Understanding base oil properties is essential for producing high-performance lubricants. The physical and chemical characteristics of lubricant base oil directly affect wear protection, oxidation resistance, temperature stability and overall equipment lifespan.

Base oil properties are typically grouped into physical properties of base oil and chemical properties of base oil, both of which must be optimized to meet real-world operating demands.

Physical Properties of Base Oil

The physical properties of base oil describe how the oil behaves under mechanical and thermal stress.

Appearance and color are fast, practical quality indicators. Darker base oils may indicate contamination or insufficient refining, which can negatively affect viscosity index and oxidation stability. While appearance alone does not define performance, it supports routine inspection and storage management.

Viscosity is one of the most critical base oil properties in lubricant formulation. Low-viscosity oils flow easily but may fail under load. High-viscosity oils provide film strength but can increase friction losses. Viscosity must always be evaluated alongside operating temperature to ensure optimal lubrication.

Viscosity index measures how stable viscosity remains as temperature changes. High-VI lubricant base oils maintain consistent performance in both hot and cold environments, making them ideal for engines, hydraulics and gear systems. Higher viscosity index values usually indicate better refining and higher cost, but also longer service life.

Density influences flow resistance and blending accuracy. As density increases, viscosity often rises, affecting pumping efficiency and lubricant circulation.

Highly saturated base oils offer improved resistance to oxidation and thermal degradation. This makes saturation level one of the most important indicators of refining quality. The balance of aromatic, naphthenic and paraffinic compounds determines how base oil properties perform across temperature ranges:

- Aromatics → lower stability

- Naphthenics → better low-temperature performance

- Paraffinics → higher viscosity index and heat resistance

Low sulfur content improves oxidation stability, reduces acid formation and limits corrosion. Highly refined base oils with low sulfur levels are preferred in modern lubricant formulations.

Water contamination weakens lubrication films and accelerates rust formation. Maintaining low water content is critical for preserving base oil performance in industrial systems.

The pour point defines the lowest temperature at which oil can still flow. Base oils with lower pour points are essential for cold climates and outdoor equipment. The cloud point indicates when wax crystals begin forming and sets the lower operational temperature limit of lubricant base oil.

Viscosity gravity constant helps identify base oil composition and additive compatibility. Paraffinic oils show lower VGC values, while aromatic oils show higher values.

The aniline point measures additive solubility. Lower aniline points indicate better additive dissolution, which is crucial for high-performance lubricants.

High demulsibility allows base oils to separate quickly from water, preventing corrosion, foaming and lubricant failure in humid or wet environments.

Chemical Properties of Base Oil

The chemical properties of base oil influence safety, oxidation resistance and long-term stability. Low volatility reduces oil consumption and emissions, while a high flash point improves handling and storage safety.

Oxidation increases viscosity and leads to sludge and acid formation. Total Acid Number is a key indicator of oil aging and degradation.

Copper corrosion and carbon residue tests reveal how aggressively a base oil interacts with metal surfaces and whether it forms deposits at high temperatures.

Foaming reduces lubrication efficiency and accelerates oxidation. Properly refined base oils minimize foam formation in high-speed systems.

American Petroleum Institute Base Oil Groups Definition

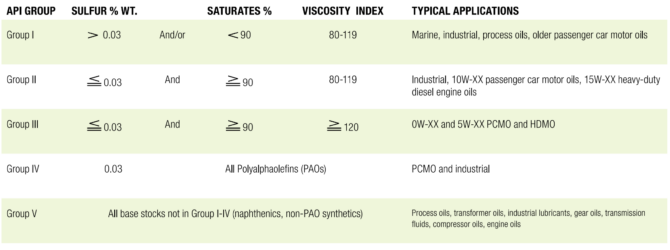

The American Petroleum Institute (API) classifies base oils into five groups under API 1509, based on saturates content, sulfur content and viscosity index. These definitions are widely used across the lubricant industry.

Mineral Base Oils

Understanding the differences between Group I, Group II, Group III and naphthenic base oils is essential for lubricant formulation, industrial performance and cost optimization. Each base oil group is defined by its refining process, chemical composition, viscosity index and performance characteristics.

Group I Base Oils (Solvent-Refined Mineral Oils)

Group I base oil refining begins with vacuum distillation, separating heavy hydrocarbons from lighter fractions. The heavy cut undergoes solvent extraction to remove aromatic compounds and impurities, followed by solvent dewaxing to eliminate long-chain wax molecules that negatively affect low-temperature performance.

