Trying to Explain the Unexplained

In contrast to last year—or even the year before—base oil demand remained fairly muted in March and early April ahead of the spring production cycle when blenders typically prepare lubricant inventories to meet heightened motor oil consumption during the summer driving season.

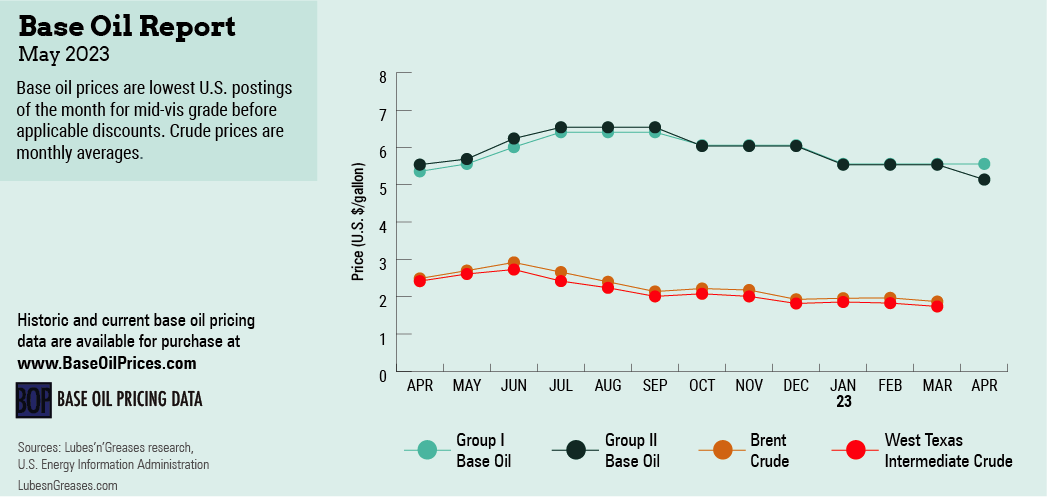

Some attributed this year’s languid market conditions to macroeconomic factors, while others speculated that buyers were waiting for base oil price decreases before securing additional volumes. Many consumers were nervous about acquiring high-priced base stocks when prices might tumble later, as such uncertainties as volatile crude oil and feedstock prices abounded.

Chevron and SK enmove communicated posted price decreases in late March, with the initiatives going into effect on March 28 and April 1, respectively. The moves were thought to have been driven by sluggish demand and a need to stimulate orders as well as by softer crude oil values and growing inventories of paraffinic oils.

Chevron lowered its API Group II 100R by 30 cents per gallon and its 220R and 600R grades by 40 cents per gallon.

SK decreased the posted price of its Group III 4-cSt grade by 15 cents and its Group III 6-cSt and 8-cSt cuts by 20 cents per gallon, effective April 1. The price of the company’s Group II+ 70N was unchanged. SK previously lowered Group III postings on March 1.

As these decreases went into effect, crude prices jumped by almost 6% after OPEC+’s announcement of a cut in oil production of over one million barrels per day, or 1% of global production. The steeper crude oil prices slowed the price adjustments on the base oils side. Nevertheless, two additional producers announced decreases in early April.

Motiva communicated a decrease of 30 cents per gallon on its API Group II 105-vis base oil, and 40 cents/gal on its 220-vis and 600-vis grades. The company also lowered its Group II+ and III base oils by 25 cents/gal. All of the decreases went into effect retroactively on April 3.

Avista Refining and Trading announced a 30 cents/gal posted price decrease on its Group II+ and III base oils, effective April 11.

It seemed that rather than cut posted prices, many suppliers resorted to temporary value allowances or adjustments to encourage domestic orders, and lower spot prices to attract export business.

The Group I segment was described as balanced-to-tight, with limited spot availability and steady-to-soft prices. A Group I refinery completed a turnaround in March, which likely contributed to the tightening of supplies.

Within the Group II segment, there was talk of TVAs of 30-85 cents per gallon being granted to several accounts. The TVAs were slightly unexpected in this segment, since Group II supply had been anticipated to tighten on the back of an extended turnaround at the Excel Paralubes facility in Lake Charles, Louisiana.

The plant had been scheduled to resume production at the end of March, but there were reports that the shutdown had been extended by two weeks due to technical issues.

Chevron was also heard to have scheduled a turnaround at its Group II plant in Pascagoula, Mississippi, in the second quarter and had been building inventories to cover requirements during the outage.

A Group II+/Group III rerefiner also completed a one-week shutdown in mid-March.

Despite the turnarounds, Group II supplies had been sufficient to meet demand amid lackluster domestic requirements and limited buying interest from other regions. Market participants said that once both plants resumed production at full rates, a larger amount of Group II base oils would be coming into the market, placing additional pressure on pricing.

Refiners were also keeping an eye on diesel prices. Should values shoot up with higher crude oil values, refiners might redirect feedstocks to produce distillates instead of base oils. This situation might affect the base oils supply/demand balance and prompt buyers to secure product to avoid potential shortages later.

The Group III segment also experienced some lengthening. Increased domestic Group III production was adding to the surplus availability of imports. As a result, some suppliers granted TVAs of 20-40 cents per gallon, but several of them abstained from adjusting prices, as they predicted that this segment would tighten, with demand likely to pick up and plant turnarounds in Asia and Europe limiting global supplies over the next few months.

In the naphthenic camp, the downward pressure on prices was mitigated by steeper crude oil and feedstock values in early April. While supply and demand of most pale oils was described as fairly balanced, participants conceded that the lighter grades were exceeding requirements. Interest from Latin America and Europe relieved some of the inventory pressure.

Both paraffinic and naphthenic U.S. suppliers pursued export opportunities, and many lowered their spot offers to promote business, with buying appetite noted in Mexico, Brazil and other Latin American countries.

At the time of writing, there were few signs the tide would be turning and base oil orders would start to pour in. Economic factors like inflation, recession fears, and higher labor and transportation costs might impact base oil and lubricants consumption in coming months. The start of the hurricane season in the Atlantic basin in June may prompt buyers to start padding inventories to cover potential supply disruptions, which could reinvigorate demand, reversing a trend that has been a source of significant concern over the past several months.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com