Verification of Lubricant Specifications Investigates Complaints Over Product Performance Claims

When Verification of Lubricant Specifications was formed in 2013, there was clearly a lack of understanding in some areas of the marketplace about finished lubricant performance standards, performance claims and what can or should happen when invalid claims are made. Fast forward to 2025 and our organization is confident that the message around compliance is being heard.

Our confidence comes in part from a rise in the number of cases VLS investigates against lubricants deemed to have invalid marketing claims – a rise driven by two factors: increased awareness of VLS and increasing complexity in the marketplace. People now know if they have a concern about a product, there is a place where they can raise it. A subsidiary of the United Kingdom Lubricants Association, VLS was created to monitor the U.K. lubricant market, to field and investigate complaints about product performance claims.

Increased awareness represents progress, but the significant rise in the number and complexity of the cases over the past three years demonstrates that there is still work to do to uphold standards and protect end users.

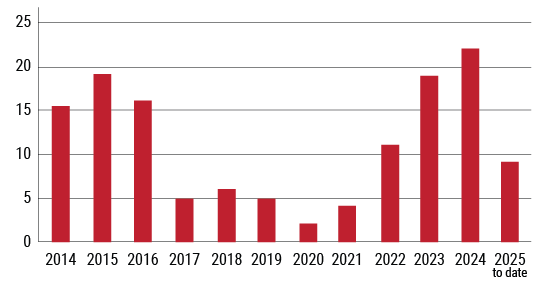

Over the past 12 years, VLS has investigated more than 130 cases. During the first nine years of that period there were 88 cases – just under an average of 10 per year. In the next two and a half years – through June of this year – there were 50, for an average of 20 per year.

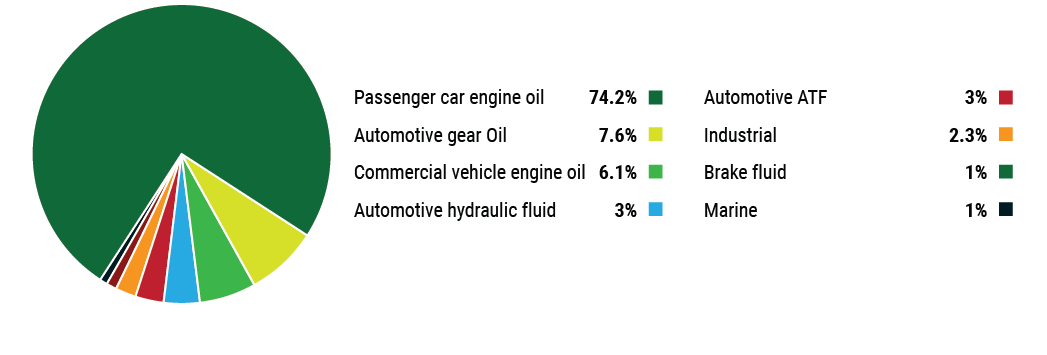

Most cases concern passenger car engine oils. However, there has been a notable jump in commercial vehicle engine oil and automotive hydraulic fluid cases. VLS only looks at products available in the United Kingdom, but many of the products investigated are also available in other markets.

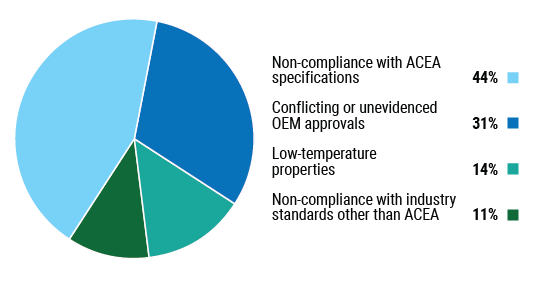

Non-compliance with stated specifications has always been the most frequent cause of complaint, but conflicting or unevidenced original equipment manufacturer approvals, and non-compliance with industry standards and low-temperature properties have all increased their share of overall complaints. In 2024, more than half of the cases opened related to conflicting or unevidenced OEM approvals.

