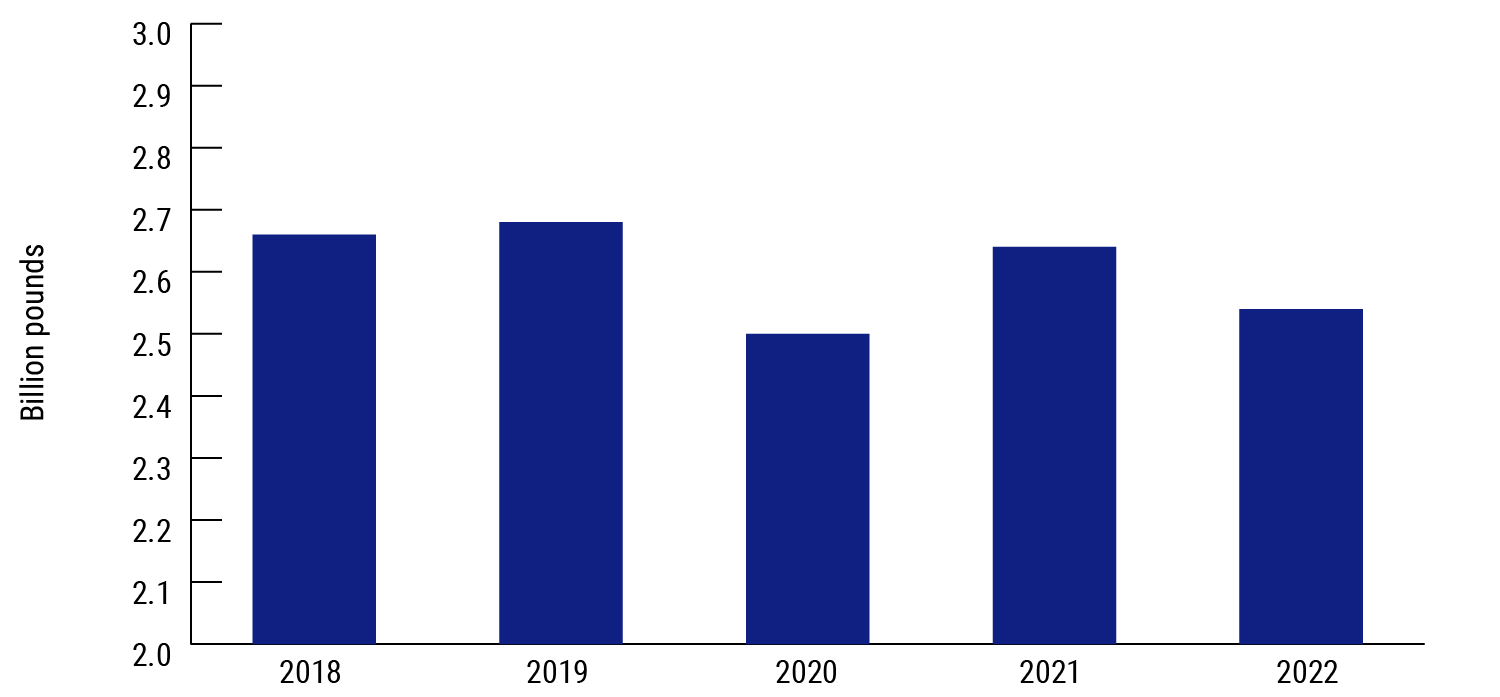

In line with lubricating oil trends, global grease production in 2024 fell slightly, according the National Lubricating Grease Institute’s most recent annual production survey.*

Production

China is still the world’s largest grease producer, even though output was reported to have fallen in 2024. The country’s economy has underperformed over the past two years, with weakening domestic demand, the bursting real estate bubble and the lingering effect of the pandemic, which may account for the decline. The domestic grease industry is also maturing, indicating companies are more inclined to report on actual output rather than capacity.

Conversely, China’s economic rival India is decent experiencing growth. India’s economic performance looks better on paper, but weak private-sector spending and low per-capita income may jeopardize sustained industrial growth and consumption of greases.

