The lubricants industry faces rising pressure due to increasingly challenging operating conditions in wide ranges of equipment, demands to ensure machine reliability, and ever more stringent environmental, health and safety standards. Increasingly, the solution comes in the form of synthetic lubricants.

Synthetic base stocks, therefore, play a pivotal role in formulating next-generation finished lubricants that meet these challenges, and global demand for them is growing steadily.

But “synthetic base stocks” is also quite a large umbrella, encompassing a wide variety of fluids with diverse characteristics. This article provides an overview and profiles several of the most popular types.

A Big Buffet of Options

As the name implies, many synthetic base stocks are produced through chemical synthesis, using raw materials from petrochemicals or bio sources such as plant oils – or sometimes both. This mostly distinguishes them from mineral base stocks, which is by far the largest base stock category in terms of volume. The lone exception is API Group III base oils. They are part of the mineral oil category and not chemically refined, but by convention they are referred to as synthetic because their performance approaches polyalphaolefins, the original most popular type of synthetic base stock.

Aside from Group III oils, synthetic base stocks cost significantly more than mineral base oils and therefore must win over end users by providing performance that is deemed important. Exactly what those characteristics are can vary, because there are many types synthetics, but they can include superior performance at temperature extremes, resistance to oxidation, exceptional lubricity, very high viscosity indices or low volatility – or some combination of these. Some synthetic base stocks also offer characteristics that are becoming more valued during the sustainability movement – lower carbon footprints, non-toxicity, biodegradability.

It is no wonder then, that synthetic base stocks are attracting growing interest from the lubricants industry, but the diversity of types makes them a complex topic. This article attempts to start providing clarity – giving an overview of the category and summaries of several of the most popular types.

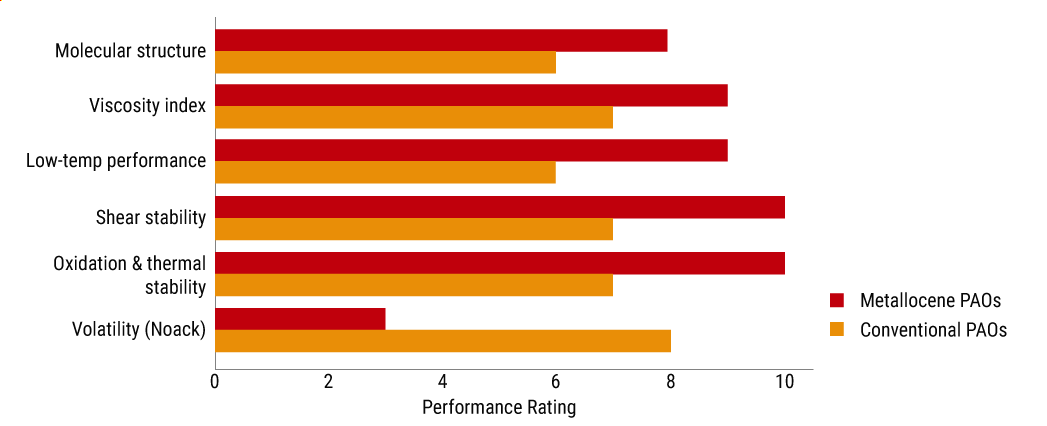

Figure 1. Comparison of Metallocene PAOs vs. Conventional PAOs

| Property | Metallocene PAOs (mPAOs) | Conventional PAOs (cPAOs) |

|---|---|---|

| Molecular structure | More uniform and precisely controlled | Broad molecular weight distribution |

| Viscosity index | Higher (typically 140–160), offering better stability across temperatures | Moderate (120–140), with relatively lower stability |

| Low-temperature performance | Superior flow characteristics and lower pour point | Decent cold-weather performance but less optimized |

| Shear stability | Exceptional resistance to viscosity loss | Good but prone to some shear thinning |

| Oxidation & thermal stability | Enhanced durability, contributing to longer lubricant life | Moderate stability at high heat temperatures |

| Volatility (Noack) | Lower evaporation rates, making it more suitable for high-temperature applications | Higher tendency to evaporate under extreme heat |

Polyalphaolefins

The aforementioned PAOs have their own category in the API base oil grouping, Group IV, tracing back to having been the most popular type of synthetic base stock when the American Petroleum Institute defined the groups in 1993. PAOs come from a sequence of processes in the petrochemical industry. First, ethylene is oligomerized to make linear alpha olefins, which are chains of hydrocarbon molecules featuring a double bond at one end. LAOs with chain lengths of eight to 14 molecules are then polymerized to make PAOs, though 1-decene – which has a chain of 10 – is the most common feedstock.

Polyalphaolefins are employed for making various high-end synthetic engine oils, gear oils and speciality greases due to unique properties such as superior thermal stability, excellent oxidation resistance, wide operating temperature ranges, low volatility, superior lubricity and shear stability, and minimal volatility at high temperatures (low Noack volatility).

