Hope and Rebirth

While visiting the “Ramses the Great” Exhibit at the de Young Museum in San Francisco, I learned that the ancient Egyptians believed in the rebirth of the soul. “Rebirth” also means that something might flourish after a decline. The end of the year often brings the opportunity to ponder about events that took place during the previous months and incites thoughts of reinvention. Will the base oils and lubricants industry experience a rebirth in 2023?

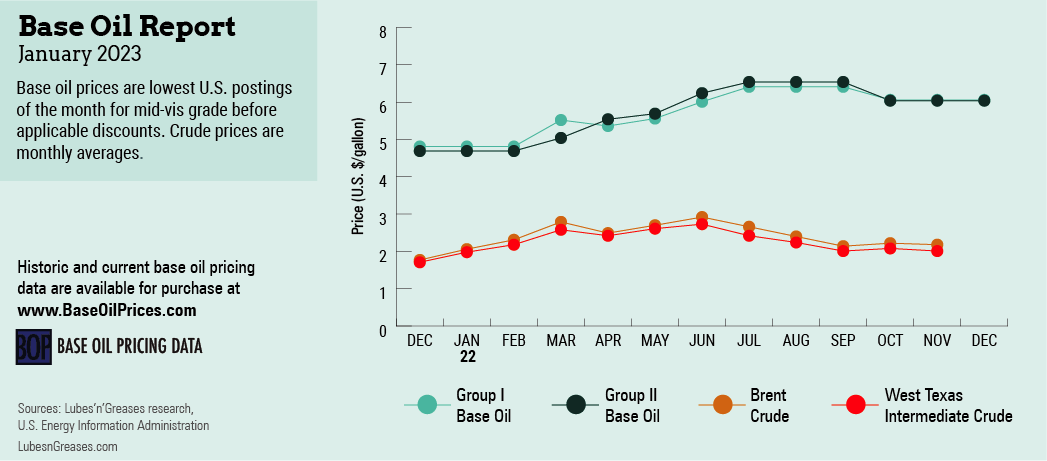

At the start of 2022, there was a sense of optimism as daily life seemed to regain a semblance of normalcy following two years of unforeseen conditions brought by the COVID-19 pandemic. But in late February, Russia launched a war against Ukraine, triggering a series of destabilizing effects, including volatility in crude oil and feedstock prices—a condition that impacted base oil values for the rest of the year.

Russia’s attacks on Ukraine prompted a United States ban on Russian oil, liquified natural gas and coal imports in early March and sent crude values to 13-year highs. During the first week of March, West Texas Intermediate skyrocketed to above $120 per barrel. Crude futures remained volatile for most of the year, and concerns about a global recession, rising inflation and reduced crude demand in China plunged WTI prices to the low $70s/bbl by early December.

The U.S. also faced a potential national rail strike that month, which would have paralyzed the transportation of innumerable products and crippled economic activity.

Additionally, record low water levels in the Mississippi River and its tributaries due to a drought in the Midwest caused transportation issues and raised barge shipping costs as vessels were forced to lighten their loads.

Industry participants admitted it was difficult to forecast product needs for 2023, as market trends had not been consistent with those from previous years. While base oil supply typically outstrips demand in the last three months of the year, the situation in late 2022 was exacerbated by persistent additive supply issues, which led to reduced base stock demand from finished products segments. Additionally, rising inflation and economic uncertainties dampened consumer confidence along with fuels and lubricants consumption.

By the end of 2022, additive supply conditions were improved compared to two or three months earlier when many customers had been placed under strict sales allocations due to production outages. Lingering issues affecting certain sectors were not anticipated to be resolved until mid-2023, particularly for additives used in gear oils and certain industrial applications.

The base oil supply-demand imbalance continued to place downward pressure on values, with spot prices edging down as suppliers tried to encourage orders, particularly domestically, since export opportunities had dwindled due to muted buying interest and high freight rates.

While plentiful availability of API Group I and Group II base oils exerted downward pressure on pricing, values for Group III grades were relatively stable on healthy demand, although supply of 6-cSt and 8-cSt grades began to lengthen.

Despite strong demand for diesel, margins weakened in early December compared to base oils, and there was less incentive for refiners to trim base stock production rates or to use light grades for fuel blending. Many suppliers also released extra inventories kept in case of hurricane-related production disruptions.

There were no posted base oil price revisions, but reports emerged of U.S. suppliers granting temporary voluntary allowances into select domestic contract accounts. Producers expected the market to tighten in the first quarter given a fairly busy plant maintenance schedule, lending more stability to pricing.

An extended turnaround at a large Group II facility on the Gulf Coast in late January lasting up to two months was likely to limit spot availability. A second Group II producer was expected to complete maintenance in the first quarter, and a third Group I/II producer was planning to start a two-week turnaround in late March.

Buying interest remained healthy for naphthenics, particularly from the transformer oil, tire and rubber manufacturing segments. A planned turnaround at Calumet’s naphthenic plant in October and unexpected production issues at another facility earlier in the year contributed to a tight supply and demand ratio. A planned turnaround at San Joaquin Refining’s unit in late January may prolong snug conditions, offering support to the prevailing price structure despite the slump in crude and feedstock values.

What can the base oils market expect in 2023? While many factors are difficult to predict, there will be increased efforts to work on sustainability and emission targets as well as to maintain steady production rates, healthy consumption levels and stable pricing.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com