The global lubricant additives market has weathered its fair share of storms over the past several years. However, much like the rest of the lubricants industry, it has proven to be quite resilient.

What problems have plagued the market in the past few years? How has the industry responded to those problems and mitigated the damage? Has demand for additives faltered, or has it managed to hold steady? What factors might affect demand in the coming years?

Major Market Interruptions

Last year in late July, severe flooding in the Midwest region of the United States forced Afton Chemical Corp., one of the Big Four additive suppliers, to temporarily close its production facility in Sauget, Illinois. The company was also forced to declare force majeure, as the unexpected shutdown resulted in a shortage of materials to be used in such products as engine oil additive packages as well as some off-road products.

While Afton was able to lift the force majeure just over a month later on September 8, the shortage set off a series of cascading effects. The decreased portion of lubricant additives available in the market resulted in a downturn in production of both finished lubricants and base oils for months following Afton’s plant closure.

The global additives market has been plagued by other supply issues, too. In September 2019, a fire broke out at Lubrizol’s additives plant in Rouen, France. The blaze caused extensive damage to the company’s facilities and took large volumes of additives out of the supply system for some time.

The additives supply woes were exacerbated the next year by the emergence of the COVID-19 pandemic. Many companies worldwide responded to the virus by implementing restrictions, and many employees were unable to go to work as the virus picked up pace. As a result, several additive plants cut production or temporarily shuttered their operations in an attempt to slow the spread of the virus and protect employees.

Additives Market Overview

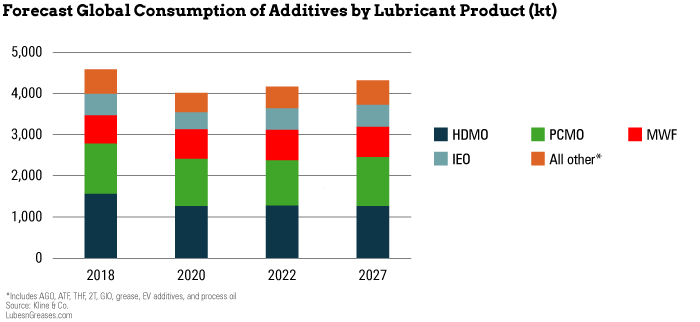

In an April 6 webinar hosted by global consultancy Kline & Co., David Tsui, product manager, energy, explained that demand for lubricant additives clocked in at well over 4 million tons in 2022. Of that 4 million tons, automotive engines oils accounted for more than half.

How has demand fluctuated over the past five years, and how might it continue to change in the next five years?

“You’ll notice that demand in 2018—sort of the pre-COVID baseline—is still higher than even our projections for growth into 2027,” Tsui said. “Part of this is due to just supply chain issues and things that have happened over the time, plus the global economics really haven’t been too great as of late. But also part of it has to do with things like IMO 2020, which is reducing detergent use because of the transition away from 100 BN cylinder oils and marine engine oils. There are also optimizations that have happened in HDMO and PCMO, which are using slightly lower but more optimized additive treat rates. All of that has kind of factored into some of the lower overall volumes.”

Tsui added that while additive demand has diminished slightly in the past few years, finished lubricant volumes have more or less recovered to pre-pandemic levels.

Challenges and Opportunities

Moving into the future, what might be some of the major challenges that the additives market will face? Conversely, what opportunities might exist for growth?

“Obviously, electrification is one of the growing challenges,” Tsui said. “I know it hasn’t really had a huge impact yet, but the impact will continue to grow.”

Other challenges include a further decline in demand for engine oils as well as issues surrounding health, safety, security and the environment. “The European Commission has been looking lately at lithium hydroxide, for instance, as a potential reprotoxin,” Tsui said. “Now, if they do label it that, that could impact lithium greases and other aspects.”

These factors, among others, are things that players in the additives space are keeping a close eye on because they may affect additive chemistries in the future. However, Tsui explained that “at the same time, even though the additives industry does tend to be a slowly changing industry, there are still plenty of opportunities” for growth and evolution.

“Is this the end for internal combustion engines?” is a common question that has been floating around the lubricants industry for some time. With the inevitable adoption of electric mobility, many wonder why new engine oil technology is even needed.

In answer, Tsui explained that the reason new engine oil development is still occurring is because “until we get a full transition to EVs, which is going to take quite a while, we’re going to have to meet the new fuel economy targets and the new emission targets for all the step-level changes that the various governments have in place. In order to do that, they’re going to have to continue to improve the engines and the lubricants as well. The OEMs are going to continue to roll out new engines, and those new engines are going to need specification changes.”

Another notable factor driving the development of new engine oils—and consequently new additive technology—is sustainability. “Obviously, as a society globally, businesses and governments alike are all very concerned about carbon neutrality, sustainability and overall trying to operate at a better planet stewardship-type level,” Tsui said. “This is certainly something that will impact additives.”

The transition to higher-quality base stocks will also affect the course of the global additives industry. “Of course, lately there has been greater availability of Group II and Group II+ base oils as well as Group III,” Tsui explained. “With the availability of better base oils, you’re going to see a faster transition away from the Group I oils, especially in industrial fluids that have been stubborn and stayed on Group I.” This transition will affect additives producers, as different base stocks may require different additives and treat rates to create an optimal finished product.

