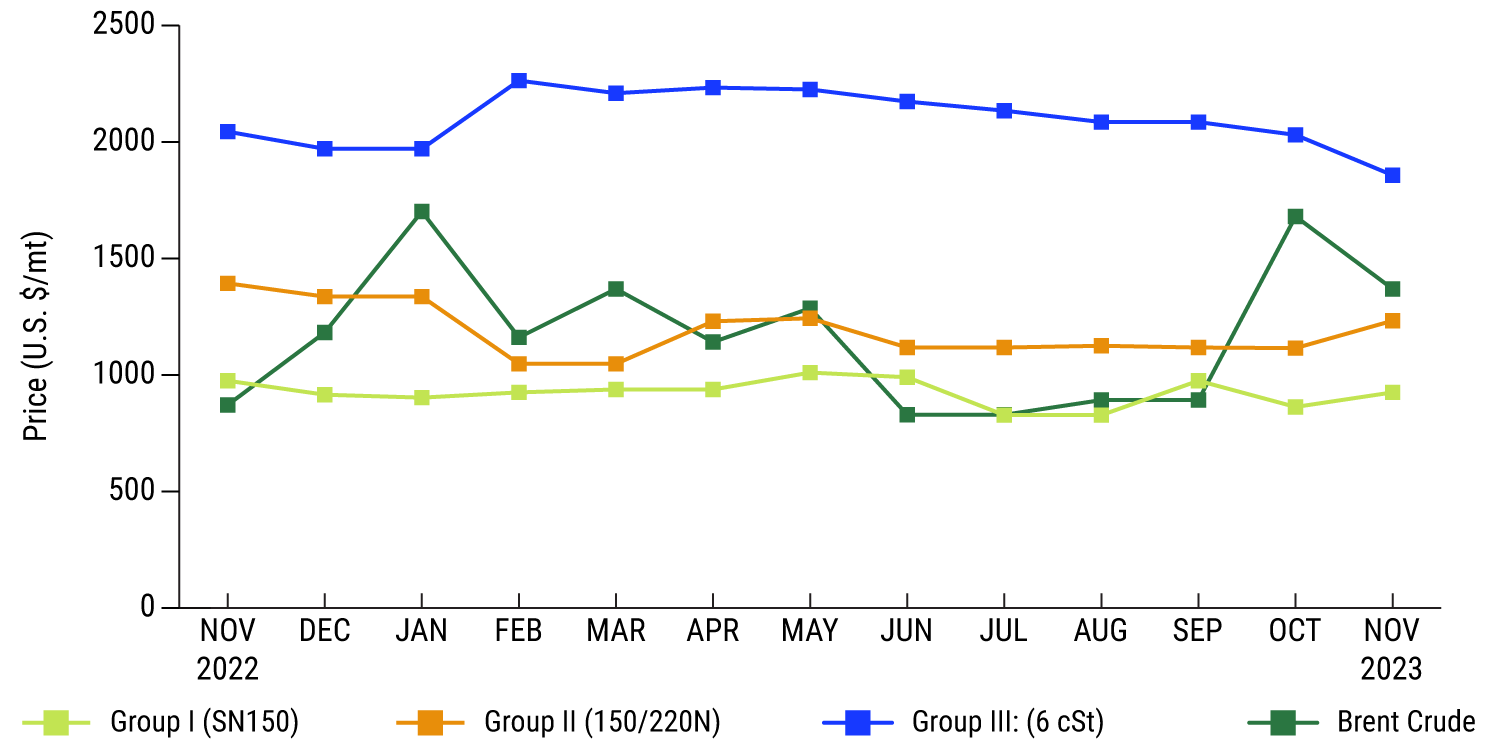

European crude oil and base oil pricing experienced a host of price adjustments in 2022. While several factors are to blame for the volatility in pricing, Russia’s invasion of Ukraine in February 2022 may be the most prominent. Base oil pricing on the continent in 2023, however, was a bit more steady, with fewer large fluctuations from month to month.

The price of Brent crude experienced several large adjustments throughout the year. Reasons for these fluctuations include higher than normal demand, abnormally tight supply as a result of OPEC+ production cuts, mounting geopolitical tensions like the Israel-Hamas war and other factors.

