Since the easing of the COVID-19 pandemic, the global lubricant additives market has shown a steady recovery, with demand reaching approximately 4 million metric tons per year. Consumption is projected to rise to 4.5 million t/y by 2027, approaching pre-pandemic levels.

Growth is being driven primarily by Asia-Pacific, led by China, followed by North America and Europe. In contrast, marine lubricant additive demand has weakened due to formulation changes triggered by IMO 2020, which reduced detergent requirements

Market Structure: The Big Four and Emerging Players

The industry is dominated by the so-called Big Four additive suppliers:

- Afton Chemical

- Lubrizol Corp.

- Chevron Oronite

- Infineum

These companies produce the majority of fully formulated additive packages and operate global manufacturing and technical support networks. Alongside them is a broad ecosystem of smaller and mid-sized suppliers, including BASF, Croda, King Industries, Elco, and Eni.

In China, domestic producers such as Richful are expanding rapidly, supported by government policies aimed at additive self-sufficiency and accelerated R&D investment.

Global Demand and Regional Growth Patterns

Global lubricant additive consumption reached roughly 4 million tonnes in 2022 and is expected to grow steadily through 2027. Key regional trends include:

- Asia-Pacific: Fastest growth, led by China and India

- North America: Stable demand supported by automotive and industrial lubricants

- Europe: Moderate growth amid tightening environmental regulation

Key Application Segments Shaping Demand

1. Automotive: Passenger car motor oils (PCMO) remain the largest single consumer of lubricant additives globally. Demand is strongest in Asia-Pacific, where internal combustion engine (ICE) vehicles continue to dominate new registrations despite accelerating electrification. Key drivers include higher-performance engine oil specifications requiring greater additive treat rates, increased focus on fuel economy, deposit control, and oxidation resistance, shorter oil drain intervals in emerging markets.

In Europe, PCMO additive volumes are under pressure due to a declining ICE vehicle parc, while North America shows stable demand supported by light-duty truck and SUV dominance.

2. Heavy-Duty Diesel & Commercial Vehicles: Heavy-duty engine oils (HDEO) represent a critical and technically demanding segment for lubricant additives. Demand is strongest in regions with high freight movement and infrastructure development, notably China, India, Southeast Asia and North America. Growth factors include the expansion of logistics and construction activity, stricter emissions standards increasing reliance on dispersants and detergents and longer drain intervals requiring enhanced durability and soot control

While overall vehicle numbers are lower than passenger cars, additive intensity per liter of oil is significantly higher, making this a high-value segment for suppliers.

3. Industrial: Industrial lubricants form a diverse and steadily growing segment, particularly in Asia-Pacific. Applications include hydraulic fluids, gear oils, compressor oils, turbine oils, and metalworking fluids. Regional demand patterns reflect manufacturing expansion in China and Southeast Asia, increased automation and equipment uptime requirements and rising emphasis on wear protection oxidation stability, and foam control.

Europe shows relatively flat industrial additive demand due to mature manufacturing sectors, while North America benefits from energy, mining, and specialty industrial applications.

4. Marine: marine lubricant additive demand is currently the weakest-performing segment globally. The implementation of low-sulfur fuel regulations has reduced the need for high-detergent formulations traditionally used in marine cylinder oils. As a result, detergent treat rates have declined, overall additive volumes have fallen and demand is concentrated in maintenance rather than growth. While global shipping volumes remain robust, formulation simplification continues to limit additive consumption in this sector.

Treat Rates

Additives comprise varying proportions of finished lubricants. Metalworking fluids tend to contain the most, at 10%–40% by volume of the formulated product. Automotive engine oils follow with 15%–25% additives and grease contains anywhere from 0%–10%.

Industrial oils rely heavily on the quality of their base oil, with many using 2% additives at the most.

