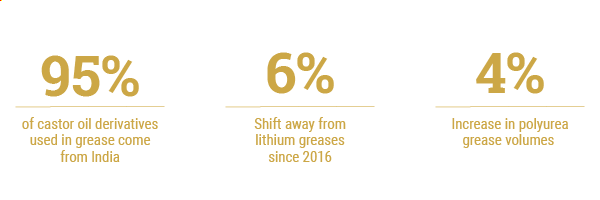

At the end of March, India implemented the world’s most stringent lockdown in response to the novel coronavirus pandemic, shutting down all of its manufacturing facilities among other measures. The country makes 95% of castor oil derivatives used in grease production, which includes hydroxystearic acid, an essential raw material for lithium greases.

While shipments resumed at the end of April, “it really shined a light on how fragile that supply chain can be, along with the pressure lithium has seen because of electrification,” said Jim Carroll, executive vice president of operations for St. Louis, Missouri-based Schaeffer Manufacturing, during the Independent Lubricant Manufacturers Association’s virtual annual meeting in October.

Lithium soap and lithium complex thickeners account for 70% of global grease production, according to the National Lubricating Grease Institute’s annual survey. But pressure on lithium supply from lithium-ion batteries for electric vehicles has made producing these greases more expensive in recent years. “Prices have flattened out a bit, but it is still a very volatile market for an important material,” Carroll remarked.

Another consequence of the challenges with lithium supply has been a 6% global shift since 2016 away from lithium greases toward other thickener types, which Carroll expects will continue over the next year as manufacturers examine their supply chains more closely.

Carroll also believes that NLGI’s new High Performance Multi-use grease specification, making its debut next month, will allow manufacturers to emphasize total maintenance cost over the price per pound. The specification “is probably a game-changer that will force people to look at their product and see if there are any ways to produce a better performing product,” he said.

Grease producers will be motivated to take a closer look at thickening systems they may have shied away from in the past—namely polyurea—because of the complexity of the reaction required to make those greases, Carroll believes. Isocyanates and amines used to make polyurea grease are highly toxic, he later explained to Lubes’n’Greases. Most companies don’t have the necessary equipment to work with these materials, nor do they want to take on the risk mitigation costs.

Polyurea Advances

Though it accounts for only 6% of global production, there has been a 4% increase in polyurea volumes since 2016, as shown in the NLGI survey. Polyurea greases are high performers, particularly attractive to the automotive industry. The thickener has unique antioxidant properties that give it a long lifespan and make it the grease of choice in electric vehicle motors and other fill-for-life bearing systems, Carroll pointed out.

According to Andrew Black, general manager of technology and manufacturing with Australian toll blender Harrison Manufacturing, use of polyurea greases is expected to continue growing, especially in China, which has seen rapid growth in the automotive sector.

“Polyurea greases have inherent oxidation stability, thermal stability, excellent water resistance and low oil bleed characteristics. With three to five times the life expectancy, they will displace lithium and lithium complex, particularly at the [original equipment manufacturer] level,” he said during the Asian Industrial Lubricants Conference in Singapore last year, jointly sponsored by ICIS and the European Lubricating Grease Institute.

“The main problem has been the isocyanates,” Carroll noted. But preformed polyurea thickener, which entered the market about a decade ago, has removed that barrier to polyurea grease production for small and medium-size companies. And with new options coming to market, it may become even more accessible.

When using preformed thickener to make polyurea grease, manufacturers can simply mix the thickener powder with base oil and additives to form a grease that can then be blended with more base oil to the desired consistency, explained Liwen Wei, president and chief technical officer of Novitas Chem Solutions, during NLGI’s Virtual Technical Week in August. The final product must be milled to make it structurally stable.

The concept of preformed thickener is not new, he pointed out. Companies like Ivanhoe Industries in Tullytown, Pennsylvania, and West Chicago, Illinois-based Blachford Chemical Specialties have been making and selling various types of powdered grease thickeners for years. But polyurea presents greater challenges in creating a consistent quality of finished grease, he said, and product options have been limited.

But at least two new products will soon hit the market. Houston, Texas-based Novitas has completed pilot production of its own preformed polyurea thickener, with commercial-scale production expected to begin in the first quarter of 2021, Wei told Lubes’n’Greases.

Dow Chemical is also preparing to launch a new preformed polyurea thickener option, which the company expects will be available in late 2021 or early 2022, according to Senior Technical Service and Development Scientist Lauren Huffman.

Both Dow and Novitas say that their products offer improvements over previous options such as better thickening efficiency and the ability to make various polyurea greases with high shear stability.

Same Grease, Less Lithium

For the large number of manufacturers still making lithium greases, a new approach to producing lithium complex products using less raw material may be a welcome development.