North America production has been consistently falling for the past decade. From a peak in 2018, European grease production is back to where it started 10 years ago. Most other regions are facing either flat or declining grease production.

Three Components

Grease is typically made from three components – the base oil, a thickening agent made from the reaction of an acid with a metal to create an organic salt, often called a soap, and additives, such as amines, esters and dyes.

Base Oils

Conventional base oils experienced a slight decline in use, falling to 85.8% from 86.4% among those companies that report to the NLGI. Semi-synthetic base oil usage remained relatively unchanged. Bio-based base oils declined for a second consecutive year.

Over the past five years, China, North America and Europe have been the primary users of synthetic base oils. Among these, China has shown the strongest growth. Europe continues to be the largest user of bio-based oils, although usage is also declining.

Also similar to lubricating oils, the use of synthetic, semi-synthetic and bio-based base stocks has continued apace in greases, driven by user demand and legislation.**

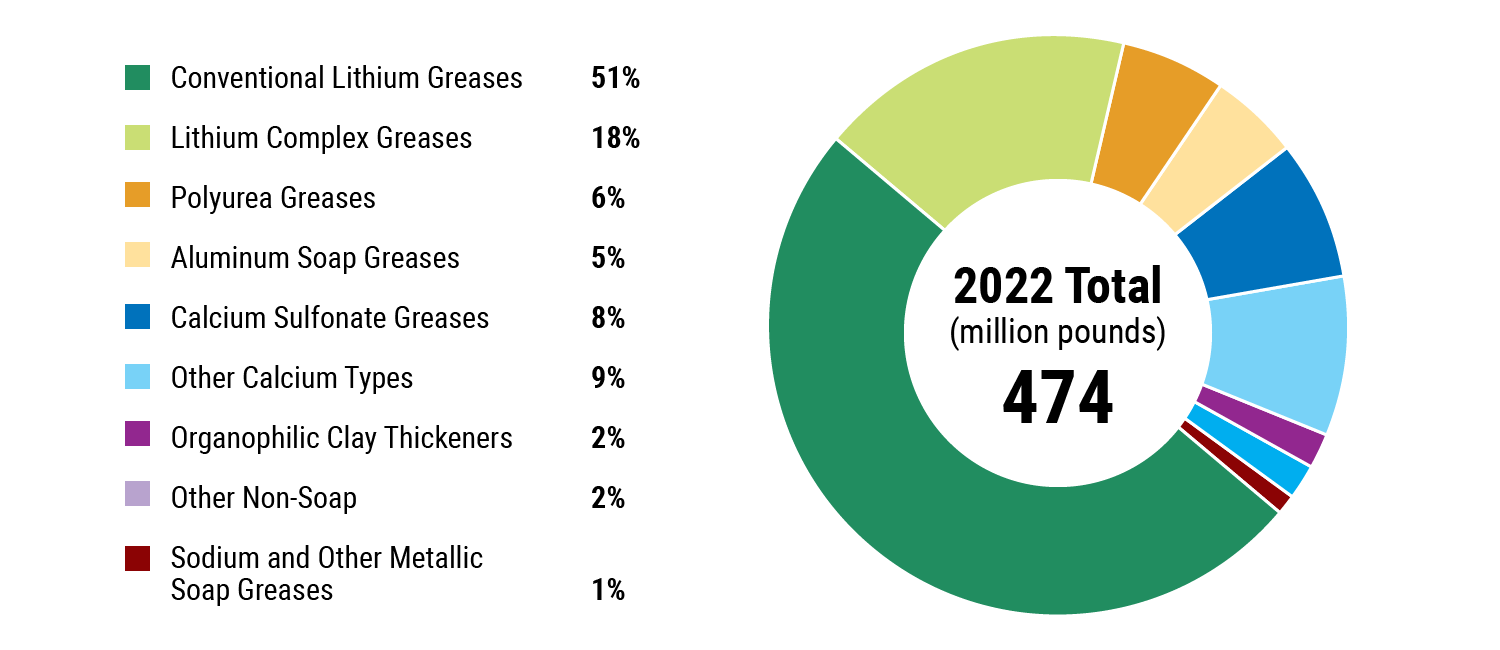

Thickeners

Since Clarence Earl patented a simple lithium soap thickener in the 1940s, lithium has been stalwart in grease formulations. It’s a jack of all trades that gets the job done. Cheap, abundant, water resistant and performs well at higher temperatures.