Production Locations and Supply Chain Trends

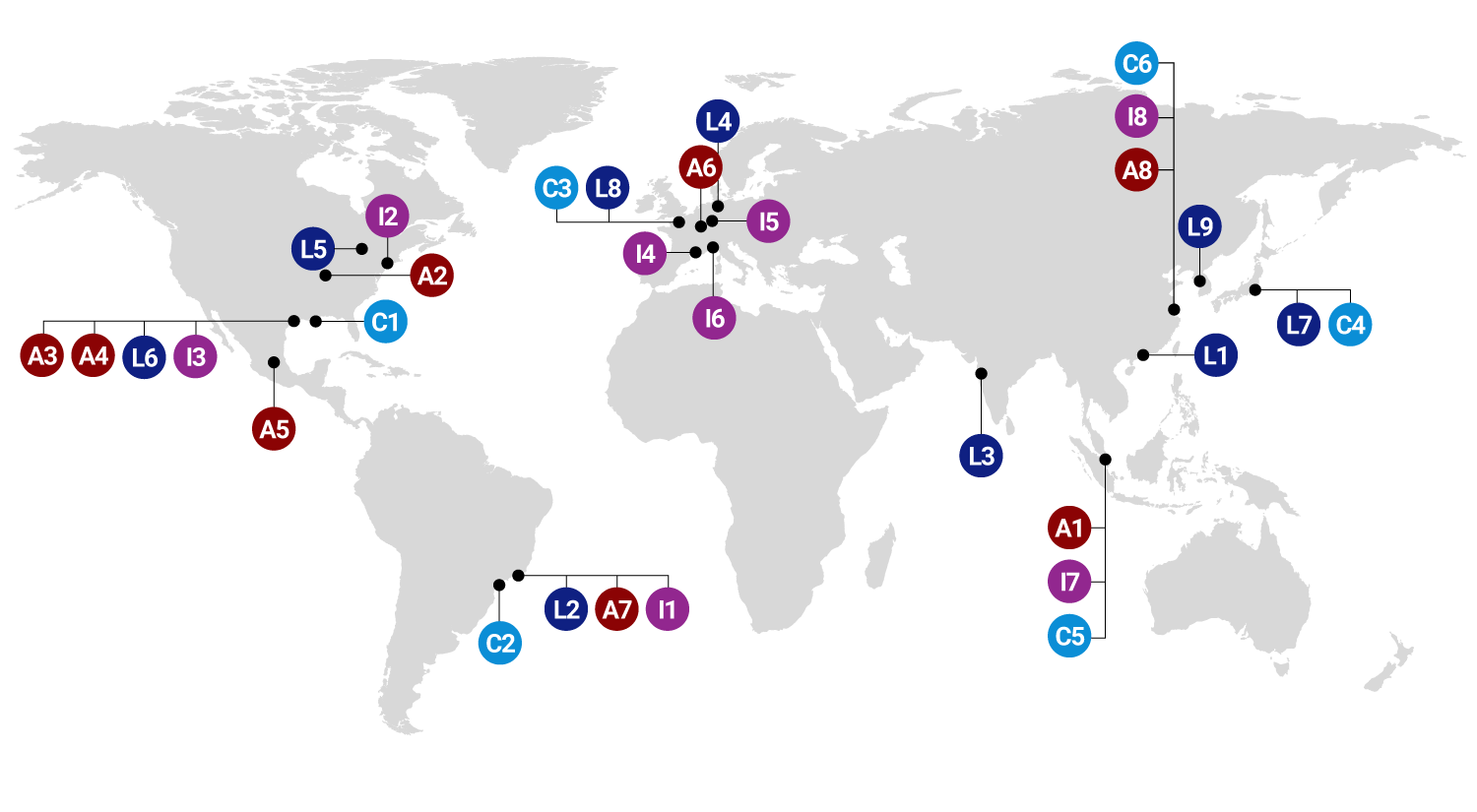

The Big Four operate blending and manufacturing plants worldwide, ensuring proximity to OEMs and lubricant blenders:

- Lubrizol: U.S., Europe, Asia

- Afton Chemical: Jurong Island (Singapore), U.S.