Typically, when cooking lithium complex grease, a source of lithium hydroxide is added to a source of thickener acid in base oil, then mixed and put through heating and cooling cycles. The grease is finished by adding more base oil to reach the desired consistency, by milling, and by other methods.

A new approach to making lithium complex grease “provides a potential path to using less lithium for a grease of a given consistency and dropping point,” reported Andrew Waynick, research fellow with NCH Corp., during the NLGI event. The method is applicable to open grease kettles, which are not pressurized, and is compatible with additives commonly used in finished lithium complex greases.

A key to the new formulation approach is the weight-to-weight ratio of 12-hydroxystearic acid to azelaic acid, he explained. In creating the grease thickener system, azelaic acid will react with just over three times as much lithium hydroxide monohydrate as will 12-hydroxystearic acid by weight. Lithium 12-hydroxystearate, which results from the reaction of the lithium and hydroxystearic acid, is the primary source of thickening. The dilithium azelate, resulting from the reaction of the lithium and azelaic acid, gives the finished grease a higher dropping point, but does not contribute much to thickening.

“Any method that increases the hydroxystearic acid to azelaic acid ratio lowers the relative amount of dilithium azelate and increases the relative amount of lithium hydroxystearate in the overall thickener,” Waynick said. This can be expected to lower cost by reducing the amount of lithium required to thicken the grease.

However, lowering the relative amount of dilithium azelate can have an adverse effect on the dropping point. “And that is the trick,” he added.

The solution is adding overbased magnesium sulfonate with 400 total base number at the beginning of the reaction, before adding the lithium hydroxide and water. “The overbased magnesium sulfonate increases the dropping point of the grease by facilitating a more intimate co-crystallization of the lithium hydroxystearate and dilithium azelate, allowing even lower relative levels of azelaic acid to be used,” Waynick explained.

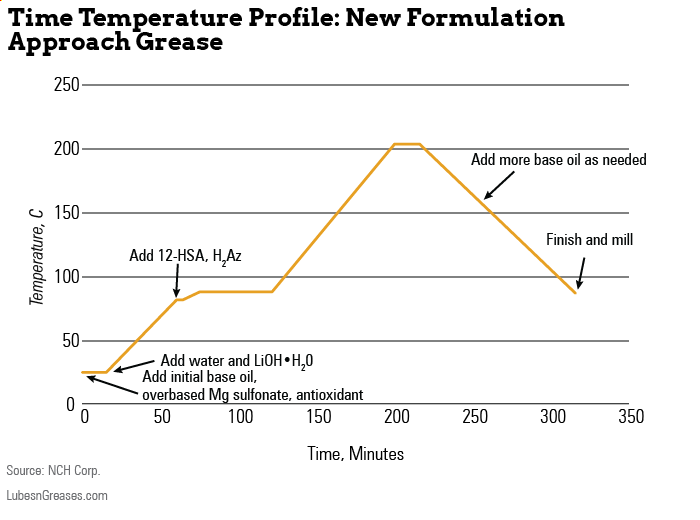

The new method begins with adding the magnesium sulfonate to base oil while mixing, then adding slightly more lithium hydroxide monohydrate than what is needed for the reaction, along with a little water. The mixture is heated to between 82 and 88 degrees Celsius, then the hydroxystearic acid and azelaic acid are added. Temperature is then raised at two intervals up to 204–210˚C and held at the top temperature before cooling and finishing.

The overbased magnesium sulfonate does its work as the semi-melted grease cools from maximum temperature, allowing the thickener fibers to form. If the cooling process occurs too quickly, as when Waynick’s team tried plunging the mixing bowl into an ice bath, or if the magnesium sulfonate is not added until the grease has cooled, it does not have enough time to boost the co-crystallization, and the increase in dropping point is mostly lost.

In fact, the researchers found that using a slower heating and cooling rate allowed even less lithium hydroxide to be used—a reduction of 12% over the baseline grease in a slower cycle closer to open kettle rates, compared to a reduction of 6% using a faster cycle. Heating and cooling rates are known to affect the thickener fiber structure and resulting properties of lithium greases.

The new approach appears to result in faster thickener formation as well as equal or better dropping points and shear stability compared to the traditional method used to make a baseline grease.

The researchers were able to achieve up to a 28% reduction in the amount of lithium hydroxide required to hit their performance targets for the finished grease. Further, the new approach uses just one heating and cooling cycle and includes fewer steps, so it could be less complicated for manufacturers.

“Results thus far consistently show that the new formulation approach using overbased magnesium sulfonate provides higher dropping point and lower required use of lithium hydroxide than the baseline approach,” Waynick concluded.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.