All Is Quiet on the Base Oils Front

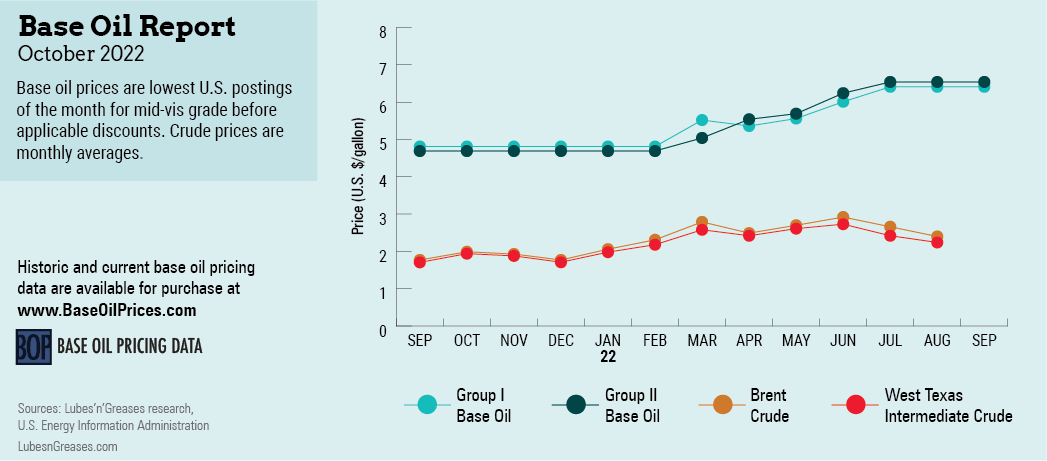

Compared to the first six months of the year—when posted price increases pelted paraffinic base oil buyers almost every month—July and August offered a reprieve. No price adjustments took place, and September was a fairly muted month in terms of pricing.

The only exception was a round of decreases that took place in the naphthenic sector, lowering pale oil prices by 30 cents per gallon and 45 cents per gallon, depending on the producer, between August 5 and August 15. The downward price revisions were prompted by a substantial drop in crude oil and feedstock prices and slowing base oil demand.

Crude oil futures tumbled in late July on concerns about a potential global recession and other downbeat economic factors. This was paired with reduced oil demand in China due to pandemic-related lockdowns. Gasoline and diesel prices were more moderate as well, lifting some of the pressure to boost base oil margins and uphold high output levels.

The end of the summer driving season marks the start of a more subdued period for base oils, with buying activity moving at a more sedate pace. Refiners manage inventories carefully and some even opt for reducing operating rates to avoid product buildup.

However, during the first few days of September, several base oil pockets still showed supply tightness as demand remained steady and production issues persisted. A major United States API Group I/II refiner was forced to extend a turnaround due to an equipment failure. While the supplier did not place customers on allocation or sales control, it was limiting availability and not entertaining additional or incremental orders. The refiner had built inventories ahead of the turnaround, which had started two months earlier, and was able to cover most requirements. The same producer was also expected to start building inventories during the last quarter of the year, as it had scheduled maintenance at a second Group I unit in early 2023.

A second refiner was expected to start a turnaround at its Group II/III plant in October and was managing supplies carefully and building inventories to cover requirements during the shutdown.

A third Group II producer completed a turnaround a few weeks prior and did not have much additional product to offer as it rebuilt stocks.

As a result, there were few cargoes available for spot business, particularly for Group I grades and some heavy-viscosity grades. Suppliers said they had turned down additional sales in some cases because they had no extra barrels to offer.

Lower price indications in other regions due to growing supply made it difficult for U.S. product to compete on the export front. There was ongoing buying appetite from Brazil, for example, but it was not always easy to find enough product to meet requirements, and logistics were challenging.

Most producers were focusing on meeting contractual obligations. Spot volumes were limited, supporting spot price ideas, although small downward adjustments between 5 cents and 15 cents per gallon were noted as availability of certain grades became more abundant. There were also reports of producers granting temporary value or voluntary adjustments ranging from 10-50 cents per gallon to fend off a general posted price decrease.

At the same time, most consumers and producers continued to carry hefty inventories in case a hurricane were to hit the U.S. Gulf Coast.

Additive shortages were impacting base oil demand in certain segments, particularly those catering to the automotive industry. An additive producer remained on 50% allocation in early September following a weather-related shutdown. This situation resulted in reduced operating rates at some manufacturing plants, leading to lower base oil demand.

The steady climb in base oil pricing during the first half of the year led to additive and lubricant price increases. An additive supplier communicated a price increase of up to 15% for August, while a second additive supplier planned to mark up prices on Sept. 1. A third additive manufacturer communicated markups up to 10%, effective Sept. 23.

Lubricant manufacturers implemented price increases in June, July and early August, and several suppliers intended to adjust values in September or October. One supplier was expected to raise prices by up to 15% on Sept. 1. A second planned to increase prices on Sept. 19, while a third slated an increase effective on Oct. 1. There were also rumblings that some suppliers had delayed implementation or adjusted the amounts of lubricant increases due to slowing demand.

Barring unexpected events, the base oil market was anticipated to stay on a steady course through the end of the year, a welcome change after a tumultuous first half.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com