After dewaxing, the oil is hydrofinished under hydrogen-rich, high-temperature and high-pressure conditions to saturate unsaturated molecules and neutralize free radicals. This conventional solvent-refining pathway produces classic Group I base stocks, including solvent neutrals and bright stock.

Some refineries use alternative hydrotreating and catalytic dewaxing methods—similar to Group II processing—especially when handling naphthenic crude feedstocks.

Group I Characteristics

- Less than 90% saturates

- More than 0.03% sulfur

- Viscosity Index (VI): 80–120

- Operating temperature range: 0 to 65.5 °C

- Simplest refining process and lowest cost

Group I base oils remain widely used in industrial lubricants, marine oils and applications where solvency and cost efficiency are prioritized over oxidation stability.

Group II Base Oils (Hydroprocessed Oils)

Group II base oil production replaces solvent extraction with advanced hydroprocessing. Heavy vacuum-distillate fractions are sent to a hydrocracker, where hydrogen at elevated pressure and temperature converts aromatics and waxes into stable paraffinic and naphthenic hydrocarbons.

Instead of solvent dewaxing, Group II oils use:

- Catalytic dewaxing, which cracks wax into lighter products (lower yield), or

- Wax isomerization, which converts wax into branched paraffins, improving yield and cold-flow properties.

A final hydrofinishing step saturates remaining unsaturated molecules and removes reactive compounds.

Group II Characteristics

- More than 90% saturates

- Less than 0.03% sulfur

- Viscosity Index (VI): 80–120

- Improved oxidative and thermal stability versus Group I

- Higher capital investment due to hydrocracking

Group II oils offer a more uniform, stable product and are widely used in automotive, hydraulic, and industrial lubricants.

Group III Base Oils (Severely Hydrocracked Oils)

Group III base oils are manufactured using severe hydrocracking, catalytic dewaxing, and hydrofinishing applied to high-quality vacuum-distillate feedstocks. Under extreme pressure and temperature, hydrocracking converts aromatics and wax into highly saturated paraffinic structures, raising the viscosity index above 120.

Catalytic dewaxing converts wax into iso-paraffins instead of removing it, preserving yield while significantly improving low-temperature flow. Final hydrofinishing eliminates residual heteroatoms and unsaturated compounds, resulting in water-white clarity and excellent oxidative stability.

Group III Characteristics

- At least 90% saturates

- Maximum 0.03% sulfur

- Viscosity Index (VI): greater than 120

- Synthetic-like performance while remaining API-classified mineral oil

Group III base oils often match or exceed PAO performance in many applications and are widely used in premium automotive and industrial lubricants.

Naphthenics

Naphthenic base oil refining starts with vacuum distillation of atmospheric residue to obtain lubricant fractions. Because naphthenic crudes contain minimal linear paraffins, dewaxing is usually unnecessary, simplifying processing.

The distillate undergoes solvent extraction or hydrotreating to remove aromatics, sulfur, and nitrogen compounds, followed by hydrofinishing to improve oxidation resistance and color stability.

These properties make naphthenic oils ideal for transformer oils, process oils, metalworking fluids, rubber oils, and greases. Fewer refining steps also make them cost-effective where high VI is not required.

Naphthenic Characteristics

- Very low pour points often below –70 °C

- Intermediate viscosity index

- High natural solvency

- Excellent additive and contaminant solubility

What are Group II+ and III+?

Industry-established categories originally developed to describe base oils suitable for SAE 10W-XX and 5W-XX multigrade motor oil blending. These are marketing terms, not official API definitions. More recently, some suppliers have begun marketing Group I+ using the same higher-VI principle

- Group II+ generally refers to Group II oils with viscosity index from 112 to 119

- Group III+ generally refers to Group III oils with viscosity index of 130 or greater

- Viscosity grades are tailored to passenger car motor oil formulation

Synthetic Base Stocks

Synthetic base stocks, unlike mineral base oils in Groups I–III, are synthesized from molecules with identical structures rather than refined. This gives synthetic base oils more predictable properties, higher performance and greater consistency, although at higher cost.

