Stationary gas engines were undergoing a revival even before the pandemic, and as with many other trends, the pace of change has been accelerated by COVID-19.

To assess the current market and its immediate prospects, London-based consultancy The Strategy Works conducted in-depth interviews with 10 players in the gas engines industry in the United States and Europe.

The consensus from this research is that reciprocating gas engines clearly have a future as prime movers in cogeneration installations for applications such as district heating and as enablers of volatile electricity sources like wind and solar.

A perfect storm for gas engines has been created by a confluence of market forces. First, the steady march toward renewable sources of energy has developed its own momentum. In the wake of the pandemic, investor sentiment has turned toward renewable energy, and government stimulus packages are driving new projects forward. Private utility companies in the West are cracking down on coal-fired power plants, injecting new life into gas engines.

And of course, with the rise of gas engines comes a rising need for gas engine oils.

Balance of Power

Gas engines are increasingly seen as a bridge to provide back-up grid support on the pathway to net zero greenhouse gas emissions by 2050, as set out by the Paris climate accord. “That is absolutely one of the driving forces behind the capacity market installations we do,” confirmed David Burke, group service support director at Clarke Energy in the United Kingdom, a Jenbacher-affiliated company that supplies, installs and maintains gas engine energy plants. In capacity markets, power plants are compensated for their capacity, or the power they may provide at some point in the future, in addition to actual energy produced.

Backup for renewable energy sources is recognized as a main driver behind Jenbacher capacity market installations, which typically consist of 10-15 engines of 1.5 megawatts each on standby to support fluctuating supply from renewables.

|

“It’s too expensive to keep a large power plant as a backup. So you have to do it with these smaller gas engines from one to 10 megawatts, which you have to aggregate for use in the winter or for when there is not a lot of wind power or not so much solar.”

– Griet Van Waeyenberge, Wipa Chemicals International NV

|

Depending as it does on the sun shining or the wind blowing, renewable energy requires balancing sources at power plants to even out supply. As Jussi Heikkinen, director of growth & development, Americas with engine maker Wartsila’s Energy division, explained, “You cannot just have renewables. You need a third ingredient that provides the flexibility and—even more valuable in the future—the resiliency of the grids.”

“It’s too expensive to keep a large power plant as a backup,” added Griet Van Waeyenberge, director of business development with synthetic lubricant manufacturer Wipa Chemicals International NV in Belgium. “So you have to do it with these smaller gas engines from one to 10 megawatts, which you have to aggregate for use in the winter or for when there is not a lot of wind power or not so much solar.”

A power source that can be brought on quickly for a short period of time is much better suited to meet the peaks and troughs of energy demand. So, suddenly, flexible gas engines are seen as part of the solution on the road to decarbonization rather than as part of the problem.

Even in the U.S., which has traditionally been perceived as behind Europe in building traction for renewables, attitudes are changing. “The U.S. power business is directed on a state level. Out of all of the U.S. states, I think there are 13 or 14 that would say we’re going for a 99% or 100% renewable target, or a carbon-free target, for the utility system,” said Wartsila’s Heikkinen.

Combined heat and power systems are an integral part of future energy supply, providing decentralized local power for a new urban infrastructure to reduce reliance on a single central source. Perceived as more environmentally friendly, their use is encouraged in key facilities such as universities and hospitals.

Energy security is another concern, and gas engines can be more readily deployed after natural disasters.

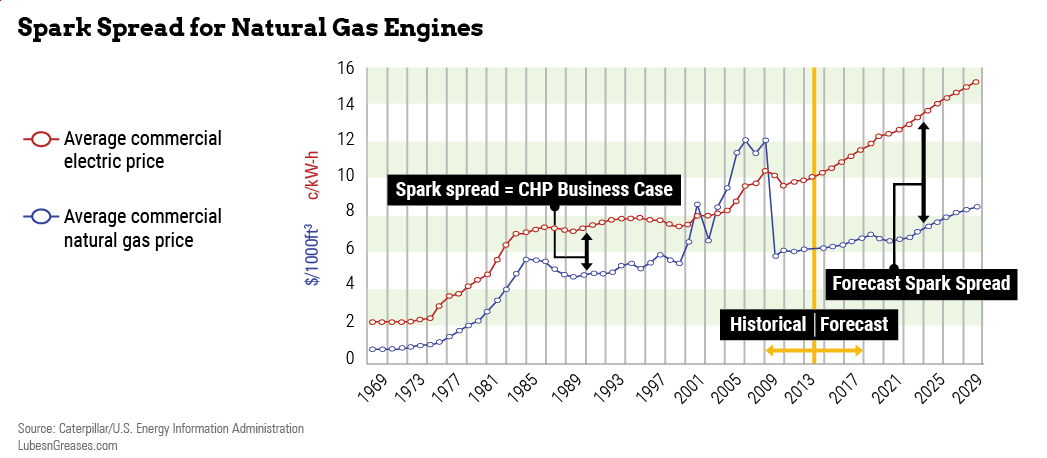

The chart below from the U.S. Energy information Administration shows the all-important “spark spread,” or the profit of a gas-fired power plant from selling a unit of electricity minus the cost of the required fuel. The spread has widened in the past few years and is predicted to go further. As the spark spread for natural gas increases relative to other fuels, gas engines become a preferred route.

Another area that is driving gas engines is battery storage, particularly in the U.S. Tony Dawson, Florida-based project manager for gas engine maintenance provider 2G Energy, said his company has been approached to incorporate energy storage and solar integration with combined heat and power, “and it is gaining momentum.”

“That’s certainly one of the most growing energy segments globally right now,” Heikkinen said. “Particularly here in the U.S., it’s growing by multiples year over year.”

