Dispersants are a vital component for lubricant formulators. They are widely used in a variety of lubricant applications and may make up 60% of the additives in a crankcase lubricant package. Usage has grown for many decades, with variations of chemistry based on their purpose. Why are they so important, how have they evolved over time, and will they continue to be a major formulation component in the future?

Dispersant Function

Ashless dispersants are used primarily in passenger car, motorcycle and heavy-duty diesel crankcase oils plus automatic transmission fluids. To a lesser extent, they may be used in other such applications as natural gas engine oils, other transmission oils, and marine and industrial lubes.

Dispersants keep insoluble materials and soot suspended in the oil so they can be removed at the next oil change. They prevent waste materials from agglomerating, causing deposits around the engine and reducing operational efficiency.

In gasoline engines, sludge formation under low speed, low temperature, stop-go conditions can be an issue. Oil-insoluble polar materials and contaminants build up in the oil. If unchecked, they cause sludge and varnish in cooler areas of the engine, creating operational problems.

Dispersants control viscosity increase caused by soot formation, primarily in HDD engines but also in some gasoline direct injection engines. The soot is created during the combustion process and makes its way into the bulk oil, causing the oil to thicken.

Natural gas engines can be very sensitive to lubricant ash levels. They come in many designs and operate on a wide variety of fuel sources. Lubricants with no or very low ash rely on ashless dispersants to provide the maximum control of insolubles and deposits.

Automatic transmission fluids usually contain some level of dispersancy. Ricardo Bloch, a retired industry chemical engineer based in the United States, told Lubes’n’Greases that the dispersant function is “to keep the clutches free of debris by dispersing the oxidation by-products. If the clutches are plugged or glazed, the transmission will not shift on time. These factors make these dispersants different from the crankcase dispersants.”

Dispersant Chemistry

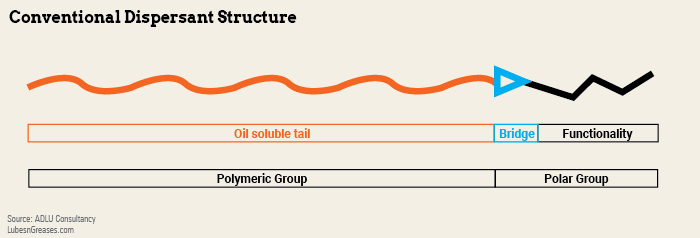

Conventional dispersants are organic materials consisting of an oil-soluble polymeric tail, usually polyisobutylene, and an attached polar group. The polar group consists of a bridging group, usually maleic anhydride, and a functional group normally based on nitrogen.

The most common conventional dispersant type uses PIB as the oil-soluble group. The molecular weight is a key variable for dispersancy properties. “PIB is made by oligomerization of isobutylene and is available in a variety of molecular weights from a few hundred to tens of thousands,” Bloch said.

“The polymeric group has to be oil soluble, and the polar group has to attach itself to the waste material in the oil so that it remains in the oil solution,” he added. “If the alkyl polymer group is too small, the dispersant is not capable of keeping the insoluble material dispersed.”

To convert PIB into dispersant, it is grafted with maleic anhydride (bridge) to form polyisobutylene succinic anhydride. The reaction with maleic anhydride can be “thermal,” using highly reactive PIB (HR-PIB) or facilitated with chlorine gas. More than one maleic anhydride can be added to a molecule of PIB to maximize the functionality per molecule.

PIBSA then reacts with an amine to give functionality. The type and nitrogen level of the amine is a further variable, and in many dispersants this is a polyamine. Other modifications, like adding boron, can be made to amend the properties.

Dispersant viscosity modifiers are used in some engine oil formulations. They do not use a PIB polymer, but instead a standard polymer, like olefin copolymer, which reacts with maleic anhydride to become functional. These have much longer chain lengths than conventional dispersants.

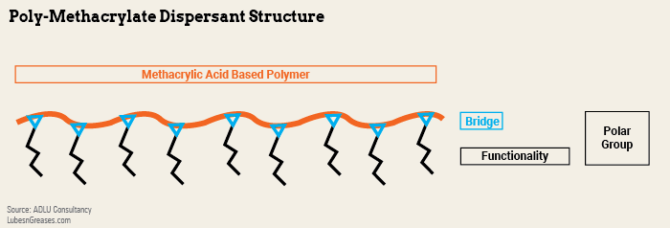

Dispersant poly-methacrylates use an alkyl methacrylate monomer to create an oil soluble polymeric group. The carboxylic acid group in the monomer is used as a bridge to add the nitrogen-containing functional groups. The bridge group and functionality are regularly attached along the polymer chain.

Dispersant PMA properties can be varied through the choice of the methacrylate-based monomer, the polymer molecular weight as well as the type and nitrogen level of the functional amine group. They combine the process of enhancing the viscosity characteristics of the fluid with dispersancy control. PMA VM technology is used in transmission fluids because of its very good low-temperature fluidity properties relative to other VM types. PMAs can be combined with the rest of the additive package into a single stable transmission performance package.

A Brief History of Dispersants

Dispersants started in widespread use in the 1950s in addition to the older technologies of zinc dialkyldithiophosphates and metallic detergents for crankcase lubricants. “When cars were driven for short distances, sludge formation occurred, which was improved by the use of low molecular weight PIBSA/PAM dispersants,” Bloch said.

