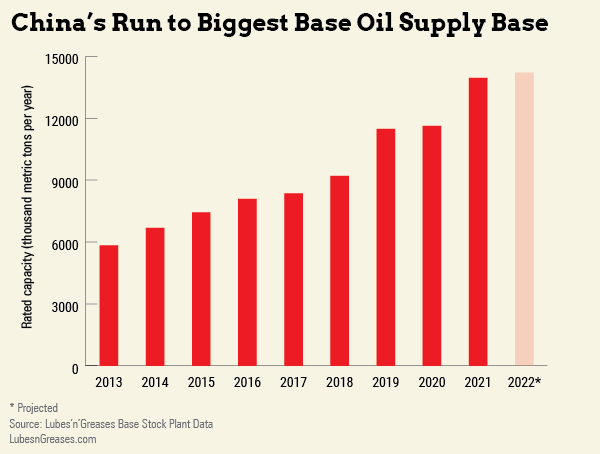

As the base oil industry prepares perhaps to exit the chaos of the COVID-19 pandemic, a new nation sits atop the base oil supply base. China overtook the United States in 2021 as the country with the most base oil refining capacity.

The U.S. has been the top base oil nation for at least several decades, but China moved ahead thanks to expansions at two plants and a change in reported operations at a third, which brought its total to 14 million metric tons per year, according to Lubes’n’Greases Base Stock Plant Data, just in front of America’s 13 million t/y.

China’s ascent is the result of a remarkable expansion over the past decade and more. Since 2010 its capacity has tripled from 4.6 million t/y. The supply base has also transformed in terms of the types of operators and types of base oils it produces. In 2010 the country had 16 base oil plants, all the possessions of state-owned oil giants Sinopec, PetroChina and China National Offshore Oil Co. Eighty percent of output was API Group I stocks or naphthenic. Today the state-owned trio operate 19 plants, while independent and semi-independent refiners have opened 15 others. Two-thirds of capacity is Group II or III.

The country’s refiners are not yet finished expanding that supply base. Feitian Petrochemical is working to complete a 250,000 t/y Group II expansion of its plant in Xinji, and market insiders predict companies will add more Group III capacity.

Analysts say many base oil plants in China are operating at significantly less than capacity. The country has long been one of the world’s largest base oil importers and still buys large volumes from South Korea, Singapore and Taiwan. Many facilities have flexibility, however, to switch production to white oils, solvents and process oils used for applications such as rubber.

The growth of domestic production creates competition for foreign suppliers.

“South Korean companies especially sell big volumes of Group II and III oils into China, as well as India,” said Stephen Ames, principal of SBA Consulting in the United States. “Construction of all these Group II and III plants in China poses a threat to that business.”

Some analysts say that during the pandemic new Chinese suppliers have taken advantage of disruptions in supply chains and the resulting desire by some lubricant companies to lean more on local sources.

“Since last year, many international and domestic additive manufacturers and lubricant manufacturers believe that it is very necessary to strengthen the localization of the supply chain, because it’s been more difficult to obtain imported base oils and additives,” said Zhang Chenhui, an independent lubricants consultant in China.

In one way China is a peculiar market: It is the only nation with a large base oil supply base that does not export significant volumes to other markets. China base oil exports have long been negligible, though a few companies have begun recently to sell small volumes abroad. CNOOC and such newcomers as Hengli Petrochemical and Qinghe Petrochemical have all established export sales desks and said they aim to sell base oils abroad as well as within China.

Some observers think that they probably will.

“Until now, the export volume of China’s base oil is small, mainly because China has been such a large importer, and the country still has restrictions on the export volume of base oil,” Zhang said. “With the increase of output in the future, the export volume will certainly increase.”

Read more from our Special Report: Base Oils Emerge from Pandemic:

• As the Pendulum Swings – The COVID-19 pandemic led to sharp changes in base oil pricing and margins. Will the market settle into a new post-pandemic norm, and what might that look like?

• Base Oil Rerefiners Rebounding from Pandemic – The pandemic wreaked havoc on the base oil market, but rerefiners may have emerged stronger than ever.

• China Moves to the Top of the Heap – China overtook the United States in 2021 as the country with the most base oil refining capacity. What contributed to its rise?

Tim Sullivan is base oil executive editor for Lubes’n’Greases. Contact him at Tim@LubesnGreases.com