Polyalphaolefins are expensive, available from just a handful of producers and increasingly being replaced in automotive lubricants by alternatives such as API Group III and Group III+ base oils. But producers remain optimistic about future demand for PAO, pointing to new opportunities created by the global drive toward lower emissions, greater efficiency in both automotive and industrial equipment and the rise of electric mobility—and they’re plowing money into new capacity around the world.

“PAOs are distinctive synthetic base oils in the sense that they achieve greater film thickness at high temperatures than comparable mineral oils to provide superior high-temperature wear protection,” Jean-Francois Boideau, Ineos Oligomers’ commercial general manager for Europe, the Middle East and Africa, told Lubes’n’Greases. They can also provide protection at low temperatures due to lower pour points.

“PAO-based synthetic lubricants are highly shear stable and are generally acknowledged to have better thermal and oxidative stability than comparable mineral oil-based lubricants,” Boideau continued. Good oxidation resistance helps to prevent viscosity increase in aged lubricant and reduces deposit- and varnish-forming tendencies.

Major uses for PAO-based lubricants haven’t changed much in 20 to 30 years, according to Alistair Westwood, synthetics global marketing manager for ExxonMobil Chemical Co. The key applications driving demand are automotive lubricants, including engine oil, transmission fluids, driveline fluids, axle and gear oils and greases for passenger cars, as well as some heavy-duty and off-road vehicles. The other major area is industrial oils, including a variety of segments from compressors to industrial gearboxes. To a lesser extent, PAO is also used in industrial greases.

Low-viscosity cuts are used mostly as base fluids in top-tier, high-performance engine oils offering fuel economy benefits and longer drain intervals, explained Boideau. High-viscosity material, often used as an additive, has a strong presence in gear oils for wind turbines, which demand superior durability.

Sowing Now to Reap Later

PAOs are made by assembling chains of linear alpha olefins, which are derived from ethylene, to reach the desired molecular weights and performance targets. While 1-decene—a hydrocarbon molecule with 10 carbon atoms—is the preferred feedstock, other chain lengths can be used, from 1-octene to 1-tetradecene, explained Boideau.

About 10 years ago, metallocene PAOs entered the market. Typically high-viscosity products, they are made using a metallocene catalyst that produces a more uniform product with no molecular side chains. Producers say these fluids offer improved shear stability, viscosity index and low-temperature performance for industrial applications.

Global PAO capacity sits around 718,000 metric tons per year, according to the 2020-2021 Lubes’n’Greases Factbook, and over 90% of capacity is held by just three companies.

ExxonMobil, the world’s largest supplier, has 301,000 t/y of capacity at its sites Gravenchon, France, and in Baytown and Beaumont, Texas.

Ineos Oligomers follows with 230,000 t/y between its Feluy, Belgium, and La Porte, Texas, plants. The company announced construction of an additional facility in Chocolate Bayou, Texas, in 2017, which was to include a 120,000 t/y PAO production line fed by a 420,000 t/y LAO unit. The facility was scheduled to start up in 2019, but the company has yet to announce completion of the project.

Chevron Phillips Chemical is the third major global supplier, also with sites in Texas (Cedar Bayou and Pasadena) and Belgium (Beringen), totaling 130,000 t/y. Other capacity is considerably smaller, including Naco Lubrication and a handful of others in China and Tatneft in Russia. Lanxess halved its capacity after closing its Ankerweg, Germany, plant in 2017, leaving the company with just 15,000 t/y in Elmira, Ontario.

The small number of PAO producers, many with facilities located along the hurricane-plagued U.S. Gulf Coast, makes some buyers nervous about supply security. “Supply disruptions have been caused due to hurricanes and operational issues, but tight supply of key raw materials, specifically C10 and C12 LAO, combined with the fact that there are few LAO producers, has been the main concern,” explained Steve Haffner, president of SGH Consulting.

