The lubricant industry’s position astride the chemicals and hydrocarbons industries puts it in the sights of lawmakers around the world for the current wave of regulations, in Europe at least, aimed at promoting a circular carbon economy and sustainable products.

Lawmakers, regulators and standards agencies across the world are driving the transition to a low-carbon economy through a raft of policy initiatives. These policies will likely add pressure on base oil refiners, additive companies and lubricant blenders to disclose their operations’ carbon emissions and what risks they face from climate change.

European Union Taxonomy

The European Union places sustainability at the center of its objectives. Over the years, the EU has enacted many directives to support that aim. One of its major programs is the Taxonomy Regulation.

The regulation was introduced in mid-2020 and standardizes the classification of 70 designated sustainable economic activities. It is part of a large package of climate-related laws called the Green Deal, which supports the bloc’s target of net-zero carbon emissions by 2050.

The first two of the Taxonomy Regulation’s six objectives—mitigation of and adaptation to climate change—were introduced on New Year’s Day with what is called a delegated act. (Delegated acts are non-legislative acts adopted by the European Commission that amend or supplement the non-essential elements of a piece of legislation.) Over the course of 2022, the European Commission will have consultations on delegated acts for the remaining objectives.

At the start of February, the commission raised a few eyebrows when it proposed a complementary delegate act to include nuclear power and natural gas—classified as transitional sources of energy under certain conditions—as able to qualify as sustainable. In July, the proposal got the thumbs up from European Parliamentarians.

Lubricants meet several of the six objectives—contributing to the mitigation of climate change and pollution by reducing energy consumption and machinery wear; and contributing to the circular economy by increasing the use of rerefined waste oil and the use of biobased feedstock. It isn’t as clear cut whether all lubricant products meet the three other objectives of climate change adaptation, protection of water and marine resources, and restoration of biodiversity and ecosystems.

Reporting

Also on the EU agenda in March was the draft of a new Corporate Sustainability Reporting Directive. The directive mandates that “large companies must publicly disclose detailed information on the way they operate and manage social and environmental risks,” according to the EU online. This will add 50,000 companies to those that already have to disclose ESG-related information in the bloc.

While yet to receive agreement from member states’ governments, the directive will “make businesses more accountable for their impact on people and the planet, while giving investors and the public access to comparable, reliable and easily accessible information on sustainability.”

MEPs agreed that the new rules should cover all large companies (those with more than 250 employees), whether public or private, and include non-EU companies operating in the EU market. Lawmakers granted that small and medium-sized enterprises should voluntarily report. They also agreed that “disclosed information should be audited, more easily accessible, reliable and comparable.”

There are almost 1,100 companies that are part of the European lubricant value chain, many with more than 250 employees.

The directive could also include special provisions for such high-risk sectors as mining and minerals, which may impact parts of the lubricants industry that rely on crude-derived feedstock.

Sustainable Products

Also on the agenda for 2022 is the Sustainable Products Initiative, which will have a large impact on manufacturers and consumers across the continent. According to the EU, the European Commission has identified several product categories, including lubricants, that “have high environmental impact and potential for improvement.”

The initiative seeks to revise the existing Ecodesign Directive, which sets the mandatory ecological requirements for 40 energy-using and energy-related product groups sold in the EU, and to normalize product sustainability. The result will guide the Ecodesign for Sustainable Products Regulation, the proposed regulation to expand the existing Ecodesign Directive.

|

“We’ve got to make sure that the European Commission and others know how valuable an industry we are to their 2050 targets, because without the lubricants industry they won’t hit their targets.”

– John Eastwood, CRODA |

Industry insiders point out that the lubricants industry has a vital role to play in other industries reducing their own carbon emissions.

“We’ve got to make sure that the European Commission and others know how valuable an industry we are to their 2050 targets, because without the lubricants industry they won’t hit their targets,” said John Eastwood, head of global business development for energy technologies at specialty chemical company Croda.

What’s Happening in the United States?

In contrast with the EU, the United States has taken a market-driven approach. As yet, no companies are required to disclose ESG information.

Under the leadership of Chairman Gary Gensler, the U.S. Securities and Exchange Commission—the country’s market regulator—has been pushing for sustainability policies since the Biden administration took over. In March 2021, the commission set up a climate task force to look at the credibility of disclosures and compliance.

In August 2021, the SEC approved standards devised by Nasdaq to enhance and report on board diversity for companies listed on the exchange. Boardroom diversity has been improving rapidly over the past two years. Directors from underrepresented groups have 17% of seats, up from 14% in 2020, while women now occupy 27% up from 24%, according to data compiled by ISS Corporate Solutions.

