Environmentalists and climate scientists believe modern life is not sustainable. We consume too many resources, produce too much waste and have created an ever-widening wealth gap between the world’s richest and poorest. We also need to quickly reverse our contribution to climate change.

Can the lubricants industry help put the global economy on a more sustainable track and mitigate climate change?

“If we don’t lubricate things, nothing would move and the world would come to a standstill,” John Eastwood, head of global business development for energy technologies at specialty chemical company Croda, told Lubes’n’Greases. “Even very small amounts of lubricant can have a tremendous impact on society, on the economy and the environment.”

The industry plays a vital role in reducing energy and resource consumption by reducing friction, corrosion and wear. In this sense, it contributes to the sustainability of other industrial activities. But is it sustainable itself?

Sustainability Defined

According to the U.N. Global Compact, corporate sustainability is “essential to long-term corporate success and for ensuring that markets deliver value across society.”

In a growing trend, companies are looking at their long-term targets through a lens of sustainability instead of just profit. The word sustainability is an umbrella term that can be used and abused. But as it relates to business, a more useful term is environmental, social and governance sustainability, or ESG.

These three words, referred to as pillars, stake out sustainability into co-equal and interconnected aspects. An organization can examine and measure its impacts and the risks it faces against them.

Investors Paradise

More and more institutional and private investors are seeking out companies that do well on market indexes that rate their ESG performance. Once a niche of the financial market, the number of ESG indexes has mushroomed over the past decade. Bloomberg predicts that the value of ESG assets under management will reach $53 trillion by 2025, or a third of all such assets.

Influential figures in the investment community—including Larry Fink, the CEO of the world’s largest asset management company, Blackrock—are encouraging fund managers to turn their backs on unsustainable destinations for their money and look for what are known as “green,” “responsible” or “sustainable” investments.

Naturally, among the unsustainable investments are fossil-fuel extraction and power generation companies.

Lubricants are not immune to these trends. Some of the unsustainable companies are also producers of base stocks and finished lubricants. No matter how much friction their products reduce, energy they save and machinery they keep in service, lubricant companies are still, in the main, part of the hydrocarbons chain, which supplies it with crude and natural gas for feedstock.

“Looking at ESG for lubricants, it would benefit from a unified and clear message from the industry to the external world,” James Moorhouse, director of ABN Resource, a United Kingdom-based recruitment company that specializes in lubricants industry personnel, told Lubes’n’Greases.

He continued: “We should communicate the value of lubes on daily life and the environment better than what we do now. Lubes reduce emissions, improve the environment and play a critical role in keeping anything that moves, moving. It’s not ‘dirty oil’!”

Environmental Impact

The number of alternatives to crude-derived base oil is growing. These include, but are not limited to, Novvi’s renewable base stock and Biosynthetic Technologies’ estolide.

Biobased materials are gradually overcoming the technical shortcomings of previous decades, but there is a limit to the number of petroleum-based materials they can realistically replace.

“I don’t foresee biobased/renewable materials fully replacing fossil-derived base oils,” Mark Miller, the CEO of Biosynthetic Technologies, told Lubes’n’Greases. “There are applications, such as where equipment can leak or spill into sensitive environments, [where] biobased fluids can and will replace petroleum oils.”

That doesn’t mean they do not have a key role to play, though. “Biobased products will help companies reduce their carbon footprint, which is becoming more and more a driver,” Miller said.

Rerefining waste oil into base oil also has a role in reducing reliance on virgin fossil-based materials. As David Hopkins, CEO of the specialty chemicals and base oil distribution company Multisol, remarked, “If you put 5 liters of engine oil in your car today, then this time next year, you should be able to remove around 5 liters of used engine oil.”

Rerefining is a strategic resource for markets in which there is no domestic virgin base oil production and can be a key component of the growing carbon circular economy.

“Rerefined base oils save more than 50% of CO2 emissions compared to equal virgin base oils,” Christian Hartmann, chief sustainability officer of Turkish rerefiner Tayras, told Lubes’n’Greases. “And all major rerefiners provide certified carbon footprint figures to the industry, whilst data from virgin suppliers are often difficult to get.”

The knock-on effect is felt further down the rerefined base oil supply chain. “This transparency helps the lubricant blenders to key in those data into their product carbon footprint calculation,” Hartmann said. “Product carbon footprint information is required from the lubricant clients, especially the automotive industry.”