The most recent disruption was the force majeure declared by Ineos on Jan. 19 for its low-viscosity products. In its allocation notice, the company blamed an unexpected disruption to feedstock supply at its Texas facilities and said it expected production would return to normal within 30 days.

Producers insist that they are working to address buyers’ concerns. “Obviously we take this very seriously,” said Westwood. “We want to be a high quality, reliable supplier to the market.” ExxonMobil is constantly evaluating various projects and working with customers to understand their future needs, he stated.

For its part, Chevron Phillips Chemical has increased the capacity of its existing LAO and PAO assets within the past five years, noted Chris Hausler, global business manager for PAO, including adding 10,000 t/y of low-viscosity PAO capacity at its Cedar Bayou plant.

“Our recent investments at our Chocolate Bayou, Texas, site are addressing both LAO feedstock and PAO capacity needs,” said Ineos’ Boideau. “With multiple production sites producing fungible products serving the market, the risk is greatly reduced that a single event will severely impact the market.”

Ineos is also building a 400,000 t/y LAO plant along with a PAO plant of unnamed capacity in Saudi Arabia—the first PAO facility in the Middle East. Both facilities will open in 2025, the company said in a press release.

It’s not just the big guys in the West ramping up production. PetroChina announced in December that it has opened a pilot plant in Lanzhou, China, producing low-viscosity PAO. Chinese producers have mostly made high-viscosity cuts until now, and the company anticipates its project will help reduce the country’s dependence on foreign supply of PAO base stocks.

More sources of feedstock are also making their debut. Not far from the slew of PAO plants in Texas, Shell Chemical expanded its LAO capacity in Geismar, Louisiana, by 425,000 t/y to a whopping total of 1.3 million t/y at the end of 2018. Even more is on the way: ExxonMobil announced in 2019 that it was constructing a new 350,000 t/y LAO unit at its Baytown location expected to open next year.

Alternatives Crop Up

With the higher cost of PAOs and periodic supply problems as a backdrop, many lubricant formulators have sought ways to reduce their reliance on these fluids.

“Increasingly, lubricant manufacturers are moving away from using PAO in their formulations,” said Darryl Purificati, who is OEM technical liaison for Petro-Canada Lubricants, an API Group III base oil producer. “Alternatives are proving to be more than suitable to meet many performance requirements of industry and original equipment manufacturer specifications.” He also noted the lower cost of Group III oils as an incentive for formulators.

Any lubricants that have traditionally been formulated with PAOs are fair game for alternative base oils, he said, including engine oils, automatic transmission fluids, gear oils, hydraulic fluids and other products.

“Group III or Group III+ can replace PAO in essentially all applications currently in use or planned right now for engine oils,” said Haffner. “There are some applications where PAO may still be preferred or needed to correct for low-temperature performance or volatility, but Group III+ has offered a lot of flexibility to formulators.

“I do not believe 100% PAO is essential in any engine oil formulation today. It may be a better option as a correction fluid than a Group III product, but it’s more about cost,” Haffner said. “PAO can deliver higher product performance to help marketers differentiate their products. Use of PAO also goes beyond engine oils, where low-temperature performance is essential.

“Additive treat rates also impact decisions around base stock, and as you go lower in viscosity, higher-viscosity-index products are required and base stock choice can be very limited,” he pointed out.

“We are seeing [a move from PAO to Group III] in certain segments,” Westwood acknowledged, “and I think it’s fair to say that the segment where we see more reformulation than others is specifically for passenger cars.

“However, we see a very bright future for PAO because we see that demand remains resilient, mainly through its unique attributes and balance of properties and performance that lend themselves to a number of other applications,” he continued.

While there don’t seem to be as many challenges to high-viscosity PAOs, new options are cropping up as technology pushes forward. For example, Macedonia, Ohio-based Functional Products has developed an olefin copolymer viscosity modifier that can also be used as a high-viscosity base fluid, according to Erik Willett, the company’s vice president of technology and development.

