Never a Dull Moment

The base oils market may be a lot of things, but it is definitely not boring. There is always something going on. The year-end holidays started with a powerful winter storm sweeping through the United States, which forced several refineries, base oil plants and gas production sites to shut down temporarily.

Some units at Motiva’s Port Arthur, Texas, refining complex were offline for at least two days during Winter Storm Elliott because of hydrogen supply issues. There was no direct confirmation from the producer, as the company does not comment on the status of its operations, but sources said that the shutdown was brief and that the refinery was up and running shortly after the storm.

The Cross Oil naphthenic base oil refinery in Smackover, Arkansas, shut down as a precautionary measure ahead of the storm but suffered no significant damage from the freeze. The unit was brought back up a few days later and was running at 100% at the time of writing.

A couple of other refineries were also heard to have been affected by “freeze-ins” and production setbacks, but the storm may have had a more limited impact on base oils than expected. The weather-related disruptions had earlier led to speculation that base oil supply might tighten in the weeks following the storm. This would have been particularly impactful if it were combined with the plant turnarounds that are scheduled during the first quarter of 2023.

Sources also noted that many buyers and sellers had likely reached the end of the year in possession of minimal inventories, and any supply disruptions could potentially result in product shortages. The similarly devestating Winter Storm Uri in February 2021 had led to production outages and a chaotic supply situation.

Several plant events will be taking place during the first quarter, including an extended turnaround and catalyst change at a large API Group II facility on the Gulf Coast that was anticipated to start in late January and last almost two months, with spot volumes likely to be curtailed. A second Group II producer has also scheduled maintenance work in the first quarter. A third Group I and Group II producer was considering a two-week turnaround at the end of March.

The naphthenic base oils segment may also see tightening supplies along with an uptick in demand. Naphthenic base oil producer San Joaquin Refining will be installing a new vacuum distillation tower at its refinery in Bakersfield, California, starting in late January, and expects the unit to be down for four weeks. Planned and unplanned production outages during the second half of 2022, coupled with healthy demand, had already strained pale oil supply in the weeks leading to December 31. Naphthenic producers also communicated 30-cents per gallon decreases, effective January 16.

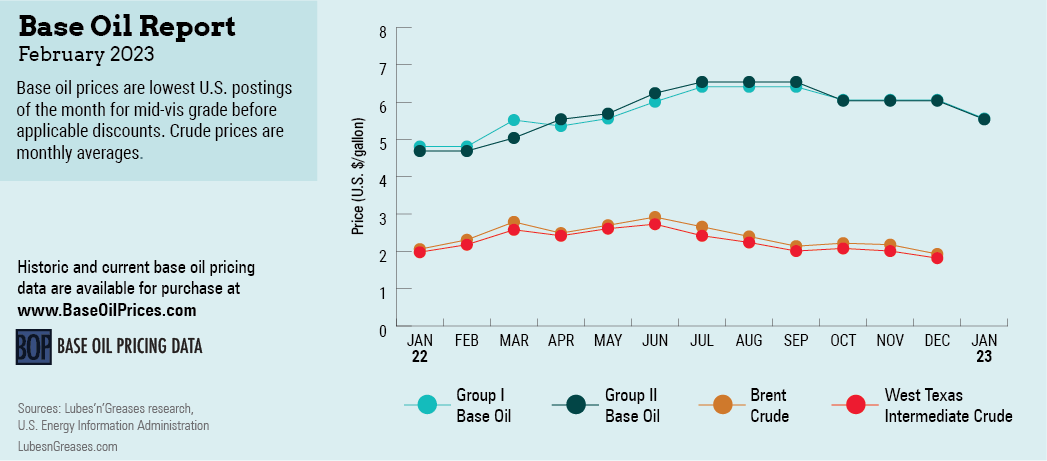

In terms of pricing, January 1 saw the implementation of the first posted price adjustment of the year as SK Lubricants Americas communicated decreases of 15, 25 and 40 cents per gallon on its Group II+ and Group III base oils. A vast majority of paraffinic suppliers and rerefiners also stepped out with decreases between 20 cents and 60 cents per gallon, depending on the product and the supplier, which went into effect in early January. The posted price decreases followed producers’ granting of temporary value allowances or adjustments that ranged from 10 cents to 50 cents per gallon in November and December.

Aside from a need to stimulate orders because of a seasonal supply and demand imbalance, softer crude oil and feedstock prices were thought to have driven the price decrease initiatives. West Texas Intermediate futures were trading in the mid $80s per barrel in early November 2022 and had fallen to the mid $70s per barrel by early January. Diesel prices had spiked in late 2022 as well, offering an incentive for refiners to divert more feedstocks into the distillates stream. But values softened toward the end of the year, and base oil margins became more attractive.

An improved additive supply situation was expected to lead to an uptick in base oil demand, although prospects for lubricant consumption were still somewhat clouded by lingering inflation and reduced consumer spending amid recession fears.

As is the case every year when the industry moves into the spring season, base oil buying activity is anticipated to pick up, lending support to prices. However, uncertainties related to factors that are beyond market participants’ control may also precipitate many surprising and interesting challenges.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com