The markets for lubricants and additives in North America and Europe have shown minimal growth in the past decade. The level of vehicle ownership has remained static, and extended drain intervals have dampened lubricant demand, although higher-quality lubricants have helped to boost it back up.

In contrast, Asian markets have shown significant growth in lubricant and additive demand during the same period, driven by significant economic growth. Consequently, companies have switched their focus more toward Asia, where demand for lubricants and additives continues to increase. Here is a look at how component and additive companies have increased their investment in Asia and the opportunities and challenges this poses.

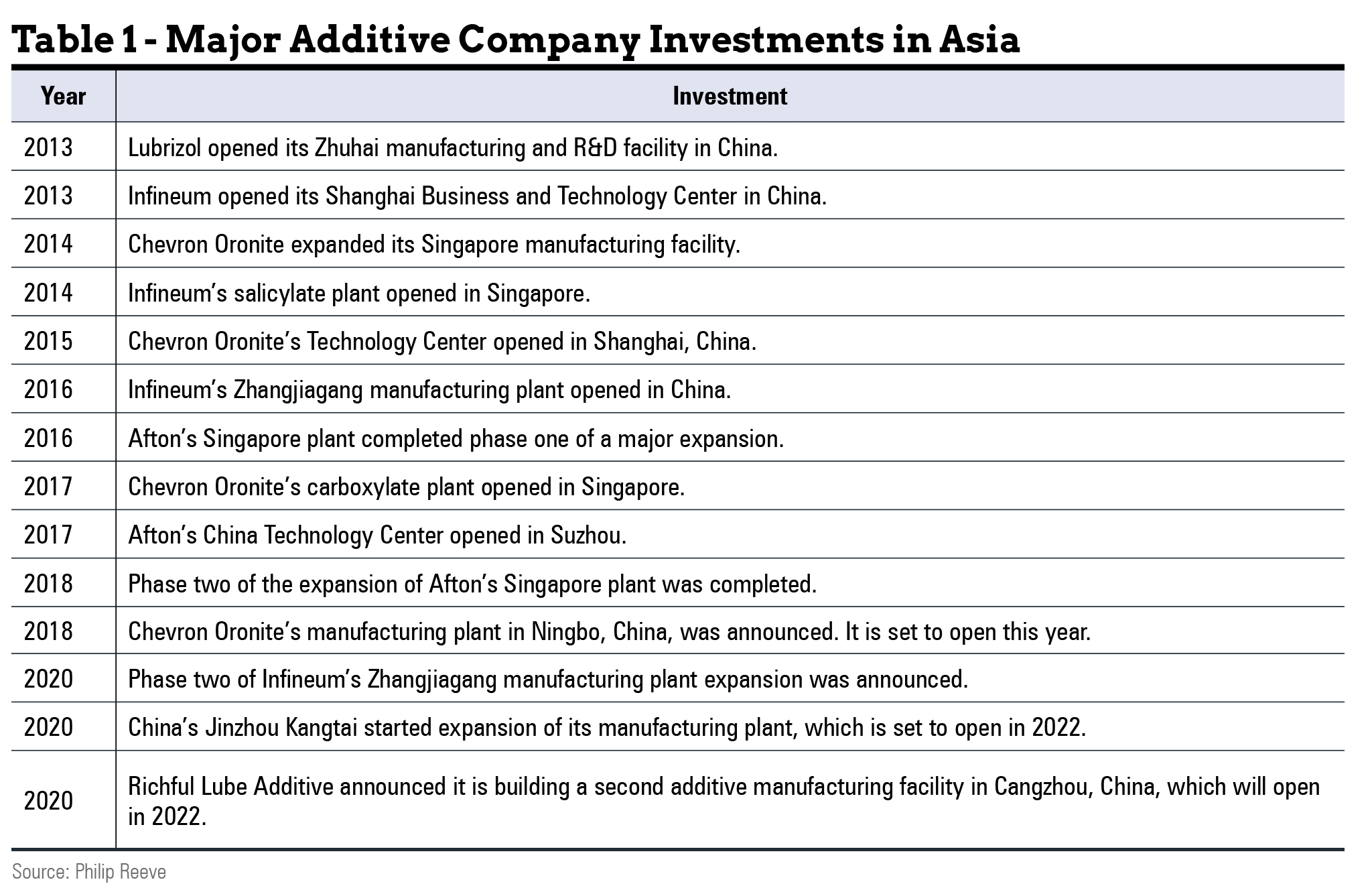

The Chinese lubricant market is now similar in size to that of the United States, and the Indian lubricants market is the third largest in the world. Almost all Asian additives markets are growing, driven by increasing urbanization, infrastructure development and more widespread vehicle ownership and regional production. The demand for better air quality and carbon dioxide reduction is resulting in greater regulation and tougher specifications, pushing oil quality levels upward. Additive and component manufacturers foresaw such growth—particularly the rise in China—and have invested steadily in manufacturing, business and R&D facilities in the region (Table 1).

With this background, investment in manufacturing and technical support has been sustained over the past 10 years with regional hubs in Singapore and specific investments in China. Chinese manufacturers are investing in increased additive capacity to take advantage of the growth opportunities. Indian component producers have also made incremental improvements in capacity.

Where to Invest

The World Bank’s Ease of Doing Business rankings consider the regulatory environment and ranks the countries that are most conducive to the foundation and operation of a local company (Table 2).

Singapore consistently places near the top of such rankings, which helps to explain its position as a powerful regional hub. Furthermore, the additives industry has had an active presence in the country for decades.

China is a different story, though. It presents more state and national hurdles to establishing operations, including taxation and cross-border trading. Keith Howard, Lubrizol strategic technology manager, explained, “China has some complex rules on what can be built and where. This can be an issue for new facility construction.”

Despite the complexity, the market size, growth rate and need to develop the supply chain has driven investment, as the opportunities are too strong to ignore.