U.S. rerefiner Safety-Kleen found that lubricants using rerefined base oil saved 7,500 metric tons of greenhouse gases for every 3.78 million liters used.

“The awareness of the benefits and the contribution to sustainability in every aspect is widely known and drive the growth of rerefining step by step,” Hartmann said. “Rerefining gave a proof of quality and sustainability.”

Beyond Feedstock

Globally, the eye on sustainability differs from region to region, but the trend toward low CO2 emissions is clearly visible, Hartmann said.

There is more to environmental sustainability than feedstock and carbon emissions. Efficiencies can be made in energy consumption, and power can be sourced from renewable suppliers or generated onsite. Reductions can be made in the consumption of water and other resources and the production of waste.

Castrol, for example, has a new strategy that sets out the company’s aims by 2030 to “save waste, reduce carbon and improve lives.” Indeed, many of the major lubricant manufacturers and additive companies have announced carbon reduction targets.

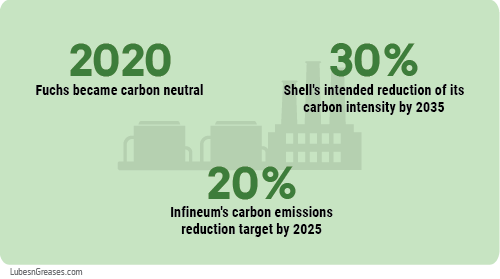

By switching to renewable energy to power facilities, among other measures, Fuchs has been CO2 neutral since January 2020. Shell aims to cut the carbon intensity (greenhouse gas emissions per energy unit) of its products by 30% by 2035 and 65% by 2050. Infineum’s target is a 20% reduction by 2025 in carbon emissions (Scope 1 and 2) per ton of product compared with 2018.

Social Standing

Reducing impact on the environment by cutting carbon emissions and switching to renewable energy captures the headlines. These actions are vital. Yet the two other pillars—social and governance—are just as important to ensuring business can go on well into the future.

“Social sustainability is about identifying and managing business impacts, both positive and negative, on people,” according to the U.N. Global Compact. Companies that engage with their workforce and the community and develop corporate social responsibility programs are more likely to be sustainable businesses, said Kezia Farnham, a marketing professional for ESG consultancy Diligent.

“It is in a corporation’s best interest to oversee social responsibility because this will ensure sustainability,” Farnham wrote. “The corporation and society will see evidence of that impact now and in the future.”

Social sustainability refers to the way a company positively manages its direct or indirect effects on its employees, workers in the value chain, customers and local communities, the U.N. said. This has the potential to “unlock new markets, help retain and attract business partners, or be the source for innovation for new product or service lines. Internal morale and employee engagement may rise, while productivity, risk management and company-community conflict improve.”

Conversely, the U.N. stated that “a lack of social development, including poverty, inequality and weak rule of law, can hamper business operations and growth.”

Social sustainability captures a raft of topics, from human rights and child labor to pay equality and employee diversity.

Diverse Views

Diversity is a key talking point among industry recruitment professionals. The lubricants industry—like many others—draws from the pool of science, technology, engineering and mathematics (STEM) graduates. Similarly, it can be a monoculture. The workforce in the industry is not only predominantly male but is also aging.

“A social element that the industry can improve on is greater inclusion, diversity and equity” Moorhouse said. “It would help overcome current and future staffing and market challenges with creative thinking and problem-solving abilities. It is proven to deliver sustainable growth, too.”

In its Lubricant Talent Report on industry employment trends published in June, ABN Resource found that men accounted for 90% of respondents to the report’s data-gathering survey.

A damning study of its student body by Yale University found that women make up less than 40% of STEM undergraduates. They go on to form only 29% of the science and engineering workforce.

Diversity isn’t limited to physical attributes such as sex, ethnicity or age. Different groups view it in their own ways. Younger generations, Millennials, for example, conceive of diversity as a mix of perspectives within a team.

“Diversity brings about an amalgamation of talent, knowledge, wisdom and exposure to different cultures,” wrote Pritti Gupta from the University of Ragistan in the International Journal of Research in Engineering, Science and Management. “This contributes to the company’s development by allowing this collective knowledge or fresh perspectives to drive innovations of products, methods and systems.”

