Need to Know

The passenger car motor oil business in the United States presents several growing challenges for lubricant manufacturers and marketers. Most notable is the need to continually invest by improving the performance of PCMO in a market where demand is on a downward trajectory.

At the start of the millennium, PCMO accounted for almost 33% of all lubricants consumed in the U.S., while in the year prior to the pandemic it represented 24%. The decrease in demand was primarily brought about by extended drain intervals. OEMS used to recommend changing oil at 3,000 miles, but the majority now recommend 7,500-10,000 miles.

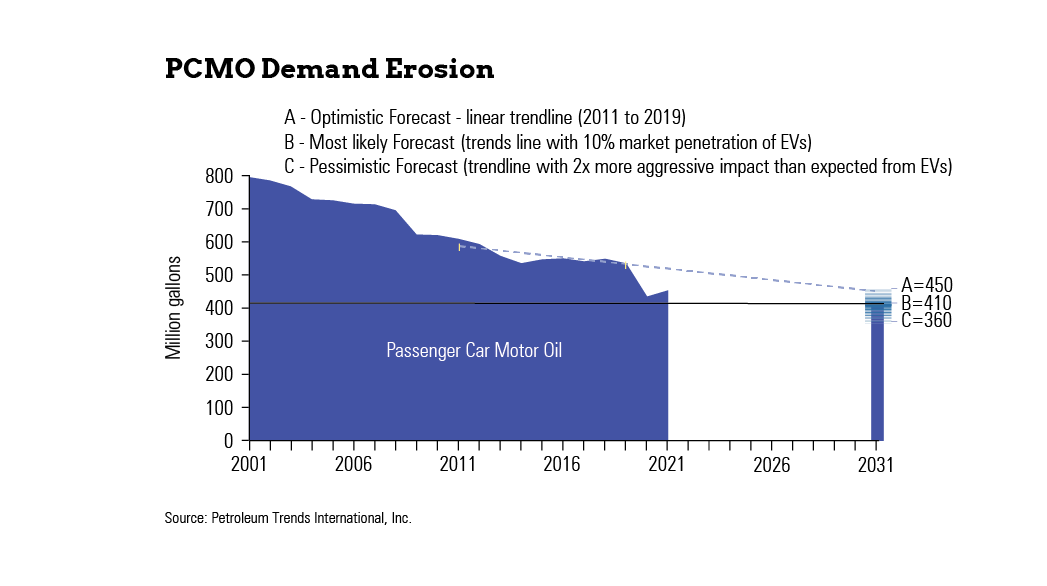

With the trend of longer drain intervals continuing to inch up and the penetration of electric vehicles rapidly gaining traction, the question isn’t if demand for PCMO will continue to decline—instead it’s how far and fast it will fall.

To get a sense of what might be on the horizon, it’s helpful to first examine the rate of PCMO demand erosion over the past 20 years. From 2001 to 2021 demand dropped from nearly 800 million gallons to just under 535 million. This represents a compounded annual growth rate of -2.8% and a loss of 265 million gallons. However, this period includes the unprecedented decline in demand in 2020 and 2021 due to COVID. Excluding this anomaly by looking at the period from 2001 to 2019, demand shows a CAGR of -2.2%. Looking at the past 10 years but excluding COVID, demand declined at a CAGR of 1.5%. Assuming the latter rate of decline is most representative and continues over the next 10 years, and PCMO demand in 2022 followed the trajectory it was on from 2011 to 2019, demand for PCMO in 2031 would reach only 459 million gallons—a loss of nearly 76 million gallons from 2021 to 2031.

The trendline includes only the start of a surge in demand for EVs. According to a recently updated report by the Edison Electric Institute, the number of light-duty vehicles on U.S. roads will reach 26.4 million, or 10% of the total car parc in 2030. EVs currently account for just over 1% of the car parc but 5% of new sales, so if this forecast comes to fruition, demand for PCMO in the U.S. could see a loss of nearly 40 million gallons layered atop the aforementioned 76 million. This would put PCMO demand at roughly 410 million gallons, or about 25% below where it was just prior to the pandemic.

This forecast is far from certain, though, due to the complexity and uncertainties around such variables as how long older cars stay on the road, oil drain intervals, government incentives to purchase EVs, expansion of the EV charging infrastructure, increasingly stringent emissions standards, the price of ICE and EV vehicles, and other factors. But even if EV sales sputter, few will argue that demand for PCMO in the U.S. will decline.

Another important trend impacting PCMO is the continuing migration to lower-viscosity multigrades. In 2001, Ford started to recommend SAE 5W-20, which eroded 5W-30 sales. In 2010, SAE 0W-20 began to come on the scene in a big way when Honda and Toyota recommend this viscosity grade. Today 0W-20, represents close to 30% of PCMO sales in the U.S. By 2030, SAE 0W-20 is expected to be the leading viscosity grade, and monogrades and light-duty engine oils that are 10W-30 and above will be nearly extinct by 2031.

Changes in base stocks brought the key innovations that enabled these lower-viscosity grades to become standard OEM recommendations. Group I base stocks did not allow for low viscosities with reasonable limits on oil volatility. Group III enabled SAE 0W-XX oils as well as more premium SAE 5W-XX products to meet lower viscometrics, low-temperature requires and increasingly stringent volatility requirements.

Further, Group III oils are evolving at higher viscosity indices, which will enable even lighter oils with lower volatility than can be achieved today. SAE 0W-16 oils are already in the market, and PCMOs as light as 0W-8 are being used in some small engines, typically hybrids. These lighter grades will likely represent niche products over the next 10 years.

Importantly, the move to lighter-viscosity PCMO is also driving up demand for synthetic PCMOs. The reason for this is that such viscosity grades as SAE 0W-20 and 0W-16 require the use of higher-quality base oils. In addition, OEMs are increasingly recommending higher performing products requiring better base stocks to meet the requirements of their engines. One example is seen in GM’s dexos1 Gen2 specification introduced in 2016, which calls for a product requiring a lower volatility base stock. The move to higher-quality products will cause erosion of PCMO demand, since better base stocks offer the opportunity to further extend oil drain intervals.

There will always be debate around any forecast, but all arrows point to a marked decline in PCMO demand as we move into the next decade and beyond. While demand declines, the cost to make PCMO will increase due to the need for higher-cost base oils and new additive formulations required to meet increasingly demanding performance specifications. With that, one of the leading challenges blenders and marketers face is how to price and promote PCMO in a market where the intensity of competion will increase due to falling demand and costs will increase due to more demanding performance specifications.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com