Here We Go Again

Just when the coronavirus pandemic seemed to be finally retreating—with fewer cases and deaths registered in most countries, vaccinations increasing and restrictions being lifted—the new Omicron variant was detected, first in Botswana in late November and then in many other nations around the world.

The immediate reaction to the news was that prices of crude oil and refined products plummeted to multiyear lows on expectations of a global economic slowdown and weaker fuel demand. Many governments tightened quarantine and travel restrictions, highlighting the possibility that jet kerosene consumption would slump and force refiners to reduce operating rates once again.

The good news, however, was that early reports suggested that while the Omicron strain seemed more contagious than other variants, symptoms were less severe.

Participants in base oil markets reacted less dramatically than crude oil traders and maintained prices. There was no panicked sell-off of base oil barrels or cancellation of orders despite the sharp fall in crude oil and feedstock values. There was no sudden decrease in postings. Posted prices remained stable and the decline in spot pricing appeared to have stalled, following a few weeks of downward revisions due to lengthening supplies and softening demand.

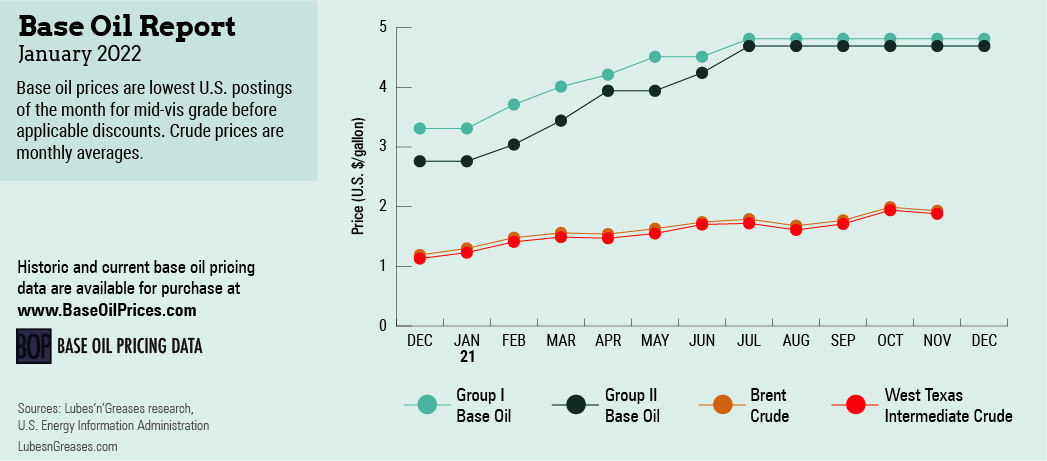

Despite the pandemic—and in contrast with many other businesses around the world—the base oil segment weathered 2021 fairly well. For the first few months of the year, activity was booming, with demand described as buoyant against a backdrop of tight supply. Availability of most base stocks had been curtailed by low refinery run rates due to reduced fuel consumption, weather-related production disruptions and scheduled turnarounds starting in late 2020. The imbalance between supply and demand led to skyrocketing base oil prices, healthy margins and several rounds of posted price increases in the United States.

The second half of the year was slightly less striking, with posted prices stabilizing and supply gradually becoming more plentiful. Base oil consumption remained fairly healthy, although a shortage of additives and other raw materials resulted in reduced demand from the finished lubricants segments as many blenders were forced to cut back production rates or shut down for brief periods. Hurricane-related plant and terminal shutdowns along the U.S. Gulf Coast also led to temporary base oil shortages and shipment delays. A lack of truck drivers, railcars and barges exacerbated the transportation and logistical issues.

By late November, it appeared that fundamentals were leaning toward a more balanced state, and spot prices softened as suppliers strove to reduce inventories ahead of December 31. Market dynamics seemed to be going back to a more “normal” pattern, since softer prices and more plentiful supply are typical trademarks of the end of the year.

What was somewhat unusual was that several major and independent lubricant and grease manufacturers raised prices by up to 15% for lubricants, greases, coolants and other finished products between December 1 and December 20. This was the eighth round of price increases since the start of the year. Suppliers said the markups were necessary to compensate for the higher production costs, including the price of base oils (which had undergone seven general rounds of increases since last January), additives, labor, freight and packaging. Additive producers had already announced price increases of 8%-9% for implementation in the first half of November, which were triggered by the increase in raw material costs and strained availability.

Perhaps market participants have learned from their experiences over the past two years and can use these lessons to face the challenge of a new COVID-19 wave with more aplomb. For example, to avoid potential risks and price fluctuations, many customers hoped to secure more volumes under contract when negotiating 2022 supply agreements. However, some suppliers did not have additional availability due to previous commitments. Producers also intend to carry slightly higher inventories throughout the year to be able to cover requirements during unexpected production-disrupting events. While nobody wants to relive the grim anxiety of the early days of the pandemic, most people have learned to live with the virus, as it is not likely to go away any time soon, and base oils industry participants are certainly adapting, too.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com