An investment favored by independent power producers in the U.S., battery energy storage systems enable operators to plan for peak demand and match that with supply, instead of hitting peak production and then pulling back as demand eases. This creates a more level output that is better for the grid—a process known as shifting. The excess energy produced during off-peak demand can be stored in the battery systems.

There is also a trend toward building microgrids that will incorporate combined heat and power, solar and battery storage. A microgrid is a self-sufficient energy system that serves a small area, such as a college campus or a neighborhood. “Microgrid integration with CHP is real,” Dawson commented. “Our systems are being utilized on multiple projects along with solar, storage of electrical and thermal energy.”

Engine Maintenance

Original equipment manufacturer warranties are typically quite short in relation to the life of gas engines. After 12 months, maintenance responsibility passes to the service contractor, who then enters into long-term agreements with the end customer—typically 10 years or longer, much closer to the life expectancy of the equipment. “It can be anywhere from five years to a 25-year contract,” said Dawson. “Our goal is to be the service provider for the lifetime of the equipment.”

These agreements, which range from “light touch” to full service, can specify the brand or type of gas engine oil that is used. Some end customers embrace this cradle-to-grave mentality, as managing engines is not their core business. About 30%-40% of customers opt to maintain their own equipment, according to 2G Energy.

The value chain between the OEMs and the operations and maintenance companies is closely connected. For example, Caterpillar has a fine-tuned globally branded service network with dealers such as Milton Cat in the Northeast U.S. and Eneria Cat in France, Belgium and Poland. They also service the engines, in a similar fashion to passenger car dealers.

Others, such as Jenbacher, conduct their servicing through affiliated distributors such as Clarke Energy.

2G Energy, a German company with 6,000 facilities worldwide, operates as both an OEM and an operations & maintenance company, building its own engines under 1 MW and supplying larger engines from Caterpillar MWM in the U.S. and MTU Friedrichshafen or Jenbacher in Europe. Wartsila also operates as an OEM and operations & maintenance company with a separate division for servicing its own engines.

The main brands of mineral oils used in all surveyed regions were Shell Mysella and ExxonMobil Pegasus. But there are opportunities for smaller brands. Wipa, which develops and manufactures Ecosyn lubricants, is a 25-year-old Belgian company.

As with other lubricant applications, synthetics compete on total cost over volume-based pricing. “Total cost of lubrication [in euros per megawatt hour] is up to 30% lower than mineral lubricants due to two to five times extended oil drain intervals and up to 50% lower oil consumption,” Ecosyn claims.

Oil companies are continuously developing new oil grades aimed at further extending oil life by improving response to common problems, such the effects of hydrogen sulfide present at varying levels in some gases. H2S forms sulfur dioxide and sulfuric acid during combustion, and the latter can cause significant corrosion.

High-performance oils are essential to ensure reasonable oil drain intervals, as engines being pushed for higher outputs are subject to increased thermal stress that can lead to oxidation and lubricant breakdown. Wear protection is also crucial, as bearing failure can lead to critical damage to an engine.

“Every oil is defined for the application,” said Dave Thomas, energy solutions service manager for Milton Cat.

Different Gases, Different Needs

The market has seen a shift in gas engine fuel away from landfill gas. Also called biogas, it causes reliability challenges for operators, mostly connected to siloxanes and hydrogen sulfide. These contaminants can create engine deposits that generate wear and corrosive acids that can degrade the engine oil and the equipment itself. Engine oils must be able to minimize deposits, neutralize acids and stand up to contamination.

Hydrogen is regarded as the gas engine fuel of the future. Every major OEM is developing hydrogen engines, either running on both natural gas and hydrogen or 100% hydrogen.

In the fourth quarter of 2020, 2G became the first company to offer a commercially viable system utilizing 100% hydrogen as a fuel. In June, Germany earmarked a $10 billion stimulus package for the development of hydrogen capacity to meet emissions targets both at home and overseas.

The switch to hydrogen will present its own set of challenges for manufacturers of gas engine oils. The higher the percentage of hydrogen in the gas blend, the lower the methane number of the gas, which can lead to pre-ignition, or knocking. Therefore, lubricant selection will be important to avoid abnormal combustion.

It’s generally believed that dual-fuel blends of natural gas and hydrogen will be the first step in the transition to pure hydrogen. “When we start doing this, it’ll be more of an economic drive,” said Heikkinen. “Mixing hydrogen with natural gas will be lower cost than pure hydrogen.” Once hydrogen production is powered solely by renewable sources, it will become cost-effective as a standalone option.

The mid-term future looks positive for gas engines, but at some point between 2030 and 2050 the music will stop, as natural gas is not a long-term sustainable fuel.

|

The switch to hydrogen will present its own set of challenges for manufacturers of gas engine oils.

|

“Although the engine sector is working on drastically reducing methane emissions, there will always be a fraction of natural gas that will not participate in the combustion process and will escape into the atmosphere, and that has a relatively high greenhouse gas effect,” noted Jacob Klimstra, a leading gas engines industry consultant based in The Netherlands.

Caroline Holman, energy lead–strategic engagement & policy with the Institution of Engineering and Technology in London, summed it up well: “I do accept that probably for the next 10 years natural gas will play a part as low-carbon technologies, hybrid systems and alternative fuels develop at scale. But we must recognize natural gas is fossil-fuel derived and finite.”

In the February issue, Herson will dive deeper into the gas engines trend through an industry survey. Read “A Partner to Power”.

Michael Herson is managing director of London-based The Strategy Works, a strategy consultancy specializing in original business-to-business insight within the lubricants industry and other sectors. Contact: +44 208 868 0212 or mherson@thestrategyworks.com.