In the January issue, The Strategy Works examined the economic and geopolitical forces driving the global uptake of stationary gas engines for power generation. This month, we report on a survey of the original equipment manufacturer and operations & maintenance company engineers who are directly responsible for servicing and maintaining these engines.

To ensure access to the most recent and relevant data, The Strategy Works collaborated with the United Kingdom-based Institution of Gas Engineers and Managers, which maintains a database of 4,000 members in the U.K. and around the world.

Ian McCluskey, head of technical and policy at IGEM, explained the institution’s motivation to help conduct the study. “Decarbonization of the energy sector is necessary to achieve the mandatory greenhouse gas emission targets [for the Paris Climate Agreement]. This has accelerated the need to reform energy systems away from unabated fossil fuels.”

The quality of gas that enters the gas network must be within pre-determined limits, primarily for consumer safety, McCluskey explained. To this end, the Gas Quality Working Group led by IGEM is developing a new gas quality standard. “As the natural gas supply mix continues to change, expanding gas quality specifications could help to enhance security of supply. It is also crucial in transitioning to a low-carbon future. It was therefore critical for IGEM to understand from the research the impact of any proposed changes on the power sector.”

|

“Decarbonization of the energy sector is necessary to achieve the mandatory greenhouse gas emission targets [for the Paris Climate Agreement]. This has accelerated the need to reform energy systems away from unabated fossil fuels.”

– Ian McCluskey, Institution of Gas Engineers and Managers

|

Survey respondents engaged in operations and maintenance activity identified themselves as either independent or corporate members of IGEM. At the end of the online survey, some offered to participate in in-depth qualitative interviews to enrich the survey findings.

The survey sample was robust, with 41% of respondents servicing between 50 and 2,000 engines. Findings confirmed the trends identified by The Strategy Works through telephone interviews with 10 leading gas engine market players, described in the January issue (“Gas Engines Spark Energy Solutions”).

The top three manufacturers of gas engines among survey respondents are Caterpillar, Jenbacher and Cummins; 54% of multiple-choice responses indicate installations that include these engines.

The survey found that power generation is the principal application for gas engines, notably combined heat and power systems, also known as cogeneration plants. Together with renewable energy, respondents see these applications as prominent in any future energy system.

Natural gas was the most prevalent fuel type, used by 90% of respondents. Landfill gas came second at 28%, but this fuel is on the decline.

Respondents said gas impurities are the main cause of technical problems that impact gas engine lubricants, principally hydrogen sulfide and siloxanes from landfill gas. Sixty-five percent of the sample use instrumentation to mitigate gas quality fluctuations.

The energy transition toward decarbonization is front of mind for most respondents, and 90% said gas engines will play a decisive and strategic role in that transition. Gas engines also have a key role to play for decentralized distributed power in hospitals and apartment blocks, as well as balancing plants to meet both peak energy demand and regional demand in replacements for conventional power plants.

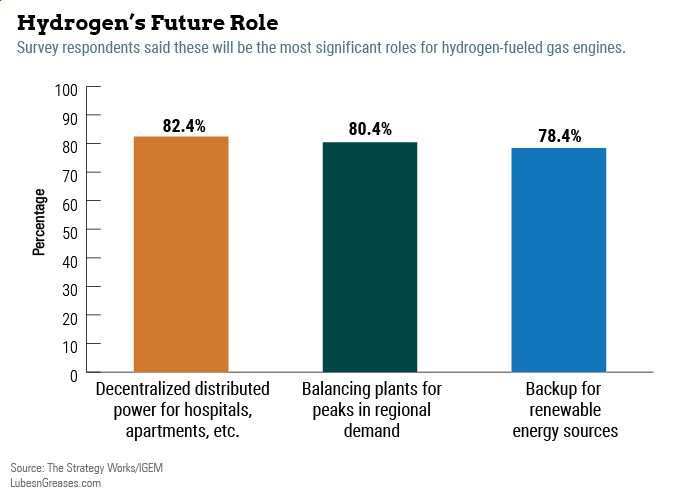

As mentioned in last month’s article, hydrogen is seen as the next-generation fuel for gas engines, with hydrogen blends viewed as a bridge as hydrogen sources are developed and become more economical. More than three-quarters of respondents believe that hydrogen technology will be fully operational within 10 years, and about the same amount said it will be most effective in the short term as a supplementary fuel that could be blended with natural gas. Forty-three percent see an even quicker transition, with hydrogen hitting the market within five years.

More than half of the sample—62%—believe their existing equipment could operate safely with a blend of hydrogen and natural gas.

Cogeneration Leads the Way

In an interview to supplement the survey, Mark Duda, senior product manager at leading OEM Cummins, reported that combined heat and power applications are driving the market for gas engines. “Lean-burn gas generator applications for power generation are up to 20 megawatts per site, typically ten 2 MW units for larger installations.”

Viessmann in Germany is one of Europe’s largest heating system manufacturers, with 55% of its 2.65 billion euros in sales outside of Germany. Christian Engelke, technical director, reported an active CHP market. “Designed specifically for commercial use, [combined heat and power systems] are most effective wherever there is a continuous need for electricity and heat. For example, leisure centers, hospitals, hotels, swimming pools, factories, etc. are all popular installations in retrofit markets.” Viessmann mainly uses Toyota and Man engines, ranging from 6 to 530 kilowatts, for this purpose.

|

Power generation and combined heat and power applications are driving the market for gas engines.