Dispersant use grew between 1970 and 2000, particularly in response to the introduction of the Sequence V passenger car engine test for low-temperature sludge and varnish. The predominant dispersant technology was based on PIB, which was chlorinated to add maleic anhydride and then reacted with amines. “Dispersant PMAs were introduced in the 1960s followed by dispersant OCPs in the late 1970s.” Bloch said. “These materials were good at handling low-temperature sludge and varnish.”

Since 2000, there has been a greater emphasis on soot handling as diesel engines have taken a greater market share of passenger car sales globally and HDD engines have created higher soot loadings. “In the late 1990s, soot in diesel was a consequence of the OEMs trying to control NOX emissions,” Rolfe Hartley of U.S.-based Sangemon Consulting told Lubes’n’Greases. “Retarded engine timing lowered peak combustion temperatures, resulting in incomplete combustion and soot.”

He added, “Cooled exhaust gas recirculation (EGR) was also used to reduce NOX; however, this resulted in the introduction of highly acidic condensate into the oil, making soot thickening worse.”

Higher-molecular-weight dispersant technology was developed and showed better soot-handling capability. Formulators balanced dispersant components to cover low-temperature sludge and varnish and higher temperature soot handling, resulting in increased dispersant treat rates and dispersant mixtures.

Dispersants have been used for some time in 2-stroke marine cylinder oils, although detergency has historically been more important.

Dispersant VM usage declined in engine oils as base oil volatilities improved with the introduction of API Group II and Group III base stocks and improvements to conventional dispersants. The engine testing protocols for dispersant VM are complex because the formulation dispersancy level varies according to the VM treat rate for every viscosity grade. Constant dispersancy requires a fixed level of dispersant VM and the addition of a second non-dispersant VM to achieve a target viscosity grade.

Greater environmental awareness around residual chlorine contents in lubricants led to the introduction of chlorine limits in some OEM lube specifications. “Automotive OEMs had concern that chlorinated compounds in the lubricant could give rise to dioxins in the exhaust gases,” United Kingdom-based consultant Trevor Gauntlett told Lubes’n’Greases. “Dioxins are very stable; many are persistent, bioaccumulative and toxic, including being potent carcinogens.”

HR-PIB based dispersants were needed to meet these chlorine limits, and they also showed benefits in premium engine lube performance. Consequently, HR-PIB has seen a significant growth in demand, replacing chlorinated PIB for dispersants.

Future Dispersancy Requirements

Current drivers for new crankcase lubricants include reducing emissions and improving fuel economy. Dispersants have no significant impact on emission control hardware, like exhaust catalysts and particulate filters, and no contribution to the chemical constraints of sulfated ash, sulfur and phosphorus. Hence, they are beneficial components in formulations constrained for emissions. The drive to lower-viscosity oils to improve fuel economy is a challenge for dispersants, as they are a significant thickening contributor to low-temperature viscosity. Researchers are seeking to maintain the benefits of sludge, varnish and soot control while reducing the polymeric contribution to viscosity thickening.

“There is no expected need for greater low- or high-temperature dispersancy for emerging new North American passenger car specifications given today’s high level of protection,” Steve Haffner of U.S.-based SGH Consulting told Lubes’n’Greases. The use of passenger car diesel engines is in significant decline; diesels accounted for only 17% of new car sales in the EU in 2021.

“Levels of soot in the oil are much reduced due to exhaust aftertreatment devices,” Hartley said. “Lower soot levels in the oil means that additional soot control is not needed.”

A growing focus area is hybrid engines, which have both an internal combustion engine and electric motor. Reduced engine operating time or low-temperature operation in hybrids can create issues of condensation and sludge, giving opportunities for better dispersancy control.

For HDD, Haffner said that “it is expected that today’s level of protection is equal or better than what OEMs need in their new engines, so existing dispersants or more optimized versions will be sufficient.”

Hartley concurred. “NOX emissions are now controlled by selective catalytic reduction by urea eliminating the need to retard timing or to use EGR in the most advanced engine designs,” he said. “These engines produce less soot in the oil, requiring less dispersancy.”

Hartley added, “The main reason that the dispersant treat rates in HDD remain high is that they must be backward compatible with earlier engine designs.”

HR-PIB demand continues to grow with the significant decline in chlorinated dispersant usage. Gauntlett commented, “For manufacturers, there is the issue that chlorine itself is a highly reactive toxic gas, which can cause skin, eye and respiratory irritation at quite low concentrations. As it reacts with iron and some polymers, it requires specialist equipment for transport, storage and manufacturing.”

Dispersant VM for crankcase reduces the amount of conventional dispersant in the formulation to enhance fuel efficiency. However, very low-viscosity grades require little or no VM, so the dispersancy achievable is low. Customer resistance to dispersant VMs remains. Products tend to be unique, so supply security is a concern along with additional VM stock at blend plants.

For marine engine oils, the move to lower-sulfur fuels, increased use of distillate grades and new engine designs means that the use of effective dispersant is gaining importance. This needs to be balanced with the continued need for detergency when formulating new products.

For ATFs, again fuel economy is a key driver along with greater electrical and hardware compatibility in e-transmissions. Viscosity is becoming very low, limiting the need and possible use of VM in e-transmissions. However, dispersant PMAs can still play a role in ensuring better oxidation protection, potentially at a slight cost of higher electrical conductivity. Friction properties may also be needed if the e-transmission has clutches or synchronizers.

Philip Reeve is a chemist with 40 years of experience in the global lubricants and additives industry. He’s held positions at Afton, Infineum and ExxonMobil and is now a director of ADLU Consultancy. Contact him at philipreeve@adlu-consultancy.com.