Figure 1. Number of Cases Received

Whether it be compliance with the European Automobile Manufacturers Association’s engine oil sequences, other industry standards or conflicting or unevidenced OEM approvals, it’s vital that end users are confident that a product can deliver the performance that the marketer claims and the product is suitable for the application for which it is prescribed. Lubricant marketers should regularly audit products, technical data sheets and claims to ensure that products are in continued compliance.

Extra Vigilance

OEM specifications evolve over time, and marketers need to be vigilant. For example, VW has maintained the reference for its 504.00/507.00 passenger car engine oil specification even while updating the spec – in some cases increasing severity of tests.

Lubricant manufacturers cannot assume that because a product meets a specification at a given time that it will continue to do so during the lifetime of the specification. Requirements change, and only regular auditing and testing through comprehensive quality management processes can ensure that products remain compliant.

When VLS receives a complaint, it investigates to determine whether performance claims for the product in question are valid. If the organization concludes they are not, the first step is to contact the product marketer and share information. In most cases, marketers reformulate or correct their performance claims.

Figure 2. VLS Case Summary by Compliant Type

A 2023 case, VLS 010201, involved Emprotec UHPD 10W-40, a heavy-duty engine oil promoted by Bolsover, U.K.-based Aztec Oils as meeting Renault’s RLD-4 specification. VLS found that claim was not supported by the manufacturer. When notified, Aztec took swift action to withdraw the claim, retaining another claim against RLD-3 and amended the product’s description and technical data sheet accordingly. VLS was content that the product had been brought back into compliance, and the investigation was closed. The case proved to be in continued compliance when VLS conducted its standard six-month review.

In a fraction of cases, the marketer does not take action that satisfies VLS, and the organization refers those cases to government agencies. Another 2023 case, VLS 010223, involved a brake fluid, Mannol Brake Fluid DOT 4 3002, alleged not to meet its listed standard. VLS contacted the product’s distributor, Northampton, U.K.-based Lubriage Ltd, after independent testing showed the fluid did not meet US Federal Motor Vehicle Safety Standards 116 DOT 4.

Lubriage, distributor in the U.K. and Ireland for Germany-based Mannol, subsequently stated it had stopped selling the product in the U.K. and that it had asked distributors to quarantine an affected batch number until further notice and not resell it. VLS, however, saw no evidence of the product being quarantined or withdrawn from relevant distributors nor any attempt to recall it by contacting end users who might have purchased the product through Lubriage distributors.

Figure 3. VLS Case Summary by Product Type

VLS escalated the case to its statutory primary authority partner, Buckinghamshire and Surrey Trading Standards part of National Trading Standards, a government consumer protection agency, which issued a safety warning. A six-month review in 2025 found that the product was still not compliant, and a second public safety message was issued.

Lab Work

Testing plays a critical role in investigations. A 2023 case, VLS 010182, stemmed from a complaint that a hydraulic oil, Varol Varpress 46 AW, did not meet the foam control requirements included in DIN 51524 Part 2, a specification the product was promoted as meeting. VLS procured a sample of the product, had it tested and found the results outside the test limits.

The manufacturer, Halesowen, U.K.-based Midland Oil Group, advised it had recalled stock and reformulated the product, and VLS accepted evidence the company provided. During the six-month review stage, however, VLS purchased another product sample, which failed again. Midland said the sample, which had been purchased from a distributor, was old stock left over in the marketplace. A third sample was procured, which produced a compliant result. The case illustrated the importance of tracing non-compliant products throughout the supply chain to protect end users.

The lubricants industry has experienced immense change since 2013, and the pace of change shows no sign of abating. Hybrid electric vehicles can place immense stress on lubricants, with different hybrid operating cycles, including increased levels of stop-start with longer warm-up times and high-power cold starts.

At the same time, engine oils for traditional internal combustion engines continue to trend toward lower viscosities, even as the vehicle parc ages. The latest SAE 0W-8 oil could fail to protect an older vehicle requiring a 5W-40, starving the engine of the protective lubricant film it needs and leading to more wear.