Group IV Base Oils (Polyalphaolefins)

Polyalphaolefin (PAO) base oils belong to API Group IV and consist of chemically engineered synthetic hydrocarbons. They are produced through polymerization of linear alpha‑olefins derived from feedstocks such as 1‑decene. The resulting fluids have a high viscosity index, typically around 130, a low pour point and high oxidative stability. These characteristics support reliable lubrication across a wide temperature range. PAOs are less volatile than mineral oils and offer improved high‑temperature wear protection. They also resist viscosity increase with age and reduce deposit formation in engines and industrial systems.

POAs are produced by a fairly small number of manufacturers, with global capacity at around 730,000 metric tons per year. The largest producers include ExxonMobil, which has capacity of 301 000 t/y, Ineos Oligomers with 355,000 t/y and Chevron Phillips Chemical with 43,000 t/y.

Growth is occurring in regions such as China where independent refiners and joint ventures have begun developing PAO facilities. China National Offshore Oil Corp. in partnership with Shell, licensed Neste technology to build a PAO plant in Huizhou City. That site also added capacity for linear alpha olefin production and will expand capacity further by 2028.

China accounts for development of mostly high‑viscosity PAOs used in gear oils and industrial lubricants. PetroChina’s Lanzhou facility is reported to be the first low‑viscosity PAO plant in the country, producing products with performance metrics comparable to imported grades in terms of viscosity index, pour point, flash point and low‑temperature dynamic viscosity. Despite that development PAO remains a small segment of global base stock production at less than 1% according to industry sources.

PAO base oils maintain advantages under low temperature and high shear conditions where mineral oils may not deliver equivalent film strength or cold‑start protection in automotive applications. The molecular consistency of PAO gives it uniform behavior that aids in performance predictability. The fluids do not require dewaxing during manufacture since their structure resists wax crystallization. Earlier low-viscosity PAOs exhibited moderate viscosity index values but modern grades made with metallocene catalysts offer improved oxidative performance and pour point resistance.

Cost remains a limiting factor. PAOs are more expensive than Group III and much more costly than mineral oil grades. Adoption depends on whether formulators receive price premiums for performance or emissions reduction benefits. PAO production is more complex and feedstock competition exists since linear alpha olefins are also used in detergent manufacturing. This limits global capacity growth and confines production to firms with olefin polymerization expertise.

Despite price pressure, synthetic demand remains in applications such as wind turbine gear oils hydraulic fluids industrial compressors and specialty automotive lubricants. PAO fluid use in these sectors continues to support long term viability for this product class while maintaining a niche position. Growth prospects are tied to industrial expansion regulatory demands for high-performance and energy-efficiency trends globally.

Producers

Apalene Technology

CNOOC & Shell Petrochemicals Co. (China joint venture)

Dowpol

Dowpol-Lu’an

ExxonMobil Chemical

Ineos Oligomers

Lanxess

Lu’an Group

PetroChina

Shanghai Fox Chem.

Taif Group

Group V Synthetic Base Stocks

Other types of synthetic base stocks are classified as Group V and include synthetic esters, polyalkylene glycols, polyisobutenes and silicones.

The synthetic base oil market is niche. Demand for ester base stocks is growing in sectors where biodegradability or nonflammable characteristics are prioritized. In 2019 esters accounted for more than two‑thirds of base stocks used for biobased lubricants. Volume remains small but grows mostly in environmentally regulated sectors. Ester technology is evolving to address previous limitations such as hydrolytic instability through molecular design that enhances stability and performance.

Emerging ester chemistries offer new functional benefits. VBASE Oil Company has developed secondary polyol ester base oils that retain biodegradability while improving deposit control friction reduction and thermal stability. These products span ISO viscosity grades 32 to 460 and provide hydrolytic resistance superior to traditional esters due to their ester and ether bond architecture and branched backbone. Other fluid innovations include estolides produced by Biosynthetic Technologies derived from castor and soy that deliver oxidative and wear performance comparable to petroleum base oils.

PAGs continue to be used mainly in industrial applications where their polarity and lubricity excel in extreme environments. Dow Chemical’s Ucon fluids are widely used in compressors and refrigeration systems. Dow operates multiple PAG plants including Tarragona Spain Freeport Texas South Charleston West Virginia and a joint venture in Malaysia. Combined output reaches nearly 246,000 tons annually. PAG demand persists in industrial markets especially in India China Europe and North America where compressor warranties or low temperature operations drive performance requirements.

Cost and compatibility remain challenges. Esters typically cost more than Group III or PAO base oils. PAGs are incompatible with many seal materials and cannot be blended easily with mineral or other synthetic oils which limits application flexibility. Ester hydrolysis may cause acid formation seal corrosion sludge or varnish if not formulated correctly.

