Base oil production numbers in the United States took a steady dip in 2019, and the COVID-19 pandemic sent those numbers plummeting even more the following year. But 2021 data show the base oil industry in the U.S. returned to pre-pandemic production levels.

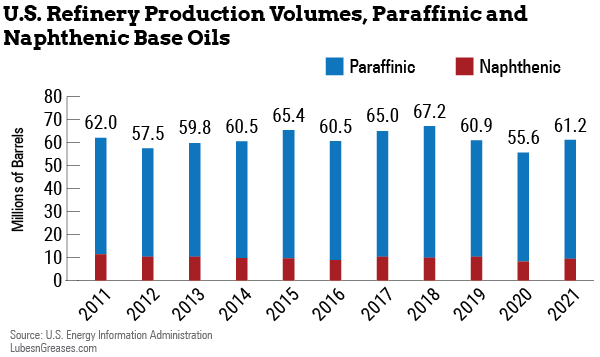

For 2021, the U.S. produced 61.2 million barrels of base oils, up 10% from 2020’s 55.6 million barrels, according to data from the U.S. Energy Information Administration.

Though 2021 steadied to 2019 levels, it lagged behind some recent years: 2017 production reached 65 million barrels, while 2018 production topped out at 67.3 million barrels. Production dropped to just 60.9 million barrels in 2019.

Steve Ames, managing director of SBA Consulting, said a few factors contributed to 2019 and 2021 falling behind previous years.

“Global base oil margins had been weak for many years as new capacity was being added without comparable closings—none since 2016—against a flat or declining demand,” he told Lubes’n’Greases. “Margins dipped to their lowest levels in 2018 and 2019 and led to global capacity utilization of 75%—a very uneconomic level.”

Ames said fuel demand increased in the second quarter of 2021 along with fuel refining margins, so crude throughput was increased, restoring vacuum gas oil feedstock to base oil plants and resuming full production.

Many refiners had planned maintenance for early 2020, before the onset of the pandemic, and their output was further cut during the spring and summer months.

While base oil demand was restored by the end of 2020 and beginning of 2021, Ames said, transport fuels did not rebound as well in that time period, which had a knock-on effect toward base oils.

“Fuel margins and overall refining margins remained at very weak, even negative, levels,” he said. “To pare losses, refiners reduced their crude intake, trimming operations—in many instances to minimum operable levels. Although base oils were profitable, there was insufficient feedstock to fully load the base oil plants. One should recognize that base oils are but a small part of a refinery’s production—rarely more than 10% of a refinery’s overall yield.”

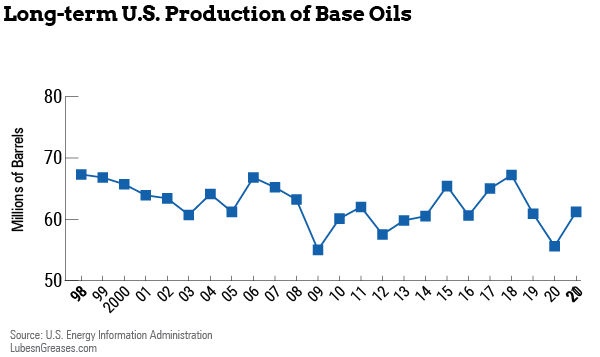

Amy Claxton, CEO of My Energy Consulting, said that despite the recent drop in production, when looking at the big picture, not much has changed. Production in 2021 and 2019 still hovers around the same totals as 2013, 2014 and 2016, with 2015, 2017 and 2018 all at similar, higher levels.

In its Rotterdam, Netherlands, facility, “ExxonMobil brought on Group II capacity and started importing it into the U.S.,” Claxton said. “I suspect this put a crimp on Group II output in [the U.S. Gulf Coast] as margins fell, which led to lower Group II output in 2019, pre-COVID.”

Naphthenic base oil production rose to 9.4 million barrels for the year in 2021, up 16% from 8.1 million barrels in 2020. In 2019, however, naphthenic production reached 10.2 million barrels, so 2021 marked an 8% decrease.

Paraffinic base oil production climbed 9% in 2021, from 47.4 million barrels in 2020 to 51.8 million barrels. Unlike in the naphthenic sector, 2021 topped 2019’s paraffinic production of 50.6 million barrels.

