Automotive

Recent events—such as the Russia-Ukraine war and skyrocketing inflation rates—have prompted many questions about gasoline, including its cost, its composition and its future. There are a number of misconceptions, assertions and falsehoods floating around that need to be addressed.

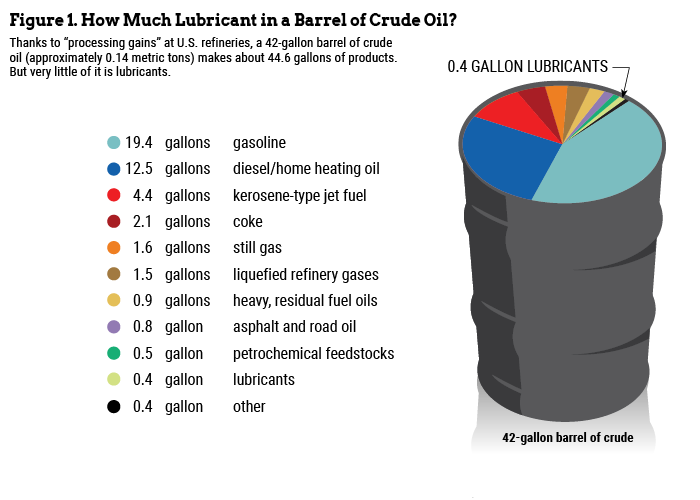

The first misconception is that gasoline and diesel are the only crude oil-derived products of any value and that the rest of the barrel is junk (my words). In fact, gasoline and diesel constitute about 60% of the total, but they are not the only assets in the crude barrel. Lubricants, which account for only about 1% of the products that can be made from a barrel of crude, are essential to the operation of any mechanical device in which friction, deposits, corrosion or wear is a problem. Petrochemical feedstocks account for 4% and are used to make the additives that augment the lubricant’s properties. The feedstocks are also used to make other products. These include such things as plastics, synthetic fabrics and pharmaceuticals.

To further address the question of crude value, Figure 1 identifies some of the products made from crude oil. Of course gasoline and diesel constitute the “flywheel” that runs the show, but they are not the primary profit producers.

Crude oil is a commodity and is traded just like wheat or pork bellies. Crude is traded in 1,000-barrel lots for delivery at a future date. The price varies with demand and availability. Since April, traditionally the start of the summer driving season, there has been a push for more crude to produce gasoline and diesel. Costs are higher because crude is at a premium right now. Given the high inflation that the United States and other countries are experiencing, prices are in the range of $100 per barrel and more. Refiners make spot purchases to assure adequate supplies are available, but they pay a premium for the additional volume.

Once crude oil is purchased and delivered to the refinery, processing of the oil begins. In case you are unaware of how a refinery works, it’s basically a huge distillation apparatus. The crude is boiled, and the various boiling range factions are separated to form the products we all know. The first time through the system, the crude is boiled at atmospheric pressure. That separates fractions between 85˚F up to about 700˚F-750˚F. What is left in the distillation unit (crude unit) is called reduced crude. The reduced crude is then re-boiled under a vacuum. By reducing pressure, the higher boiling components can be separated without significant degradation. This process is where base oils and other heavy products are made. From there, other processes—such as catalytic cracking, hydrogen processing and reforming—are carried out. The net result is that what was once a pot full of various hydrocarbons is now an array of hydrocarbons, which are used to supply a wide variety of products.

|

Ethanol has a high octane number, so blending it into

gasoline provided an octane kick that allowed for more efficient engine operation. However, ethanol has less

energy content than hydrocarbons as well as lower

volatility.

|

I want to focus on gasoline and the misconceptions about it. Almost all gasoline contains about 10% ethanol for two reasons. First, ethanol was introduced in about 2003 to replace MTBE (methyl tertiary-butyl ether) as the oxygenate in gasoline. This improves the emissions performance of the gasoline. The changes to fuel in 2003 required that only ethanol could be used. An additional benefit was that it extended the supply of petroleum-based fuel. This was prior to the widespread use of fracking, which materially increased crude reserves.

