Need to Know

Consolidation has been a prevalent trend shaping the lubricant distribution business over the past three decades. Although there has been a slowdown in the number of acquisitions driving consolidation over the past three years, there is more to come. Importantly, acquisitive companies are expected to be increasingly discerning in selecting companies to acquire.

In a once highly fragmented industry where there were close to 10,000 lubricant distributors in 2000—of which about 1,500 were sizable—today roughly 800 sizable players remain. Among them are several behemoths that rose to the top, including RelaDyne, Brenntag and Cadence Petroleum.

Although consolidation was most heated over the past 15 years, the first signs of a trend in acquisitions emerged in the 1990s and early 2000s when PetroChoice gobbled up lubricant distributors and private equity (PE) entered the space. PE gave rise to Windward Petroleum, Maxum Petroleum and RelaDyne. Additionally, PE took ownership of PetroChoice.

From 1990 to 2010, Windward acquired 17 distributors before it was acquired by G.H. Berlin, then Brenntag acquired Berlin in 2015. Waud Capital launched Maxum Petroleum in 2004 and within less than 10 years consolidated 19 distributors before Waud sold to Pilot Flying J (now Pilot Thomas Logistics) in 2012.

The PE firm Wingate Partners entered the space in 2010 when it acquired Western Marketing. In a secondary buyout, Wingate exited with the sale of Western Marketing to RelaDyne in 2017. Prior to its ownership by three different PE firms, PetroChoice acquired 15 companies on its own and six under the ownership of PE. PetroChoice grew to become one of the largest lubricant distributors in the U.S. before Golden State Capital sold the company to Moove in 2022.

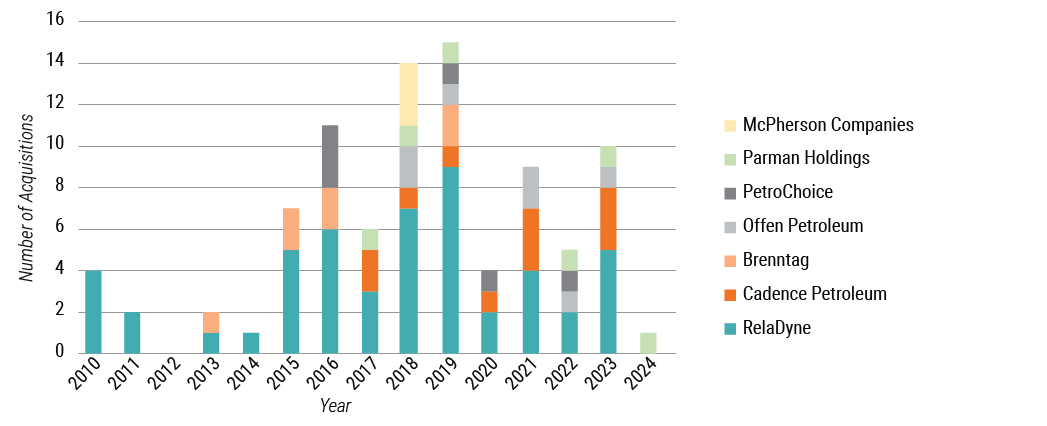

Dealmaking in the lubricant distribution business reached a fever-pitch in 2018 and 2019, when there were 29 notable acquisitions. RelaDyne was by far the most acquisitive, having closed on 16 deals. Among these were five companies with businesses focused on such activities as fluid systems, filtration and cleaning, condition monitoring, lubrication management, and other lubricant- and fluid-related industrial services. Although these companies are not lubricant distributors, they added considerable depth and breadth to the RelaDyne Reliability Services capabilities, capacity and geographic reach. In addition, the acquired service companies actively identify lubricant sales opportunities when servicing accounts.

Cadence Petroleum was also notably acquisitive. Cadence Petroleum Group was formed in 2018 through the combination of Apollo Oil, Halco Lubricants, Mid-South Sales, Pugh Lubricants and Veteran’s Oil. The company was then acquired by Wellspring Capital in 2020. Since its inception, Cadence has acquired 12 lubricant distributors and expanded geographic coverage to most of the Mid-Atlantic and Midwest region. Closing on six deals, Parman Holdings has also been growing through acquisitions.

Figure 1. Number of Acquisitions, by Company and Year

Taken together, the seven most acquisitive companies, along with the deals of Pilot Thomas Logistics’ predecessors, rolled up close to 150 lubricant distributors and sell roughly 25% of the volume currently available to distributors in the U.S. market.

In addition, consolidation has been driven by acquisitions by Parkland, Andretti Petroleum, Palmdale Solutions, Shrader Tire & Oil and Hampel Oil, among others. As seen with Palmdale, owned by First Reserve, some of the smaller rollups are also backed by PE. Distressed companies exiting the business, some moving away from lubricants to focus on more profitable segments, and other factors have eroded the number of distributors in the market.

Although the number of acquisitions in the lubricants business soared in 2018 and 2019, the rate of transactions declined significantly during and after the pandemic due to several macro-environmental factors. The most significant was in 2020 when COVID-19 was declared a global pandemic. With lockdowns, supply chain interruptions, a sharp drop in demand and uncertainty about the long-term impact of COVID, businesses focused attention on keeping their employees safe and business operating. Consequently, many companies either put acquisitions on hold or pumped the brakes.

While acquisitions picked up in 2021, the number of deals closed was still down from the peak in 2019. Slower deal flow was said to be due primarily to business uncertainties stemming from lingering challenges of COVID, skyrocketing raw material costs and volatility in the economy.

Although the pandemic’s impact diminished greatly in 2022, the number of acquisitions was markedly down. This was largely due to the need for companies to focus on operating their business through a year that brought deep allocations and stockouts in lubricant supply due to an additive shortage. Costs continued to ramp up at a rapid rate in 2022, the direction of the economy remained uncertain, and Russia’s invasion of Ukraine further complicated the already stressed global supply chain.

With additive supply issues and COVID mostly behind us in 2023, deal flow improved. But the number of distributors acquired remained below pre-pandemic levels. Investments during that time were cautious due to the U.S. Federal Reserve hiking interest, demand for lubricants in the doldrums and uncertainties about the economy.

Importantly, notwithstanding the recent slowdown in deal flow, acquisitions remain an important part of the growth strategy for many leaders in lubricant distribution. It’s too soon to tell if deal volume will rebound, but it is clear that there is a growing tendency to cherry pick companies in the deal flow. Where distressed, underperforming and small companies were often in the mix, there is now little interest in such distributors. Instead, leading acquirers say they are scouting for companies with brand synergies, strong balance sheets, talented people and opportunities to expand market share in new geographies, products, sectors and services. Talent retention and anticipated time and cost to integrate acquisitions will also be scrutinized more closely when selecting targets.

While there is still a long tail on the number of lubricant distributors in the business, times have changed. M&A is moving to a buyers’ market, and buyers now know more than ever about what types of deals will help them grow business and how much such companies are worth to them.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com