in hybrids will run under optimum conditions with little idling or full power operation, however they will have more frequent starts. In addition, they could have lengthy periods without being used at all. These conditions will create different stresses for both the engine and lubricant which are not addressed by current lubricant specifications,” Ian Field, an independent lubricant consultant, agreed.

Other ICE-based lubricant markets are unlikely to be significantly affected by BEV penetration. “We see heavy-duty diesel trucks and marine as remaining on the ICE for a long time based on a combination of required power output, weight and charging downtime. There will be an increased use of natural gas with its lower carbon footprint in the interim years to 2040,” Finn noted.

Electrification also creates opportunities in non-ICE market, some believe. There may be opportunities for coolants used in EV batteries and/or electric motors too, as the technology develops.

“We see opportunities for greases, e.g., in e-motor bearings. As global electrical power increases, we expect to see an increased need for improved turbine lubrication, industrial gear oils, greases and hydraulic fluids for wind turbines, and heat transfer fluids for energy applications,” Norman added.

The ICE car parc will peak as BEVs continue to grow in market share. After that point, related lubricant and additive demand is anticipated to decline. The timing is uncertain, as it is largely down to government policies and the extent of coordinated actions on a ban on ICEs. BP, ExxonMobil and Shell all predict continued growth of ICEs and associated lubricant additives until 2040. Additive companies will continue to monitor the environment to respond if disruptive changes occur more rapidly, for example, via new government policies.

“Additives and lubricants still have a strong and long-term sustainable role to play in delivering better performance and longer oil lifecycles,” Finn said.

Banks added that, “ICE-electric hybrids may be the ‘eternal transition’ between full ICE power and full electric power, creating opportunities for hybrid crankcase oils and transmission fluids.”

“We continue to invest in crankcase additives. However, we see opportunities outside of crankcase additives in an increasingly electrified world,” agreed Norman.

Overall, ICEs continue to grow globally in the current market driven environment. Other factors, such as downsizing and extended drain intervals, will impact lubricant and related additive growth, so this may be more modest. In this environment, additive companies may be more careful before making significant new investments. However, increasing electrification provides some new opportunities for additives.

Far from being pessimistic about the future, additive companies still have many reasons to be positive. They include the continued need for high-quality lubricants; crankcase and transmission opportunities due to hybrids; continued demand for additives in heavy-duty diesel and marine additives market; and new opportunities in non-automotive segments driven by greater electrification.

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at lubesngreases@omeda.com.

Click here link to homepage