Motorcycles are an increasingly popular mode of everyday transportation in numerous Latin American countries.

To best support this growing market segment, lubricant manufacturers must deliver dedicated oil formulations that can help protect motorcycle engines in ways that passenger car engine oils cannot.

In many regions in the Northern Hemisphere, motorcycles and scooters tend to be thought of as leisure items. A motorcycle may be fun to take out of the garage and ride on a sunny summer day, but it makes for a poor mode of year-round transportation in locations with cold winters featuring plenty of snow and ice.

Head south of the equator, though, and the story is much different. In countries like Brazil—where economies are experiencing rapid development, significant growth in gross domestic product and subsequent growth of income levels—the need for affordable day-to-day transportation has risen sharply. While public transportation is readily available and reliable in some major municipalities, commuters are increasingly seeking alternatives, especially those who reside outside of the large metropolitan hubs.

What’s more, they’re often not looking to cars as a transportation solution.

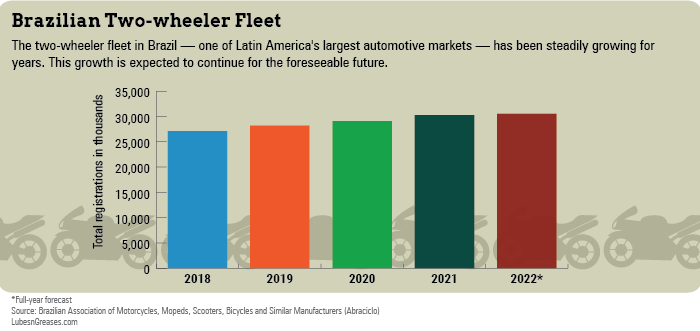

Research shows that, based on a confluence of different societal factors, the motorcycle fleet in Brazil has grown by nearly 900% in the past two decades. The motorcycle has become a critical mode of everyday transportation for a broad swath of the country as well as in other countries in the region. Warm climates have allowed the motorcycle to become a reliable and cost-effective mode of year-round, everyday transit, and plenty are taking advantage.

For lubricant manufacturers looking to support this growing part of the market and seize the opportunity it presents, some specific considerations are needed. This article will explore why certain market conditions unique to Brazil and other Latin American countries can have an impact on lubricant performance needs and overall motorcycle performance. It will also discuss how formulators must adapt their formulating approach to meet the increasingly divergent performance needs in motorcycle applications versus passenger car applications, and why end user education is critical to ensure use of the right oils in motorcycle applications.

Unique Market Factors in South America

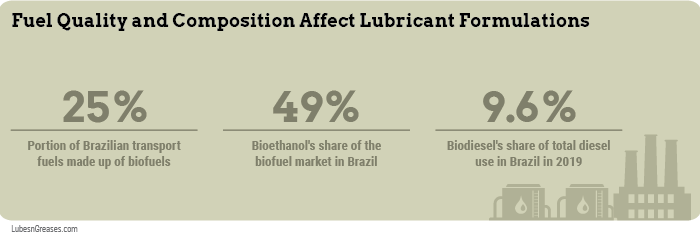

One major consideration that must be made when formulating lubricants ideal for motorcycles operating in South America is fuel quality and composition. In Brazil specifically, various forms of biofuels make up a significant portion of available fuels. IEA Bioenergy, a technology collaboration program set up by the International Energy Agency, reported that as of 2021 biofuels represented 25% of transport fuels in Brazil. This is a very high proportion when compared to other countries in the world, and the share is still increasing. Bioethanol is the most prominent biofuel, on average representing 49% of combined gasoline and ethanol use. Simultaneously, the role of biodiesel is growing (to replace diesel in heavy-duty vehicles) and in 2019 represented 9.6% of diesel use.

Why has ethanol proliferated as a fuel and fuel component in South America?

The shift toward increased use of ethanol in fuel has taken place in recent years for a few reasons. First, the development and widespread distribution of biofuels has enabled Brazil to take greater advantage of its own agricultural resources and reduce reliance on imported traditional gasoline and diesel fuels. Second, the move has enabled the country to make significant reductions in nationwide on-road emissions.

When it comes to commonly available gasoline that the average motorcycle rider would have access to, high ethanol content versus other markets is a certainty. Fuels widely available for purchase in Brazil range anywhere from 27% ethanol content to 100%–formulations that are known locally as “flex fuel.” By way of comparison, gasolines throughout North America typically contain levels of ethanol no higher than 10%. While both passenger car and motorcycle engines have been adapted to remain compatible with such high ethanol levels, there are some important factors to consider when it comes to lubricant formulation.

Generally, one of the most significant challenges that higher ethanol content in fuel poses in engines is its propensity to accumulate water. Ethanol has the tendency to absorb water from the atmosphere from a vent in the fuel tank, incorporating it into the gasoline before it is sent to the combustion chamber.

Vehicles powered by diesel engines, like those found in passenger cars, typically have effective water separator systems integrated into their designs. But vehicles powered by gasoline engines often do not, which has the potential to lead to engine protection issues. Water content can compromise the engine oil’s lubricity—or its ability to maintain an effective layer of protection between the piston and the cylinder bore. A lack of protection in this critical environment can lead to scoring, scuffing and ring stick, all of which can lead to severe engine damage. Meanwhile, an excess of water being brought into the engine means a higher threat of corrosion throughout every part of the engine.

