The long-awaited 2021 ACEA light-duty engine oil specifications are finally in the hands of lubricant blenders, marketers and original equipment manufacturers across Europe. Engine technology has changed dramatically since the last iteration in 2016, and the new sequences reflect the European Automobile Manufacturers Association’s efforts to provide a usable baseline for OEMs and lube blenders alike.

The new ACEA sequences—developed by the association’s 15 automaker members in close cooperation with representatives from the lubricants, specialty additives and engine testing industries—reflect a general switch by car manufacturers to gasoline and diesel direct-injection turbocharged engine technology. This is often complemented by start-stop strategies and hybrid and electric technology.

“Consequently, ACEA members that manufacture light-duty vehicles are introducing new engine tests in two new engine oil categories to ensure base protection and performance for modern engine hardware,” the association stated on its website. The new categories focus on low-speed pre-ignition and durability protection and are complemented by five new engine tests.

Lutz Lindemann, chief technical officer and member of the executive board at Fuchs Petrolub, lauded the new sequences as “a significant move unique in the history of the ACEA specifications.”

As of May 1, new claims can be made against the 2021 oil sequences. From the same date in 2022, the new sequences will be mandatory for all new claims.

Two New Categories

The first new category, the High SAPS (sulfated ash, phosphorus and sulfur) A7/B7-21, offers low-speed pre-ignition and durability protection for turbocharged gasoline direct injection engines as well as turbocharger compressor deposit protection for modern direct injection engines.

The second new category, C6, was created for SAE XW-20 oils that provide low-speed pre-ignition and wear protection for turbocharged direct injection engines as well as diesel turbocharger compressor deposit protection for low-SAPS products compatible with aftertreatment systems, like selective catalytic reduction and gasoline or diesel particulate filters.

Both categories, A7/B7 and C6, are engine oil performance baselines intended for use at extended oil drain intervals in passenger car gasoline and light-duty gasoline and direct injection diesel engines. Category A7/B7 is also for use in engines designed for low-viscosity engine oils with high temperature, high shear viscosity limits of 2.9 to 3.5 milliPascals-second. C6 is for use with mid-level SAPS oils with HTHS viscosity of at least 2.6 mPa-s.

“The sequences have been updated to introduce tests that evaluate lubricant performance for turbocharged and DI engines,” Alex Jones, regional business manager for passenger car motor oils at Lubrizol told Lubes’n’Greases. “Both are linked to the industry needing to increase fuel economy performance.”

Lindemann added, “The intention is to combine OEM specifications with additional underlying requirements which cover modern engine technology, especially in light of low-viscosity grade 0W-20.”

New Sequences, New Tests

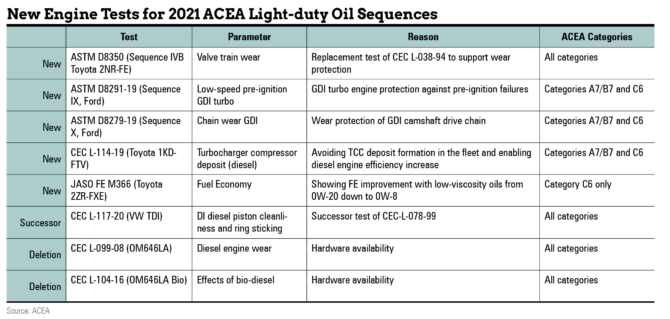

In addition to two new categories, the ACEA sequences contain five new tests, one successor test and two test deletions (see Table 1). Three of the new tests are borrowed from American Petroleum Institute and ILSAC ASTM methods.

The first of the new tests is the ASTM D8350 (Sequence IVB Toyota 2NR-FE), which measures valve train wear and replaces the CEC L-038-94 test to support wear protection. The test applies to all categories.

The CEC L-114-19 (Toyota 1KD-FTV) tests for turbocharger compressor deposits in diesel engines, with the goal of avoiding them and enabling diesel engine efficiency increases, and the CEC L-117-20 (VW TDI) tests for direct-injection diesel piston cleanliness and ring sticking. It applies to all categories and succeeds CEC-L-078-99.

ASTM D8291-19 (Sequence IX, Ford), builds on the Ford low-speed pre-ignition test, which was initially developed for North America and was included in API SN-Plus, a supplemental category introduced in 2018. ACEA applies it to categories A7/B7 and C6.

ASTM D8279-19 (Sequence X, Ford) represents the chain wear requirement of A7/B7 and C6 and derives from Ford hardware, namely the Ford chain wear test. It is intended to ensure an oil’s capacity to protect against wear of the gasoline direct injection camshaft drive chain.

CEC L-099-08 and CEC L-104-16, which tested for diesel engine wear and the effects of biodiesel, respectively, were dropped from the sequences due to hardware availability concerns.

“Whilst OEMs have required LSPI performance in their own specifications for some time, this is the first time the ACEA industry baseline has required LSPI performance be built into the latest light-duty products,” Adam Rice, technology deployment manager at Lubrizol, told Lubes’n’Greases. “This requires a different lubricant formulating approach for LSPI protection.”

What Took So Long?

ACEA’s new requirements for light-duty engine oils were originally planned for release in 2018. In 2019, ACEA’s heavy-duty diesel chairman at the time, Bengt Otterholm, told the UNITI Mineral Oil Technology Congress in Germany that engine oil sequences would be delayed until at least mid-2020.

However, the 2020 deadline came and went, leading many industry players wondering what the holdup was.

The delay was originally laid to similarly delayed API and ILSAC tests, which are incorporated into the new sequences. “Certain things were communicated on the ACEA side surrounding the Sequence X” for light-duty chain wear, “while the ILSAC tests were still ongoing” at the time, Otterholm said.