Ethanol has a high octane number, so blending it into gasoline provided an octane kick that allowed for more efficient engine operation. However, ethanol has less energy content than hydrocarbons as well as lower volatility. The major source of ethanol in North America is from corn. About 40% of the annual corn crop is converted to ethanol instead of cattle feed and food.

Here’s where some people get confused. When the refinery prepares gasoline, it makes a blend called conventional base oxygenate blend (CBOB, for short). This product is shipped by pipeline or other means to a blending terminal where it is mixed with ethanol and other specialized additives to form the gasoline sold at local gas stations, most of which are associated with convenience stores. In fact, less than 10% of all gasoline outlets are owned by oil companies.

It’s even more confusing when you consider that many areas of the country have unique climatological saturations that require additional blending. Phoenix, Arizona, where I live, is such an area (called non-attainment). This means that at certain times of the year and depending on climatic conditions, the gasoline does not allow vehicles to meet emissions requirements. The refiners’ answer to that is to make a different blend called a reformulated base oxygenate blend (RBOB, for short). The differences between RBOB and CBOB are mostly related to volatility.

So at this point I’m sure some of you are asking, “What has this got to do with engine oils?” That’s a good question and one that has been in the back of my mind for some time. Here are my thoughts on that point.

Oxygenates have been added to gasoline for many years. When I was new to the business and working at ARCO Research in California, we were field testing MTBE in a fleet of Fords. We were testing MTBE because an ARCO chemical plant produced it as a byproduct. The test was complex and included 18 identical vehicles driven by employees. The participants drove them for two weeks and then changed to another car until they had driven 12 of them. Mileage, oil properties, fuel economy and driver comments about drivability were carefully noted. We were comfortable with MTBE in gasoline because it reduced emissions. Later, experience showed that it was contaminating groundwater through leaking underground storage tanks at gas stations. Specifying ethanol as the only suitable oxygenate in the 2003 legislation was a means of preventing groundwater contamination.

That was a bunch of engine oil categories ago, and no engine tests at the time were run using fuel containing ethanol. That is still the situation today.

I think this is an important oversight and will be compounded by the federal government’s decision to authorize up to 15% ethanol. At the same time, GF-7 (which is an unofficial name) is in the wings to be developed by the middle of this decade. The new fuel economy and emissions standards will become the law at that time.

So here we are: There is no standardized test or tests that have been developed for engine oils using fuels containing ethanol. There is a federal decision allowing 50% greater levels of ethanol in gasoline and a significant improvement in fuel economy and emission levels required by 2025. The proposal to allow 15% ethanol in gasoline was made several years ago and resulted in opposition by small engine manufacturers. These are the folks who build string trimmers, lawn mowers, blowers and so forth. The higher content of ethanol was causing problems with seals and fuel. About 20 million vehicles on the road can use up to 85% ethanol. Wholesale introduction of such vehicles cannot be adequately supplied with high-ethanol fuels. There are more than 280 million vehicles are in operation in the United States. The average age of the car parc in the country is 12.2 years, and new vehicle prices are through the roof, partly due to inflation. The COVID-19 pandemic killed new car sales for nearly three years. Inflation has raised vehicle prices, and there is a lot of pent-up demand for newer cars.

Then there’s the electric vehicle. The cost differential between internal combustion-powered cars and EVs is around $20,000. That means the vehicles in operation will continue getting older and will require better engine oils to keep them running. It seems to me that the next 20 years will be very interesting for shop owners and quick lubes. The opportunities are there for vehicle maintenance of this older, ICE population. But success in this area will require a distribution system that has a wider variety of products—for instance, there are dozens of transmission fluid requirements—as well as aftermarket additives.

The bottom line is that the death of the ICE is not assured; however, the EV will inevitably become the normal means of transportation. There are lots of hurdles to overcome, including infrastructure, battery design, driving range and vehicle cost. Don’t give up hope, though. The ICE will likely not be lost, just improved.

Steve Swedberg is an industry consultant with over 40 years experience in lubricants, most notably with Pennzoil and Chevron Oronite. He is a longtime member of the American Chemical Society, ASTM International and SAE International, where he was chairman of Technical Committee 1 on automotive engine oils. He can be reached at steveswedberg@cox.net.