Demand by Function

According to Kline’s study titled “Global Lubricant Additives: Market Analysis and Opportunities,” viscosity improvers account for more than a quarter of overall additive demand. “VIs are basically the leading category as far as volume demand, but they’re also expected to grow at a faster rate; certainly, they will outpace the overall additives growth,” Tsui said. “Part of the reason for that is the continued transition to multigrades. You’re going to see that there are still some regions that continue to use monograde fluids, but you’re also seeing a lot more use of VIs in industrial fluids like hydraulic fluids, where you’re seeing more energy-efficient fluids.”

Dispersants make up about one-fifth of total additive demand, according to Kline. They are projected to grow; however, the overall volume of dispersants has decreased slightly because of the transition to newer “thermal-type” dispersants and other more efficient options. These types of dispersants require smaller volumes in the finished formulation to deliver higher performance levels.

Ranking in third place are detergents. Kline expects demand for these additives to flatten over time because IMO 2020 has set in motion a shift away from 100 BN marine fluids to those in the range of 40-70 BN. Also, modern engine oils boast low ash limits, thus lessening the volume of detergents that are necessary in finished formulations.

Next in the ranks are antiwear additives, antioxidants and friction modifiers, respectively.

Demand by Region

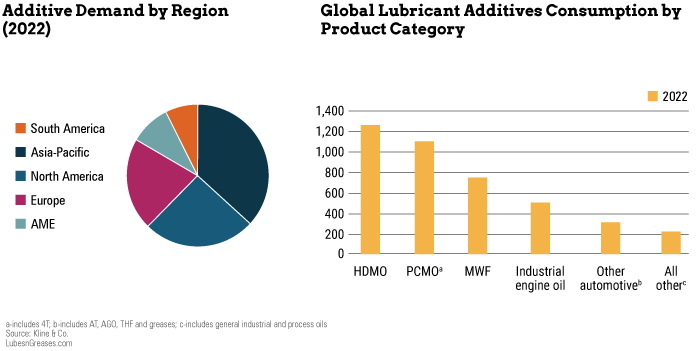

Kline’s study concluded that the Asia-Pacific region was by far the biggest consumer of lubricant additives in 2022. “Within China and Singapore, there’s a lot of production of additives in the region, and you also have growing production in companies like Richful, for instance, with their plans to open a new 400+ kiloton plant in China,” Tsui said. “Certainly, that will change some of the aspects of supply within the region and the country.”

Trailing behind Asia-Pacific are North America, Europe, Africa and the Middle East, and South America, respectively.

Demand by Product Category

Heavy-duty engine oils and passenger car motor oils account for more than half of overall additives demand, Tsui said. Total demand is rounded out by metalworking fluids, industrial engine oils and other automotive lubricants.

Top Suppliers

According to Tsui, there are two categories of additive suppliers: component suppliers and package suppliers. Component suppliers—including BASF and Lanxess—supply “detergents, dispersants, precursors for antioxidants and things of that nature,” he said. “But then there are also package houses, and they supply the finished dexos Gen1, GF-6 or CK-4 additive packages.”

The Big Four additive package houses—Lubrizol, Infineum, Chevron Oronite and Afton Chemical—produce 80% of all additives. Following the Big Four are component producers Lanxess and BASF, respectively.

Major Trends

One of the most prominent trends in the additives segment centers around sustainability, Tsui said. “From the lubricant suppliers, lubricant marketers and additive companies, I know one of the common things they think of when it comes to sustainability is using more biodegradable fluids or EAL-type lubricants,” he explained. “The issue is when it came to the first generation of EALs, they tended to be a little more expensive and offered worse performance, so they kind of left a sour taste in the market.” Fortunately, great strides have been made in the EAL space, and their performance is catching up with their more traditional counterparts.

Furthermore, additive and lubricant suppliers must focus their sustainability efforts on things outside of the products themselves. “When you look at it from a bigger picture, some of the things to look at are not just the fluid itself or the additive itself,” Tsui said. “You also have to look at the carbon footprint of production and transportation, of material sourcing and all the other aspects—even the product life cycle.”

Mike Kunselman, business development manager for the Center for Quality Assurance, cited government regulations as another key trend affecting lubricants and additives. “The first example here is Germany, Italy and a handful of other countries over the past few weeks starting to renegotiate the EU ban on ICE vehicles that was set for 2035,” he said. “Basically, the EU has agreed to incorporate e-fuels into what is allowed moving forward.”

He provided another example in the United States in which incentives are being offered to automakers to invest in development of battery electric vehicles instead of allocating resources to incorporate low-carbon fuels. “That could change just like is being seen in the EU,” he said. “That’s something to keep in mind moving forward.”

Another major trend focuses on fluids for electric vehicles. “There’s segmentation around what hardware configurations exist today and potentially in the future,” Kunselman said. “Today, the number one technology that’s out there by vehicles on the road is an air-cooled motor with a separate battery coolant, a separate driveline or powertrain fluid. In the future, one of those hardware segments would be this potential single fluid where you’re doing the cooling of the battery and you’re also providing the powertrain fluid all in one. We have not gone through it to prioritize which one of those hardware configurations are going to be worked on from a fluid perspective, but I think everyone realizes that change is happening and there will obviously be change moving forward.”

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com