A Summer Rollercoaster Ride

Most people did not expect 2022 to be full of uncertainties. After two years of living with the COVID pandemic—which regrettably claimed more than six million lives globally and also wreaked havoc on most countries’ economic wellbeing—people hoped for a more orderly, predictable year.

Most people did not expect one country to start a war on a neighbor. But then Russia invaded Ukraine in late February, and it soon became clear that the conflict would not only impact the two nations but the entire world, turning 2022 into another unpredictable year.

To impair Russia’s economy and coerce the country to cease its attacks on Ukraine, the United States, members of the European Union and other countries decided to ban Russian imports of crude oil and refined products. This led to supply constraints and price spikes of crude oil and vacuum gas oil, ultimately impacting base oil output and pricing.

Throughout May and June, some U.S. refiners favored the production of fuels, like diesel and jet kerosene, over base stocks as prices skyrocketed and were competing with base oils. This resulted in decreased production of base stocks in some cases, although most plants were said to be running at normal rates.

Several turnarounds were slated for the third quarter, and producers were starting to build stocks ahead of their shutdowns, limiting spot supply in the domestic market. Buyers and suppliers also started to bolster inventories in preparation for the hurricane season on the Atlantic Basin, which began on June 1. Severe weather could potentially disrupt base stock production along the U.S. Gulf Coast in the coming months.

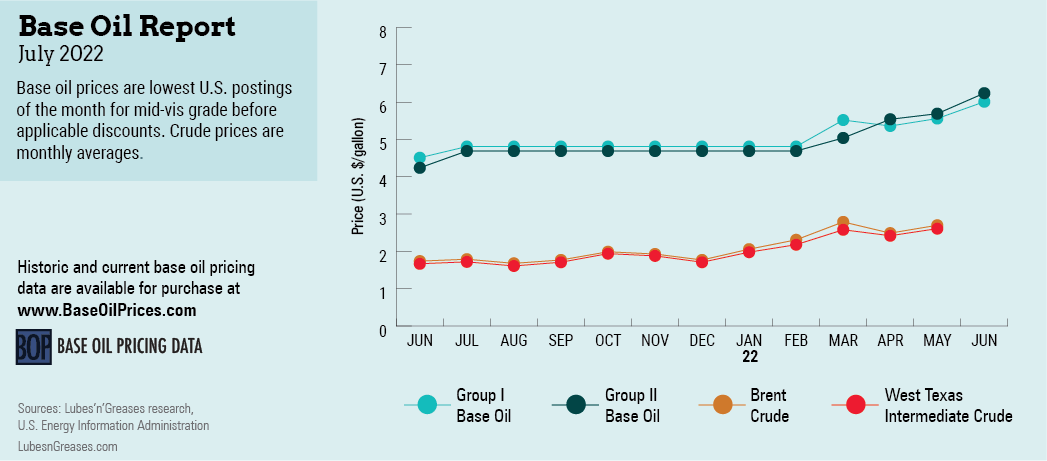

The combination of all these factors exerted pressure on base oil pricing and led to several increase initiatives in late May and early June. Both paraffinic and naphthenic base oil producers communicated price increases, driven by a need to prop up margins as crude oil, feedstocks, transportation and other costs continued to escalate.

On the paraffinic side, in early May a series of markups first lifted postings between 20 cents per gallon and 70 cents per gallon, with implementation dates set between May 4 and May 23.

No sooner had these increases been implemented than a second round of increases emerged. A vast majority of API Group I, Group II and Group II+ producers implemented posted price increases of 20, 25, 30, 35 and 45 cents per gallon, depending on the supplier and the product, with effective dates sprinkled between May 20 and May 27.

On the naphthenic front, producers increased the price of all viscosities by 25 cents and 30 cents per gallon, with effective dates between May 16 and May 31.

Shortly after, Cross Oil announced another upward adjustment of 30 cents per gallon, with an effective date of June 15. Other suppliers continued to monitor the market intently as fundamentals remained volatile.

Similar conditions to those prompting the increases on the paraffinic side fueled the markups for pale oils. The supply-demand ratio was balanced to tight, and crude oil and feedstock prices were exerting upward pressure on pricing. Other mounting costs such as raw materials, energy, transportation and labor added to the pressure.

Base stock consumers faced difficulties in transferring the higher raw material prices down the supply chain, despite several increase initiatives for finished products scheduled for May-July implementation. Furthermore, an additive supplier also communicated a price increase of up to 10%-15%, expected to go into effect on July 1. This was the third additive increase since the beginning of the year.

Lubricant and other finished product manufacturers, including several majors, initiated their own price markups due to the relentless climb in raw material prices. Increases of up to 8%-20% were communicated, with implementation dates scheduled between May 27 and July 5.

The additive segment had been plagued by production issues and other conditions leading to supply shortages in the first two quarters of the year. While lubricant manufacturers continued to deal with strained raw material supplies, the situation was much improved compared to earlier in the year, with some blenders able to source most of the additives they needed because additive plants had ramped up rates. However, price pressure seemed to be a factor affecting everyone equally.

Just like riders must fasten their safety belts when riding rollercoasters at an amusement park, base oil participants will also need to be prepared for the ups and downs that the market will likely throw at them this summer.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com