The onset of the coronavirus pandemic was like a mighty gust of wind that blew asunder the many ships sailing the seas of the base oils industry. Producers are gradually regaining their bearings, with many new trade opportunities and arrangements emerging as a result.

In September, during the ICIS Asian Base Oils & Lubricants Virtual Conference, industry experts agreed that COVID-19 had impacted each of the base oil groups differently, but a common thread was the significant demand destruction that ensued from the implementation of lockdowns, business closures and production outages.

Speaking at one of the conference’s roundtables, Rebecca Harding, CEO of United Kingdom-based trade data company Coriolis Technologies, said another trend that surfaced was “reduced globalization” and “increased intra-regional dependence,” meaning that trade between countries within a particular region increased while interaction between major regions such as Europe and Asia decreased. After the difficulties companies encountered sourcing materials from distant regions, many have sought to reduce the risk of supply chain disruptions.

The winds became more favorable in June when many countries emerged from strict lockdowns and businesses began to reopen, resulting in an uptick in base oil and lubricant demand.

The Amazing Group I

There was unusually keen appetite for API Group I grades following the start of the pandemic, leading to a substantial and somewhat unexpected tightening of Group I base oils, especially in Asia. The increased consumption was partly attributed to higher demand for heavy-viscosity cuts and bright stock from segments such as heavy-duty transportation and marine lubricants. As most of the world’s population followed stay-at-home orders from the first quarter of the year on, many retailers saw a surge in online sales, prompting a significant increase in the use of land and sea freight transport because air freight was disrupted by the pandemic.

At the same time, a reduction in consumption of gasoline and other fuels, together with increased crude oil output from Saudi Arabia and Russia, brought about a precipitous crash of crude prices in March.

Michael Connolly, senior consultant at ICIS Analytics, explained that the drop in crude prices “was particularly a boon for Group I producers that were suffering at the hands of IMO 2020 and the relative impact that it had on the price of [vacuum gas oil feedstock] globally and within Asia itself.”

Once the majority of countries emerged from lockdowns, manufacturing operations were revived, particularly in China, increasing use of industrial lubricants and therefore demand for Group I base oils. Most of the conference speakers concurred that the country had an advantage in coming out of the pandemic earlier than others because it had been affected first.

“We have seen a recovery in China, and according to the latest figures, they are above historic figures, effectively catching up,” Connolly explained. “But we’ll see how that plays out throughout the year and how that recovery continues.”

India has huge Group I demand levels, but availability fell the past couple of years since Iranian Group I imports ceased due to international sanctions.

Given the worldwide rationalization of Group I production over the past couple decades, it was hardly a surprise that the market fell out of balance when demand started to pick up.

This was especially evident in China. While several new Chinese base oil plants came on stream during the first half of the year, none contributed to an increase in the domestic supply of Group I. The last increase in Group I capacity occurred with the expansion at PetroChina Karamay Petrochemical’s unit in Xinjiang in 2019, remarked Whitney Shi, ICIS’ China base oil editor.

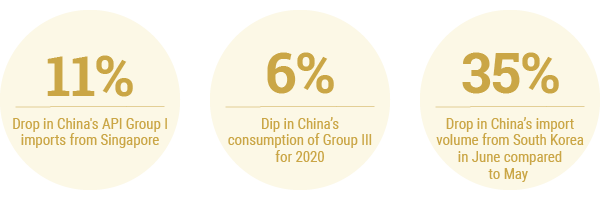

An extended shutdown at ExxonMobil’s Group I plant in Singapore started in May. The unit was expected to remain idle for an indefinite period of time, which also played a part in the tightening of that market segment in Asia. Shi said that China’s imports of base oils from Singapore had dropped by 11% from the end of May due to the Group I shutdown.

Connolly remained optimistic that Group I grades would continue to do well in the coming months. “Group I is heavily impacted by industrial output, which is predicted to predominantly return in 2020. It’s obviously not going to return to 100%, but a lot of the industry is essential industry; it’s the workforces that allow economies to continue,” he explained.

Group II Continues to Thrive

Asian demand for API Group II base oils fell during the first three months of the pandemic as the use of personal vehicles and public transportation plummeted. Since significant volumes of Group II base oils go into automotive lubricants, the drop in driving distances and car purchases resulted in reduced consumption of these cuts.

The scenario seemed to reverse course in June, with a general demand revival tightening the market.

In India, demand for API Group II base oils flourished as the country reemerged from lockdowns and other pandemic-related measures to resume transportation, manufacturing and other business activities. It saw another uptick in August as the monsoon season ended and as manufacturers prepared for the traditional festival period in the fourth quarter.

Regular sources of Group II spot cargoes such as Taiwan, South Korea and the United States saw a combination of planned and unplanned outages in the third quarter that largely contributed to a regional tightening of supply.

In Taiwan, a turnaround at Formosa Petrochemical’s Group II plant in Mai-Liao in July and August limited the number of spot cargoes available for shipment to China and other Asian destinations. “China’s import volumes of Taiwanese base oils fell by 29% so far this year due to Formosa’s planned maintenance from early July,” Shi noted.

