Mystery Bags

In Japan, a popular tradition in the first few days of a new year is to buy “fukubukuro,” or mystery bags. These are surprise shopping bags that retailers sell at various price points without disclosing the contents. The items inside are typically worth three or more times than the price the buyer pays. Part of the fun is being surprised by an item you really like, although there is a risk of getting things you will not use.

Given all the unknowns of 2022, it feels as if the base oils and lubricants industry possesses a fukubukuro, with chances that this year might be very positive along with the risk of encountering obstacles.

One factor likely to have a major impact on business is uncertainty surrounding the coronavirus crisis. Most people had hoped that the pandemic would be under control by now and that life would return to pre-pandemic norms. However, the discovery of the Omicron variant and the dizzying speed of its spread have affected daily activities and the way organizations conduct business.

Among the difficulties that participants faced were an increased reliance on technology, since many companies delayed their employees’ return to the office and extended remote work. Perhaps the biggest challenge was the disruption of the supply chain because of personnel absences, raw material shortages and transportation issues.

One of the segments hit particularly hard by product shortages was the finished lubricants segment, as it was first affected by a lack of base oils in the early part of 2021 and later compounded by a shortage of additives and other chemicals. These problems were still affecting blending operations, although the additive situation has been gradually improving.

The additive shortage forced many lubricant manufacturers to reduce rates or shut down production temporarily. While most blenders reported improved conditions, there were some participants that were still unable to run at full rates due to the scarcity of additives. Tight availability of API Group III supplies was mentioned as another factor affecting operations, particularly the manufacture of synthetic oils, although additional cargoes were expected to be imported from South Korea and the Middle East in the first part of the year.

As a result of these disruptions in downstream segments, base oil demand declined in the weeks leading to the holidays and was expected to remain lackluster until blenders begin to build inventories for the busy spring production season, which traditionally starts this month. In the meantime, buyers reported that base oils appeared to be readily available across all grades.

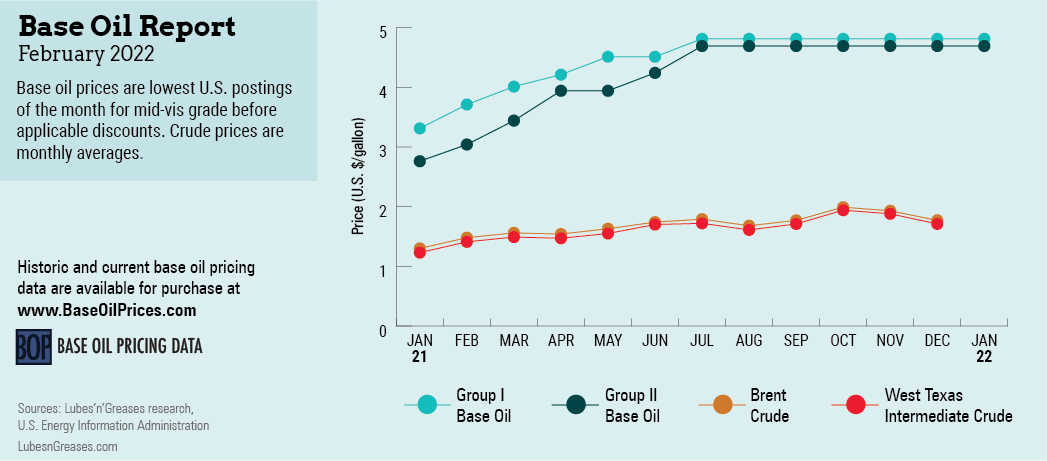

The lower base oil demand levels and improved supply in December led to downward adjustments on spot prices, particularly for export transactions as suppliers had tried to entice foreign buyers to take more cargoes. Several shipments had been lined up for Mexico, India and the Middle East that month, and suppliers continued to evaluate export options. However, with crude oil numbers climbing in late December and into January, and the prospects of improved base oil demand in coming weeks, the price pressure had largely faded. Posted prices were assessed as stable at the time of writing, with almost no adjustments seen in the second half of 2021.

Transportation and logistics problems persisted, with suppliers expressing concern at the rising freight costs and the inability to meet delivery deadlines due to a lack of truck drivers and other staffing issues. Disruptions in the supply chain have also resulted in difficulties sourcing packaging materials, like steel pails.

An explosion and fire at the ExxonMobil refinery in Baytown, Texas, last December was expected to have limited impact on base oils output even though refinery run rates were reduced during the inspection and repairs process. The refinery houses a Group I and Group II base oils unit.

The naphthenic segment may experience tighter conditions, as San Joaquin Refining will be starting a three-week turnaround at its naphthenic base oils plant in Bakersfield, California, on February 1.

On the bright side, a new year often brings fresh opportunities, like finding novel applications in response to the enhanced focus on sustainability and vehicle electrification. The new demands may inspire suppliers to delve into areas they had not dared explore in the past and they may be surprised by what they find. Innovation is what will help the industry overcome challenges and catapult itself into the future.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com