Although it ranked 142 five years ago, India is still only 63 on the World Bank’s list because of its relatively high level of bureaucracy. This includes registrations, contracts, taxation and other factors. Shailendra Gokhale, managing partner of Mumbai-based Rosefield-DAA consultancy, explained, “Historically, foreign investment in India has been difficult. However, the Indian government is now seeking to change this, as reflected in a remarkable improvement in the ranking on Ease of Doing Business. A Make-in-India agenda is providing incentives for foreign investment to create a wider manufacturing base for India to supply local and export needs.”

Opportunities and Challenges

The opportunities for growth in Asia were well recognized by the major global additive suppliers and have been capitalized upon with improved regional and local manufacturing. This better serves local and regional customers, providing a shorter and more robust customer supply chain. Eugene Ng, sales and marketing manager for Chevron Oronite, Asia-Pacific region, told Lubes’n’Greases, “Chevron Oronite’s new Ningbo manufacturing facility will supplement our current warehouses in China and increase local supply capabilities by enabling shorter supply lead time and reliability.” Additional production capacity allows for market growth and gives improved supply security to other regions, which is a key concern for customers, he added.

Additive companies face challenges in facilities construction. “There were learnings with regards to local regulatory processes and requirements, which were important in the successful execution of the manufacturing project,” Ng said. “Understanding and incorporating these took time, but we were fortunate to have the local authorities guide us.”

Other challenges are more related to culture, and Asia has significant cultural and language barriers for foreign entrants. Vikas Gupta, Lubrizol’s sales director, South Asia, explained, “Cultural and language barriers have been the primary challenge. For example, in South Asia, operations are in multiple languages, such as Thai, Vietnamese, Malay, etc. These then end up complicating items, such as label design. Customer communication also needs to be very specific and culturally sensitive.”

Additionally, China has a history of intellectual property theft in some areas, which is challenging for western companies. However, an IP protection law is now being enacted.

China is challenging with respect to recruitment and retention of staff as well. Howard explained that the “very high level of education in China means there are very good-quality people available. However, they may lack relevant practical experience, so training, mentoring and on-the-job learning are key. High turnover is an issue, as many of our positions require significant investment to get someone up to speed. So the payback period can be long. Lubrizol does a great job at staff retention, but the changing labor market and talent market due to more flexible working arrangements globally have an industrywide impact.”