Additives play a vital part in lubricant performance, delivering a variety of characteristics to combat wear and corrosion, disperse soot and prevent the build-up of deposits whilst ensuring compatibility with emission control devices.

With the proliferation of lubricant products, VLS is concerned about the integrity of offerings from new companies entering the additives market. These products are in some cases cheaper, but our organization is concerned they may not be fully tested or approved as required in published industry and OEM specifications. This market development is one that VLS is monitoring closely, as additives are a critical aspect of lubricant formulations.

Asking Questions

With the U.K. market becoming increasingly complex, VLS conducted a survey to understand attitudes among U.K. independent workshop technicians toward engine oil specification claims and how they affect purchasing decisions. In cooperation with Moove Lubricants, a web-based survey was sent to over 12,000 U.K. workshop contacts.

When asked to explain the difference between oils approved by original equipment manufacturers and those that meet manufacturer specifications, most respondents demonstrated an understanding: OEM-approved is an oil specifically recommended by the equipment dealer, while language that a product “meets specification” or is “suitable for use” means the oil meets performance requirements but is not the original oil. In other words, one is designed specifically for those engines while the other is generic.

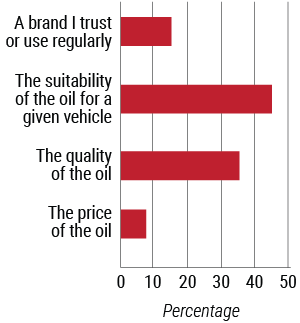

Figure 4. Thinking about your workshop and the oil you purchase, how would you rank these considerations?

Around 30% of respondents either didn’t understand the difference, didn’t think there was a difference or thought the only difference was the price. In a separate question, three quarters of respondents chose OEM-approved as the preferred description for a lubricant, as opposed to “meets requirements,” “suitable for use” or “recommended for.”

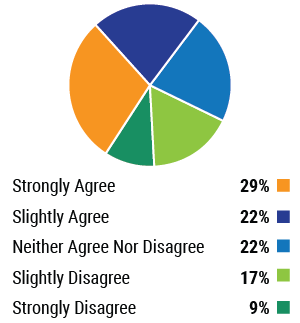

Opinions were split when it came to whether oils that meet a specification are just as good as OEM-approved oils. Whilst 51% agreed, many were unconvinced, and 27% disagreed. Lubricant manufacturers seem yet to convince workshops that the significant sums they invest in gaining OEM approvals are well spent.

Figure 5. Engine oils that “meet the requirements” of an OE are just as good as OEM-approved

Quality and suitability were identified as key driving factors in product selection. However, several workshops did rank price as the most important consideration.

Having identified OEM-approved oil as superior, most workshops agreed it was important to use an OEM-

approved oil for customer vehicles. Seventy percent of respondents agreed or strongly agreed that it’s very important to always use an OEM-approved engine oil, but fewer thought this important as vehicles aged.

• 78% agreed or strongly agreed with the statement, “I tend to use an OEM-approved engine oil if servicing a newer, higher value and/or in-warranty vehicle.”

• 61% agreed or strongly agreed with the statement, “I tend to use an OEM-approved engine oil regardless of the age, mileage, value or warranty status of the vehicle.”

Our thanks to Moove Lubricants for their support in completing the survey. We hope to repeat it in the future to see how attitudes change in the complex and evolving lubricants market.

Essential Expertise

VLS remains indebted to the members of its independent technical review panel and their organizations for their ongoing support in determining product compliance and resolving complaints. Investigating products thoroughly and helping lubricant marketers take corrective action wouldn’t be possible without their expertise and the robust, anonymous VLS process.

So much so, that other industry associations in different markets look to VLS as a blueprint for their own activities. While some issues are unique to the U.K. market, many countries experience similar issues, and we can all benefit from sharing that experience.

As the industry continues to face ever-greater complexity and change, the technical expertise of these contributors will be more valuable than ever in supporting blenders, manufacturers, and distributors – and in protecting end users.

Harald Oosting is chairman of VLS. He is also president and CEO of Olyslager, a Netherlands-based provider of information on lubricants used in various types of equipment.