European Base Oil and Crude Prices

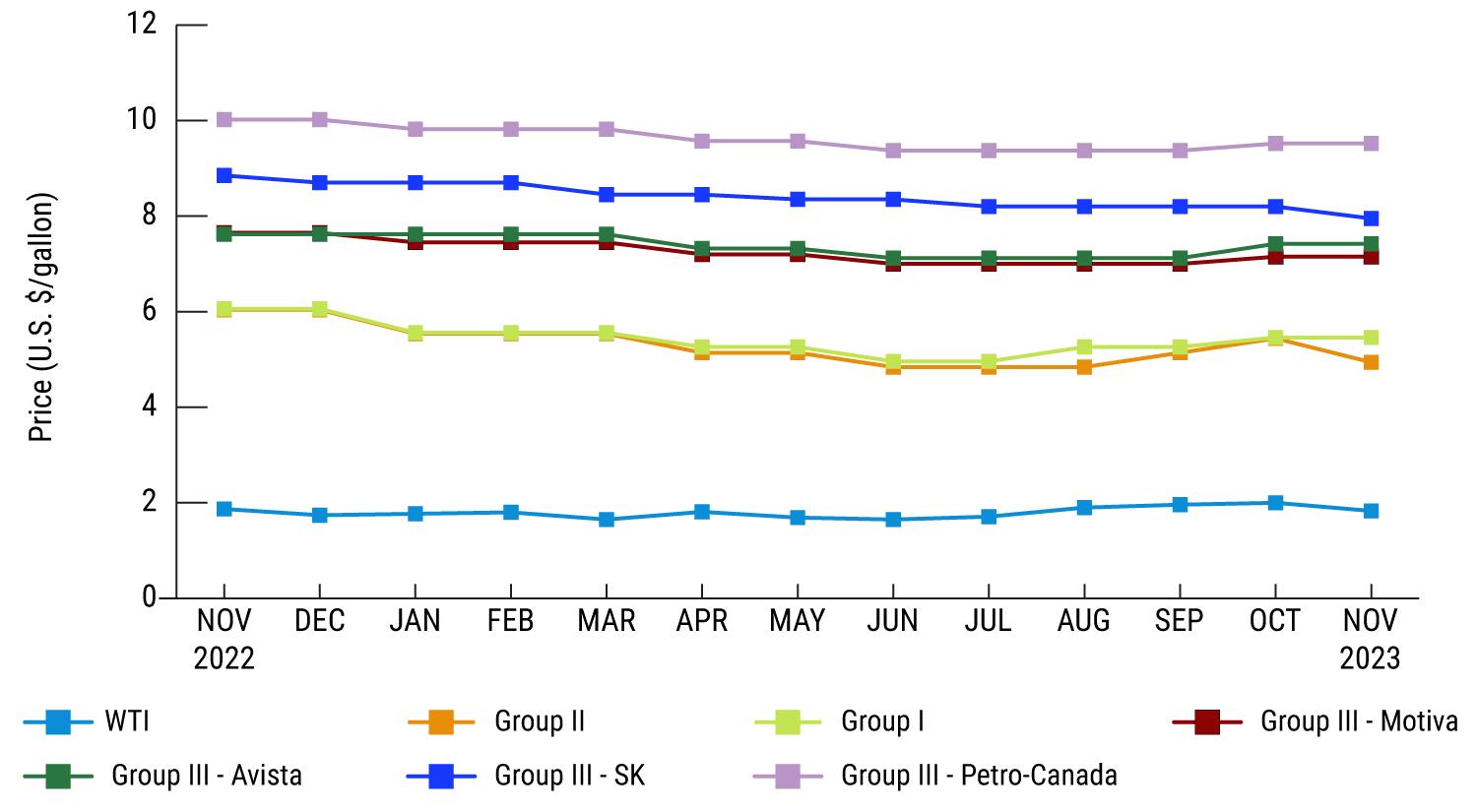

While 2022 was marked by an impressive number of base oil price increases, pricing in the U.S. in 2023 settled into a more steady pattern. In fact, the year can generally be characterized by a somnolent market and subsequent posted price decreases.

On the U.S. crude oil front, pricing was similarly steady, experiencing only minor fluctuations from month to month. According to the U.S. Energy Information Administration, the U.S. produced a record amount of crude in 2023 and is expected to keep pace in 2024.

U.S. Base Oil and Crude Prices