Against All Odds

After a fairly strong start to the summer driving season, most base oil suppliers expected demand to taper off, supplies to lengthen and the summer doldrums to set in. Typically, base oil consumption weakens as the summer unfolds because most lubricant manufacturers have produced enough stocks to cover consumers’ needs, and there is less incentive to acquire large orders comparable to those placed in the spring.

This year, however, lubricant demand remained quite vigorous and even showed an uptick in the days leading to the Independence Day holiday in the United States, because numerous drivers were expected to hit the road over the Fourth of July weekend. Base oil demand was up, resulting in a few suppliers having to release some of the barrels they were keeping as back-up for potential supply disruptions during the hurricane season.

Domestic base oil supplies tightened in June because both buyers and sellers had bolstered inventories in preparation for potentially strong storms in the June-September timeframe. Many base oil facilities are located on the U.S. Gulf Coast and are liable to suffer production setbacks due to hurricanes and tropical storms, resulting in a scarcity of many base oil grades. According to several weather monitoring agencies, this year’s season was expected to be extremely active, and this set participants on edge.

Indeed, in early July, Tropical Storm Beryl proffered the first test to hurricane preparedness plans. Strong winds and torrential rains from the storm battered Houston, Texas, and surrounding areas on July 8, flooding streets, knocking out power and leaving a number of fatalities in its wake. Many base oil and petrochemical plant operators implemented weather preparedness plans ahead of the storm, including reduced operating rates or complete shutdowns.

The hurricane inventory building efforts, combined with several plant turnarounds, created generally tight conditions for the Group I and Group II grades in June and July. Paulsboro completed a brief turnaround at its Group I plant in New Jersey in May. Also that month, the light-viscosity base oils lines at Motiva’s Group II plant in Port Arthur, Texas, underwent a brief turnaround that strained Group II supply levels. The Excel Paralubes Group II plant in Lake Charles, Louisiana, was reported to have been taken offline for maintenance in mid-June and was not expected to resume production until the first few days of July. Sources said that the turnaround reduced spot and export availability of Group II grades, but the producer was able to continue meeting contractual obligations.

Aside from enjoying healthy domestic demand, limited base oil supplies in Europe and Latin America led to a wave of product inquiries for export transactions, which sometimes went unfulfilled, as U.S. supplies were tight and producers prioritized contract commitments.

Suppliers reported robust buying interest from Europe, the West Coast of South America and Brazil. European demand picked up in May and June but was likely to wane once the summer holiday period starts in late July and early August. In Latin America, attractive offers of Asian product competed with U.S. exports, and in some cases, these cargoes were a welcome alternative, as U.S. offers were limited.

While several Mexican buyers were reportedly inquiring about spot cargoes of Group I and Group II grades, availability of U.S. material was not abundant. This supported firm price ideas. There was a product build in Brownsville, Texas, earlier in the year as shipments were held there while new import licenses were being processed in Mexico. However, these volumes had been cleared and availability at the border tightened by late June.

A Brazilian base oil producer lifted its June domestic prices, which also made offers of U.S. products slightly more competitive, despite recent increases due to higher spot prices at origin and increased freight rates.

Within the Group III segment, availability of the 6-centistoke and 8-cSt grades in the U.S. tightened as well, given the delay of a large import shipment coupled with steady demand. This placed upward pressure on spot prices.

On the naphthenic front, the lighter grades were described as snug due to recent robust activity, namely from the transformer oil and adhesives sectors, while the heavier grades lengthened, exerting downward pressure on pricing. This trend was partly offset by steep crude oil values and flourishing interest from Europe, Asia and Latin America.

A naphthenic base oil producer was heard to be building inventories following an unexpected brief shutdown in early June, but the balance of the suppliers were running refineries at top rates.

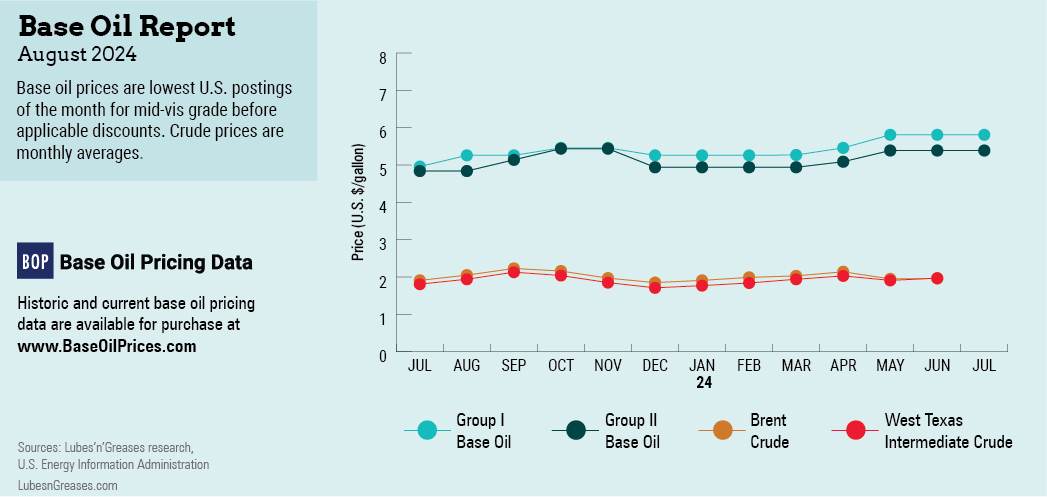

Both paraffinic and naphthenic market participants were monitoring crude oil values closely because futures had registered yearly lows in May but had been catapulted to steeper levels in June on forecasts of strong global demand and ongoing geopolitical tensions in the Middle East. On May 30, West Texas Intermediate futures settled at $69.46 per barrel but climbed to above $83 per barrel by early July. These price levels were exerting pressure on base oil indications.

Many unpredictable factors such as severe weather could cause a further tightening of base oil availabilities. Against most expectations, supply and demand conditions have been rather healthy this summer, and participants hoped the momentum could be sustained into the fall.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com