– Mark Duda, Cummins

|

“It’s the total efficiency and ease of installation that drives package solutions,” Engelke said. Package systems reclaim the exhaust heat from engines that generate power in a cogeneration system.

“The integration of engine, exhaust interchanger and oil cooler, factory-fitted and tested, will provide guaranteed efficiencies,” he continued. “Some have integrated condensing boiler technology and, as a result, achieve total efficiency of up to 106%. From the installer point of view, it makes the installation in the plant room easier by just connecting to the building services (water, gas and electricity).”

French utility giant Engie, with revenue of 60 billion euros ($73.5 billion) globally, has committed to a zero-carbon transition—a move away from fossil fuels to renewable sources of energy—at its power generation operations in 120 countries, including the United States and Brazil, and at 450 biomass plants in Europe. In the U.K., the company focuses more on district energy, and 20 of its sites have installed gas engines.

Apart from its obvious cost benefits, combined heat and power resonates as a compelling environmental proposition for Engie’s customers, according to James York, technical compliance manager in the U.K. “If you are running an engine and you output the power, technically you are getting the heat to the buildings for free. That is a big selling point. But I believe it is also environmental. A lot of ours [customers] are sold on how many tons of carbon dioxide we can save per year just decentralizing the power grids.”

Powering the Energy Transition

Cummins is also moving away from traditional sources of power. “Leadership of the company is clear that the future isn’t going to be fossil fuels, the future will be something else, and we’re transitioning towards that future,” said Duda.

“One of the big trends right now is decarbonization, so we’re seeing significantly higher renewable penetration in the market,” explained Jaimie Hamilton-Antonson, technical leader for energy management with Cummins.

The company sees energy storage as another growing sector of the power market. “We’re seeing a lot of interest in microgrids and distributed energy assets,” Hamilton-Antonson said.

Along with most survey respondents, Cummins believes that gas-fueled energy distribution systems will need to be repurposed to accommodate hydrogen. In the short term, the company expects a blended fuel with hydrogen making up anywhere from 5% to 20% of the mix, moving toward 100% hydrogen in the long term.

|

“We’re seeing a lot of interest in microgrids and distributed energy assets.”

– Jamie Hamilton-Antonson, Cummins

|

“Blending hydrogen is strongly feasible with existing gas technologies. It’s less disruptive for the whole market and the supply chain, for mixing or blending hydrogen into the existing gas,” explained Engelke.

Viessmann is also developing engines that will run on pure hydrogen, he added. “Everybody’s asking for it, but no infrastructure is in place yet.”

Engines Oils Must Keep Up

Hydrogen gas could create fresh technical challenges, according to Hamilton-Antonson. “Hydrogen is a very fast-burning fuel, so it impacts the flame speed within the combustion chamber significantly. Also, it will have impact on your auto-ignition interval, and that can lead to significant and heavy knock, which can be disruptive to an engine.” Knock occurs when fuel burns unevenly in an engine’s cylinders, limiting performance and efficiency and potentially damaging the engine.

Confirming the findings from interviews conducted prior to the survey and covered in last month’s article, responses indicate that ExxonMobil’s Pegasus and Shell’s Mysella are the two dominant gas engine oil brands in the market.

Other popular brands include Q8 Oils’ Mahler brand, Castrol’s Duratec, Chevron’s HDAX and Total’s Nateria. Q8 recently teamed up with Innio Jenbacher to supply oils for the OEM’s non-natural gas engines, such as those running on biogas, sewage gas and landfill gas. The co-branded oils are expected to launch in this quarter.

For its part, Viessmann uses exclusively synthetic engine oils. “The gas engines are highly tuned, and our requirements are for driving ever-longer service intervals for the customer, which means the specified oil is tested to last up to 8,000 hours, or 3,000 hours in larger engines,” explained Engelke.

About the only cloud on the horizon for gas engine operations and maintenance companies is the difficulty some report in recruiting a new breed of skilled gas engineers to keep up with demand— and this holds true on both sides of the Atlantic. The investment environment, however, continues to favor gas engines.

Apart from government-led green stimulus programs in the aftermath of COVID-19, global asset managers are now getting firmly behind decarbonization. In December, The Financial Times reported that 30 of the largest asset managers globally, collectively overseeing $9 trillion, have set a goal of achieving net-zero carbon emissions behind their investment portfolios by 2050. The investors, which include Japan’s Asset Management One, Fidelity International, UBS Asset Management and others, formed the Net Zero Asset Managers initiative ahead of the fifth anniversary of the Paris Agreement.

Natural gas may not be the ultimate winner in the fuels lottery—that mantle is likely to go to hydrogen—but gas engines themselves are likely to outlive the fuels that power them on the inexorable pathway to eliminate greenhouse gas emissions by 2050.

Michael Herson is managing director of London-based The Strategy Works, a strategy consultancy specializing in original business-to-business insight within the lubricants industry and other sectors. Contact: +44 208 868 0212 or mherson@thestrategyworks.com.