Applications where synthetic base stocks dominate include aerospace gear oils metalworking fluids environmentally acceptable lubricants and electric vehicle coolant fluids. Ester technology supports lubricant formulation in sectors pursuing thermal and environmental performance. PAGs offer performance in conditions unsuitable for mineral oils such as low temperature compressors and food machinery scenarios. Together these fluids support equipment reliability regulatory compliance and reduced environmental impact while filling gaps that mineral and PAO fluids cannot address.

Growth for Group V synthetic base stocks is expected to continue where performance requirements intersect with regulatory or sustainability mandates. Capacity expansion by specialist ester producers and continued PAG investment by major industrial suppliers will shape the future of these products. Despite limited volume compared with other base stocks, Group V synthetics provide essential functional value in niche but expanding markets.

Synthetic Esters

| Manufacturing Process | Properties | Applications |

| Produced by reacting carboxylic acids with alcohols | Thermal resistance | Hydraulic systems |

| Oxidation stability | Aviation greases Compression systems | |

| Low volatility | Environmentally acceptable lubricants (where residue control, fire resistance, or biodegradability are required) | |

| Biodegradability |

Producers

Biosynthetic Technologies

Lanxess

Matrica

NOF Corp.

Nouryon

Nyco

Oleon

OQ Chemicals

Patech Fine Chemicals

Perstorp

Peter Greven GmbH

Savita Oil Technologies

Shin-Nihon Rika

Stearinerie Dubois

Teknor Apex

Vantage Specialties

VBASE Oil Company

Wellnj

Youmi Chemical

Zschimmer & Schwarz

Polyalkylene Glycols (PAGs)

| Manufacturing Process | Properties | Applications |

| Polymerization of ethylene oxide or propylene oxide with alcohols or water to form glycol chains | High viscosity index | Food-grade lubricants |

| Excellent lubricity | Quenching fluids | |

| Polarity | Compressor oils | |

| Temperature stability | Gear and chain lubricants | |

| HFC hydraulic fluids |

Producers

Adeka

BASF

Clariant

Croda

Dow Chemical

Ethox

Geo Specialty Chemicals

Idemitsu

Ineos Oligomers

Nalco

Pan Asia Chemical

Pelron Corp.

Petronas Chemicals

Sanyo Chemical

Solvay

Vantage Specialties

Vladimir Chemical

Wellnj

Polyisobutenes (PIBs)

| Manufacturing Process | Properties | Applications |

| Polymerization of isobutene, which is further processed into various grades of PIB.glycol chains | Excellent tackiness | Viscosity modifiers in engine and industrial oils |

| Good film-forming ability | Tackifiers in adhesive formulations and lubricants | |

| Oxidation and thermal stability | Fuel additives (e.g., detergents and dispersants) | |

| Water resistance | Sealants and caulks | |

| Low toxicity | Cable insulators and packaging materials |

Producers

BASF Petronas Chemicals

BASF-YPC

Braskem

Chevron Oronite

Daelim Industrial Co.

Eneos

Gujarat Polybutenes

Ineos Oligomers

Infineum

Jilin Chemical (CNPC)

Jinzhou Jinex Lub. Add.

Kochi Refineries (BPCL)

Kothari Petrochemicals

Lubrizol

NOF Corp.

Shandong Hongrui New Material

TPC Group

YPF

Phosphate Esters

| Manufacturing Process | Properties | Applications |

| Reaction of phosphorus oxychloride (POCl₃) or phosphoric acid with alcohols or phenols to form triaryl or trialkyl phosphate esters. | Excellent fire resistance | Fire-resistant hydraulic fluids (especially in aerospace and power generation) |

| Good oxidative and thermal stability | Base stocks for high-temperature lubricants | |

| High load-carrying capacity | Anti-wear and extreme-pressure additives in lubricants | |

| Low volatility | Plasticizers in polymers | |

| Poor hydrolytic stability | Aircraft turbine engine lubricants |

Producers

Clariant

Daihachi Chemical

ICL Industrial Products

Lanxess

Mitsubishi Gas Chemical

Prasol

Protex

Showa Ether

Solutia (Eastman)