Production in the PADDs

Of the five Petroleum Administration for Defense Districts, all topped their 2020 production levels in 2021.

PADD 1, covering refineries on the east coast of the U.S., rebounded from a slow first half of the year by producing 4.1 million barrels in 2021, up from just under 4 million in 2020. In its first six months, the district was down 8%, which could be partly explained by a fire in May at Ergon’s refinery in Newell, West Virginia, that shut down the facility’s base oil unit. Force majeure was declared on base oils made at the refinery, which has capacity to make 2,900 barrels per day of API Group II base oils and 1,900 b/d of Group I.

Production in PADD 2—consisting only of HollyFrontier’s refinery in Tulsa, Oklahoma, with capacity to make 9,500 b/d of Group I—rose 22% for the full year, from 2 million barrels in 2020 to 2.4 million barrels.

In the ever-important PADD 3, which encompasses the U.S. Gulf Coast and contains the most base oil output in the country, production increased from 40 million barrels to 48.3 barrels, a 20% climb year-over-year.

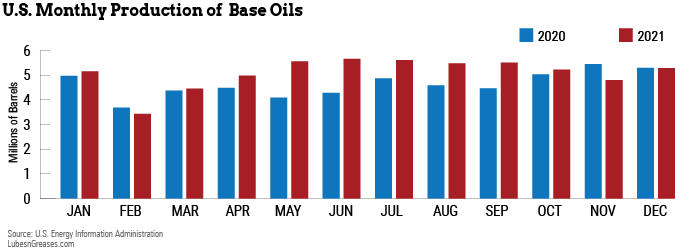

Still, severe winter storms in Texas in February 2021, which caused statewide power outages, put a dent in the district’s base oil production.

“Base oil and fuels production was heavily impacted by the ‘big Texas freeze,’ otherwise known as Winter Storm Uri,” Ames said. “It knocked 25 refineries offline for one to three months, including some with large base oil plants, such as Baytown and Port Arthur, and affected operations and extended turnarounds at still others.” ExxonMobil operates a 27,000 b/d plant—8,200 b/d of Group I and 18,800 b/d of Group II—in Baytown, Texas, while Motiva runs a 40,300 b/d Group II plant in Port Arthur, Texas.

|

“Base oil and fuels production was heavily impacted by the ‘big Texas freeze,’ otherwise known as Winter Storm Uri.”

– Steve Ames, SBA Consulting |

“That reduced supply by the better part of one million tons to the then-restored domestic demand and the lowest monthly production since 2009,” Ames said. “On the positive side, fuel margins improved by the reduction in fuels output.”

The interruption in base oil production in PADD 3 affected the rest of the lubricants supply chain.

“The lubricant additive producers were also impacted by Winter Storm Uri, either directly at affected production facilities or by their inability to source chemicals, feedstock or base oil from their Gulf Coast suppliers,” Ames said. “The resulting shortage of additives restricted many U.S. blenders from being able to meet all their customers’ lubricant demands for most of 2021. It added to the imbalance, as many blenders were then forced to reduce base oil purchases despite strong demand for their finished lubricants.”

In another severe weather event, Hurricane Ida, a Category 4 hurricane that made landfall in Louisiana in August 2021, had a “more marginal” impact on base oil production in the state, mostly at Excel Paralubes’ Westlake facility and ExxonMobil’s Baton Rouge plant, Ames said. The former plant makes 22,200 b/d of Group II, and the latter produces 16,000 b/d of Group I.

The area was still able to contribute 19.5 million barrels to PADD 3’s total.

Also of note, Hurricane Laura struck the Louisiana Gulf Coast in August 2020, reducing production at several refineries for up to two months. The losses “tightened the supply of base oils against increasing demand and margins soared,” Ames said.

PADD 5, covering the West Coast of the country, jumped almost 30% on the year, from 4.9 million barrels in 2020 to 6.4 million in 2021. The region’s refineries include Chevron’s plant in Richmond, California, with capacity of 20,700 b/d of Group II and 1,000 b/d of Group III, and San Joaquin Refining’s 8,100 b/d naphthenic plant in Bakersfield, California.

Imports Leap Forward

Imports rose by 27%, from 13.2 million barrels in 2020 to 16.8 million barrels in 2021. The summer months of the pandemic hit imports hard in 2020, as the numbers dipped to 327,000 barrels in June; 747,000 barrels in July; and 789,000 barrels in August. In June 2020 levels sank to the lowest since June 2008, when only 250,000 barrels were imported to the U.S.