Polyalphaolefins are produced by a few specialized manufacturers globally as these companies have expertise in synthetic base stock production and alpha-olefin feedstock processing. Each producer of PAOs has unique production capabilities, technological advancements, and product performance strengths.

PAOs are available in a range of viscosities, starting from as low as 2 centiStoke and extending up to 40 cSt. Those in the lower end of the range are used as base stocks, while those in the heavier end are used as viscosity-correcting additives.

Since the 1990s, chemical companies have been introducing an advance in PAOs, metallocene polyalphaolefins which offer superior performance. They are produced using metallocene catalysts, which provide precise molecular control leading to improved viscosity, oxidation stability and energy efficiency in lubricants.

Metallocene PAOs are much used in challenging applications such as wind turbines, electric vehicles, aviation, aerospace and high-fuel-economy engine oils. Key drivers include original equipment manufacturer demand for greater fuel efficiency and extended lubricant life. The growing adoption of metallocene PAOs in EVs further underscores their importance in advanced lubricant formulations.

Group V: Versatility Beyond Conventional Base Stocks

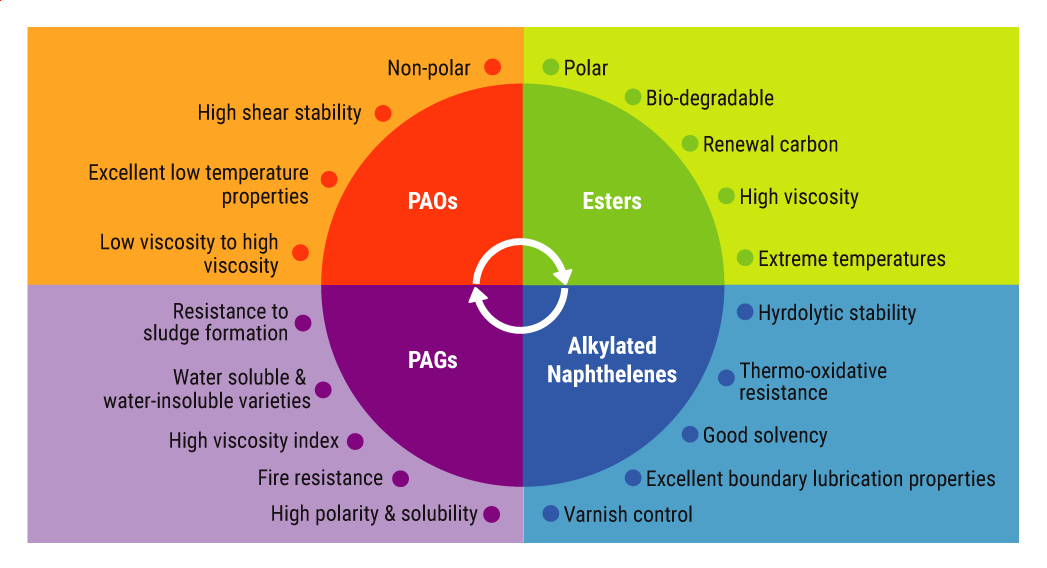

API designated Group V as a catch-all category for nearly all base stocks not included in Groups I through IV. (There is also a Group VI for poly internal olefins.) Group V includes naphthenic base oils, which are mineral oils and not synthetic, but everything else in the category is synthetic, including esters (synthetic and natural), polyalkylene glycols, polyisobutenes, alkylated naphthalenes and silicone oils. Some of these provide exceptional thermal stability, biodegradability and lubricity that draw interest for high-performance and environmentally sensitive applications. As demand for synthetic and sustainable lubricants grows, these base stocks will be at the center of innovation in lubrication technology. Their future depends on additive chemistry, regulations and emerging needs from EVs and advanced systems.

Figure 2. Synthetic Base Stocks

Polyalkylene Glycols: Versatile Base Stocks

PAGs are distinguished by their excellent lubricity, outstanding thermal stability and resistance to sludge formation. Unlike mineral oils, PAGs can be either water-soluble or water-insoluble, allowing for versatility across various industrial applications. They also have high viscosity index.

These properties make them popular in applications requiring exceptional thermal stability, and fire safety, biodegradability, low toxicity, extended service life and clean systems. Key applications include refrigeration compressor oils, fire-resistant hydraulic oils, gear oils metalworking fluids and EV lubricants and fluids. With growing demand for high-performance and environmentally friendly lubricants, PAGs are expected to play an increasingly significant role in the future of synthetic lubrication technology.

Polyisobutylenes: Valuable Viscosity Modifier

PIBs are specialty base stocks valued for their ability to enhance viscosity, to resist oxidation and to improve tackiness. These polymers serve as critical components in lubricant formulations, optimizing film strength, reducing evaporation losses and maintaining stability across a range of temperatures. Available in various molecular weight grades, PIBs are used in applications spanning industrial lubricants, fuel additives and sealants. Distinctive features include effective viscosity boosting, superior oxidation and heat resistance, low volatility and outstanding shear stability that makes them eligible candidates for chain oils, wire rope lubricants, speciality greases, fuel additives and other uses.