Tianjin Binhai Chemicals

Tina Organics

Silicone Base Oils

| Manufacturing Process | Properties | Applications |

| Synthesized by hydrolyzing and polymerizing chlorosilanes (typically dimethyldichlorosilane) to form polydimethylsiloxane (PDMS) and other organosilicone polymers. | Excellent thermal and oxidation stability | Damping fluids and release agents |

| Water repellency | High-temperature lubricants | |

| Chemically inert | Dielectric fluids | |

| Electrical insulating properties | ||

| Wide operating temperature range | ||

| Low surface tension |

Producers

Dow Corning

Elkem Silicones

Evonik

Evonik Goldschmidt

Momentive Performance Materials

Shin-Etsu Chemical

Wacker Asahikasei Silicone

Wacker Chemical

Rerefined

Rerefined base oil production is gaining traction globally as sustainability goals and circular economy models reshape the lubricants market. Capacity remains modest compared with virgin base oil refining, with the United States and Europe each offering about 875,000-877,000 metric tons per year as of early 2022.

Rerefined oil has been part of the industry since API and ATIEL created group definitions in the 1990s that permitted regenerated oils to meet quality standards.

Superior environmental performance makes rerefined oil compelling: life cycle assessments show rerefined base oil carbon footprints at 70%-80% of virgin feedstocks and greenhouse gas savings of up to 7,500 tons per 3.78 million liters. Technological advances such as improved vacuum distillation solvent extraction and hydrotreating have enabled rerefiners in North America and Europe to routinely produce Group II and even Group III quality base oils.

Europe

European reuse of waste lubricating oil has matured. The EU collects nearly 90% of used lubricants – about 1.7 million tons per year – and converts roughly one‑third into base oil, making rerefined stocks nearly 600,000 t/y in 2014, rising toward 800,000 t/y by the mid‑2020s.

Extended Producer Responsibility rules in EU member states have driven mandatory collection and regeneration targets. In Greece, rerefining rates reached 43% of total lubricant consumption; in Germany, rerefined base oil contributes about 20% of market demand.

Leading rerefiners such as Avista, Viscolube and Sertego now produce Group II+ grade base oil through severe hydroprocessing and advanced solvent techniques.

European firms have asked the EU to enact binding targets requiring collection and rerefining – aiming for 60% of collectable oil by 2025 and 85 percent by 2030 – pushing rerefined base oils toward 1.1 million t/y in total. Consequently regional growth is slowing as capacity approaches regulatory and infrastructure‑defined limits, suggesting Europe may plateau soon.

United States

Rerefined base oil capacity in the U.S. stood at nearly 875,000 t/y as of early 2022, primarily Group I. Unlike Europe, the U.S. lacks broad regulatory mandates requiring rerefining. Most used oil is collected voluntarily and processed by commercial enterprises like Safety‑Kleen and Avista.

Despite the absence of laws, capacity has grown incrementally driven by circular economy incentives and lifecycle carbon reduction goals. Safety‑Kleen alone processes more than 757 million liters of used oil annually, producing Group II+ base oil meeting modern engine oil specs and often outperforming virgin oils. With no saturation from regulation, the U.S. market still offers opportunity. Growth depends on private investment, sustainability commitments from blenders, and evolving voluntary collection networks rather than statutory requirements.

Asia

Asia is a wide-open growth region. China collected more than 6.5 million tons of waste lubricants in 2023 and produced approximately 1.4 million t/y of rerefined base oil. Indian EPR regulations, started in 2024‑25, set recycling targets beginning at 5% and rising to 50% by 2030‑31.

Actual rerefined penetration remains very low, around 1%, compared with 22% in Italy and Germany or 26% in Brazil. A lack of organized collection systems and limited infrastructure remain key barriers. But major investments are under way, including large provincial plants in Shandong exceeding 200 000 t/y output with hydrotreating units to elevate quality toward Group II/III. Industry experts emphasize scale regulation and standards as Asia’s unreadiness is overcome, unlocking vast potential.

Beyond Asia, rerefining remains nascent. In Central Asia, firms such as Uz‑Prista are building networks for collection and rerefining to serve domestic and regional markets in Turkmenistan, Tajikistan, Kyrgyzstan and beyond. Developing regions in Africa and Latin America currently rely heavily on virgin base oils and lack regulatory frameworks – presenting untapped potential for rerefining development.

Outlook

Rerefined base oil output remains a small fraction of approximately 30 million tons of global base oil demand projected to plateau by 2030. But demand for high‑quality Group II and Group III oils and a shift toward sustainability make rerefining increasingly strategic. Europe has made the sector mature through legislation and infrastructure – growth will be incremental. The U.S. has room to grow commercially, though lacking mandates. Asia and many developing markets remain at the early stages with high upside potential once collection systems scale and regulation catches up.

