Out with the Old, in with the New

As the end of the year approaches, many base oil industry participants are likely to evaluate the circumstances that shaped business during the previous twelve months and apply their learnings to prepare next year’s action plans.

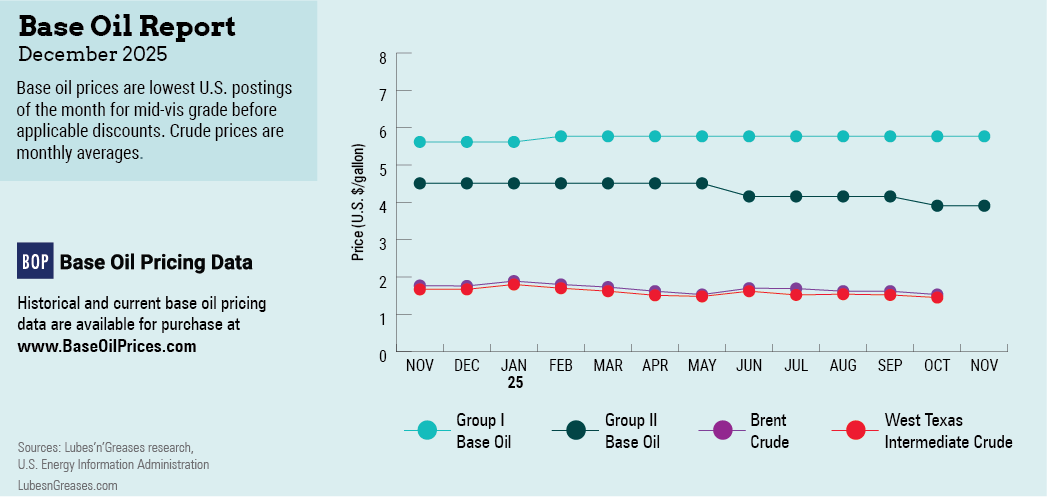

When looking back, what stands out about 2025 is that posted base oil prices were fairly static for most of the year. Unlike in years past, when several rounds of price adjustments would take place, 2025 only witnessed three initiatives, with one involving just a single producer. Some players noted that the lack of adjustments were an indication that posted prices were not as relevant as they used to be. While it is true that most buyers and sellers do not settle contracts purely based on a company’s posted price, postings still reflect market direction and are used as a benchmark in negotiations, with discounts applied, depending on volumes and other terms, along with the price of other refined products.

Perhaps it is necessary to look more closely at what occurred during the year to figure out whether market conditions might have been the real culprits of the price stagnation. Aside from some sharp fluctuations in crude oil futures–which did indeed prompt naphthenic base oil suppliers to decrease prices in May–and trade turmoil caused by U.S. president Donald Trump’s tariffs, there were few unexpected or unsettling events powerful enough to push prices in a particular and defined direction.

A massive explosion and fire at Smitty’s Supply’s large blending and packaging plant in Roseland, Louisiana, in August did free up some base oils as significant lubricant and grease production was lost and the plant was not expected to be operational for a long time, if ever. But this disruption was temporary, and several other blenders picked up some of Smitty’s business. Smitty’s also ramped up production at its other facilities, which meant that the suddenly displaced base oil supplies were eventually absorbed into the system.

There were also several scheduled plant turnarounds which tightened the market and provided support to both posted and spot prices. However, fairly sluggish consumption levels offset any short-lived tightness. Supply and demand fundamentals in other regions have also had an increased influence on the U.S. market, with plant turnarounds in Asia, Europe and the Middle East providing opportunities for U.S. suppliers to ship surplus barrels into other regions.

Fresh U.S. tariffs on many imported goods did not affect base oils directly as they fall under the energy products category, which were mostly exempt from duties, or could be imported duty-free as long as they complied with the United States-Mexico-Canada trade agreement. Tariffs did impact lubricant and finished products manufacturers in that they raised the cost of many imported raw materials and inputs. At the same time, blenders did not receive much relief from base oil price decreases as most producers did not officially lower prices during the year. Transferring higher production costs down the supply chain proved to be challenging for blenders because of ongoing competition with other manufacturers amid soft demand.

Export business into Mexico was also impacted by economic uncertainties due to the tariff dispute between Mexico and the U.S., and by new Mexican tariff and customs policies that may affect fuel and base oil imports in the future. The Mexican government has proposed tariff reforms that would expand the number of product classifications affected by new duties—potentially increasing costs for some imports—and changes to customs law to tighten import controls. While these changes were focused on the fuel market itself, they represented an overall trend of tightening government oversight of the energy sector and resulted in difficulties to obtain or renew base oil import licenses.

A highlight this year was the lack of severe weather events that could have impacted production along the U.S. Gulf Coast, even though earlier weather forecasts had predicted a very active hurricane season. In September/October, suppliers started to release emergency inventories kept in case of output disruptions and this exerted downward pressure on pricing. However, a four- to six-week turnaround at Excel Paralubes Group II/Group III plant in Louisiana that started in October was expected to tighten Group II spot supplies, and some sellers held off on export transactions until they had a better feel about market conditions following the turnaround.

Similarly, on the naphthenics front, an extended turnaround at Ergon’s plant in Mississippi from September until mid-October also tightened pale oil supplies and offered support to pricing.

One aspect that most base oil categories had in common was a general slowdown in consumption after the summer driving season. The tariff upheaval that caused ripples in the manufacturing segment and dampened demand for industrial lubricants and metalworking fluids also affected base oil demand. These trends exerted downward pressure on base oil prices but seemed to prompt suppliers to grant discounts and temporary value allowances into select accounts rather than trigger a general posted price decrease.

Conditions were not anticipated to change significantly as the market enters 2026, but participants have increasingly started to adapt to the “new normal” that has driven activity since the COVID-19 pandemic. Industry disruptors such as vehicle electrification and the use of AI are likely to reshape the way production and business are conducted in the future as well.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com