Spring Symphony

The arrival of spring does not only bring longer days, warmer weather and cherry blossoms; it also ushers in revived activity in base oil markets. This optimistic time of the year often acts as the overture to a symphony of changes, from a crescendo in sales to an allegro in production rates and competition as the industry awakens from its hibernal slumber.

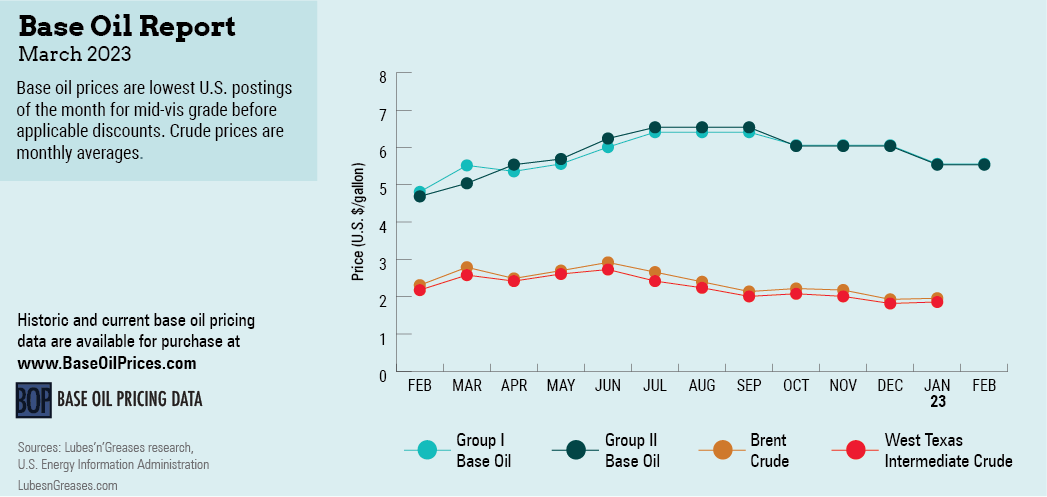

In late January and early February, base oil and lubricant suppliers detected the first signs of an increased buying rhythm, although some players admitted that demand was not quite as strong as it had been during the same period the previous year. Many lingering uncertainties, such as ongoing inflation and steep raw materials and transportation costs, were still affecting purchase plans. Buyers remained cautious on concerns that base oil prices might move down, catching them with pricey inventories, as values had been on a downward trend during the first few weeks of 2023. Producers had granted temporary value allowances or adjustments in November and December, and this contrasted sharply with the consecutive rounds of base oil price increases seen at the beginning of 2022.

The year-end downward price trend culminated with paraffinic producers’ implementation of a posted price decrease of 15 cents per gallon to 60 cents per gallon in January. Motiva and SK Lubricants Americas also issued steeper price cuts on their Group II+ grades to bring values more in line with prevailing market prices.

On the naphthenic side of the business, suppliers lowered prices by 20 cents and 30 cents per gallon in mid-January as well.

A tightening supply and demand scenario might offer support to prices in the second part of the first quarter. API Group II spot availability was expected to become more limited as Excel Paralubes embarked on a two-month turnaround at its Group II plant in Westlake, Louisiana, in late January. The producer was understood to have built inventories to cover contractual obligations during the outage, but spot supplies may be restricted, although this information was not confirmed by the producer directly. A second Group I/Group II producer was contemplating a two-week turnaround starting at the end of March. A third Group II producer was expected to shut down its plant for maintenance in the second quarter and could be starting to build stocks in the first quarter.

Naphthenic base oil prices were also receiving some support from a balanced-to-snug supply and demand ratio, given that orders have started to pick up and a turnaround at San Joaquin Refining’s Bakersfield, California, refinery took several barrels out of the supply system. The turnaround began on January 21 and was expected to last approximately four weeks.

Base stock availability could also be affected by refiners’ incentive to maximize distillates production as diesel prices remained firm on strained supplies. Sources said that the ultra-low-sulfur diesel market was very strong, although prices had come off previous highs. The drive to produce more diesel could lead to reduced base oil output, a situation that also influenced refinery operations last November and December, resulting in low inventories of Group I grades. An increase in diesel production may prevent the building of Group I or Group II inventories, but sources speculated that it would not cause any base stock shortages.

In the realm of Group III base oils, supply and demand were deemed fairly balanced, depending on the cut. The 4-cSt grade continued to command the most attention given its burgeoning use in automotive applications, and supply of this grade was therefore more strained than that of the 6-cSt and 8-cSt grades. Most of the Group III base stocks used in North America are imported from Asia and the Middle East, and plants in both regions were running well, allowing for plentiful supplies to move to the Americas. However, a South Korean Group II/Group III unit was anticipated to undergo maintenance in June, which could restrict supplies beforehand if the producer started to build inventories.

With more positive news coming out in early February regarding falling inflation and a flourishing job market in the U.S., industrial activity was also expected to increase in the coming months, although consumer spending—considered the biggest engine of the U.S. economy—was beginning to abate, according to media reports. The softer sentiment could also impact the lubricant and finished products segments in the short term and affect base oil requirements.

Major lubricant manufacturers have communicated price decreases on most lubricants of up to 8%, effective mid-January, while several independent blenders have decreased lubricant prices between 40 cents and 55 cents per gallon on the back of lower base oil values and sluggish demand. Suppliers hoped that the decreases would encourage additional lubricant purchases.

Despite many ongoing uncertainties, as base oil prices have come down and many consumers had started the year with low inventories, there should be enough incentive for buyers to gradually bump up orders and prepare for the more upbeat spring production cycle.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com