Two months later, the U.S. Department of Labor proposed a rule that would explicitly permit retirement plan fiduciaries to consider ESG matters in their investment decision-making and voting decisions as shareholders. The Trump administration had previously blocked fiduciaries from doing so.

“The proposed rule announced today will bolster the resilience of workers’ retirement savings and pensions by removing the artificial impediments—and chilling effect on environmental, social and governance investments—caused by the prior administration’s rules,” Ali Khawar, the acting assistant secretary for the Employee Benefits Security Administration, said in a department press release.

Khawar continued: “A principal idea underlying the proposal is that climate change and other ESG factors can be financially material and when they are, considering them will inevitably lead to better long-term risk-adjusted returns, protecting the retirement savings of America’s workers.”

President Joe Biden signed an executive order in December 2021 that committed the federal government to cut its emissions as well as encourage growth of zero-emissions energy generation and transport. The U.S. government consumed 915 trillion British thermal units of energy in 2020, almost 1% of energy used in the country and as much as the entire Czech Republic.

In March this year, the SEC released a disclosure proposal that would require all publicly traded companies to publish their greenhouse gas emissions and the risks to their businesses posed by climate change. This is an indication that government could be gearing up for a legislative push toward mandated reporting.

In late June, the Supreme Court delivered a blow to global carbon reduction efforts when it stripped the Environmental Protection Agency’s authority to regulate emissions from existing power plants. The U.S. is the second-largest emitter of greenhouse gases after China, and fossil-fuel power generation is the second-largest polluter in the country after transport. The Biden administration wants to cut greenhouse gas emissions by 50% over the next 78 years.

Don’t Forget About Japan

In Japan, the Financial Services Agency and the Ministry of Economy, Trade and Industry are deliberating non-financial disclosure reporting requirements for Japanese companies. The FSA’s mandatory climate disclosure requirement for carbon emissions and climate-related risks are expected to be in harmony with the Task Force on Climate-related Financial Disclosures.

At the same time, the Ministry of the Environment is looking into revising and providing new guidelines for green investment instruments.

Standards

There is demand among regulators and financial markets for a universal accounting standard that incorporates ESG, and this year it could be a reality.

Attempts to develop a universal ESG accounting standard have been ongoing for several years. The International Accounting Standards Board set up the International Sustainability Standards Board in 2021 in response to demands for transparent, reliable and comparable reporting standards for ESG. The ISSB’s creation followed the Global Reporting Initiative’s launch of revised Universal Standards in October 2021.

Outlook

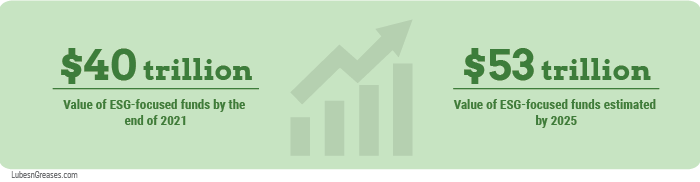

By the end of 2021, the value of ESG-focused funds approached $40 trillion, and according to Bloomberg could balloon to $53 trillion by 2025. This is an indication of how much weight investors are placing in corporate sustainability.

The lubricants industry and its supply chains are not immune to these market forces. Companies will need to be transparent about their sustainability targets, particularly carbon emissions, if they are going to attract capital, take advantage of favorable ESG financing and keep up with evolving environmental laws.

“The lubricant industry is in a unique position,” Eastwood told Lubes’n’Greases. “Lubricants are an enabling technology. We already provide solutions to drive improvements in energy efficiency and to support the transition toward renewable energy, something we’ve been doing for years. Wind turbines haven’t just appeared in the last few years; they’ve been around for several decades, and they require sophisticated lubrication.”

Read more from our Special Report: Can the Lubricants Industry Truly be Sustainable?

• Can the Lubricants Industry Truly be Sustainable? – Some critics are sceptical about the lubricants industry’s ability to operate in a sustainable manner. Others are hopeful that the industry can do its part to mitigate climate change.

• Pump Up the Policy – Lawmakers, regulators and standards agencies around the world are driving the transition to a low-carbon economy through a raft of policy initiatives. What kind of pressure will these policies put on lubricant industry players?

• No Longer Neutral About Climate: The Decarbonization of a Lubricant Company – Industry expert and sustainability adviser Apu Gosalia explains how lubricant companies can achieve climate neutrality.

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.