Ng added, “We needed to overcome challenges in attracting talents, competency development and training of our project and manufacturing teams.”

Fortunately, the industry can provide opportunities for an international career and good pay, which is attractive to new employees. Howard asserted that “there is less of a reliance on expatriate expertise these days, but it is still sometimes required for specialist areas, such as emissions.”

|

“We needed to overcome challenges in attracting talents, competency development and training of our project and manufacturing teams.”

– Eugene Ng, Chevron Oronite

|

On the customer side, relationships have been cultivated with such regional lubricant marketers as Sinopec, Petrochina, Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. while continuing to support the major global players. Ng said that having local facilities “helps to accelerate the development and marketing of innovative solutions to address emerging new emission regulations as well as OEM and customer needs.”

More local additive manufacturers are expanding in China and India, which provides a further threat to the major global additive companies. “There is a very high entry barrier to the additives industry,” Howard said. “Combined with the long-term uncertainty of demand for new [internal combustion engine] related products, there is a disincentive for locals to make big investments in this area.” It remains to be seen whether local manufacturers will focus on component supply or expand into additive package development.

Quality Upgrades

The automotive industry in China and India is upgrading oil quality and introducing new specifications to their markets. Lubricants must meet established API and ACEA specifications, and original equipment manufacturers are increasingly working on their own specifications. Additive companies have been investing in the development of relationships, which becomes more important as emissions regulations increase, new specifications emerge and higher-quality lubricants result.

China has implemented China 6a tailpipe standards nationwide, equivalent to Euro 6. China 6b standards, which are even more stringent than Euro 6, are scheduled for implementation in 2023.

“India is committed to the Paris climate change agreement and embarked on an ambitious plan for emission controls,” Gokhale said. “They migrated directly from Bharat Stage IV (BS IV) to BS VI in April 2020, equivalent to moving from Euro 4 to Euro 6.” Tighter emissions regulations create opportunities for premium lower-SAPS [sulfated ash, phosphorous and sulfur] lubricants and associated additive packages, like those developed for the European market. Gokhale added, “This is in addition to the ongoing upgrade in diesel engine oils from API CF-4 to CH-4 and CI-4 Plus, which is increasing additive demand.”

Quality upgrades provide new opportunities for premium lubricants, but the entry barriers for new competitors remain high. Global additive suppliers have a raft of historical test and performance data, the formulation knowledge around premium formulations and the ability to finance expensive programs. This gives them a strong position in the region.

Looking Forward

Lubricant growth in Asia is set to continue for the medium term. Longer-term growth depends to a large extent on the rate and degree of electrification, specifically the growth of battery electric vehicles over ICEs.

Boon Ping Chia, lubricants business growth director for Infineum, said, “We will continue to see ICE-derived additive growth in the major Asian markets for at least the next 10-15 years, albeit likely with significant regional variations by country, application and quality level. This means that further investments will need to be strategic in nature and potentially involve partnerships with other companies in the value chain to ensure that any new capacity is available in the region both flexibly and cost effectively.”

Lubrizol’s Kailash Sawant, associate director, PMG, India and Middle East, told Lubes’n’Greases, “These are exciting times wherein you see the Asia market is emerging and upgrading with higher lubricant quality and specifications with focus on the end user and the environment. Emphasis and compliance on clean air and zero emissions has surely accelerated the implementation of higher emission norms, leading to changes in ICE hardware and growth of EVs in these markets. Pollution is at an all-time high in major cities, and that calls for eco-friendly solutions. The EV space brings in huge opportunities due to technology upgrade demanding investment in vehicle production and charging infrastructure.”

Additive companies are embracing the new technical challenges in Asia and have responded with major investments in the last decade. It seems likely that more investments will continue in the future but with a greater emphasis on emissions-reducing technology and supporting greater electrification. The promise of greater opportunities in the East continues.

Philip Reeve is a chemist with 40 years of experience in the global lubricants and additives industry. He’s held positions at Afton, Infineum and ExxonMobil and is now a director of ADLU Consultancy. Contact him at philipreeve@adlu-consultancy.com.