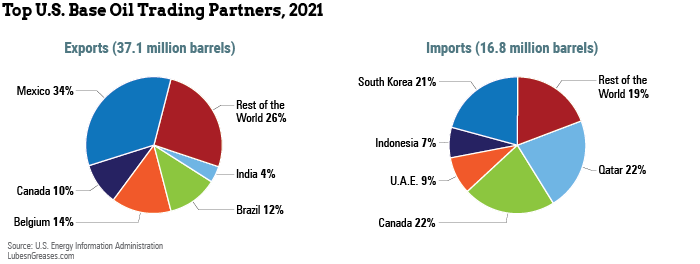

“The big story on imports is the annual total of around 48,000 barrels per day—a record high—and it has been rising for the past decade, since the U.S. cannot economically make Group III base oil, and it is needed for low-viscosity SAE passenger car 0W and 5W engine oils,” Claxton said.

Ames echoed the point on Group III imports. “The U.S. produces less than 10% of its Group III demand,” he said, adding that it is “a major importer of Group III from Korea and Qatar, Abu Dhabi and Bahrain in the Middle East.”

While recovery from the pandemic is an obvious factor in the rise of imports, the severe winter storm in Texas in February and March also played a part. Four refineries—Motiva in Port Arthur, Texas; ExxonMobil in Baytown, Texas; Calumet in Shreveport, Louisiana; and Holly Frontier in Tulsa, Oklahoma—which make up nearly 40% of North American paraffinic base oil production, went offline due to the cold weather. U.S. blenders imported base stocks to make up for the lack of supply.

In August 2021, the U.S. imported 2.4 million barrels—the highest total for any month dating to 1981, when the EIA started collecting data. Claxton said the number was mostly a matter of timing or supply chain issues causing a backload of shipping.

In August 2021, “both Shell and ExxonMobil brought several loads of Group II from Rotterdam,” Claxton said. “Historically, Sonneborn (now HFC Sonneborn) brings around 1,000 b/d of Group II (white oil) from its white oil plant in Amsterdam, which shows up as an import from the Netherlands. Now with ExxonMobil and partners bringing in Group II from Rotterdam, that’s pushing U.S. import figures higher by another 2,000 b/d.”

The usual players made up the majority of U.S. base oil imports. Canada topped the list with just under 3.8 million barrels, with Qatar (3.7 million barrels) and South Korea (3.5 million barrels) not far behind. The United Arab Emirates sent 1.6 million barrels to the U.S., and Indonesia rounded out the top five with 1.2 million barrels.

The U.S. imported base oils at noticeably higher volumes from Canada and Qatar compared to 2020—a 48% increase and a 27% increase, respectively. Levels from the rest of the top five saw only marginal increases.

Exports Trend Upward

U.S. exports rose to 37.1 million barrels for the year, an 8% climb compared to 2020. The pandemic heavily affected exports, particularly in its first few months after lockdowns shut out demand. In April 2020, 1.9 million barrels were exported, with only 1.8 million the following month before demand recovered to 2.8 million barrels in June.

In April, May and June 2021, exports reached 2.9 million barrels, 3.4 million barrels and 3.7 million barrels, respectively.

Mexico remained the premiere destination for U.S. base oils, reaching 12.6 million barrels for all of 2021, while Belgium once again landed as the runner-up with 5.2 million barrels. Brazil and Canada came third and fourth on the list with 4.4 million barrels and 3.6 million barrels, respectively. While Colombia was the fifth-highest destination at the half-year mark of 2021, India overtook the South American country in the end with 1.3 million barrels. A strong August surge of 299,000 barrels exported for the month helped secure India’s top-five place, the same place it finished at the end of 2020.

U.S. capacity for Group II “exceeds domestic consumption by over 35%,” Ames said. “The U.S. is the principal exporter of Group II to Latin America and Europe, as well as a major supplier to South Asia, the Middle East and Africa.”

Claxton added: “Rerefining is adding Group I and II to the U.S. supply, maybe 12,000 b/d. That is a big chunk putting downward pressure on mostly Group II players.”

Will Beverina is assistant editor for Lubes’n’Greases. Contact him at Will@LubesnGreases.com