- Infineum: U.S., Europe, Singapore

- Chevron Oronite: U.S., Brazil, France, Japan, China, Singapore

This global footprint allows rapid response to regional specification changes and OEM approvals.

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | City | Company |

|---|---|---|---|---|---|---|---|

| 1 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 1 | Zhuhai, China | Lubrizol |

| 2 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 2 | Rio de Janeiro, Brazil | Lubrizol |

| 3 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 3 | Turbhe, Navi Mumbai, India | Lubrizol |

| 4 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 4 | Hamburg, Germany | Lubrizol |

| 5 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 5 | Painesville, Ohio | Lubrizol |

| 6 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 6 | Deer Park, Texas | Lubrizol |

| 7 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 7 | Tokyo, Japan | Lubrizol |

| 8 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 8 | Rouen, France | Lubrizol |

| 9 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 9 | Seoul, South Korea | Lubrizol |

| 10 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 1 | Jurong Island, Singapore | Afton Chemical |

| 11 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 2 | Sauget, Illinois | Afton Chemical |

| 12 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 3 | Houston, Texas | Afton Chemical |

| 13 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 4 | Port Arthur, Texas | Afton Chemical |

| 14 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 5 | San Juan del Rio, Mexico | Afton Chemical |

| 15 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 6 | Feluy, Belgium | Afton Chemical |

| 16 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 7 | Rio de Janeiro, Brazil | Afton Chemical |

| 17 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 8 | Suzhou, China | Afton Chemical |

| 18 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 1 | Rio de Janeiro, Brazil | Infineum |

| 19 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 2 | Linden, New Jersey | Infineum |

| 20 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 3 | Houston, Texas | Infineum |

| 21 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 4 | Berre, France | Infineum |

| 22 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 5 | Cologne, Germany | Infineum |

| 23 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 6 | Vado Ligure, Italy | Infineum |

| 24 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 7 | Jurong Island, Singapore | Infineum |

| 25 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 8 | Zhangjiagang, China | Infineum |

| 26 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 1 | Belle Chasse, Louisiana | Chevron Oronite |

| 27 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 2 | Maua, Brazil | Chevron Oronite |

| 28 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 3 | Gonfreville, France | Chevron Oronite |

| 29 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 4 | Omaezaki, Japan | Chevron Oronite |

| 30 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 5 | Jurong Island, Singapore | Chevron Oronite |

| 31 | user_oc_299 | 24/12/2025 04:10 AM | user_oc_299 | 24/12/2025 04:10 AM | 6 | Ningbo, China | Chevron Oronite |

Regulations, Specifications and Environmental Pressure

Lubricant additives are regulated indirectly through lubricant and engine oil specifications rather than as standalone chemicals. Compliance relies on meeting OEM and industry standards set by ASTM, SAE and regional authorities.

Key trends shaping the market include:

- Stricter limits on sulfur, phosphorus and sulfated ash

- Rising demand for deposit control and oxidation inhibitors

- Higher additive treat rates under specifications such as ILSAC GF-6, including Sequence IIIH testing

- Increased scrutiny in Europe over human and environmental health risks, with some additive chemistries likely to be phased out

Manufacturing, Testing and OEM Approvals

In the U.S., Europe and Asia, additive development follows rigorous testing protocols, including:

- Friction and wear testing

- Oxidation and thermal stability

- Foam and corrosion resistance

- Shear stability and durability

These tests are conducted through bench rigs and field trials, with OEM approvals typically coordinated by the Big Four. Their role extends beyond chemistry to include formulation guidance, testing logistics, and regulatory support.

In China, additive manufacturers benefit from fewer export constraints and are increasingly aligning their products with global OEM standards to compete internationally.

Outlook for the Global Lubricant Additives Market

As vehicle parc growth, industrial activity and emission standards evolve, the global lubricant additives market is expected to see steady but regionally uneven growth. Asia-Pacific will remain the primary engine of expansion, while regulatory pressure and sustainability concerns will continue to reshape additive chemistries worldwide.