Electric vehicle sales in China, already running far ahead of any other country, have accelerated in recent months, partly, analysts say, because of the central government’s plan to eliminate generous subsidies.

A surge in sales has bolstered expectations that China, the world’s largest automobile market, might reach ambitious government goals for EV penetration, while at the same time raising questions of whether the trend will sustain itself after the payouts end.

Meanwhile, Chinese manufacturers are stepping up their strategies for the second-largest automobile market, introducing their own brands to the United States.

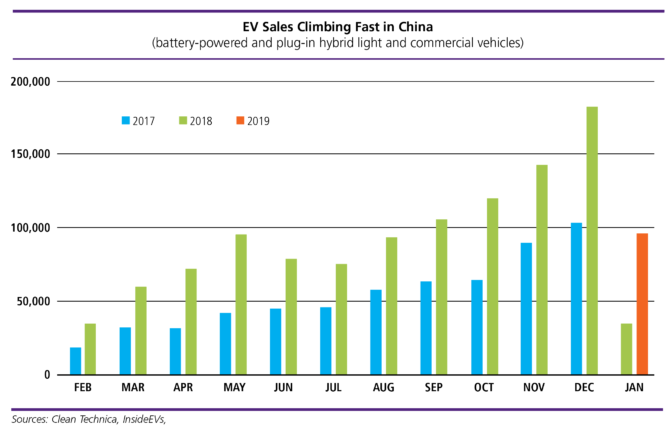

Registrations of battery-powered and plug-in hybrid passenger and commercial vehicles in China reached 96,000 in January, according to news site Clean Technica, an increase of 175% from the same month in 2018. January and February are normally the slowest months for EV sales in China, but sales skyrocketed in the last third of 2018, closing out the year with four consecutive record-setting months. September broke a nine-month-old record with 104,900 BEV and PHEV registrations, and that mark was promptly smashed with totals of 119,400 in October, 141,800 in November and 181,385 in December.

That finish helped BEV and PHEV registrations in the country reach 1.26 million for all of 2018, according to the Chinese Association of Automobile Manufacturers, an increase of 64% from 2017. China also accounted for a bit more than half of global EV sales, which topped 2 million in 2018, according to InsideEVs.

EV sales in China were already increasing rapidly, but observers agree they have received a boost from consumers eager to take advantage of big subsidies while they can. The central government currently offers up to ¥44,000 (U.S. $6,570) to help offset the cost of what it refers to as new energy vehicles, a category that includes units powered by fuel cells but mostly consists of EVs, depending on range.

But the bill for those payouts mounted as EV numbers rose, so the government announced a phase-out plan, saying it would reduce its subsidies by 30% this year and eliminate them altogether at the end of 2020. The exact date of this year’s reduction has not been announced yet.

The jump in EV sales is more impressive in light of the leveling off of overall auto sales. The latter fell 3% in 2018 to 28.1 million, the first decrease in China in approximately two decades, and some analysts are predicting another decrease this year. Of course, that has meant that electrics are taking a bigger slice of the country’s overall vehicle pie. EVs accounted for 4.2% of all new vehicle registrations in 2018, up from 2.7% in 2017. In November, that number reached 6.3% and in December 8%.

Reaching those percentages at this time, in the eyes of some analysts, improves odds that the market will meet the central government’s stated goal that NEV sales reach 7 million by 2025. Forecasts by industry observers vary. Bloomberg New Energy Finance forecasts that 34% of new Chinese vehicles will be electric in 2030, while Clean Technica predicts the market will reach the 50% threshold in 2025.

Future EV sales will depend in part on how consumers respond to the end of subsidies from the central government. State payouts to consumers may not disappear completely, as some incentives are offered by municipal or provincial governments, including the homes of some EV manufacturers. Shanghai and Shenzhen, locations for the headquarters of original equipment manufacturers SAIC and BYD, respectively, are two examples.

In addition, the central government is not abandoning EV policy altogether, having announced several new strategies that will replace existing incentives. One of the main ones would require automakers failing to meet national corporate average fuel economy targets to purchase credits from those that exceed them. The rule, which applies to automakers supplying at least 30,000 passenger cars per year, sets the corporate average fuel economy target at 42 miles per gallon for 2020 and would increase it to 54.5 mpg in 2025. Essentially this would put the onus on OEMs to do whatever they need to in order to sell enough EVs to reach the targets.

Besides reducing emissions of greenhouse gases and particulate pollutants, Beijing has said that another reason for throwing its weight behind EVs is the pursuit of its goal that its automakers become global leaders in EV technology. Chinese OEMs continue to test their abilities by branching into foreign markets.

In December, Beijing-based Qiantu Motor Ltd. announced an agreement with a Californian company to begin manufacturing and selling the K50, an electric two-seater, in the U.S. by 2020. Two months later, another Chinese OEM, Kandi Technologies Group, said it had received permission from the U.S. National Highway Safety and Traffic Administration to begin importing its Model EX3 and Model K22, and that its U.S. subsidiary, SC Autosports, would begin preparing for a launch.

Some other Chinese OEMs already market EVs in the U.S. under foreign brands, such as Volvo, which is owned by Geely, and the Buick Envision, built by a joint venture between GM and SAIC, but Qiantu and Kandi are among the first Chinese automakers to pedal their own brands in America.

It should come as no surprise for Chinese EV manufacturers to look abroad. Their home market may be the world’s largest for EVs, but it is also among the most competitive. Every major car maker from Europe, Japan, South Korea and the U.S. is jostling to carve out a place there, along with hundreds of domestic companies. Why shouldn’t Chinese OEMs try to return the favor?

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at lubesngreases@omeda.com.

Click here link to homepage