A Cool Summer Breeze

After a sweltering summer—not only because of the high temperatures that scorched large parts of the country but also because of unprecedented base oil fundamentals—a crisp summer breeze in the shape of lower crude oil and feedstock prices, along with easing supplies, led to a cool-down in base stock pricing in early August.

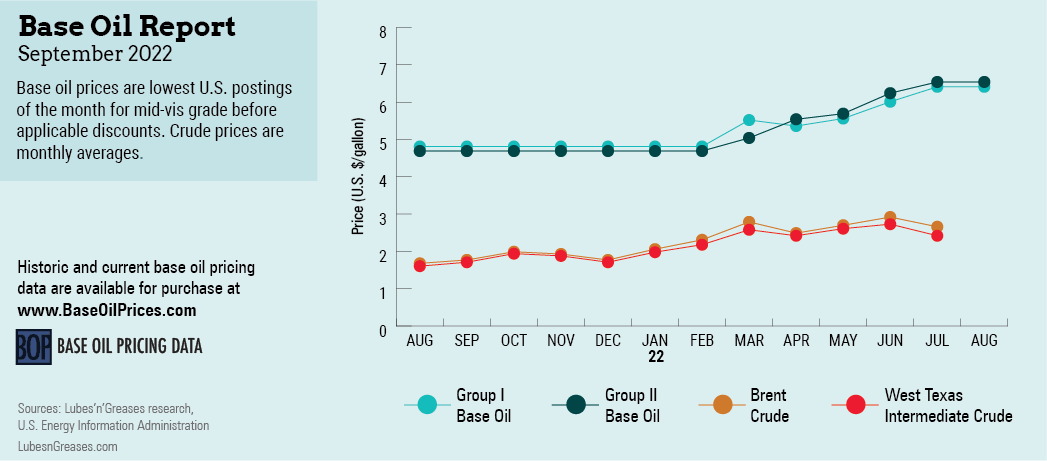

This was a welcome turn of events for consumers, as base oil prices had seen heated conditions during the first half of the year, with six consecutive rounds of increases implemented since January. The upward adjustments had been driven by sky-high crude oil and feedstock prices, together with healthy base oil demand, tight global supply and reduced base oil output as refiners favored the production of distillates due to attractive margins.

The last increase was prompted by strong market fundamentals and the need to bolster margins, with paraffinic base oil producers communicating posted price increases between 20 cents per gallon and 40 cents per gallon between June 14 and June 27.

On the naphthenic base oil front, producers implemented 30 cents per gallon and 45 cents per gallon increases between June 15 and July 6.

In the first few days of July, however, crude oil futures became very volatile due to the prolonged Russian war on Ukraine, global energy supply concerns and fears of a potential worldwide recession. Crude oil prices generally softened compared to earlier in the year when they had reached record levels, and this relieved some of the pressure on base oil values. West Texas Intermediate futures were hovering near $95 per barrel in late July, down from highs of around $123 per barrel in early March.

Despite the drop in feedstock prices, spot and posted base oil prices remained relatively stable throughout July. This stability was supported by healthy demand, balanced-to-tight inventories and the prospect of snug availability as a couple of base oil plants were set to begin turnarounds.

Additionally, base stock buyers and sellers alike kept healthy inventories during the hurricane season—which started on June 1 and will finish on November 30—to cover potential weather-related supply disruptions along the United States Gulf Coast, where many base oil facilities are located.

By early August, however, reports of discounts and temporary voluntary or value adjustments (TVAs) and lower spot prices started to emerge on the paraffinic side. On the naphthenic side, official announcements by Ergon, Calumet and Cross Oil ushered in the first price decreases of the year.

Naphthenic base oil producer Ergon announced a decrease of 30 cents per gallon, effective August 5, while Calumet also stepped out with a 30-cent decrease, which went into effect on August 8. Cross Oil communicated a 30-cent decrease on packaged naphthenic oils, also effective August 8, and offered a discount on bulk base oils on a customer-by-customer basis.

Meanwhile, pale oils supply and demand remained balanced, with suppliers reporting healthy demand for the light grades amid snug conditions.

An unplanned production outage and force majeure declaration at a U.S. additives plant in late July was expected to exacerbate the lingering tight additive supply situation and have repercussions on base oils consumption as well.

On July 26, Afton Chemical declared force majeure on additive production at its plant in Sauget, Illinois, which was flooded and forced to shut down following torrential rains in the St. Louis, Missouri, area. The company told customers that it would be limiting order quantities on engine oil additive packages and off-road products in North America.

Production outages and supply chain disruptions had caused ongoing supply headaches within the additives segment since late 2019, sometimes forcing lubricant blenders and finished product manufacturers to reduce operating rates and place customers on allocation. The unexpected shutdown of Afton’s additives plant was likely to affect lubricant output rates and possibly result in reduced base oil demand, although the full impact of the additives production outage was difficult to ascertain.

While supply and demand fundamentals remained strained in some segments of the base oils market in early August, it was easy to see that the tide had begun to turn in terms of pricing, and that the heated conditions observed during the first part of the year had finally started to simmer down.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com