Gupta said that “a diverse workforce offers a competitive advantage to the company. Companies that overcome certain diversity issues often achieve greater productivity, profit and company morale.”

The current cohort of Generation Z STEM graduates, who will fill roles in the industry as the graying workforce retires, has different outlooks, interactions and values. This suggests that workforce diversity has a direct relationship to sustainability if the industry cannot attract new employees.

|

“Company leaders need to set the example, implement and support initiatives to create an organizational culture for diversity and inclusion to flourish.”

– James Moorhouse, ABN Resource |

In their paper “Reaching and Retaining the Next Generation,” Christine Ladwig and Dana Schwieger from the Department of Accounting at Southeast Missouri State University point out: “The world in which Gen Zers have been raised has been fraught with political tension, violence and societal instability post-9/11. Gen Zers have never known a world in which they could not instantly connect and have information and communication channels immediately at their fingertips.”

Moorhouse also sees the connection between the social and governance pillars. “It links to governance because company leaders need to set the example, implement and support initiatives to create an organizational culture for diversity and inclusion to flourish,” he said.

Good Governance

The least discussed pillar outside the boardroom or annual general meeting is the sustainability of governance. This includes such elements as transparency, fair compensation, board diversity and accountability. Investors want to see effective stewardship that protects their investments into the future.

In his annual letter to CEOs, Fink wrote: “Most stakeholders … now expect companies to play a role in decarbonizing the global economy. Few things will impact capital allocation decisions … more than how effectively you navigate the global energy transition in the years ahead.”

Publicly traded companies are feeling pressure from outside the boardroom to disclose their ESG activities. Agencies that generate ESG ratings and indexes on which they are ranked are growing apace. Companies are rated whether they choose to be or not.

Additional pressure can be felt inside the boardroom from activist shareholders. 2021 was a landmark year for shareholders using their collective clout to effect change.

Shareholder groups made the headlines when they faced off against Goliaths of the hydrocarbons industry. Investors wanted these companies to change the way they operate, but their motivations and goals varied from group to group.

Dutch environmental group Follow This wants companies to comply with the Paris Agreement’s carbon reduction target. To achieve this, it filed resolutions at the shareholder meetings of BP, Equinor, Chevron, Phillips 66 and Shell.

A San Francisco-based investment firm called Engine No. 1 also pressed ExxonMobil to decarbonize—but from the perspective of long-term shareholder value. The investment firm had only 0.02% of Exxon’s stock but was still able to rally support among larger shareholders to back a plan to replace board members with people onboard with a carbon-neutral Exxon.

Activist investor groups have also called for sex equality and ethnic diversity on boards, with some success. Shell’s board is 50-50 men and women, average director tenure has shortened, the average age of board members is younger and ESG metrics are considered in CEO pay packets.

A cautionary note is that despite activists’ best effort to effect change in the boardroom, global events got the upper hand. U.S. oil production was already expected to rise even before the invasion of Ukraine. Now that the West is shunning Russian crude, Exxon, for one, is ramping up at the same time as strategic petroleum stocks are released.

In another twist, Fink appeared to have performed a U-turn when in June he said in an interview with Bloomberg, “I don’t want to be the environmental police.” He also announced that Blackrock would not endorse “extreme” shareholder climate change resolutions.

While every company has a measurable environmental impact, it’s harder to calculate its social impact. A lubricant blender in an industrial park in Slough is unlikely to employ child labor. But it is easier to imagine it happening in a mine that supplies a key process mineral. However, with good governance, these issues can be mitigated and business sustained.

Read more from our Special Report: Can the Lubricants Industry Truly be Sustainable?

• Can the Lubricants Industry Truly be Sustainable? – Some critics are sceptical about the lubricants industry’s ability to operate in a sustainable manner. Others are hopeful that the industry can do its part to mitigate climate change.

• Pump Up the Policy – Lawmakers, regulators and standards agencies around the world are driving the transition to a low-carbon economy through a raft of policy initiatives. What kind of pressure will these policies put on lubricant industry players?

• No Longer Neutral About Climate: The Decarbonization of a Lubricant Company – Industry expert and sustainability adviser Apu Gosalia explains how lubricant companies can achieve climate neutrality.

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.