Desperate Times Call for Desperate Measures

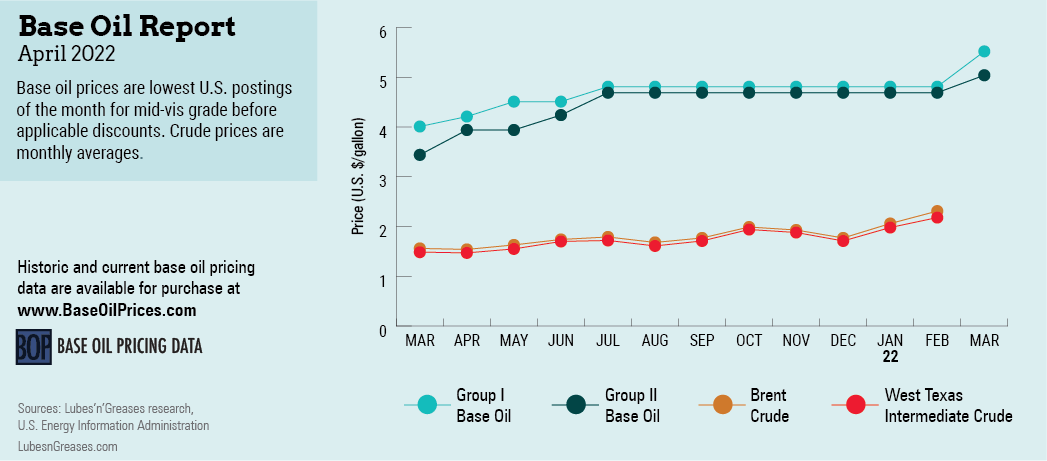

The COVID-19 pandemic had finally started to loosen up its nefarious grip when the world witnessed the invasion of Ukraine by Russian military forces. It is impossible to fathom the heartbreaking implications and human toll of the attack. But laying them aside for just a moment, one of the most immediate impacts of the invasion was a vertiginous jump in crude oil and feedstock values. West Texas Intermediate futures leapt to fourteen-year highs, vaulting over the $120-per-barrel mark during the second week of March for the first time since 2008.

Crude oil values had already been on a steep ascent since the beginning of the year, which had pushed naphthenic base oil producers first, and then paraffinic suppliers, to announce posted price increases in early February.

Naphthenic producers implemented 25-cents-per-gallon markups for all naphthenic base oils between February 8 and February 11, driven by steep crude oil and feedstock costs and coupled with a snug supply-demand scenario. Availability of certain grades was strained, particularly for spot business, as several turnarounds at naphthenic base oil plants were taking place or were about to be completed.

Shortly after the naphthenic price hikes, a vast majority of paraffinic suppliers announced posted price increases of 20, 25, 30 and 35 cents per gallon, depending on the grade and the supplier. The lighter viscosities generally displayed the steeper hikes, given stronger demand and tighter supply. The effective dates were peppered between Feb. 15 and March 1.

These hikes were in the process of implementation when Russia launched its attack on Ukraine, pushing crude oil values to sky-high levels on concerns of a potential oil and natural gas shortage. Russia is a massive exporter of energy commodities, particularly to other European nations, and a majority of these countries had started to implement sanctions against Russian exports. Crude oil and gas, however, were not initially banned as governments tried to avoid further increases in energy and fuel pricing.

The effects of the huge jump in crude oil and natural gas values was immediately felt in base oil markets, pushing suppliers to seek a second series of increases only two weeks after the first round.

ExxonMobil led the pack with an increase initiative of 30 cents per gallon, quickly followed by Chevron, Calumet, Excel Paralubes and the rest of the producers, which sought to raise prices by 30 to 35 cents per gallon, with effective dates between March 8 and March 17.

On the naphthenic base stocks front, Cross Oil stepped out with an increase of 35 cents, effective March 11. Calumet and San Joaquin Refining were hot on its heels announcing a similar hike.

The February round of base oil price hikes, together with markups in additive prices, triggered increase initiatives in downstream segments as well. Several independent lubricant manufacturers, as well as a number of majors, announced increases of up to 18% on finished lubricants to be implemented between March 1 and March 28.

The base oil price increases later announced in March were expected to squeeze lubricant margins further.

Aside from persistent price pressure, a lack of truck drivers, logistical and transportation issues, and a shortage of raw materials such as additives and packaging materials continued to plague manufacturing operations. Some finished lubricant manufacturers resorted to allocation programs on certain products to manage orders and inventories. Shipment and delivery delays were also noted.

All eyes remained on crude oil and feedstock prices, as their rapid ascent not only continued to erode base oil producers’ margins but also affected all aspects of everyday life. The price of gasoline in the U.S. broke records, hovering at an average of $4.14 per gallon on March 7. Analysts say crude prices could escalate even further if the U.S. and its European allies decide to implement sanctions on Russian oil and gas exports.

The rapidly changing nature of the situation in Ukraine makes it difficult to predict what will happen next or what measures might be implemented to deter Russia from continuing its invasion. Perhaps one of the only positive outcomes of the conflict might be the unified support that Ukraine has received as individuals and governments around the world expressed solidarity with the people of Ukraine and hope that the conflict will end quickly.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com