Elsewhere, ethanol can present material compatibility issues with other engine components. For example, the fuel system and carburetors contain a number of small elastomer seals and diaphragms that ensure proper operation. Ethanol’s chemical makeup can interact poorly with many of these materials and can cause them to become rigid and brittle. This issue can cause difficulty starting the engine and can interrupt smooth running, amongst other things.

Ethanol fuel content in South American markets will be a factor for the long term, and it is reasonable to expect that higher levels will be seen into the future. So what can be done to mitigate its potential effects in motorcycle applications?

In short, dedicated motorcycle lubricants must be formulated with ethanol fuels in mind. Certain additive chemistries can be deployed in oil formulations that can help prevent loss of lubricity and deliver elevated corrosion resistance. Common lubricant formulations typically used within motorcycles have not traditionally been formulated for such specific needs, but the ongoing prevalence of ethanol in most commonly available gasoline has begun to demand it, especially throughout Latin America. Reliable hardware performance hinges on lubricants that have been formulated for modern needs. Specific lubricant formulations must be developed and marketed for end users who depend on motorcycles to go about their daily lives.

Meeting Specific Needs for Motorcycle Engine Oils

Ethanol in fuel is not the only reason that motorcycles in Latin America—or anywhere, for that matter—require specific performance needs for modern engine technology.

While it was commonplace for many years to simply fill a motorcycle with the same type of engine oil you might use to service a passenger car, the two engine technologies have diverged significantly in recent years. This divergence has meant that passenger cars and motorcycles have some fundamentally different performance requirements from an optimized engine oil.

Harsher Operating Conditions. Motorcycle engines operate at a much higher power density than passenger cars. This means that relative to their size and engine capacity motorcycles typically generate far higher specific horsepower levels than that of cars. Additionally, while passenger cars utilize a coolant to maintain ideal operating temperatures, motorcycles are commonly air-cooled. Motorcycles also have drastically smaller sumps than typical passenger cars, relying on a much smaller volume of oil to deliver reliable performance.

All of this adds up to severe operating conditions for the lubricant. It must withstand thermal and oxidative degradation that can result from higher operating temperatures. It must also protect the engine from the formation of high-temperature piston deposits.

Comprehensive Protection. Motorcycles utilize a single lubricant to protect not just the engine but the clutch and the gearbox, too. Since passenger car engine oils are not required to lubricate and protect gears, they do not contain extreme pressure gear protection components. Because the gears are subject to very high contact pressures, the absence of gear protection booster chemistry can lead to insufficient protection to the motorcycle transmission. This may cause gear pitting, leading to a noisy engine that can be uncomfortable for the rider. Over the long term, an unsuitable lubricant may eventually lead to gear failure. A formulation optimized for motorcycles will maintain robust film strength and utilize special extreme pressure additive components to ensure durable gearbox protection.

Clutch Performance. As noted, motorcycle lubricants must also protect the clutch, a vital part of the engine that transfers power smoothly and efficiently from the engine to the wheels. As the clutch is engaged, power is transferred through friction between the clutch plates. A motorcycle lubricant must provide the right level of friction between the plates to ensure smooth reliable operation. But today’s modern passenger car lubricants often contain significant levels of friction modifiers in order to deliver higher levels of fuel economy. In a motorcycle application, these friction modifiers can give rise to excessive clutch slip, resulting in poor drive feel for the rider and power transfer loss. The correct additive chemistry to deliver the right balance of friction performance in the clutch is critical in a motorcycle lubricant to maintain good clutch operation and durability.

Catalyst Requirements. Most new motorcycles models incorporate catalytic converters—devices used to clean up tailpipe emissions by essentially converting undesirable particulates into water, nitrogen and carbon dioxide. While this is not a new technology—passenger cars have used catalytic converts for many years—the application of catalytic converters in motorcycle applications is relatively new. Given the sensitivity of exhaust catalysts to some common oil additive components, formulators also need to give careful consideration to additive component selection to ensure the right balance between engine, gearbox and clutch performance and to promote catalyst durability.

Adherence to Relevant Specifications

When in doubt about required performance for motorcycle applications, turn to the relevant specifications. The Japanese Automobile Standards Organization—known as JASO—is an industry organization and specification-setting body for lubricants designated for use in a broad range of Japanese hardware. JASO small engine specifications are broadly recognized and have effectively been adopted globally as a key benchmark performance standard for small engine applications.

For 4-cycle applications, including motorcycles, JASO introduced the T903 specification in 1998 as a global standard. The specification was designed to ensure a good level of crankcase oil performance, to address clutch slippage problems in the field, and to provide the correct balance between hardware durability and catalyst protection along with improved fuel economy performance in scooter applications. The T903 specification is updated regularly to ensure oil performance level upgrades to meet the latest hardware needs are reflected. Regular updates also test components to reflect the latest materials being used. The last update was in 2016, and the next is anticipated in 2023. There is certainly a revision on the near horizon that oil formulators will want to pay close attention to.

Opportunities Abound

It is one thing for lubricant formulators to be familiar with the necessary performance characteristics that allow modern motorcycles to meet their full potential, but it is another for everyday motorcycle riders. As markets like Latin America continue to see greater motorcycle adoption, it is incumbent upon the lubricant industry to not just supply end users with optimal choices but to educate them on why such formulations are important for everyday use.

The growing Latin American motorcycle market represents a good opportunity for the lubricants industry to grow by supplying the region with the right oil technology for today’s motorcycle applications.

Fabio Araujo is business manager, Latin America, engine oils for Lubrizol.

Mark Wilkes is global business manager, small engines for Lubrizol.