With the increasing demand for high-performance and environmentally friendly lubricants, PIBs continue to play a crucial role in modern formulations.

Alkylated Naphthalene: A Compatible Ingredient

Alkylated naphthalenes are known for outstanding oxidation resistance and thermal stability, which translate to durability. They blend well with various base oils and are often used as co-base stocks to improve performance under extreme conditions. They offer excellent lubricity and solvency like esters with superior hydrolytic stability. They also improve chemical additive compatibility and resist sludge formation.

Alkylated naphthalenes are frequently used in high-temperature, long-life lubricant applications. Uses include compressor oils, thermal transfer fluids, high-temperature chain oils, turbine oils, greases and glass moulding lubricants.

As demand for high-performance lubricants continues to grow, alkylated naphthalenes are emerging as a preferred base stock. Recent studies on elastohydrodynamic film thickness and pressure-viscosity coefficients confirm their viability as alternatives to synthetic esters.

Esters: Thermal Stability, Lubricity Plus Sustainability

Esters are one of the most widely used Group V base stocks, known for outstanding thermal stability, lubricity, and biodegradability. There are synthetic and natural varieties, all made by combining an alcohol with an acid – so there are a large number of varieties, designed for various performance characteristics depending on the choice of either molecule. Esters are divided into several classifications: monoesters, di-esters, polyol esters, neopolyol esters and complex esters, each considered for different applications.

In general, this category is known for exceptional thermal and oxidative stability that enables reliable operation in extreme temperatures while extending lubricant life. Superior lubricity minimizes friction and wear, enhancing component durability. With excellent solvency, esters ensure effective additive dispersion and optimized performance across formulations. They also offer low volatility, reducing oil loss at high temperatures.

Additionally, esters possess high viscosity indices, low pour points, and high flash points, making them suitable for both low- and high-temperature applications. Their low coking tendency makes them ideal for aviation and specialty uses. Many esters are also biodegradable and renewable, aligning with modern environmental standards for eco-friendly lubricants.

Prime application areas for esters include aviation and aerospace lubricants as most jet engine oils and turbine oils are formulated based on esters. Esters are also preferred in high-end engine oils such as those used in racing vehicles. Esters are the preferred base stocks for many formulators making environmentally friendly and biodegradable lubricants, such as hydraulic fluids used in natural environments. In addition, esters are employed in compressor and refrigeration oils, specialty greases and metalworking fluids. Ester-based transformer oils are being rapidly adopted across the globe due to their fire resistance and biodegradability.

Driving the Future of Lubrication

The demand for synthetic base stocks is rapidly rising, driven by stricter environmental regulations, evolving designs of automotive and industrial equipment and the increasing need for high-performance lubrication. The growth is largely fueled by industrialization and increasing vehicle ownership in emerging markets including India, Southeast Asia, the Middle East, Africa and Latin America.

Key drivers include the global shift toward EVs, industry efforts to reduce maintenance and operating costs and to minimize downtime, along with environmental regulations and other regulations. Continuing OEM efforts to require better fuel efficiency, longer oil drain intervals and improved equipment protection also contribute.

Sustainability initiatives and regulatory pressures are pushing for environmentally friendly lubricants with lower carbon footprints, particularly those made from renewable sources. This shift is raising demand for base stocks such as esters and PAGs, especially in applications where eco-compliance is a key requirement.

Synthetic lubricants often provide superior lubrication, reduced friction and enhanced thermal stability compared to conventional mineral oils, contributing to energy savings across industries. Core sectors like mining, steel, cement, power, and heavy engineering stand to benefit greatly. For example, steel plants using synthetic gear oils in rolling mills can realize energy savings of 5%-8% while improving equipment uptime.

Some synthetic base stocks also have limitations that prevent their use in certain applications, and their cost premium to mineral base stocks is forever a challenge, as reflected by the continued dominance of mineral oils. As operating conditions become more challenging, however, and as focus mounts on characteristics such as energy efficiency, sustainability, service life and environmental impact, the equation for synthetic lubricants and synthetic base stocks should continue to improve – application by application. To maximize the potential of synthetic base stocks, continued innovation and advances in feedstock technology are crucial, as are local manufacturing and strategic partnerships. Collaboration among lubricant producers, OEMs, and policymakers will be key to overcoming challenges and accelerating adoption.

As the global lubricant industry evolves, synthetic base stocks will remain at the forefront of innovation, offering sustainable and high-performance solutions to meet the challenges of tomorrow’s markets.

Vivek Gupta is national key accounts manager at Coraplus India Pvt., a subsidiary of Vestcorp Holdings Group. He has more than 25 years of experience in the lubricants field including positions working with specialty lubricants, base stocks and additives.