In South Korea, a turnaround at S-Oil’s base stocks plant also resulted in reduced spot availability in the region. In late August, the producer started a planned maintenance program at its Groups I, II and III complex in Onsan that was scheduled to last until mid-September, only affecting production of Groups I and II. S-Oil had built inventories to cover contract obligations during the outage, but spot cargoes were limited.

In the U.S., unplanned outages caused by hurricanes and tropical storms in August through October forced Group II producers, including Excel Paralubes, ExxonMobil and Motiva, to reduce run rates or shut down operations. As a result, most producers suspended spot shipments and focused on meeting domestic contract requirements, squeezing an artery that had been supplying significant amounts of Group II base oils to India and other destinations in Asia since June.

What’s more, typhoons and severe weather in Asia caused port congestion and shipment delays in China, Taiwan and South Korea during the same period.

U.S. shipments to Asia were expected to stall moving into the fourth quarter. Instead, there appeared to be an increase in cargoes moving from Southeast Asia to India and the Middle East, while Taiwanese parcels were also expected to reappear in India.

China’s situation was slightly different in terms of Group II supply because a number of new plants have started production there since last year, raising domestic availability of light grades. According to Shi, seven plants came on stream or completed an expansion in China in 2019, but many are running at reduced rates.

All units that started up in 2020 will produce Group II base oils, including Ningbo Bohui Petrochemical, Shandong Jincheng Petrochemical and Hebei Feitian. Most of the new plants are located in Shandong province, which is expected to be severely oversupplied this year.

Despite these start-ups, total Chinese base oil production was anticipated to fall below 4.5 million tons this year, mostly due to the effects of the coronavirus outbreak, Shi noted. Many base oil producers reduced or shut down operations in February and March, resulting in an 8% total estimated drop in production compared to 2019.

Group III Feels the Pain

The Group III segment was probably the most heavily affected by the pandemic, as this sector caters mostly to automotive lubricants, and the lockdowns brought about a marked decline in car sales and distances driven in the second and third quarters. For example, estimated consumption of all base oil in China may drop to about 7 million tons for 2020, a decrease of about 6% compared to 2019, Shi said.

South Korean Group III producers were forced to adapt to the new landscape by dialing back production rates, although they were not alone in resorting to this strategy to manage growing inventories.

“South Korea was one of the countries that was less impacted by the coronavirus, particularly as it may have had a good suppression of the cases,” Connolly explained. “In terms of domestic lubricant demand, there was a dip in March, but they did remain close to historic ranges.”

Roughly half of South Korea’s base oil production is consumed domestically while the rest is exported, according to Connolly, with numerous cargoes typically moving to China, India, Thailand and the U.S., among other destinations.

China’s import volumes from South Korea fell by about 35% in June compared to May, according to statistics from the Korea International Trade Association. This drop was partly attributed to a reduced need for Group III imports given China’s own production of those cuts following the start-up of the coal-to-liquids Group III plant of Chinese producer Shanxi Lu’An, as well as Hengli Petrochemical’s Groups II+ and III output. Most Chinese base oil plants increased operating rates in the second quarter as the country’s activities intensified.

At the same time, India’s demand for base stock imports was weaker in May as the country was in the throes of lockdowns.

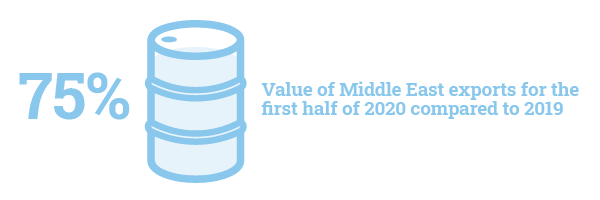

Another key region for Asia’s Group III supply is the Middle East, where the pandemic reduced export volumes in the first half of the year.

“In terms of inter-regional trade, what we see is that while the trade between Southeast Asia and Northeast Asia remained relatively high—short routes in the global context—we did notice that the Middle East markets seemed to have suffered the most as far as exports are concerned,” Connolly noted. He added that Middle East total base oil trade levels in the first half of 2020 reached only about 75% of their value compared to 2019.

Harji Gill, CEO of Penthol USA, the U.S. distributor for United Arab Emirates-based Group III refiner Abu Dhabi National Oil Co., explained that lubricant and base oil demand normally drops in the fourth quarter, but that this year conditions may be quite different because there is still pent-up demand that has not been fulfilled. “I don’t believe anyone can predict Q4 demand, but we are still forecasting a strong quarter based on current numbers. Our plan is to have good inventory into 2021 so as to be ready to meet this demand.”

Shi predicted base oil requirements from Chinese lubricant companies would gradually recover in the fourth quarter. Import volumes may also rise compared to the third quarter, as lubricant companies will be looking for spot cargoes.

Connolly said that variations in the rate of COVID-19 cases regionally will continue to alter trade flows and influence regional competitiveness.

Another of the roundtable speakers, Anckur Sachdev, CEO of Kent Chemicals in Jaipur, India, added that “there is a huge amount of adaptability in our industry, and we are very optimistic. Last year, we kept talking about the IMO 2020 and its impact on base oils; now we are talking about this pandemic. We will adapt to the situation, as we’ve always done.”

George Gill contributed to this story.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.