Artemis’ Ascent

In 2025, NASA plans to launch the Artemis 3 mission, sending the first woman and the first person of color to the moon—a reflection of how times have changed since the first manned moon landing 53 years ago. In Greek mythology, Artemis is the goddess of hunting, nature and birth, and Apollo’s twin sister—thus NASA’s fitting name choice for its new mission.

Much like the aerospace industry has had to adapt to new technological discoveries and a transformed social environment, the base oils and lubricants industry is also going through significant changes to develop products that will fulfill its sustainability, fuel economy and low-emission goals.

Looking at the more immediate market situation, the base oils segment faced a supply and demand imbalance throughout October, November and likely December, brought about by an expected seasonal demand slowdown, steady production rates and the release of hurricane-related stockpiles.

The lengthening supply exerted downward pressure on pricing, with export spot indications losing ground as suppliers explored possibilities of moving excess barrels abroad to achieve a more balanced situation at home. This required suppliers to adjust price expectations down to compete with European and Asian barrels. Spot offers within the domestic market also edged down.

While no general posted price decreases emerged, there were reports of consumers requesting temporary voluntary allowances on contract shipments given the sliding spot prices and ample availability of most grades.

Some segments of the market showed more significant surplus than others. Supply of heavy-viscosity grades within the API Group I and II segments became temporarily snug given production setbacks at two Gulf Coast facilities and a scheduled turnaround at a Group II/III plant that affected output of Group II 600 neutral grade. Once the two plants increased production rates, availability of most grades improved.

The turnaround at the Group II/III facility was expected to be completed the first week of November. The producer had not placed customers on allocation; it had built inventories to meet requirements during the shutdown.

The Group III segment was less likely to become oversupplied because of turnarounds and production cutbacks in Asia, Europe and the Middle East, where a majority of imported barrels are sourced.

Availability of naphthenic base oils remained tight on the back of a scheduled plant turnaround in October, an unplanned production outage and healthy demand. A pickup in raw material requirements was partly attributed to reconstruction work in Florida and other states that suffered extensive damages from Hurricane Ian in September. Buying interest in Latin America, especially Brazil, had also been consistent. The tighter supply, along with firmer crude oil and feedstock values, offered support to the prevailing naphthenic pricing.

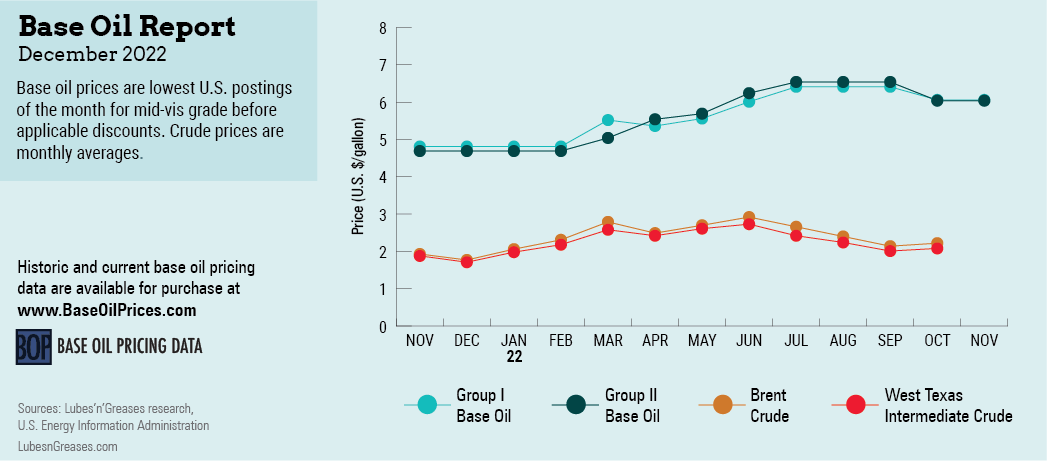

Base oil producers continued to deal with crude oil and feedstock price volatility brought about by international geopolitical and economic turmoil. Global recession concerns, renewed COVID-related lockdowns in China, the ongoing war in Ukraine and planned production cutbacks by OPEC+ members impacted crude values. West Texas Intermediate oil futures were hovering near $78 per barrel in late September and had climbed to around $92/barrel by early November.

Expectations of a global supply crunch of diesel amid rising values might encourage refiners to produce more fuels and limit the feedstock supply going into base stock output. Vacuum gasoil premiums over WTI crude were also hovering at lofty levels, so producers needed to maintain healthy base oil margins to be able to justify output against other refined products.

In downstream markets, a shortage of additives caused by production issues at two major manufacturers’ sites earlier in the year and supply chain disruptions at a third producer’s operations led to reduced lubricant manufacturing rates and lower demand for several base oils. Some blenders saw little impact from the additive shortage, but others were forced to trim output rates as they were heavily dependent on specific additives. By mid-October, the additive supply situation had improved, with producers lifting force majeures and relaxing sales allocations, although certain supply issues were expected to persist. As a result, manufacturers have had to find ways to keep production going by changing suppliers or altering their product lineup.

Like the space exploration missions, the base oils and lubricants industry thrives thanks to the expertise and knowledge of its participants, their resiliency and their willingness to adapt to the challenges of an ever-changing world.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com