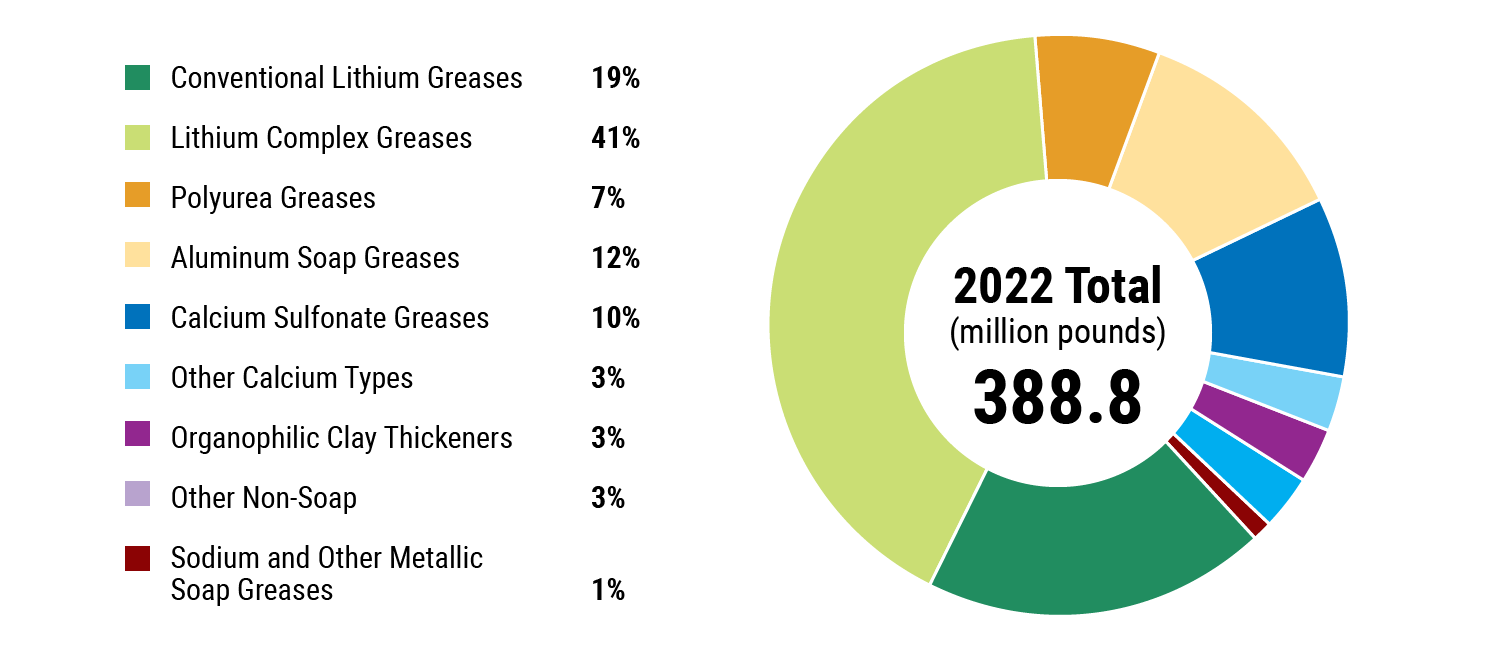

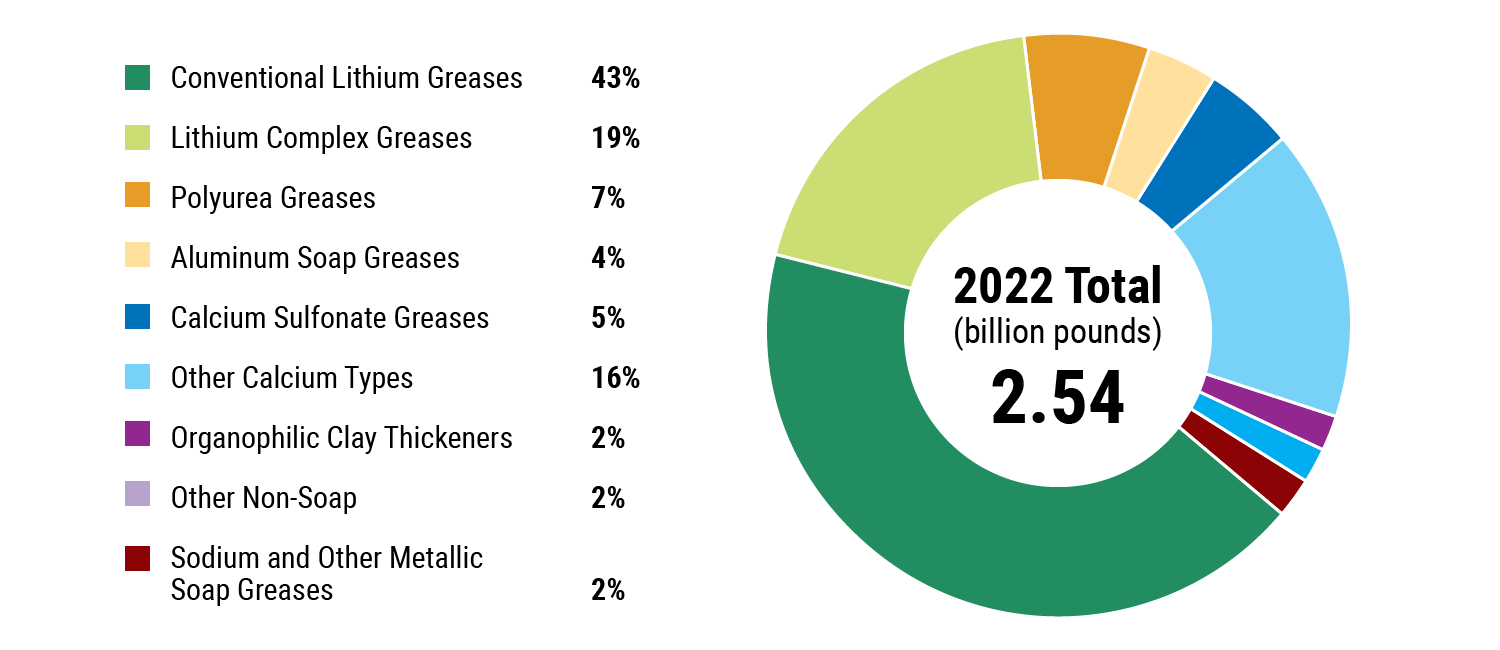

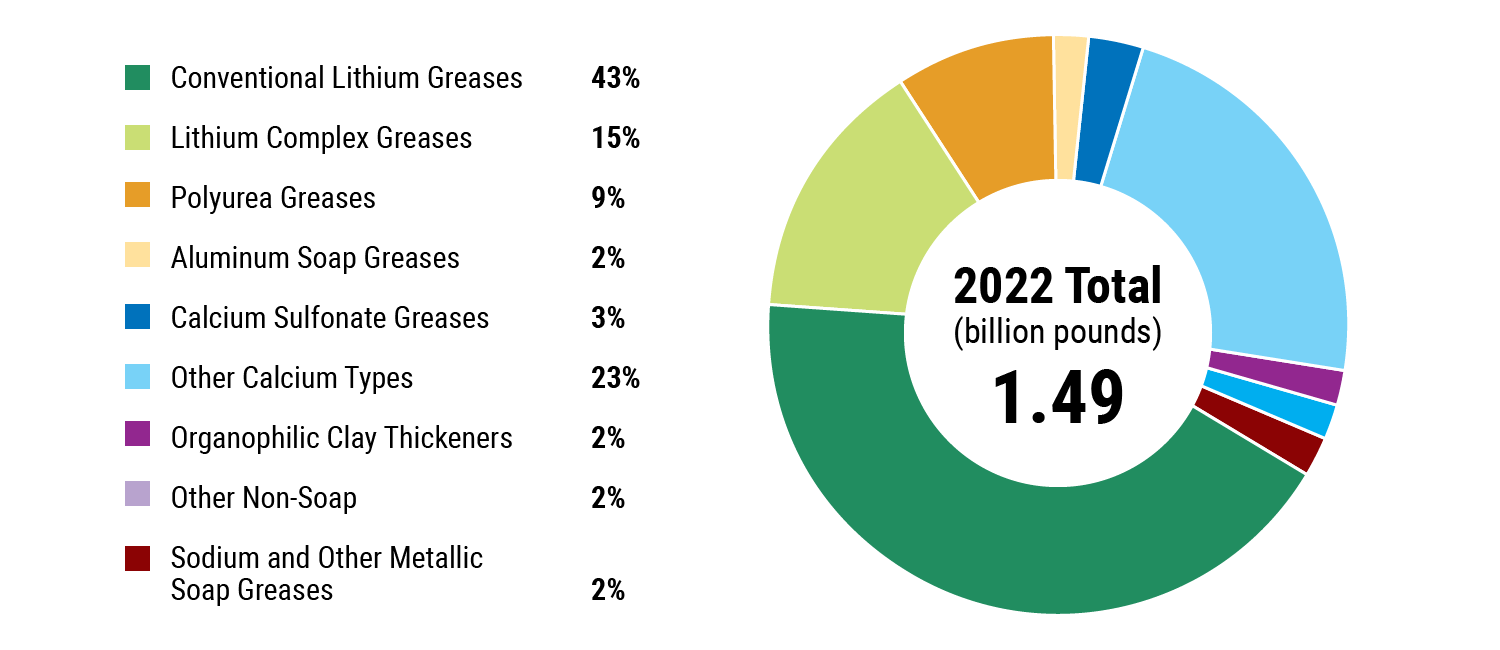

Despite demand pressure for lithium by electric vehicles batteries and other applications, lithium and lithium complex greases continued to be by far the most popular thickener types, at 38.3% and 18.6%, respectively. Together, they accounted for more production than all others combined. However, production of simple and complex lithium greases continued to decline globally, dropping by 0.8% and 3.8%, respectively, reflecting market shifts toward other thickeners, namely the calcium-based alternative, evolving technological preferences and the potential restriction on use by the European Union’s REACh regulations.

Calcium sulfonate greases saw strong global growth of 7.7%, particularly in North America, China and Europe, with all regions except India contributing to gains.

Anhydrous calcium greases experienced a sharp 14.2% global decline, largely due to a 57 million kg drop in China, though growth was seen in Europe.

Calcium hydrated grease production increased modestly, though historical trends remain inconsistent.

Polyurea greases, after sustained growth driven by China, declined slightly, primarily driven by reduced production in China, Southeast Asia and the Pacific.

Lithium calcium greases made up 2.3% of total production, though this may be underreported due to missing Chinese data.

*The NLGI survey reflects market trends by extrapolating data from a growing number of participants, up to 248 reporting grease plants in 2024 up from 232.

**In the European Union, only lubricating products claiming to be bio-based must have bio-based content ≥ 25%. If substances such as palm oil are used, they must meet other sustainability regulations. Even so, global bio-lubricants market is projected to expand more than 20% faster than the overall lubricants sector over the next decade, according Kline & Co. In the U.S., the Department of Agriculture’s BioPreferred Program mandates what can claim to be bio-based and suitable for federal purchase and a voluntary labeling system that encourage sector growth.

Global Lubricating Grease Production Over Time

Global Lubricating Grease Production

Asia

Europe

North America