ACEA Emissions & Fuels Director Paul Greening said that ACEA had decided to postpone the release of the new oil sequences yet again, pushing the standards for light-duty lubes back by an additional three months. “We wanted to use the time for data gathering of the new engine tests that we would like to introduce to cover future needs driven by more stringent CO2 and fuel efficiency standards coming soon and the prospect of a new Euro 7 pollutant emission standard.”

Another major roadblock was the ASTM D8350 test. The wear test was adopted into ILSAC GF-6, the latest passenger car specification upgrade in North America, despite criticism that it did not adequately distinguish between oils that provide the desired level of antiwear protection and those that do not.

Something similar applied to ASTM D8279-19, another test developed for ILSAC GF-6. “One significant problem was the limits for the chain wear test based upon API SP limits,” Lindemann said. They were so stringent that they “risked ruling out existing formulations in the order of some 60 percent.”

This led to further discussions between ACEA, the Additive Technical Committee and the Technical Association of the European Lubricants Industry. “There were concerns around some of the limits in the categories at the start of this year, and that contributed to the delay,” Rice said.

“ACEA was receptive in responding to data-driven argumentation as to why those limits were potentially an issue and conflicting,” Nigel Britton, Lubrizol technical manager, said. “This process took time to generate relevant and representative data. Overall, it was a good collaborative effort between the industry associations.”

Rice added, “ACEA has acknowledged the industry feedback and gathered data related to the new tests, resulting in them re-aligning some of the limits. This enabled a more representative baseline for the OEMs to create their own performance specifications.”

Is a Heavy-duty Spec on the Horizon?

ACEA initially intended to include heavy-duty sequences in the update that was scheduled for 2018, but it decided to split the light- and heavy-duty sequences into two separate documents, citing different stages of readiness as the main reason. “ACEA expects to publish the 2021 ACEA heavy-duty oil sequences no earlier than June 2021,” the association said upon the release of the new light-duty specs.

However, at the time of writing, it was unclear whether the heavy-duty oil sequences would be published in full. Greening told Lubes’n’Greases last December that the revised E categories for most heavy-duty sequences would be released first, pending the readiness of the OM471 test and that the new F categories for oils that boost fuel economy in heavy-duty engines would possibly be released later.

“The F categories—we are anticipating—are the most challenging and exciting ones in view of the low-viscosity grades,” Lindemann said. “The discussion focuses on introducing a low-soot wear test. Additionally, a lack of reference data makes it difficult to define high and low reference grades to define specification limits. This development will be with us for the next years until we have a clear view forward.”

“The ACEA F8 and F11 categories have been discussed extensively over the past few years,” Lubrizol’s Britton said. “The aim is to provide enhanced fuel economy through reduced HTHS viscosity in line with API FA-4 (2.9 to 3.2 mPa-s), whilst maintaining the performance requirements [including wear protection] of ACEA E8 and E11. ACEA F8 and F11 have been highlighted as categories that ACEA members would like to see introduced, with the inclusion of new wear tests. Despite extensive industry activity, these new test developments have not reached a point where they can be included in the categories.”

ACEA is also planning to replace E6 with E8 and E9 with E11. The two replacement E categories are designed for newer engines because of their low SAPS levels. Sulfur, phosphorus and sulfated ash are associated with chemical additives or other materials that have traditionally boosted some oil performance parameters, but in more recent years concerns have been raised that they could damage technologies employed to reduce emissions.

“It is important to highlight that a significant part of the upgrade is focused on the E8 and E11 categories to better protect newer vehicles entering the market,” said Matthew Bentley, product manager, commercial engine lubricants at Lubrizol.

A major feature of the two replacement E categories is the increased alignment with API CK-4, which was introduced at the end of 2016. “The alignment with the North American tests is a performance upgrade, increasing the base performance level of European lubricants. The OM471 being introduced into the ACEA E4 and E8 categories is representative of the latest generation engine technology that is currently in the marketplace,” Britton said.

According to Bentley, in E8 and E11 the OM646 biodiesel limits also see an increase in piston merit requirements. “The API categories don’t include biodiesel compatibility testing, so this is also seen as beneficial for certain countries in regions such as Southeast Asia, where high levels of biodiesel are used,” he said.

Where Do We Go from Here?

With an increased focus on electric vehicles, major manufacturers such as Audi, Mercedes-Benz, Renault and Volkswagen have said they will not be developing new generations of internal combustion engines. Others, including Bentley, Ford, Jaguar, MINI and Volvo, have already committed to selling only battery electric vehicles in Europe before 2030.

As such, Lindemann does not expect another major overhaul of ACEA sequences for light-duty vehicles. “Because OEMs are not prepared to develop new generations of ICE [vehicles], these specifications will be the only relevant ones for the next 8 to 10 years,” he said.

There are a few caveats, though. “The growth in sales of European vehicles around the world is increasing,” Cole said. “ACEA used to be more relevant in Europe, but now it is applicable to maintain ACEA’s members’ vehicles all around the world. We see that in other places vehicles with an ICE will be sold for a long time to come. Even if there are no all-new engine platforms, there will be evolution to existing designs, resulting in changing demands on the engine and the lubricants.”

Jones said: “Updates to the ACEA sequences reflect the ability to provide a baseline for the specifications that the OEMs would need in all those different markets. Therefore, we need to consider this from a global perspective.”

Nick Augusteijn is an automotive and mobility sector reporter in the Netherlands. His coverage of the lubricants industry has appeared in Lubes’n’Greases EMEA, Lube Report and Electric Vehicles InSite. He can be contacted at nickaugusteijn@gmail.com