Rerefining is transitioning from niche to mainstream. Europe leads in regulatory maturity. The U.S. continues moderate expansion in the absence of firm policy. Asia and the rest of world are ripe for growth, supported by scale building standards and circular economy initiatives.

Major oil companies have begun investing in rerefining capacity. ExxonMobil in France is reconfiguring its Lillebonne site to start operations in the second half of 2025. Once converted, that facility is expected to produce about 125,000 tons of Group I rerefined base oil annually. Shell and BP have pursued partnerships in the sector, but ExxonMobil is notable for building its own standalone rerefinery.

There is growing recognition that the quality of rerefined base oil has improved. Advances in solvent extraction, vacuum distillation and hydrotreating have enabled production of Group II and III base oils from waste feedstocks. Among processors in North America and Europe, the gap between rerefined and virgin oils has narrowed and in some cases performance is considered equivalent or better, according to its proponents.

Interest among major lubricant blenders is rising in rerefined base oils as part of carbon reduction and cost management goals. Buyers increasingly consider rerefined oils to meet internal sustainability standards and communicate reduced Scope 1 and Scope 2 emissions to investors. The sector appears likely to expand modestly in established regions and potentially more broadly in markets where collection infrastructure and regulation are nascent.

Avista Oil

Avista Oil operates several rerefining facilities. In North America, it runs a plant in Peachtree City, Georgia, producing Group II and III base oils. In Europe, its operations include sites in Dollbergen, Germany, and Kalundborg, Denmark.

Eneos

Eneos operates a pilot plant in Japan that has produced rerefined base oil meeting Sequence IIIH performance standards, as part of a government‑commissioned demonstration project.

Green View Technologies

Green View Technologies announced plans in 2014 to commission a new rerefinery in Rollinsford, New Hampshire, U.S.

Heritage‑Crystal Clean

Heritage‑Crystal Clean is developing a rerefinery in Indianapolis, Indiana, that was planned to produce Group II base oils.

IFP Petro Products

In India, Avista has a partnership with IFP Petro Products to develop waste lubricant rerefining capacity.

Lwart Environmental Solutions

Brazil’s Lwart Environmental Solutions operates a rerefinery in Lencois, Brazil – one of the largest such facilities in the world.

Metalub

Costa Rica’s Metalub has a U.S. $12 million used oil facilities with capacity to process 5,400 tons of used oil per year and to produce 4,000 t/y of base oil.

Pentas Flora

Malaysian waste collection and lubricant blending company Pentas Flora upgraded its used oil rerefinery to make Group II and III oils.

Petromaca

Venezuelan petrochemical and environmental management company Petromaca’s rerefinery is the latest used lubricant recycling project to spring up in South America. More than 900,000 metric tons of oil is used in vehicles and ships in Venezuela per year. The federal government is set on solving the problem of how to dispose of those lubricants once they are used, and its solution is to process the material to turn it back into a raw material for manufacturing new lubricants.

Puraglobe

Operations in Europe and the U.S.

Recvoil

Recvoil, a used oil management organization, in cooperation with fuels and lubricants distributor Enex, broke ground last month on what will be the first used oil rerefinery in Chile. The facility, which will be owned and operated by Recvoil, is being built in the coastal city of San Antonio and is designed for capacity to produce 7,100 metric tons of base oils per year. The price tag for the project is U.S. $7.5 million, and it is scheduled to begin making base oils by 2024.

Safety‑Kleen (Clean Harbors)

Safety‑Kleen is cited as the largest rerefiner in North America. It processes more than 757 million liters of used oil annually and produces Group II base oil.

Tayras

Turkey’s first rerefiner Tayras has processing capacity of 60,000 tons, producing 45,000 t/y of Group II base oil.

Vertex Energy/Kleen Performance Products

Vertex Energy, through its Kleen Performance Products subsidiary, maintains rerefining operations in the U.S., including a facility in East Chicago producing Group II and II+ base oils. Its Mobile, Alabama hydrocracker began producing a 4-centistoke API Group III rerefined base oil in late 2025.

Yunitco

Saudi base oil rerefiner Yunitco has a 120,000-ton unit that is undergoing a production capacity increase to 200,000 tons.