“We’re able to reproduce the shear stability and low-temperature Brookfield performance of mPAO or PAO in SAE 75W-90 and SAE 75W-140 automotive gear oils [formulated with] Group III base oil, which tends to halve the formulation cost versus an equivalent PAO formula,” he said. The product is also aimed at hydraulic fluid, synthetic greases and specialized lubricants.

Looking Forward to the Harvest

“We see a bright future for PAOs,” Westwood reiterated. “Our optimism is based on a number of global trends that favor lower emissions, improved fuel economy and energy efficiency,” in addition to the level of performance offered by PAO lubricants.

Regulations limiting carbon dioxide emissions “are going to be very challenging to formulators, OEMs and big blending companies that provide the finished lubes,” he explained. As the challenge ramps up, PAO producers seem confident that their base stocks will be back in favor for engine oils.

“As emissions requirements become more strict and engines require higher-performing lubricants, we see the shift toward low-viscosity engine oils and the need for good volatility properties while also retaining the beneficial frictional, thermal conductivity and low-temperature performance properties,” agreed Hausler of Chevron Phillips Chemical. “We also see new applications for PAO developing on a regular basis as the world continues to evolve toward a more sustainable future.”

Ineos estimates that global demand for low-viscosity PAOs will sprout up by about 4%-5% per year, exceeding GDP growth. The growth in high-viscosity PAO will be even stronger, said Boideau.

Regional demand is centered in Western Europe, which has historically been the largest market, and Westwood expects that to continue thanks to emissions regulations creating a push toward ultra-low-viscosity engine oils. The North American market is next in size, with Asia in third.

The Asian PAO market is growing fastest, a trend that Westwood anticipates will hold for the next few years, depending on electric vehicle sales in China. Smaller markets have potential for significant growth in synthetics demand, and ExxonMobil views India as one such market, he said. “It all adds to overall growth of market.”

EVs are a bright spot in the future of low-viscosity PAOs, in particular. Westwood sees significant potential for their use in heat-transfer fluids or coolants for batteries and electric motors, as well as driveline fluids and greases. He also highlighted the potential of multi-purpose fluids that act as both heat transfer fluid and lubricant.

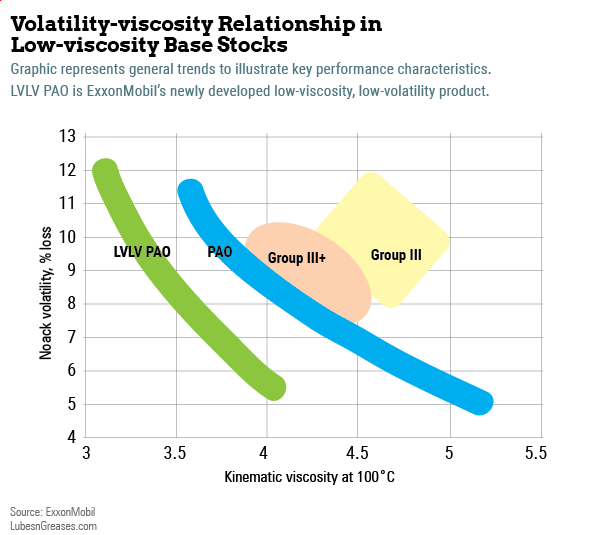

“The key strength of PAO [in EV applications] is in its viscosity-volatility balance combined with its excellent thermal and electrical properties,” said Boideau.

In this arena, ExxonMobil has developed what it calls the next generation of PAOs. “The world will need more PAO, and potentially it will need more step-out base stocks, which leads us into our new generation of PAO products focused on meeting those market needs of improved fuel economy and energy efficiency through much lower viscosity and volatility than conventional PAO and Group III products,” Westwood said.

The world won’t have to wait long, as the company plans to commercialize these new fluids mid-year.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.